(TheNewswire)

-

Global in situ gold resource increases by 78% over original MRE

-

Global in situ silver resource increases by 113% over original MRE

-

New MRE figures:

-

Measured Resources: 835,000 mt @ 4.3 g/t Au and 15 g/t Ag

-

Indicated Resources: 296,000 mt @ 3.6 g/t Au and 15 g/t Ag

-

Inferred Resources: 250,000 mt @ 3.7 g/t Au and 13 g/t Ag

-

-

4,500-meter drilling program planned for the next phase of field work, which will include resource infill drilling and exploration drilling around the license

Vancouver, BC - TheNewswire - July 17, 2023 - Avrupa Minerals Ltd. (TSXV:AVU ) is pleased to announce that its partner at the Slivova Gold Project in Kosovo, Western Tethyan Resources (WTR), has provided a new Mineral Resource Estimate and general near-term work plan for the gold-silver deposit. Slivova is located in the prolific Vardar Mineral Trend, about 30 km SE of the capital, Pristina. WTR can earn-in to 75% of the Project by funding exploration and development for Euro 1,800,000 over three years, and then a further 10% by making certain milestone and success payments, producing an Environmental Impact Statement, delivering a Feasibility Study, and completing a Mining License application.

Paul W. Kuhn, President and CEO of Avrupa Minerals, commented:

"We are truly excited about this new development in the progress of the Slivova Project, and look forward to continued success in the program. WTR and its associated company, Ariana Resources, are working hard to advance the Project to the next level. We expect further information concerning progress, as the two companies work to complete a Preliminary Economic Assessment for Slivova in the coming months and begin a 4,500-meter drilling program to further define the Slivova deposit and test other attractive, previously-identified possibilities around the license."

Dr. Kerim Şener, Managing Director of Ariana Resources, provided further information:

"We are very pleased to provide a substantial resource update on the Slivova Gold Project in Kosovo. With a Measured and Indicated Resource of 146,000 oz of gold and 546,000 oz of silver, and an Inferred Resource of another 30,000 oz of gold and 100,000 oz Ag in global resources now defined, Slivova is now well on track to be developed conceptually as a high-grade, open-pit and underground mining operation.

We are increasingly confident that further resource expansion will occur as exploration proceeds at the site in the upcoming years. Several exploration targets in the immediate vicinity require follow-up and drill-testing, and the broader project area contains significant exploration potential for similar mineralisation based on the latest regional BLEG stream-sediment results.

We are firmly in the planning stage for a new drilling programme at Slivova, which will be focused in part on resource infill and extensional drilling. We are targeting a minimum resource of 200,000 oz of gold prior to the initiation of more advanced project development work, which would include more advanced studies."

Mentor Demi, Managing Director of Western Tethyan Resources added:

"Western Tethyan Resources is very excited to announce a significant resource increase for the Slivova gold deposit. The resource growth came mostly from the incorporation of the new historical drilling data and the revision of the geology and resource interpretation and model.

Based on the current resources' size, Slivova represents a very prospective, undeveloped gold project, in Kosovo.

Slivova is well on its way to becoming an advanced project, yet with a lot of exploration upside, down dip from the current resource, as well as from the surrounding satellite prospects. WTR is looking forward to starting in Q3 with the exploration program, Environmental Impact Assessment, and Social Engagement Plan following recommendations from the Preliminary Economic Assessment."

The following information is a Summary of the Mineral Resource Estimate, provided by Mr. Richard Siddle, MAIG, of Addison Mining Services Ltd., an Independent Qualified Person, as defined by Canadian NI 43-101 regulations. With the publication of this document, the full MRE must be publicly filed within 45 days.

Introduction

Between October 2022 and June 2023, the Western Tethyan and Ariana teams completed detailed field, drill core and digital data reviews of all information attributed to the Slivova Project and its Mineral Resources. Mineral Resources have been estimated by Mr. Richard Siddle, MAIG, of Addison Mining Services Ltd., an Independent Qualified Person as defined by Canadian NI 43-101.

The Slivova gold and silver deposit, consists of intrusive-related, stratiform massive to disseminated gold-bearing and base metal mineralogy hosted in Cretaceous-aged calcareous sediments. The mineralisation occurs as disseminated to massive replacement of calcareous sandstone to pebble conglomerate and minor replacement of limestone, associated with pyrite, pyrrhotite, arsenopyrite, and base-metal sulphides. Lithological control and structural features appear to have played a major role in focusing the alteration and mineralisation, both as fluid pathways and fluid retardants.

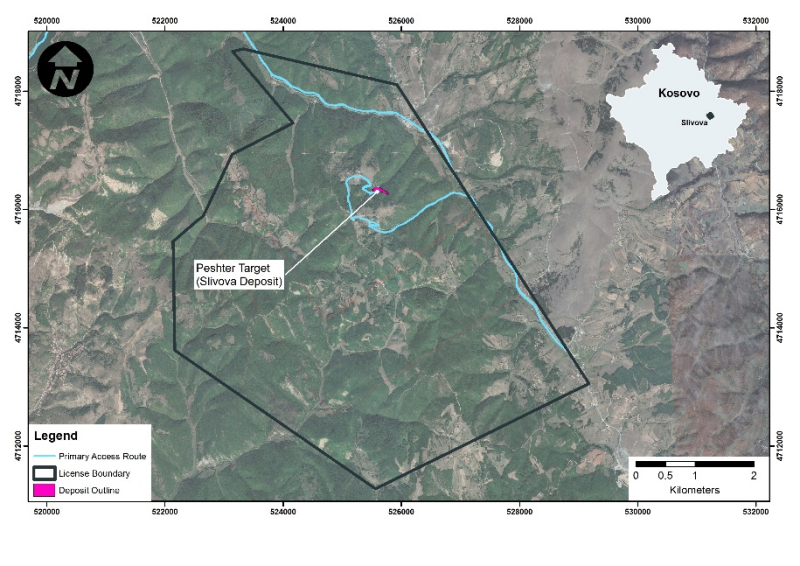

The Slivova Project exploration license is located along the Vardar Trend, approximately 30km SE of Pristina, the capital city of Kosovo (Figure 1).

Figure 1: The Slivova deposit (Peshter Target), and its associated license boundary.

Slivova Mineral Resource Estimate

Mineral Resources have been estimated for the Slivova deposit (Peshter Target) only. No Mineral Resources have as yet been declared for other targets within the Slivova Project, such as Dzemajl, Valiaviste and Brus.

The estimated Mineral Resource for Slivova is reported in accordance with CIM Definition Standards, comprising of an anticipated open-pittable portion and an anticipated underground extraction portion reported above appropriate cut-off grades reflecting each anticipated mining type. Identification of material which has a reasonable prospect of eventual economic extraction is supported by existing metallurgical test work and an ongoing Preliminary Economic Analysis by Bara Consulting Ltd of the UK.

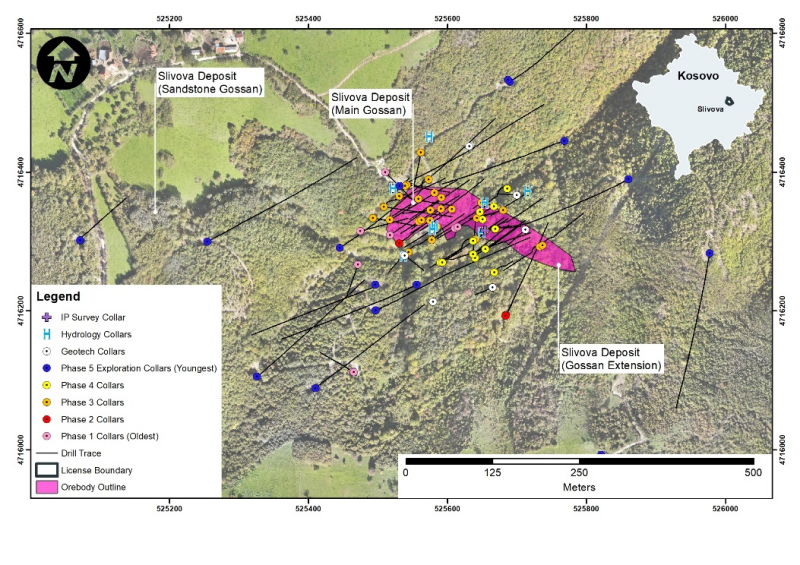

Mineralisation and block models for the Mineral Resource Estimate were informed by data from 62 surface drillholes over a total of 6,640m performed between 2014 and 2018 by the previous explorer, Innomatik Exploration Kosova (IEK). The hole spacing for the deposit is approximately 15m north by 15m east in the core of the deposit, extending to 30m north x 30m east towards the edges (Figure 2). Sample spacing and distribution are considered sufficient to establish the geological and grade continuity required for modelling and resource estimation. Gold and silver have been estimated as mining products, with no by-products or deleterious elements modelled.

Figure 2: Summary map of the various phases of drilling completed within the Slivova Project area. Some drill collars in the core of the deposit are not visible at this scale. WGS84 Z34N.

The drill database was validated prior to resource estimation and quality control (QC) checks were made using industry-standard control charts for blanks, core duplicates and commercially certified reference material inserted into assay batches. The Qualified Person has reviewed the QC data and has found it suitable for use in Mineral Resource Estimation. Additionally, the assay database was reconstructed from the original assay certificates to increase confidence in the final assay database used in the resource estimation.

Geological Modelling

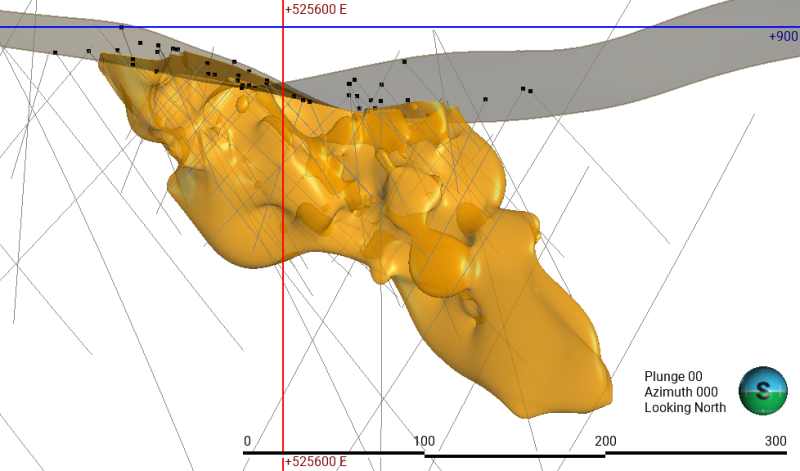

The mineralisation is understood to be typically defined as a single identifiable unit, and geologically constrained (e.g., higher grades are noted in some cases to be associated with coarser grained ‘pebble conglomerates'). The steeply-dipping, intercalated pebble and cobble conglomerates, sandstone and minor siltstone beds are thought to control the mineralisation through their different porosity and permeability characteristics. The geological model as applied to the Mineral Resource Estimate comprises a single domain plunging to the east-southeast, the strike of which is controlled by the host rocks (Figure 3).

The Slivova geological modelling used a combination of surface mapping data, structural measurements, geophysics, geological interpretations, and multi-element geochemical analysis in conjunction with date derived from diamond drill holes across the deposit area. Interpretations of geological surfaces are derived from 3D implicit modelling of drill hole data in Leapfrog GEO and EDGE v. 2023.1.0 using the software's ‘intrusion' function to generate an encapsulating volume over economically defined drill composites (Figure 3). All wireframes have been clipped to the topography.

A mineralised wireframe at a cut-off of approximately 0.2g/t Au was used to distinguish mineralised and unmineralised material. Grade continuity within the interpreted mineralised zones is generally robust. Where continuity was not established between sections, the strike extrapolation was limited both manually (wireframes) and statistically (interpolations). While higher-grade sub-populations of 3-10 g/t Au and above 10g/t Au are inferred from the data distribution inspection, the drill core indicated that this could not reliably be modelled, and as such an indicator kriging approach was adapted during block model estimation.

Figure 3: 3D view of the modelled mineralised volume looking north. WGS84 Z34N.

The mineralisation broadly follows a northwest-southeast trend, as supported by structural measurements both in outcrop and on oriented core. The mineralisation outcrops at surface with visible sulphides in the exposure. The mineralised zone is approximately 260m along strike and 70m wide and covers an area of approximately 1.7 hectares. The Mineral Resources extend from surface to a depth of approximately 200 metres, plunging for approximately 300 metres to the east-southeast with a vertical extent of 100-150 metres and is typically 50 to 100 metres wide. Mineralisation is closed by drilling to the north, south and east, however, remains open down plunge to the east-southeast. The northern contact of the mineralisation is interpreted to be controlled by a bounding fault.

Estimation Methodology

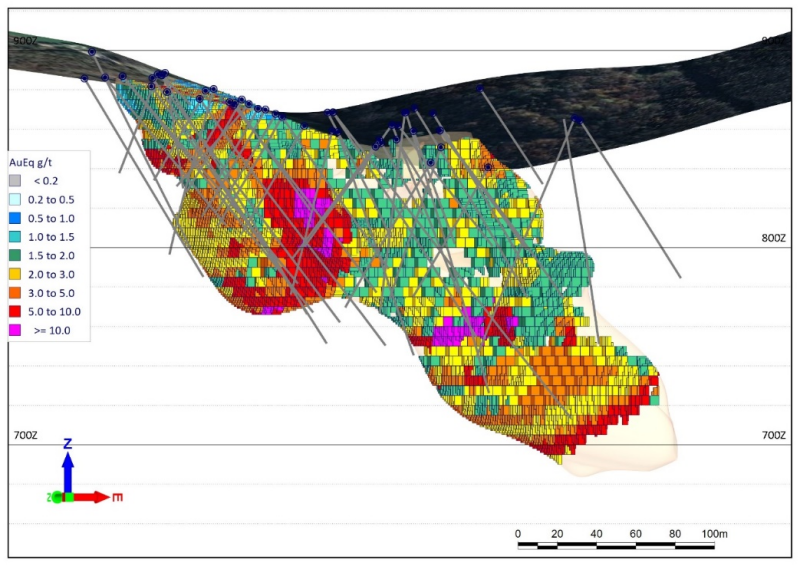

The block model was prepared using Micromine Origin and Beyond version 2023, Services Pack 4 (Figure 4). A 5m x 5m x 5m block model was created with sub-blocks of minimum size 1m x 1m x 1m on domain boundaries. Grade estimation from 2m composites was carried out using median indicator kriging (mIK) for gold and using ordinary kriging for silver. The model was validated by comparison of input and output statistics, de-clustering, kriging neighbourhood analysis and by inspection of the assay data and block model in cross-section.

Figure 4: Oblique view of the block model showing the estimated gold grades. WGS84 Z34N.

The density database contains 2,472 bulk density determinations of which 1,222 fall within the mineralised domain. Values within the domain were interpolated into each block using inverse distance weighting to a power of 2 with a lower limit of 1.5t/m 3 and capped at 3.8t/m 3 .

Slivova Mineral Resource Classification

Mineral Resources were classified according to the Qualified Persons' view of the accuracy of the estimates and the quality and confidence of data underpinning them. Mineral Resource classification considered the data quality, spacing and kriging standard error statistic (SE). Measured Mineral Resources are supported in the part of the deposit with the closest spaced drilling where the SE is 0.4 and the average data spacing was typically less than 25m. The remaining blocks were classified as Inferred Mineral Resources including the down plunge portion of the deposit which is largely informed by two drill holes and is extrapolated by approximately 55m.

The Mineral Resource Estimate has an effective date of 22 June 2023, superseding the previous Mineral Resource Estimate which had an effective date of 31 May 2016. The Mineral Resource Estimate for Slivova is reported in Table 1, which was completed 14 July 2023.

No estimates of Mineral Reserves have been prepared. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. The Qualified Person is not aware of any such issues at the time of writing.

Table 1: Estimated Mineral Resources for Slivova. Numbers are rounded to an appropriate number of significant figures and as such discrepancies may exist between individual values, products and totals.

| Category | Tonnes | Bulk Density | AuEq (g/t) | Au (g/t) | Ag (g/t) | Au (oz) | Ag (oz) |

| Total Mineral Resources (Gross to the Project) | |||||||

| Measured | 835,000 | 2.9 | 4.3 | 4.2 | 15 | 113,000 | 402,000 |

| Indicated | 296,000 | 2.8 | 3.6 | 3.5 | 15 | 33,200 | 144,000 |

| Meas + Ind | 1,130,000 | 2.9 | 4.1 | 4.0 | 15 | 146,000 | 546,000 |

| Inferred | 250,000 | 2.8 | 3.7 | 3.7 | 13 | 30,000 | 100,000 |

| Open Pit Resources Above 0.5g/t AuEq | |||||||

| Measured | 110,000 | 2.9 | 3.2 | 3.2 | 14 | 11,200 | 48,300 |

| Indicated | 39,300 | 2.6 | 2.8 | 2.7 | 13 | 3,390 | 16,500 |

| Meas + Ind | 150,000 | 2.8 | 3.1 | 3.0 | 13 | 14,600 | 64,800 |

| Inferred | nil | nil | nil | nil | nil | nil | nil |

| Underground Resources Above 1.5g/t AuEq | |||||||

| Measured | 725,000 | 2.9 | 4.4 | 4.4 | 15 | 102,000 | 354,000 |

| Indicated | 257,000 | 2.9 | 3.7 | 3.6 | 15 | 29,800 | 127,000 |

| Meas + Ind | 982,000 | 2.9 | 4.2 | 4.2 | 15 | 131,000 | 481,000 |

| Inferred | 250,000 | 2.8 | 3.7 | 3.7 | 13 | 30,000 | 100,000 |

Notes to the Mineral Resource Estimate (1-9):

-

The independent Qualified Person responsible for Mineral Resource disclosure, as defined by NI 43-101, is Mr. Richard Siddle, MSc, MAIG, of Addison Mining Services Ltd. The effective date of the Mineral Resource Estimate is 22 June 2023.

-

Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resource will be converted to Mineral Reserves.

-

A gold equivalent (AuEq) grade was calculated for each block using the formula AuEq = (Ag g/t x 0.05) + Au g/t. It is the opinion of the Qualified Person that all elements included in the Au Equivalent calculation have a reasonable prospect of being recovered and sold, the calculation of the Au equivalent value considers the relative recovery and payability of each element (recovery by cyanide leaching of 93.4% for gold and 50% for silver and 95% and 85% payability, respectively, as informed by metallurgical test work completed to date) as well as the assumed commodity prices.

-

Reasonable prospects of eventual economic extraction are satisfied by the estimation of break-even cut-off grades for each anticipated mining scenario (0.5g/t AuEq for open pit and 1.5g/t AuEq for underground mining). These cut-off grades were used to report the Mineral Resource. The cut-off grades were estimated on the basis of the following assumptions: a gold price of US$1850/oz (selected following consideration of (1, 2 and 3 year trailing average LMBA gold price and LMBA 2023 average forecast gold price, a silver price of US$20/oz, underground mining costs of US$43.7/t, processing costs (including tailings disposal) of US$29.5/t and GA costs of US$3/ROMt.

-

Estimates in the above table have been rounded to three significant figures for Measured and Indicated Resources and two significant figures for Inferred Mineral Resources.

-

CIM Definition Standards for Mineral Resources have been followed.

-

The independent Qualified Person for Resources is not aware of any additional known environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues that could materially affect the Mineral Resource Estimate.

-

The Mineral Resource figures set out above are quoted gross with respect to the Project. WTR of which Ariana owns 75%, has yet to establish a net attributable interest under the Earn-in and accordingly, no separate net attributable figures are reported.

-

Western Tethyan Resources is the operator of Slivova

Additional drilling is required to increase the confidence in the Mineral Resources in the Indicated and particularly Inferred parts of the resource estimate. Increased levels of information brought about by further drilling may serve to either increase or decrease the estimate of Mineral Resources. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration. A 4,500-metre drilling programme has been planned for the next phase of resource infill and exploration work at Slivova.

Comparison to Previous Mineral Resources

A resource estimate was completed by Mining Plus for Slivova as part of the 2016 NI43-101 Study on the project (Table 2). The most significant change is the upgrade of Mineral Resources from the Indicated category to the Measured category.

-

115% increase in total tonnes

-

17% decrease in gold grade but a 78% increase in total gold ounces

-

1% decrease in silver grade but a 113% increase in total silver ounces

There was a slight decline in the gold grade due to extending the model in areas showing grade continuity, but at a lower grade. This increased the number of ounces and tonnage as the result of extrapolating the resource with the additional drilling. The 2016 estimate did not include any of the 2016 drill program data and, as such, a detailed comparison is less meaningful. Changes in the estimate, including classification, grade and contained metal can largely be attributed to the inclusion of additional data and increased confidence in the model due to better understanding of the geology and the outcomes of the in-depth QC review and reviewing laboratory assay certificates in detail.

Table 2: Mineral Resources reported in the 2016 NI43-101 study. The Mineral Resources were reported at a cut-off grade of 1.0g/t Au and had an effective date of 31 May 2016.

| 2016 MRE | Mass | Average Value | Material Content | ||

| Au | Ag | Au | Ag | ||

| t | g/t | g/t | oz | oz | |

| Measured | - | - | - | - | - |

| Indicated | 640,000 | 4.80 | 14.68 | 98,700 | 302,000 |

| Inferred | 2,000 | 2.00 | 16.12 | 130 | 1,000 |

| Total | 642,000 | 4.79 | 14.68 | 98,830 | 303,000 |

Other Considerations

To the best of the Qualified Person's knowledge, at the time of estimation there are no known environmental, permitting, legal, title, taxation, socio-economic, marketing, political or other relevant issues that could materially impact the eventual extraction of the Mineral Resource.

The most likely extraction scenario is anticipated to be by means of a small 100m wide open pit to a depth of approximately 30m, followed by underground stoping. While a larger open pit would likely be economically viable based on pit optimisation tests, the size of the pit may encroach on local waterways and bring nearby farm buildings within the safe blast radius of the pit. As such, the above scenario is considered more likely.

Studies have been previously completed as part of the 2017 PFS (internal, unpublished) on the natural environment and potential impacts on the local community.

GR Engineering Services Ltd (GRES) completed a metallurgical and processing report for the project as part of the 2017 PFS (internal, unpublished). The metallurgical work was conducted at ALS Metallurgical Laboratories in Balcatta, Western Australia with initial tests confirming the gold is not refractory. In summary, good gold recovery was demonstrated in cyanide leaching (96%) and flotation (88%), whereas the gravity method gave only 36% recovery.

Detailed studies were previously completed as part of the 2017 PFS (internal, unpublished) on mining, hydrology, geomechanics, waste geochemistry, mine waste and tailings, power supply, surface infrastructure and CAPEX & OPEX.

Sampling and Assaying Procedures

All of the drill holes used to define the Slivova Project have been drilled using diamond core drilling techniques in HQ, NTW and NQ diameter core sizes. All diamond drill core is processed in the Company's core shed, near the Slivova Project. Initially, all sample preparation occurred at the ALS Group sample preparation facility at Rosia Montana, Romania and then at ALS in Bor, Serbia. Drill-core samples from the drilling programmes at Slivova were cut in half by a diamond saw and sent for analysis in batches in line with the Company's quality control procedures.

The review of the QA/QC results from the 2014-2016 drill programme, the holes which were used in the resource estimate, indicated no issues. Standards, blanks and duplicates all showed good performance. The insertion rate of QA/QC samples for these phases of the drill programme was 12% (4,930 samples incl. 582 QA/QC samples), with a similar proportion of blanks, standards, field duplicates, analytical duplicates and pulp duplicates inserted.

Diamond drill core recoveries were monitored and recorded in the sampling database. Overall core recovery for the diamond drilling is 92%, with core recovery for only the holes used in the resource estimate being 90%. There is no bias between sample recovery and grade. Samples with less than 80% recovery were noted to be in zones of fault gouge, highly broken core or drill-spun core.

All samples have been submitted for gold and silver analysis, with some batches being submitted for a full multi-element suite of analysis. Not all batches had multi-element analysis due to budget constraints. All analysis has been undertaken by ALS Group at their fully accredited laboratories, as detailed below.

Gold analysis was undertaken at the ALS laboratory in Rosia Montana, Romania using Fire Assay with an Atomic Absorption Spectrometry Finish on a 30g charge. The upper detection limit for this method (Au-AA23) is set at 10g/t gold, with any over-detection values re-analysed via Fire Assay with a Gravimetric Finish (Au-GRA21).

Silver analysis was undertaken at the ALS laboratory in Loughrea, Ireland using a multi-acid digest and a hydrochloric acid leach with an AAS read. An upper detection limit of 100g/t silver is set for this analytical technique – no samples returned grades at this upper detection limit.

Multi-element analysis was undertaken at the ALS facility in Ireland, using a multi-acid digest with the analysis completed by inductively coupled plasma-mass spectrometry (ICPMS).

Review of the assay results determined that all Quality Control and Quality Assurance samples (blanks, standards, and duplicates) passed the required quality control checks established by the Company, with duplicate samples showing excellent correlation. Laboratory sample preparation, assaying procedures and chain of custody were appropriately controlled. The Company maintains an archive of half-core samples and a photographic record of all cores for future reference.

The independent Qualified Person for Mineral Resources as defined by NI 43-101 is Mr. Richard Siddle, MAIG, of Addison Mining Services Ltd. Mr. Siddle has reviewed and approved the scientific and technical content of this news release. The Qualified Person completed a site visit to the project on 13 June 2023, and has inspected the property, drillhole locations and has reviewed selected intervals of the drill core used in the Mineral Resource Estimate. No concerns were identified during the visit.

Ariana Resources is an AIM-listed mineral exploration and development company with an exceptional track-record of creating value for its shareholders through its interests in active mining projects and investments in exploration companies. Its current interests include gold production in Turkey and copper-gold exploration and development projects in Cyprus and Kosovo.

Western Tethyan Minerals is a UK-registered, mineral exploration and development company focused on South East Europe. The company has a strategic alliance with Newmont Corporation and Ariana Resources and is currently focused on exploration for major copper-gold deposits in the Lecce Magmatic Complex and Vardar Belt. The company is assessing several other exploration project opportunities across Eastern Europe, targeting copper-gold deposits across the porphyry-epithermal transition.

Avrupa Minerals Ltd. is a growth-oriented junior exploration and development company directed to discovery of mineral deposits, using a hybrid prospect generator business model. The Company holds one 100%-owned license in Portugal, the Alvalade VMS Project, presently optioned to Sandfire MATSA in an earn-in joint venture agreement. The Company now holds one 100%-owned exploration license covering the Slivova gold prospect in Kosovo, and is actively advancing four prospects in central Finland through its in-process acquisition of Akkerman Finland Oy. Avrupa focuses its project generation work in politically stable and prospective regions of Europe, presently including Portugal, Finland, and Kosovo. The Company continues to seek and develop other opportunities around Europe.

For additional information, contact Avrupa Minerals Ltd. at 1-604-687-3520 or visit our website at www.avrupaminerals.com .

On behalf of the Board,

"Paul W. Kuhn"

Paul W. Kuhn, President & Director

This news release was prepared by Company management, who take full responsibility for its content. Paul W. Kuhn, President and CEO of Avrupa Minerals, a Licensed Professional Geologist and a Registered Member of the Society of Mining Engineers, is a Qualified Person as defined by National Instrument 43-101 of the Canadian Securities Administrators. He has reviewed the technical disclosure in this release. Mr. Kuhn, the QP, has not only reviewed, but prepared and supervised the preparation or approval of the scientific and technical content in the news release.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Copyright (c) 2023 TheNewswire - All rights reserved.