- WORLD EDITIONAustraliaNorth AmericaWorld

Top 5 Canadian Nickel Stocks

Guide to Uranium Mining in Canada

Overview

Ontario has always been a premier jurisdiction for mining in Canada. However, one of Ontario’s earliest gold camps in the province’s northwestern region is showing signs of high-grade revitalization.

The town of Atikokan in Ontario is known for its two massive iron ore pits mined in the middle of the Second World War and operated until the late 1970s. The earliest gold exploration dates back to the 1800s, with significant production reaching upwards of approximately 52,000 ounces of gold and 174,000 ounces of silver in that period. With over 50 occurrences, prospects and producers of gold since Atikokan’s initial discovery, the gold camp boasts exploration potential for investors worldwide.

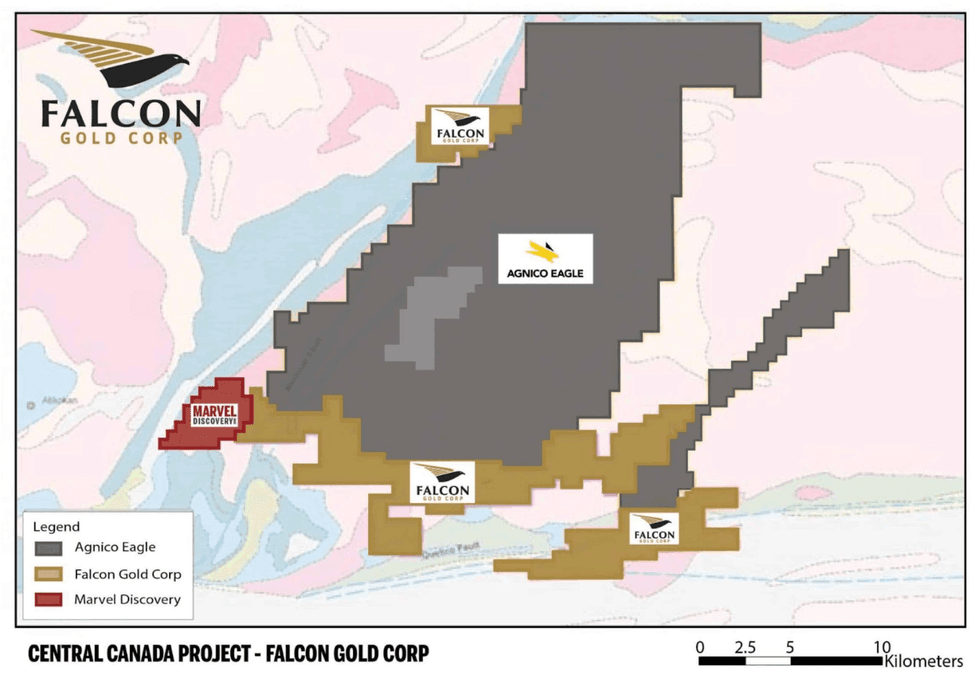

One such mining exploration company with a project in Atikokan is Falcon Gold (TSXV:FG, FWB:3FA, OTCQB:FGLDF). Its flagship Central Canada gold and polymetallic project leverages strategic positioning 20 kilometers east of Agnico Eagle’s Hammond Reef gold deposit. The world-class deposit currently has an estimated 3.32 million ounces of gold mineral reserves at 0.84 grams per ton (g/t) gold grading and an indicated mineral resource at 2.3 million ounces. The Central Canada project has a high potential to mimic this exceptional high-grade gold mineralization with further exploration and discovery.

Falcon Gold conducted a 17-hole drill program at the Central Canada project totaling 2,942.5 meters of core. The weighted average grade of the main gold zone is 1,570 parts per billion (ppb) gold or 1.57 g/t gold and within the main zone intersections, the first meter of core returned 5.68 g/t gold. The company also completed sampling on the J.J. Walshe mine trend in 2021 which returned five grab samples ranging from 11.2 g/t gold to 79.7 g/t gold. Assay results highlight several gold-bearing zones across the property previously undocumented including the Sugar Shear (22.9 g/t gold), Monte (3.63 g/t gold), Honey (1.04 g/t gold), and Hoist Zone.

The company’s portfolio of mineral projects also includes those in prolific mining jurisdictions of Ontario, British Columbia and Argentina. In April 2021, Falcon created the Argentina-based Falcon Gold LatamARG S.A. to manage its South American exploration and development operations. This creation came at an optimal time with the company’s acquisition of the Esperanza gold-silver-copper project in La Rioja, Argentina. Falcon intends to explore further interests in South America’s mining-friendly jurisdictions.

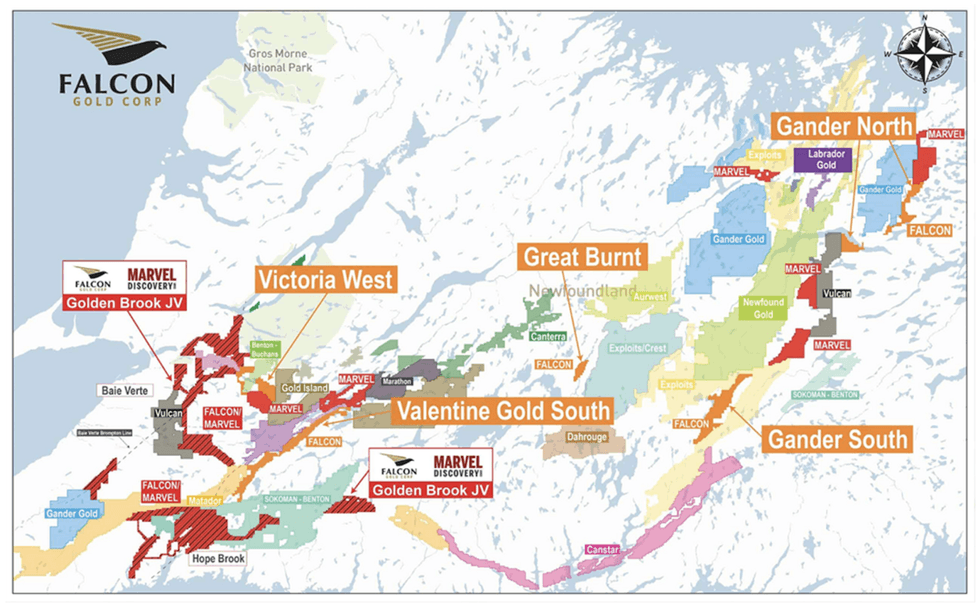

Falcon currently has approximately 90,000 hectares of prospective ground in Newfoundland which are strategically located and contiguous to companies like First Mining Gold, Sokoman Minerals-Benton JV, Gander Gold, Exploits Discovery, Vulcan Minerals and Marvel Discovery.

In 2022, Falcon entered into two separate agreements to acquire a 100-percent interest in two battery metals projects in the province of Ontario and Quebec, collectively known as the Timmins West and Outarde Nickel projects northwest of Baie Comeau, Quebec. The first purchase agreement covers five mining claims totaling 1,940 hectares within the Kamiskotia Gabbroic Complex (KGC), a gabbroic to anorthositic intrusive mafic to ultramafic body that has documented nickel-copper-cobalt mineralization. The second purchase agreement comprises 93 claims covering 5,138 hectares located 120 kilometers northwest of Baie-Comeau, Quebec.

In November 2022, Falcon completed the spin-out of its subsidiary Latamark Resources Corp. The arrangement entitles Falcon shareholders to one common share in Latamark for every 5.8 common shares held in Falcon. Latamark will also issue 5 million Latamark shares to Falcon, as part of the arrangement.

Company Highlights

- Falcon Gold Corp is a mineral exploration company focused on exploring, expanding and developing its robust portfolio of highly prospective precious metal projects in prolific mining jurisdictions in the Americas.

- The company operates a robust project portfolio with its flagship Central Canada gold and polymetallic project hosting excellent road access, gold mineralization and strategic positioning near Agnico Eagle’s Hammond Reef gold deposit, which contains a multi-million estimated gold resource.

- In addition to Central Canada Gold Mine, which currently holds an estimated 3.32 million ounces of gold, Falcon Gold holds 15 additional projects in other prime mining jurisdictions, including Springpole West, Burton and Timmins West in Ontario; Spitfire & Sunny Boy and Gaspard gold projects in British Columbia; The Great Burnt, Gander North/South, Valentine Gold South, Victoria West, and Golden Brook in Newfoundland; Viernes and Area 51 Properties in Latin America; and Outarde, HSP south and Hope Advance in Quebec.

- Falcon acquired a 100-percent interest in two battery metals projects in Ontario and Quebec, collectively known as the Timmins West and Outarde Nickel Projects.

- Falcon has completed a spin-out of its Latin American asset, the Esperanza gold project, located in La Roja Province, Argentina.

- The company has a world-class management team consisting of several mining, finance and geological heavyweights with years of experience in a diverse portfolio of related industries.

Get access to more exclusive Gold Investing Stock profiles here