September 02, 2024

Aurum Resources Limited (ASX:AUE) (Aurum or the Company) is pleased to announce the renewal of its Boundiali South (BST) exploration licence1 (earning 100% interest), which hosts the advanced high-grade Nyangboue gold deposit. The BST tenement is one of four tenements making up Aurum's Boundiali Gold Project in Côte d'Ivoire, West Africa.

Highlights

- Boundiali South (BST) exploration licence renewed; Ministerial approval for exploration drilling at the high-grade Nyangboue deposit (partially located in a classified forest area) expected in coming weeks

- Boundiali South has returned previous impressive exploration results2 including:

- 20m @ 10.45g/t gold from 38m (BRC0004S BIS)

- 30m @ 8.30g/t gold from 39m (NDC007)

- 28m @ 4.04g/t gold from 3m and 6m @ 3.29g/t gold from 47m (BRC003)

- 9m @ 7.90g/t gold from 99m (BRC006)

- Two new diamond drill rigs arriving on site this week, increasing Aurum’s fleet to six; drilling rate to reach ~10,000m per month with assays pending (targeting 45,000m for CY2024)

- New centralised exploration camp progressing on schedule, expected to be operational by end-October 2024, improving efficiency and reducing costs

- Initial Mineral Resource Estimate for Boundiali on track for late CY2024

- Aurum is well-funded (~$20M) for continued aggressive exploration.

Aurum’s Managing Director Dr. Caigen Wang said: “We are pleased to announce that the renewal of the advanced BST exploration licence has been approved by Côte d’Ivoire’s Ministre des Mines, Petrole et Energie.

This advanced tenement hosts the high-grade Nyangboue deposit (20m @ 10.45g/t Au from 38m: BRC0004S BIS) and we are just waiting on sign-off from the Minister for Forest and Water to begin step back diamond drilling to test for depth extensions of these high-grade shoots.

We extend our great thanks to Côte d’Ivoire government’s support in exploring and developing gold resources in this highly promising gold tenement.

With six rigs on site, we'll be drilling ~10,000m per month. We're well-funded to continue our aggressive exploration program, with ~$20 million cash at bank, to accelerate drilling and build on the encouraging results to date and targeting inaugural JORC resources by late 2024.”

Boundiali South (BST) renewal

The BST exploration licence hosts Nyangboue, the most advanced exploration gold play within the broader Boundiali gold project. The exploration licence for BST was renewed by Côte d’Ivoire’s Ministre des Mines, Petrole et Energie on 19 August 2024, covering a substantial area of 167.36km2.

Approvals Progressing for Nyangboue Drilling

Following the permit renewal, approvals for exploration drilling at the high-grade Nyangboue prospect are advancing. Final Ministerial sign-off is anticipated within weeks. Drilling is expected to commence shortly after receiving the necessary approvals for operations within a classified forest, which covers less than half of the exploration licence.

Multiple Gold Targets Defined3 within BST

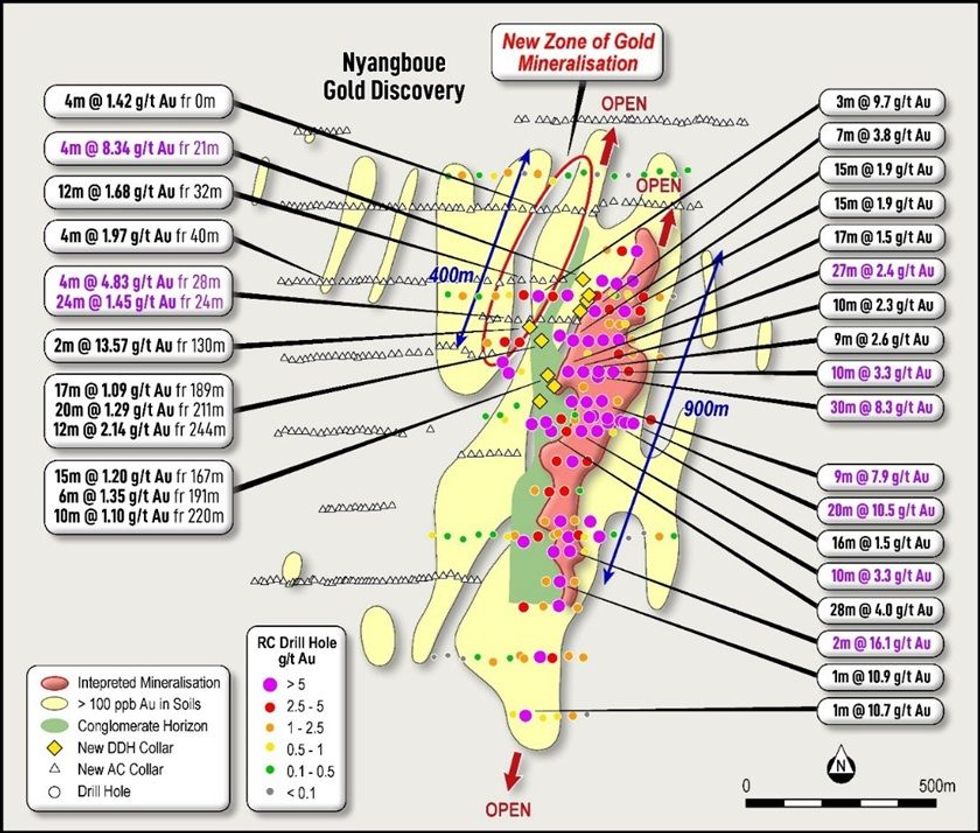

Extensive surface geochemical sampling (more than 5,700 soil samples) returned high-grade gold-in- soil values up to 9,964 Au ppb, and delineated three compelling gold anomalies:

- Nyangboue: +6km strike

- Nyangboue South: +2km strike

- Gbemou: +1.5km strike.

Gold mineralisation is observed to be associated with quartz veins, often containing visible gold. The Nyangboue gold deposit sits at the interface of two distinct lithologies.

Extensive Drilling Database

The project boasts a comprehensive historical drilling database, encompassing:

- Aircore: 545 holes, 21,056.00m

- RC diamond tail: 10 holes, 1,658.12m

- Diamond drill: 8 holes, 1,771.33m

- RC drilling: 247 holes, 17,975.00m.

High-Grade Potential Confirmed

Screen fire assay re-assay of high-grade samples by previous explorers yielded a Boundiali Gold Project sample high of 192.5 g/t Au from hole BRC004BIS, underscoring the project's significant potential.

Historic Drill Results at Nyangboue4

Previous drilling at Nyangboue delivered encouraging results, including:

- 20m @ 10.45g/t Au from 38m (BRC0004S BIS)

- 30m @ 8.30g/t Au from 39m (NDC007)

- 28m @ 4.04g/t Au from 3m and 6m @ 3.29g/t Au from 47m (BRC003)

- 9m @ 7.90g/t Au from 99m (BRC006)

- 27m @ 2.42g/t Au from 27m (BRC175)

- 20m @ 1.29g/t Au from 211m (NDC016)

- 2m @ 13.57g/t Au from 130m (NDC017)

- 17m @ 1.09g/t Au from 189m; 20m @ 1.29g/t Au from 211m and 12m @ 2.14g/t Au from 244m EOH (NDC016).

Click here for the full ASX Release

This article includes content from Aurum Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AUE:AU

Sign up to get your FREE

Aurum Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 September 2025

Aurum Resources

Game-changing gold exploration at prolific Côte d’Ivoire, West Africa.

Game-changing gold exploration at prolific Côte d’Ivoire, West Africa. Keep Reading...

25m

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

04 February

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

28 January

Quarterly Activities/Appendix 5B Cash Flow Report

Aurum Resources (AUE:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

27 January

Further high-grade intercepts at BMT3 in Boundiali

Aurum Resources (AUE:AU) has announced Further high-grade intercepts at BMT3 in BoundialiDownload the PDF here. Keep Reading...

14 January

Boundiali Gold Project produces more good drilling results

Aurum Resources (AUE:AU) has announced Boundiali Gold Project produces more good drilling resultsDownload the PDF here. Keep Reading...

17h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

Latest News

Sign up to get your FREE

Aurum Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00