(TheNewswire)

Brossard, Quebec, August 29, 2024 TheNewswire Charbone Hydrogen Corporation (TSXV: CH;

OTCQB: CHHYF; FSE: K47) (the "Company" or "CHARBONE"), North America's only publicly traded pure-play green hydrogen company, is pleased to announce the financial and operating results for the three and six-month periods ending June 30, 2024.

Forward progress continues to be reflected in both 2024 quarter-end financials and in project advancements, as CHARBONE's priority plan to start producing green hydrogen during the second half of 2024 remain on track.

Q2 2024 HIGHLIGHTS:

-

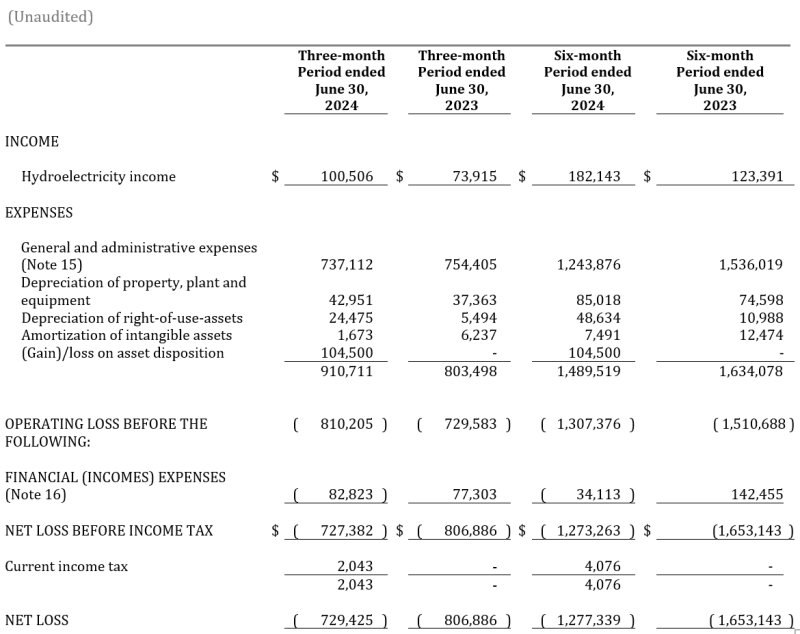

Spending decreased 19% to $1,243,876 in the six-month period ending June 30, 2024 compared to $1,536,019 in the six-month period ending June 30, 2023 (activities refocus and tightening of general and administrative expenses).

-

Revenue increased 48% to $182,143 in the six-month period ending June 30, 2024 compared to $123,391 in the six-month period ending June 30, 2023 (generated from the Wolf River acquisition on December 1, 2022).

-

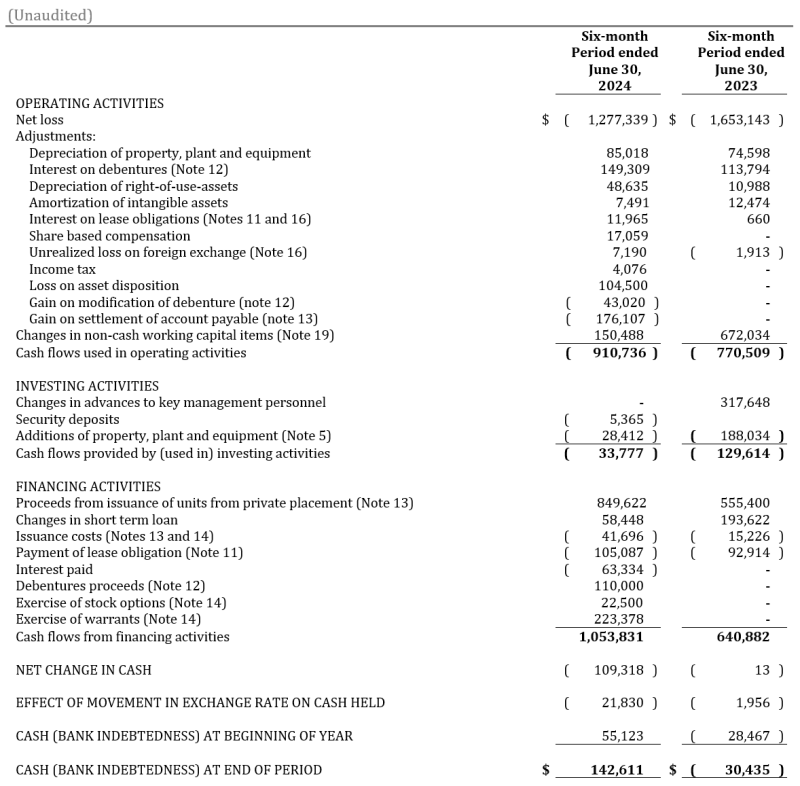

The Company has closed a private financing for gross proceeds amounting to $849,622, Units for debt settlement of $352,214 and exercises of warrants/options of $245,878;

-

The Company also received an additional $100,000 in 2024 from Finexcorp secured convertible debentures at a deemed price of $0.10 and agreed on an extension of the $1.2 million CAD 14% (now 12%) secured convertible debentures maturity date that were issued by the Company in reducing significantly the current liabilities and with better terms; and

-

The Company made acquisitions of storage hydrogen equipment and upgraded its Sorel-Tracy electrolyzer capacity to 1.75MW.

Located near Montreal, Quebec, CHARBONE's Sorel-Tracy Green Hydrogen Project will serve as the Company's flagship facility, giving CHARBONE a first-mover advantage with plans to commence production later this year.

"Management's efforts to shore up and strengthen our balance sheet have been focused and deliberate. We've made significant cost-reduction headway in recent months, while still driving forward with our near-term plans to deliver a network of North American green hydrogen production facilities," said Benoit Veilleux, Chief Financial Officer and Corporate Secretary of CHARBONE . "The recent discussion with strategic partners is advancing well to help to execute CHARBONE's growth potential with our financial partners and investors, and the team feels supported and is advancing on all fronts."

Units for debt

Further to its news release dated May 22, 2024 announcing the closing of Units for debt settlement for a total of $302,213 of suppliers' payables, the Company is pleased to announce that it has received all approval from TSX Venture Exchange to issue the shares and warrants and can confirm settlement of the debts. Also, the nature of services provided were $222,213 for accounting fees, $40,000 for legal fees and $40,000 for consulting work.

About Charbone Hydrogen Corporation

CHARBONE is an integrated green hydrogen group focused on delivering a network of modular green hydrogen production facilities across North America. Using renewable energy sources to produce green (H2) dihydrogen molecules and eco-friendly energy solutions for industrial, institutional, commercial and future mobility users, CHARBONE plans to scale and deliver green hydrogen production facilities in both the US and Canada by 2024, with an additional 14 facilities planned by 2030. CHARBONE is the only publicly traded pure-play green hydrogen company with common shares trading on the TSX Venture Exchange (TSXV: CH); the OTC Markets (OTCQB: CHHYF); and the Frankfurt Stock Exchange (FSE: K47). For more information, please visit www.charbone.com

Forward-Looking Statements

This news release contains statements that are "forward-looking information" as defined under Canadian securities laws ("forward-looking statements"). These forward-looking statements are often identified by words such as "intends", "anticipates", "expects", "believes", "plans", "likely", or similar words. The forward-looking statements reflect management's expectations, estimates, or projections concerning future results or events, based on the opinions, assumptions and estimates considered reasonable by management at the date the statements are made. Although Charbone believes that the expectations reflected in the forward-looking statements are reasonable, forward-looking statements involve risks and uncertainties, and undue reliance should not be placed on forward-looking statements, as unknown or unpredictable factors could cause actual results to be materially different from those reflected in the forward-looking statements. The forward-looking statements may be affected by risks and uncertainties in the business of Charbone. These risks, uncertainties and assumptions include, but are not limited to, those described under "Risk Factors" in the Corporation's Filing Statement dated March 31, 2022, which is available on SEDAR at www.sedar.com; they could cause actual events or results to differ materially from those projected in any forward-looking statements.

Except as required under applicable securities legislation, Charbone undertakes no obligation to publicly update or revise forward-looking information.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release .

| Contacts Charbone Hydrogen Corporation | ||||

| Dave B. Gagnon | ||||

| Chief Executive Officer and Chairperson of the Board | ||||

| Telephone: | +1 438 844-7170 | |||

| Email: |

| |||

|

| ||||

| Daniel Charette | ||||

| Chief Operating Officer | ||||

| Telephone: | +1 438 800-4946 | |||

| Email: | ||||

| Benoit Veilleux | ||||

| Chief Financial Officer and Corporate Secretary | ||||

| Telephone: | +1 438 800-4991 | |||

| Email: | ||||

Copyright (c) 2024 TheNewswire - All rights reserved.