September 30, 2024

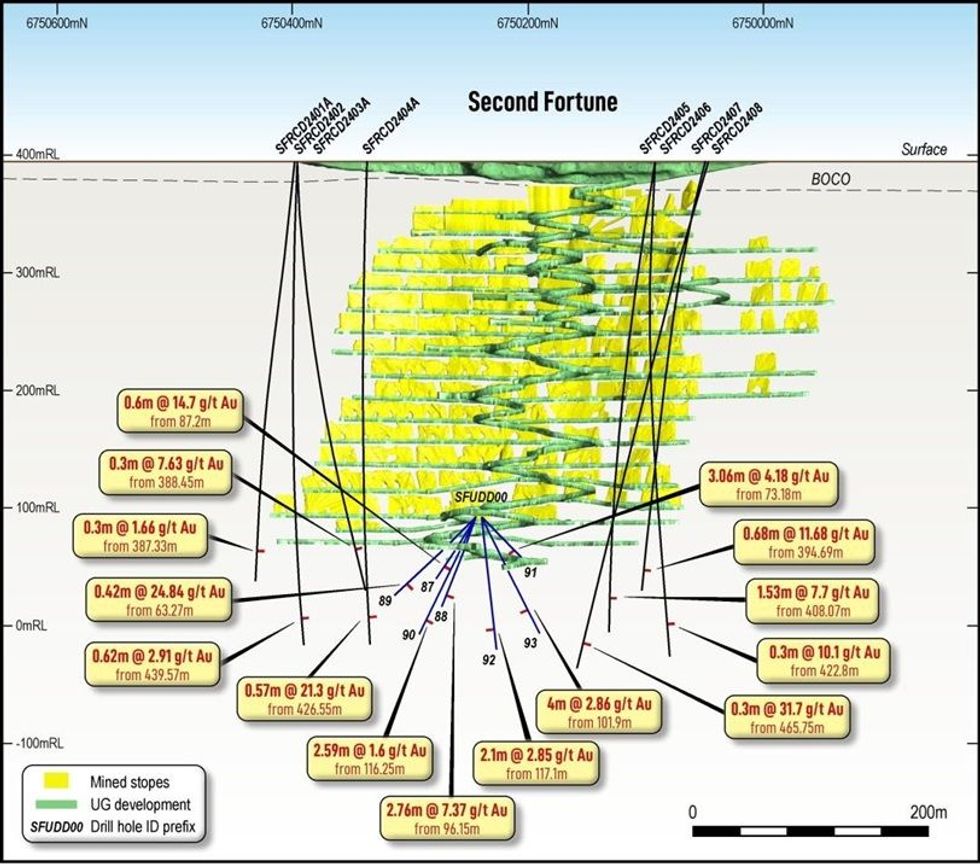

Brightstar Resources Limited (ASX: BTR) (Brightstar) is pleased to announce results from the surface and underground drilling programs conducted at the Second Fortune Gold Mine, located south of Laverton, WA.

HIGHLIGHTS

- First diamond drilling assays returned from the Second Fortune underground mine by Brightstar delivers high grades within and beneath the current forward mine plan

- The deepest hole drilled to date at Second Fortune, SFRCD2408, returned +31g/t Au from a 0.3m downhole intercept at 465.75m depth, proving that the high grade Second Fortune mineralisation continues at depths +400m below surface

- Drilling assays highlight the high-grade and narrow-vein nature of the Second Fortune orebody, which has shown strong geological consistency over recent years of operational history, including:

Surface holes:

- SFRCD2404A:

- 0.57m @ 21.3g/t from 426.55m (12 gram-metres, gm)

- SFRCD2405

- 1.53m @ 7.7g/t from 408.07m, including (12gm)

- 0.41m @ 17.0g/t Au from 408.89m

- SFRCD2408:

- 0.3m @ 31.7g/t from 465.75m (10gm)

- SFRCD2407:

- 0.68m @ 11.68g/t from 394.69m (8gm)

Underground holes:

- SFUDD0087:

- 0.6m @ 14.7g/t from 87.2m (9gm)

- SFUDD0088

- 2.76m @ 7.37g/t from 96.15m, including (20gm)

- 0.33m @ 52.37g/t Au from 96.15m

- SFUDD0089

- 0.42m @ 24.84g/t from 63.27m (10gm)

- 0.34m @ 27.84g/t from 106.08m (10gm)

- 0.51m @ 11.7g/t from 109.91m (6gm)

- SFUDD0091

- 3.06m @ 4.18g/t from 73.18m, including (12gm)

- 0.46m @ 11.22g/t Au from 73.18m

- SFUDD0093

- 0.49m @ 19.22g/t Au from 103.6m (10gm)

- Drilling intercepts are ~100m below currently developed levels on the 1065 level and provide significant confidence in mine life extension at Second Fortune.

- Drilling targeted mining areas within and below the current 12 month mine plan in order to improve the classification of the Mineral Resource Estimate, provide confidence on future mine life extension and enhance mine planning and scheduling activities

- Following the success of this program, Brightstar has commenced further underground drilling to further improve geological knowledge and confidence of CY25 production

Brightstar’s Managing Director, Alex Rovira, commented “The desired outcome of our combined surface and underground drilling program was to infill certain areas to increase confidence in the resource model, whilst also taking the opportunity to drill deeper holes outside and below the current mine plan.

We are delighted with the results which successfully proved that the high-grade Second Fortune vein system continues at depths well below the current mine plan. This result provides a compelling target for Brightstar to explore further in order to extend the mine life at Second Fortune. Accordingly, we have expedited plans to complete further underground drilling to commence imminently, which will inform an upgraded Mineral Resource Estimate this CY24 with the intent of potentially supporting the declaration of Ore Reserves and formal production outlook.

We look forward to sharing ongoing results as they are received, with assays still pending from various programs across the Brightstar portfolio including previously announced RC and Diamond drill programs”.

TECHNICAL DISCUSSION

The Second Fortune deposit lies at the southern end of the Laverton Tectonic Zone which lies on the eastern margin of the Norseman-Wiluna Belt. Gold mineralisation occurs within a north-to-northwest striking sequence of intermediate to felsic volcaniclastic rocks and subordinate sediments, intruded by irregular, narrow, tabular bodies of albite porphyry.

Gold mineralisation is associated with an arcuate narrow quartz vein system (0.2m to 2m width) that has a strike of over 600 metres and dips steeply to the west. Within the vein there is locally abundant pyrite with wall rock alteration characterised by a thin selvedge of sericitic and chlorite alteration providing a strong mineralisation vector.

The Second Fortune vein system consists of the Main Lode and a number of subsidiary lodes, the Hanging wall and Footwall lodes which are located within ~10m of the Main lode, and the Caturra lode to the West.

Linden Gold Alliance Limited (Linden) acquired the Second Fortune Gold Project in 2020 and moved quickly to bring the project back into production, achieving its first gold pour within seven months in April 2021. In 2023, Linden produced in excess of 13,000oz gold, with ore processing through Genesis Minerals Limited’s Gwalia processing facility, and subsequently merged with Brightstar in 2024.

The purpose of the combined surface and underground drill programs were to infill and confirm the resource within the planned underground mine design, and to target extensions at depth to assess potential for lode continuity.

Click here for the full ASX Release

This article includes content from Brightstar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BTR:AU

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

08 January

Brightstar Resources

Emerging gold producer and district-scale resource developer in Western Australia

Emerging gold producer and district-scale resource developer in Western Australia Keep Reading...

03 March

Brightstar Secures US$120M Bond to Fund Goldfields Project

Brightstar Resources (BTR:AU) has announced Brightstar Secures US$120M Bond to Fund Goldfields ProjectDownload the PDF here. Keep Reading...

02 March

Results of Oversubscribed Share Purchase Plan

Brightstar Resources (BTR:AU) has announced Results of Oversubscribed Share Purchase PlanDownload the PDF here. Keep Reading...

22 February

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

16 February

GNG: Preferred Contractor - Laverton Processing Plant

Brightstar Resources (BTR:AU) has announced GNG: Preferred Contractor - Laverton Processing PlantDownload the PDF here. Keep Reading...

04 February

High grade assays continue from Sandstone RC drilling

Brightstar Resources (BTR:AU) has announced High grade assays continue from Sandstone RC drillingDownload the PDF here. Keep Reading...

19h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

20h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00