Crypto Market Update: Bitcoin Price Drops Again After Weekend Selloff

Bitcoin fell to around US$77,000 over the weekend, erasing all gains made since Donald Trump returned to office and marking its lowest price since April 2025.

Here's a quick recap of the crypto landscape for Monday (February 2) as of 9:00 p.m. UTC.

Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrency market news.

Bitcoin and Ether price update

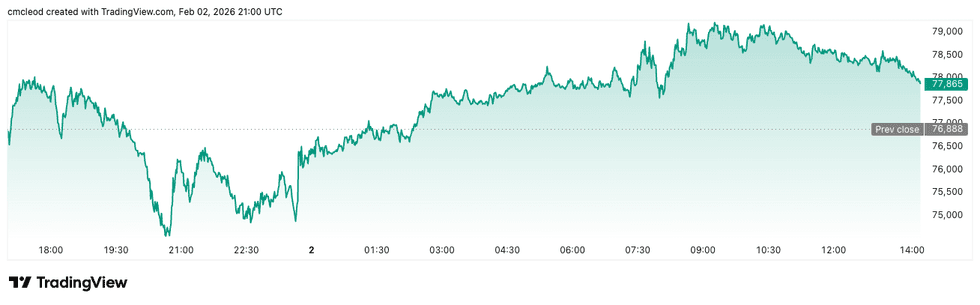

Bitcoin (BTC) was priced at US$77,944.63, up by 1.2 percent over 24 hours.

Bitcoin price performance, February 2, 2026.

Chart via TradingView.

Bitcoin slid to its lowest level since April last year over the weekend, briefly touching the US$74,000 mark. The drop capped Bitcoin’s fourth consecutive monthly decline and its longest losing streak in seven years.

“The crypto market is currently suffering from panic among speculative participants,” said Samer Hasn, senior market analyst at XS.com, pointing to a steep contraction in derivatives activity and persistent outflows from spot Bitcoin exchange-traded funds. According to CoinGlass data, Bitcoin open interest fell by 1.68 percent to US$52.21 billion in the four hours leading up to Monday's close, with US$6.55 million in liquidations, mostly long positions.

Geopolitical uncertainty has added another layer of strain. “Concerns surrounding the situation with Iran were the main news factor weighing on the market,” said Vasily Shilov, chief business development officer at SwapSpace. Shilov noted that heightened geopolitical rhetoric, combined with trade threats and the US Federal Reserve’s decision to keep interest rates unchanged, has pushed investors toward liquid assets and away from higher-risk exposure.

Some analysts caution that bearish sentiment may persist into the first half of the year.

Ray Youssef, CEO of NoOnes, said capital outflows into precious metals and uncertainty around US fiscal policy have tilted market dynamics firmly in favor of sellers. While Bitcoin found temporary support near US$75,000, Youssef said the US$73,000 level is now critical, with a sustained break potentially accelerating losses.

Investors are now looking toward upcoming US economic data and Congress' direction on crypto policy as signals on whether the current drawdown marks another stress test or the start of a deeper bear phase.

Ether (ETH) was priced at US$2,318.68, up by 0.2 percent over the last 24 hours.

Altcoin price update

- XRP (XRP) was priced at US$1.62, up by 1.2 over 24 hours.

- Solana (SOL) was trading at US$103.69, up by 1.9 percent over 24 hours.

Today's crypto news to know

Trump admin officials meet on stablecoin yield and CLARITY Act

Trump administration officials met with crypto and banking representatives on Monday to discuss addressing stablecoin yield in the Senate’s proposed market structure bill. The Digital Chamber, a crypto advocacy group, reported that CEO Cody Carbone visited the White House to discuss the CLARITY Act.

Issues expected to be addressed before the postponed Senate Banking Committee markup include tokenized equities, decentralized finance, crypto ethics for elected officials and stablecoin rewards.

Carbone called the meeting “exactly the kind of progress needed” to resolve major roadblocks, adding optimism that detailed policy work will “create a fair playing field for digital assets in the US.”

Jupiter secures strategic investment from ParaFi Capital

Jupiter, a Solana-based onchain trading and liquidity aggregation protocol, said it has secured a US$35 million strategic investment from ParaFi Capital, a financial technology company that provides embedded financing powered by artificial intelligence, as well as capital solutions for small businesses

According to reports citing NS3.AI, the transaction was structured to reflect long-term alignment, including the sale of tokens at market prices with no discount and an extended lockup period. The entire investment was settled using Jupiter’s JupUSD stablecoin. Additionally, the deal included warrants allowing ParaFi Capital to purchase further tokens at higher prices. Financial terms beyond the US$35 million investment were not disclosed by the companies.

Bed Bath & Beyond to acquire Tokens.com

Bed Bath & Beyond (NYSE:BBBY) said it will acquire Tokens.com to create a unified investment and personal finance platform aiming to address the fragmented financial services market by providing a one-stop journey for real estate and other real-world asset finance. Tokens.com will become wholly owned by Bed Bath & Beyond, leveraging the company’s experience as an early investor and proponent of blockchain technology, along with its portfolio's infrastructure and regulatory expertise. Bed Bath & Beyond currently holds strategic digital asset investments, including tZERO and GrainChain, both directly and through its Medici portfolio.

Chinese crime networks moved US$16 billion in crypto last year, report finds

Chinese language organized crime groups moved an estimated US$16 billion in cryptocurrency in 2025, accounting for roughly one-fifth of global illicit crypto activity, according to a new report from Chainalysis.

These networks rely heavily on Telegram-based “guarantee” channels that act as informal escrow and marketing hubs for money-laundering services. Investigators say the platforms facilitate not just laundering, but also human trafficking, scam operations and the sale of equipment used in Southeast Asian fraud centers.

Stablecoins such as USDT and USDC are favored for their liquidity and lower volatility, which help criminals avoid losses while moving funds. Chainalysis estimates the networks laundered roughly US$44 million per day, often serving clients ranging from organized crime syndicates to sanctioned state actors.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.