January 29, 2025

The highly anticipated maiden diamond drill program has commenced at Portland Creek to test stunning uranium soil geochemistry (peak 7.5% U3O8) coincident with a prolific shear corridor

Infini Resources Ltd (ASX: I88, “Infini” or the “Company”) is thrilled to announce the commencement of diamond drilling at its 100% owned Portland Creek Uranium Project in Newfoundland, Canada (ref announcement 16 December 2024).

Highlights

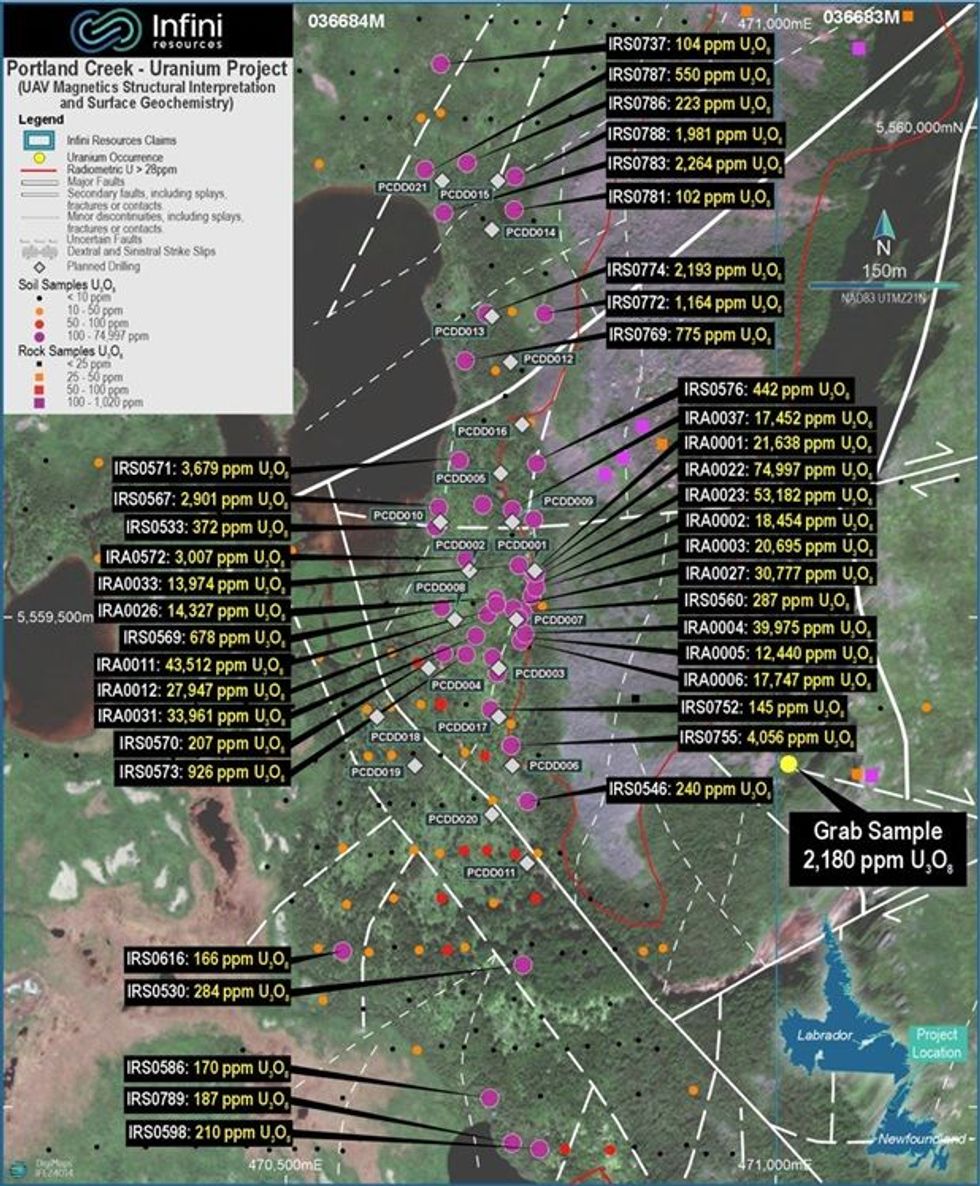

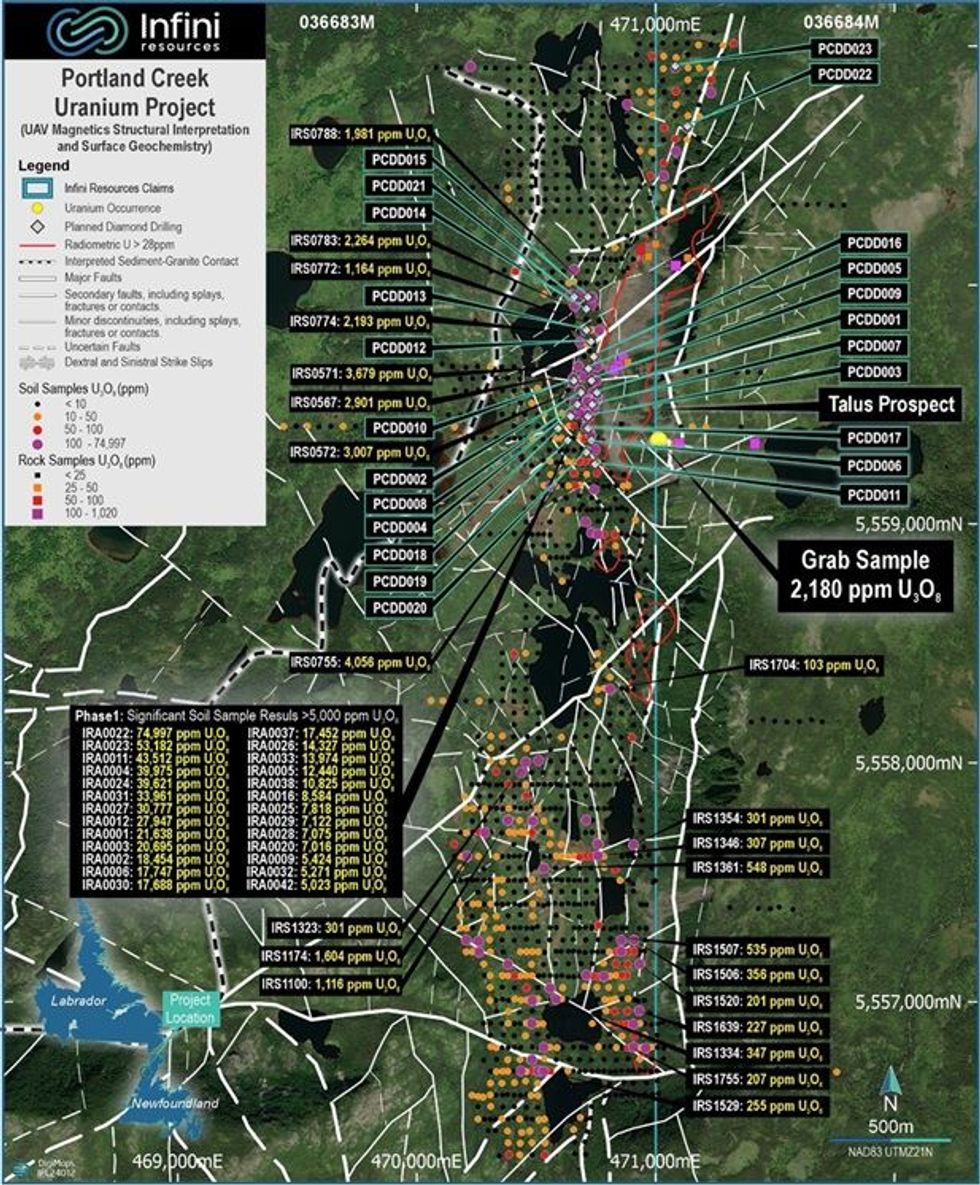

- Phase 1 diamond drilling will comprise up to 23 holes, targeting a high-grade uranium discovery in the tier-1 jurisdiction of Newfoundland, Canada

- The first priority one hole, PCDD001 is planned to be drilled to a depth of approximately 600m, testing the peak 74,997ppm U3O8 soil anomaly coincident with a 46.54 Pb 206-204 ratio and major demagnetized north-south fault zone at depth

- Site core logging and cutting facilities have been built and await the first batch of core from the field

- The staged program is anticipated to take 6-8 weeks to complete with the Company to update on progress

Infini’s Managing Director and CEO, Charles Armstrong said: "We’ve entered an incredibly thrilling chapter for the Company as we start drilling at our highly promising greenfield uranium prospect in Portland Creek, NL.

Myself and the Infini team are incredibly excited for the commencement of drilling, starting with our priority one diamond holes (1A). The anticipation is palpable as we target a high-grade soil anomaly right on top of a significant shear zone and three converging second-order faults.

The Talus prospect is just the beginning—one of many exciting targets within this expansive uranium corridor we’ve worked tirelessly to advance over the past year. The period ahead could mark a pivotal moment for the Company if this eagerly awaited maiden drill program uncovers a major uranium discovery in the tier-1 jurisdiction of Newfoundland, Canada. The excitement is real, and the potential is enormous."

Click here for the full ASX Release

This article includes content from Infini Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

I88:AU

The Conversation (0)

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Trading Halt

2h

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00