September 06, 2022

Benton Resources Inc. ('Benton' or 'the Company') (TSX-V: BEX) is pleased to announce it has received the all payments from Metallica Metals Corp. (CSE:MM) (OTCQB:MTALF) (FWB:SY7P) (the "Company" or "Metallica Metals") for 100% interest in its Saganaga/Starr gold-silver project ("Starr" or the "Project"), located in the Thunder Bay Mining District of Ontario, Canada (see Figure 1).

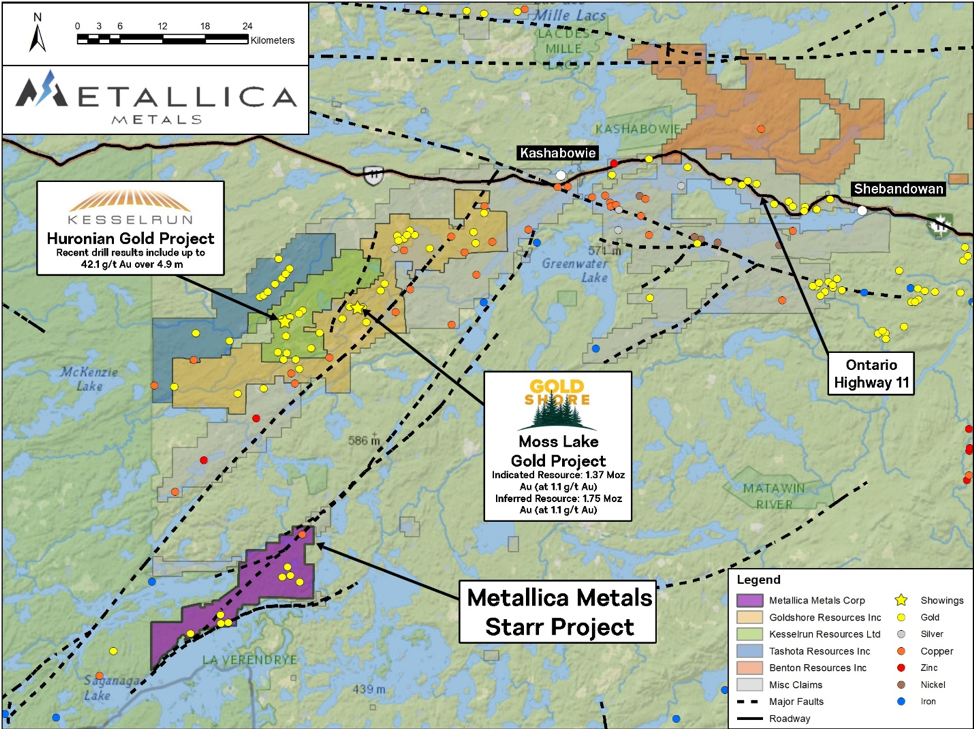

Figure 1 Figure 1: Location of Metallica Metals' Starr Gold-Silver Project with respect to adjacent properties including the Moss Lake gold deposit (sources: 2013 NI 43-101 Technical Report and PEA for the Moss Lake Project and Kesselrun Resources October 7, 2020 news release - see figure notes below for further details on mineral resource estimate reference)

Figure Notes: The adjacent Moss Lake gold deposit hosts an Indicated Mineral Resource of 39,797,000 tonnes grading 1.1 g/t Au for 1,377,300 contained ounces of gold and an Inferred Mineral Resource of 50,364,000 tonnes grading 1.1 g/t Au for 1,751,600 contained ounces of gold, and is currently under care and maintenance (source: NI 43-101 Technical Report and PEA for the Moss Lake Project with an effective date of May 31, 2013 and filed on SEDAR under Moss Lake Gold Mines Ltd., now Wesdome Gold Mines Ltd.). Readers are cautioned that mineralization and mineral resource estimates on adjacent and/or nearby properties are not necessarily indicative of mineralization on the Starr Project (please refer to additional cautionary statements below).

Completion of acquiring 100% interest of the Starr Project

On November 16, 2020, the Company entered into a share purchase agreement to acquire 2752300 Ontario Inc. whose sole asset was an option agreement with Benton Resources Inc. ("Benton") to earn up to a 100% interest in the Project.

The Company has made the following payments to Benton to earn the 100% interest in the Project:

- On November 25, 2020, the Company was issued 1,380,000 common shares and paid $50,000 cash;

- On July 30, 2021, the Company was issued 1,248,177 common shares and paid $50,000 cash; and

- On July 29, 2022, the Company was issued 1,082,120 common shares and paid $50,000 cash; and

- On August 31, 2022, the Company was issued 2,000,000 common shares and paid $50,000 cash.

On behalf of the Board of Directors of Benton Resources Inc.,

"Stephen Stares"

Stephen Stares, President

About Benton Resources Inc.

Benton Resources Inc. is a well-funded mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Following a project generation business model, Benton has a diversified, highly-prospective property portfolio in Gold, Silver, Nickel, Copper, and Platinum Group Elements and currently holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains Net Smelter Return (NSR) royalties for potential long-term cash flow. Benton has also recently entered into a 50/50 strategic alliance with Sokoman Minerals Corp. (TSXV: SIC) through three large-scale joint-venture properties including Grey River Gold, Golden Hope, and Kepenkeck in Newfoundland that are now being explored.Parties interested in seeking more information about properties available for option can contact Mr. Stares at the number below.

For further information, please contact:

Stephen Stares, President & CEO

Phone: 807-475-7474

Email: sstares@bentonresources.ca

Website: www.bentonresources.ca

Twitter: @BentonResources

Facebook: @BentonResourcesBEX

CHF Capital Markets

Thomas Do, IR Manager

Phone: 416-868-1079 x 232

Email: thomas@chfir.com

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains “forward-looking statements” within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be “forward-looking statements.”

Click here to connect with Benton Resources Inc. (TSX-V: BEX) , to receive an Investor Presentation

BEX:CA

Sign up to get your FREE

AuKing Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

09 February

AuKing Mining

Advancing a diversified portfolio of uranium, copper and critical minerals projects across Australia, Tanzania and North America, with current priorities including the proposed tin acquisition in north-west Tasmania, the Koongie Park copper-zinc project in Western Australia, and the Mkuju uranium project in southern Tanzania.

Advancing a diversified portfolio of uranium, copper and critical minerals projects across Australia, Tanzania and North America, with current priorities including the proposed tin acquisition in north-west Tasmania, the Koongie Park copper-zinc project in Western Australia, and the Mkuju uranium project in southern Tanzania. Keep Reading...

10 February

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

09 February

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

09 February

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

09 February

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

09 February

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

09 February

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Sign up to get your FREE

AuKing Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00