- WORLD EDITIONAustraliaNorth AmericaWorld

Top 9 Global Lithium Stocks (Updated January 2026)

Top 5 Canadian Lithium Stocks (Updated January 2026)

Nickel Price Forecast: Top Trends for Nickel in 2026

Nickel Price 2025 Year-End Review

Overview

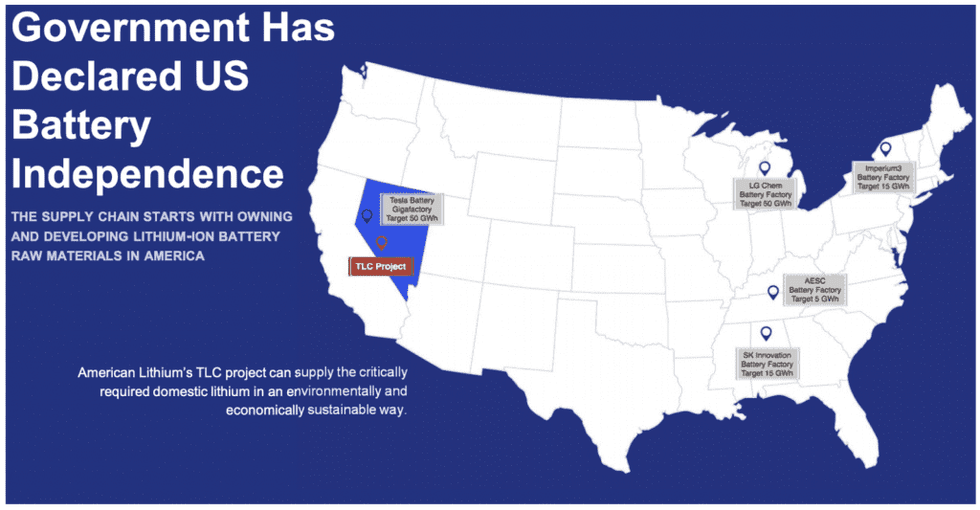

Even with surging global lithium demand, political powerhouses like the US are concerned about its critical minerals supply chains in meeting those growing demands. As the US reviews its critical supply chain risks, lithium mining companies operating in the Americas present the potential to turn the tides of critical mineral market vulnerabilities.

American Lithium (TSXV:LI, OTCQB:LIACF, XFRA:5LA1) is a top TSX Venture 50 company focused on exploring and developing high-quality lithium deposits within mining-friendly jurisdictions throughout the Americas. The company is currently operating its Tonopah Lithium Claims (TLC) project located in the highly prospective mining Esmeralda lithium district in Nevada.

The 100 percent owned TLC project hosts overwhelming operational and geological advantages. Its unique mineralogy, lack of deleterious elements and favorable processing conditions primes project development for fast track potential.

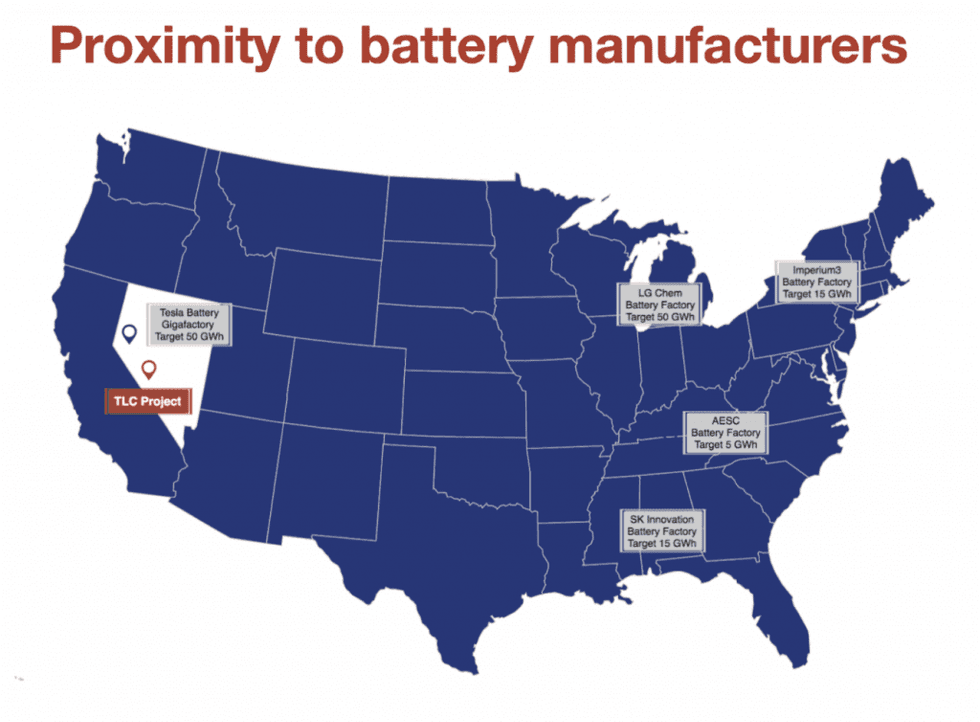

The project boasts excellent existing infrastructure and strategic positioning in the top mining investment jurisdiction of Nevada. The property leverages proximity to paved roads, electricity, water networks and skilled local labor. Additionally, premier solar conditions across the geographic region point to some of the world’s lowest power and natural gas costs.

The TLC project has one of the fastest processing times relative to its peers. Beneficiate samples taken from TLC achieved a 49 percent mass reduction while increasing lithium grade by 66 percent, and subsequent leach testing extracted 96 percent of the lithium from upgraded samples.

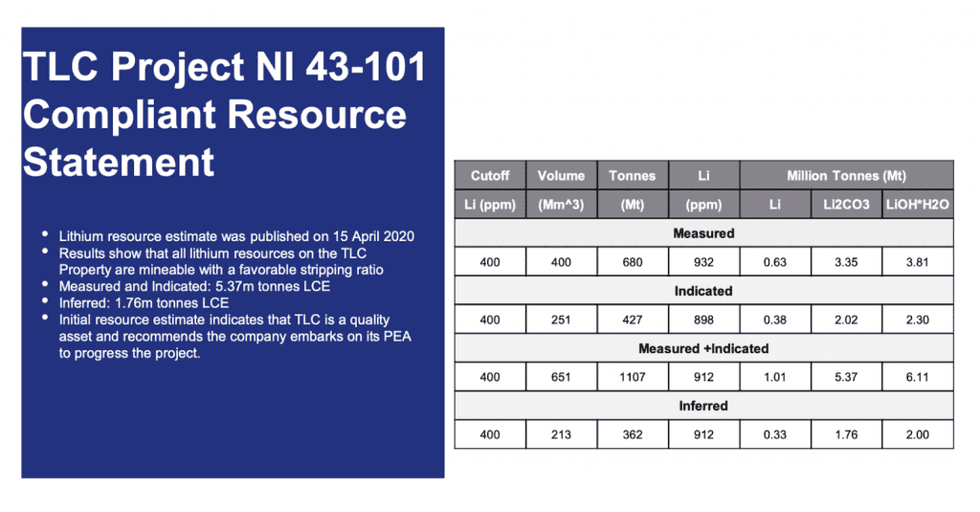

A 43-101 compliant technical report for TLC shows a measured and indicated resource of 5.37 million tonnes lithium carbonate equivalent (LCE) and another 1.76 million tonnes LCE inferred.

In March 2021, the U.S. Department of Energy Advanced Manufacturing Office selected American Lithium as a co-recipient of a grant funding 50 percent of the capital cost for a US$4.5 million lithium extraction hydroxide pilot plant.

This grant provides funding to complete field demonstration of selective leaching, purification and electrochemical production of battery-grade lithium hydroxide precursors from US claystone deposits like the TLC project. This announcement further legitimizes American Lithium as a major player in tackling the US’ domestic lithium supply problem.

The company has a robust capital structure and tight shareholder portfolio. Its market cap stands at US$141.8 million, with key shareholders largely consisting of retail investors, management and insiders. American Lithium currently has zero debt.

The American Lithium management team has a proven history of returning value to shareholders and years of combined experience in mineral exploration, resource development and project management. The company is led by CEO Andrew Bowering, who has founded, funded and grown a number of exploration companies in the last 30 years. Part of this roster are Cap-Ex Iron Ore (now ML Gold), Prime Mining (TSXV:PRYM), and Millennial Lithium (TSXV:ML).

Company Highlights

- American Lithium is focused on exploring and developing highly prospective lithium deposits across mining-friendly jurisdictions in the Americas. The company currently is operating its high-quality Tonopah Lithium Claims (TLC) project in Nevada, USA.

- The company presents excellent investing opportunities and leverages surging global lithium demand, which is expected to rise exponentially by 2028. It could become a significant player in aiding the domestic lithium supply problem in the US.

- The TLC project boasts strategic positioning in Nevada, ranked the top jurisdiction in the world for mining investment in 2020. The project also sits near the Tesla gigafactory and leverages excellent existing infrastructure.

- TLC hosts unique metallurgical properties with high lithium concentrates, over 90 percent recoveries and fast leaching potential. Operational advantages also include low-cost mining and processing.

- The company continues to expand its robust asset portfolio with the recent acquisition of the Macusani and Fulchani projects connected with Plateau Energy Metals Inc. (TSXV:PLU).

- The company’s leadership has a proven track record of mining and exploration success across years of experience—their depth of management primes American Lithium for significant growth and economic prosperity.

- American Lithium currently has zero debt.

Get access to more exclusive Lithium Investing Stock profiles here