- WORLD EDITIONAustraliaNorth AmericaWorld

March 20, 2024

Brightstar Resources Limited (ASX: BTR) (Brightstar) is pleased to announce that following on from the maiden and second gold pours announced 07/03/20241 and 12/02/20242, all processing of the ore from the Selkirk joint venture has successfully been completed at Genesis Minerals’ Gwalia processing plant.

HIGHLIGHTS

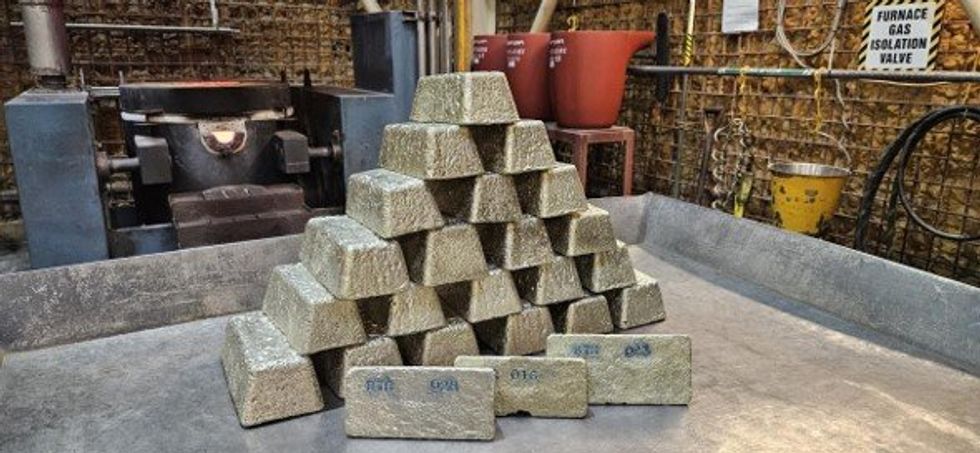

- Brightstar has successfully finalised its gold pours from ore processing of Selkirk material from the Menzies Gold Project, with a total of 430.7kg of gold doré poured

- Total preliminary unreconciled ounces produced of 8,049.6oz exceeds the modelled JV budget for Selkirk and highlights the quality of Brightstar’s Menzies Gold Project

- Positive reconciliations of ore mined, head grade and metallurgical recoveries exceeded Brightstar’s expectations

- Total joint venture costs are being finalised and are expected to be approximately $12 - $13 million

- Refining of the gold doré is ongoing at the Perth Mint, after which all metals refined will be sold and the revenue will be generated to the JV on a 50/50 Profit Share

- The first 28 gold doré bars have been refined and sold at the Perth Mint, with 5,546 ounces sold at A$3,306/oz for $18M revenue generated under the joint venture

Brightstar advises that processing of the remainder of the ore from the Selkirk mining joint venture has successfully completed, with total unreconciled gold production of 8,049.6oz from 43 gold doré bars produced in the campaign.

Final reconciliations of the gold-in-circuit are underway between Brightstar’s independent metallurgists and Genesis Minerals Ltd. With the current AUD gold price trading at approximately A$3,300/oz, the revenue to be generated from the Selkirk mining campaign significantly exceeds the joint ventures model (done at A$2,850/oz) and BTR management expectations due to additional recovered ounces at a higher gold price.

To date, 5,546oz have been sold to the Perth Mint after refining at an average realised sale price of A$3,306/oz.

Final costs for the joint venture are still being finalised and reconciled, and once approved by the joint venture, the net project income will be split 50/50 between Brightstar and our joint venture partner BML Ventures Pty Ltd. Total project costs are expected to be approximately A$12 - $13 million.

Brightstar’s Managing Director, Alex Rovira, commented “We are pleased to announce that gold processing of our Selkirk Mining JV material has safely and successfully concluded by the team at Genesis Minerals Ltd’s Gwalia operation. Their assistance, along with JT Metallurgists acting on behalf of the joint venture, has seen the successful processing of ore from the Menzies Gold project into doré bars poured at record high AUD gold prices.

In parallel with the finalisation of gold-in-circuit calculations, which is expected to occur shortly, we are also finalising the joint venture accounts and making provisions for rehabilitation and waste dump seeding to achieve best practice environmental outcomes.

With the Selkirk Mining JV all but concluded, we continue our focus on building Brightstar into a meaningful gold producer and look forward to updating the market with finalised accounts and announcing the reconciled 50% Profit Share value attributable to Brightstar.”

Click here for the full ASX Release

This article includes content from Brightstar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BTR:AU

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

08 January

Brightstar Resources

Emerging gold producer and district-scale resource developer in Western Australia

Emerging gold producer and district-scale resource developer in Western Australia Keep Reading...

04 February

High grade assays continue from Sandstone RC drilling

Brightstar Resources (BTR:AU) has announced High grade assays continue from Sandstone RC drillingDownload the PDF here. Keep Reading...

01 February

Strategic $180M capital raising funds Goldfields development

Brightstar Resources (BTR:AU) has announced Strategic $180M capital raising funds Goldfields developmentDownload the PDF here. Keep Reading...

30 January

Quarterly Activities/Appendix 5B Cash Flow Report

Brightstar Resources (BTR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Updated Goldfields Feasibility Study

Brightstar Resources (BTR:AU) has announced Updated Goldfields Feasibility StudyDownload the PDF here. Keep Reading...

29 January

Updated Goldfields DFS Presentation

Brightstar Resources (BTR:AU) has announced Updated Goldfields DFS PresentationDownload the PDF here. Keep Reading...

22h

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The Toronto-based miner said its board has authorized preparations for an IPO of a new entity that would house its premier North American gold operations,... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

05 February

TomaGold Borehole EM Survey Confirms Berrigan Deep Zone

Survey also validates significant mineralization and unlocks new targets Highlights Direct correlation with mineralization : The modeled geophysical plates explain the presence of semi-massive to massive sulfides intersected in holes TOM-25-009 to TOM-25-015. Priority target BER-14C :... Keep Reading...

Latest News

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00