June 18, 2024

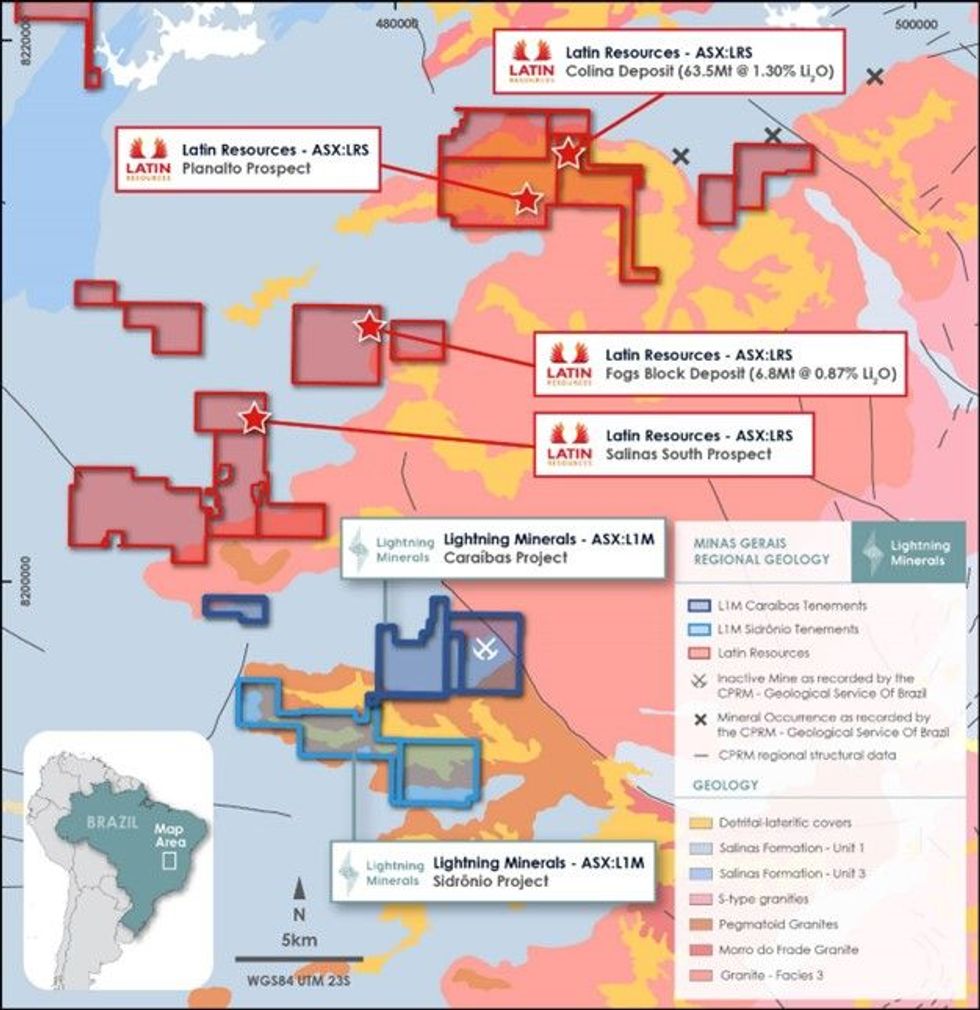

Lightning Minerals (L1M or the Company) is pleased to announce completion of the acquisition of Bengal Mining (Bengal). Bengal holds, via its wholly owned subsidiary Tigre Mineracao Ltda (Tigre) option agreements over two lithium projects, Caraíbas and Sidrônio (the Projects). The Projects are located in Brazil’s prolific Lithium Valley district in the state of Minas Gerais in proximity to Latin Resources’ (ASX: LRS) Colina project1 hosting 70.9Mt @ 1.25% Li20 and Sigma Lithium’s (NASDAQ: SGML) Grota do Cirilo project2 hosting 108.9Mt @ 1.41% Li20.

HIGHLIGHTS

- All Conditions Precedent have been met including receipt of shareholder approval at the Company’s EGM on 13 June 2024 including completion of tranche 2 capital raising

- Completion of acquisition of Bengal Mining and options over highly prospective lithium projects Caraíbas and Sidrônio, located in the prolific Lithium Valley region of Minas Gerais, Brazil

- Recent site visit confirms the highly prospective nature of the projects in Brazil’s prolific Lithium Valley in the state of Minas Gerais

The acquisition of Bengal Mining is now complete and is seen as transformative to the future of the Company as it positions itself in the prolific Lithium Valley district of Minas Gerais, Brazil. Currently, Managing Director, Alex Biggs is in Brazil visiting the projects and region as well as attending the Brazil Lithium Summit in Belo Horizonte. He will be meeting with key stakeholders, contractors and business leaders to ensure the Company is well positioned in Brazil moving forwards. Recent site visits have demonstrated the potential that the Caraíbas and Sidrônio projects present as reported in ASX Announcement 14 June 2024.

Lightning Minerals Managing Director Alex Biggs said, “Completion of the Bengal acquisition is a significant step forward for the Company and we can now begin to focus our efforts on target generation across our Brazilian assets. Having spent time in Brazil over the past couple of weeks we really like what we see and the potential these projects present to the Company. To be positioned where we are in the region is a significant achievement for us. Couple that with our relationships in Brazil, the prospectivity of the projects we are setting ourselves up for success. We welcome new shareholders on board as part of the transaction and capital raising and look forward to the future as we begin our exploration in one of the world’s premier lithium regions”.

Caraíbas and Sidrônio Projects

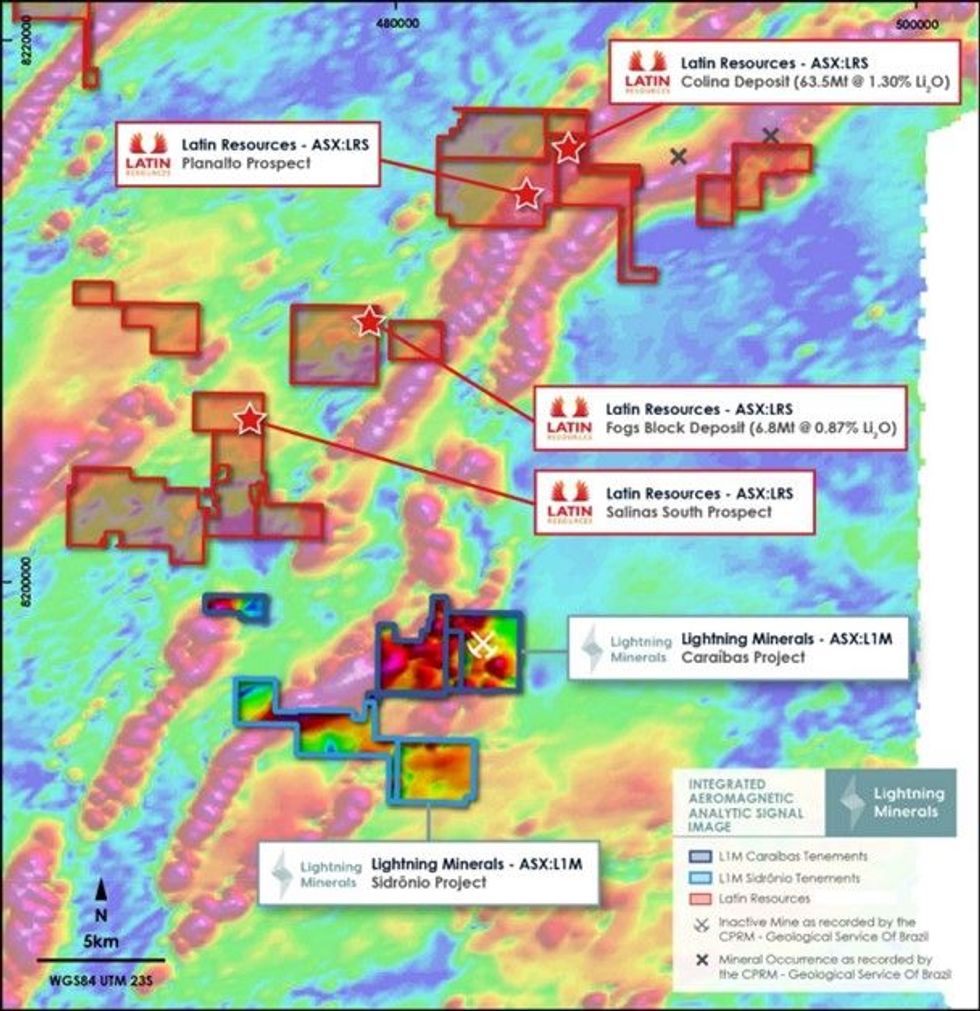

The Projects are located in the Eastern Brazilian Pegmatite Province that encompasses approximately 150,000 km2, stretching from Bahia state to Rio de Janeiro state. The Caraíbas Project consists of five (5) separate tenements covering 1,733 Ha and the project area contains a series of albite and muscovite rich pegmatites identified by Bengal’s initial reconnaissance works. Aeromagnetic data shows the tenements are located along regional structures and shear zones which are analogous to the trends present at Latin Resources’ (ASX: LRS) Colina deposit. The Caraíbas Project is located approximately 20km to the south in the same Salinas geological formation.

The Sidrônio Project consists of two (2) tenements covering 1,638 Ha, strategically located adjacent and along strike to the south from the Caraíbas Project. Aeromagnetic data shows the tenements are located along similar interpreted structural trends that may potentially be conduits for mineralisation. Both Projects cover prospective Salinas Formation geology which is thought to provide adequate rheological conditions suitable for the emplacement of late hydrothermal fluids. In similar geological settings, proximal to S-type granites, the Salinas Formation is known to host fertile lithium mineral bearing pegmatites.

Next Steps

Work programs will focus on ground reconnaissance, geophysical drone survey works, drill target identification and drilling. It is estimated that these works will occur over the next 6-months but are subject to change as the Company gains further knowledge on the projects.

Initial indicators and impressions gathered from this site visit will continue to inform the Company’s approach to exploration at both Caraíbas and Sidrônio over the coming months but the strategy already developed is considered appropriate with a view to developing drill targets over the next few months.

Click here for the full ASX Release

This article includes content from Lightning Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

L1M:AU

The Conversation (0)

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00