November 10, 2024

Aurum Resources Limited (ASX: AUE) (Aurum) is pleased to report further high-grade gold intercepts from exploration diamond drilling at multiple prospects on the BM Tenement, part of its 1037km2 Boundiali Gold Project in Côte d'Ivoire, West Africa.

Highlights

- Exploration diamond drilling (26 holes for 5,049.5m) from the expanded diamond program targeting multiple prospects on the Boundiali BM tenement returns shallow, wide and high- grade gold hits1 including:

- 1m @ 35.86 g/t Au from 82m & 4.25m @ 3.75 g/t Au from 120m (MBDD070)

- 17m @ 1.60 g/t Au from 230m inc. 10.05m @ 2.02 g/t Au (MBDD057)

- 13m @ 2.07 g/t Au from 139m inc. 4m @ 3.29 g/t Au (MBDD054)

- 6m @ 3.57 g/t Au from 118m inc. 2m @ 10.14 g/t Au (MBDD065)

- Gold mineralisation remains open along strike and down dip at BM Targets 1 (up to 2.5km strike), 2 & 3

- Diamond drilling continues at both Boundiali tenements with assays pending for ~60 holes (13,000m), next batch expected end of November

- Aurum has six self-owned diamond rigs at Boundiali Gold Project with up to ~10,000m drilling capacity per month and will complete more than 45,000m in CY2024

- Results from metallurgical test work overseen by MACA Interquip Mintrex (MIM) and ALS (Perth) expected by year end

- Inaugural Mineral Resource Estimate for Boundiali Gold Project targeted for late CY2024

- Aurum’s takeover of Mako Gold (ASX: MXG)2 progressing well – the merged company will achieve greater scale and market presence, creating a stronger platform for future growth and success in the industry

- Aurum is well-funded (~$19M cash at bank at 30 Sept) for continued aggressive exploration.

Aurum’s Managing Director Dr. Caigen Wang said: “Our exploration drilling at BM continues to grow the known extent of gold mineralisation, which is now up to 2.5km at BM Target 1. Our expanded drilling program at BM is hitting multiple intercepts downhole including shallow high-grade hits such as 1m @ 35.86 g/t Au from 82m and 4.25m @ 3.75 g/t Au from 120m in MBDD070.

Our six rigs are systematically ramping up production and with our new camp coming online, we expect to see increased operational efficiencies to demonstrate the full potential of the Boundiali gold project. We're well-funded with $19 million cash at bank, allowing us to accelerate drilling and build on these encouraging results. We're targeting an inaugural JORC resource for Boundiali by late 2024.”

BM Target 1 - Latest Drill Results

Aurum reports results for 26 holes for 5,049.5m of diamond core drilled at BM Target 1 (19 holes for 3,445m), BM Target 2 (two holes for 314.5m) and BM Target 3 (five holes for 1,290m) on the BM Tenement, part of an expanded drill program on the BM Tenement where Aurum is working toward and 80% project interest3. Best results for these holes4 include:

BM Target 1

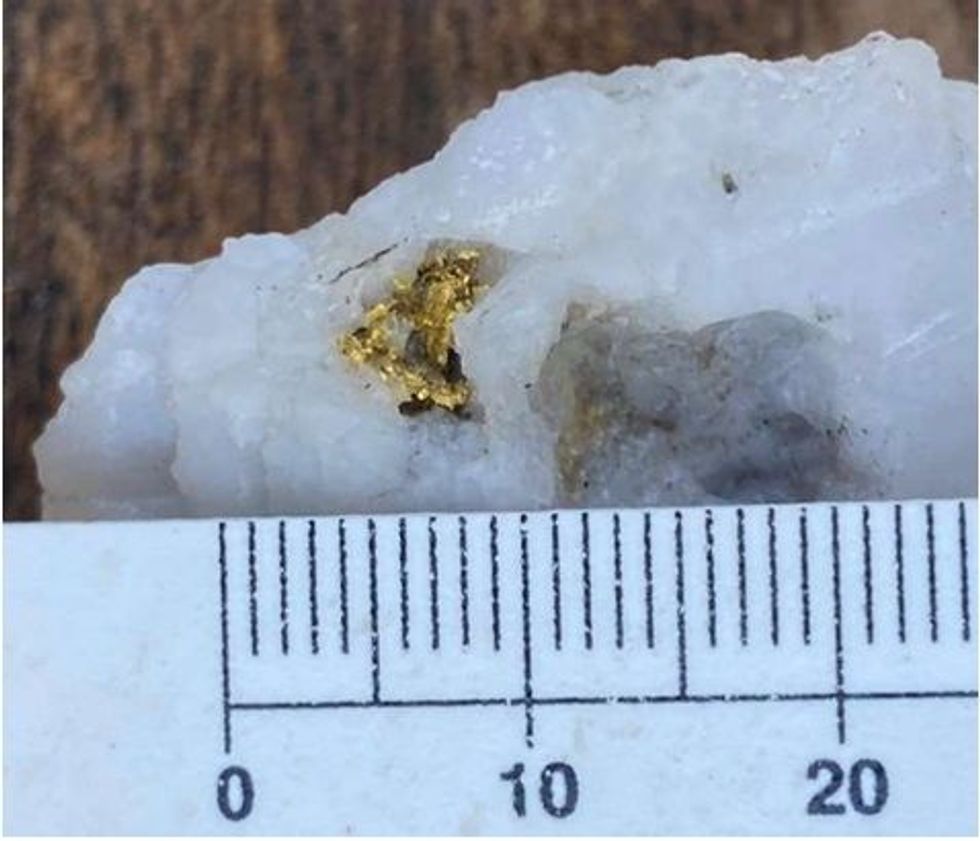

- 1m @ 35.86 g/t Au from 82m (Figure 1) & 4.25m @ 3.75 g/t Au from 120m (MBDD070)

- 17m @ 1.60 g/t Au from 230m inc. 10.05m @ 2.02 g/t Au (MBDD057)

BM Target 3

- 13m @ 2.07 g/t Au from 139m inc. 4m @ 3.29 g/t Au (MBDD054)

- 6m @ 3.57 g/t Au from 118m inc. 2m @ 10.14 g/t Au (MBDD065).

These new results are in addition to diamond holes previously drilled by Aurum at BM Target 1 and reported on 22 January 2024, 1 March 2024 and 18 September 2024, which included:

- 11.46m @ 6.67 g/t Au from 162.54m incl. 1.46m @ 45.04 g/t Au (MBDD049)

- 45m @ 0.93 g/t Au from 78m incl. 8m @ 1.18 g/t Au from 78m & 25m @ 1.15 g/t Au from 98m (MBDD0045)

- 16m @ 1.24 g/t Au from 117m incl. 6m @ 2.44 g/t Au (MBDD0010)

- 7.39m @ 1.94 g/t Au from 139.34m incl. 5.35m @ 2.53 g/t Au (MBDD017)

- 16.3m @ 1.02 g/t Au from 86.7m incl. 8m @ 1.71 g/t Au (MBDD019)

- 16.64m @ 1.45 g/t Au from 56.26m incl. 10.40m @ 2.11 g/t Au (MBDD007)

- 5m @ 4.73 g/t Au from 53.5m incl. 1.10m @ 20.35 g/t Au (MBDD004).

Click here for the full ASX Release

This article includes content from Aurum Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AUE:AU

Sign up to get your FREE

Aurum Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 September 2025

Aurum Resources

Game-changing gold exploration at prolific Côte d’Ivoire, West Africa.

Game-changing gold exploration at prolific Côte d’Ivoire, West Africa. Keep Reading...

22 February

Boundiali Resource Grows to 3Moz - Indicated Up 49%

Aurum Resources (AUE:AU) has announced Boundiali Resource Grows to 3Moz - Indicated Up 49%Download the PDF here. Keep Reading...

15 February

Boundiali extends strike and depth at BDT3 and BST1

Aurum Resources (AUE:AU) has announced Boundiali extends strike and depth at BDT3 and BST1Download the PDF here. Keep Reading...

09 February

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

04 February

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

28 January

Quarterly Activities/Appendix 5B Cash Flow Report

Aurum Resources (AUE:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

3h

As Gold Investment Surges, Fake Platforms and AI Drive New Fraud Wave

As gold prices continue to soar past record highs, investors are pouring billions into bars, coins, and digital tokens. However, regulators and analysts warn that the same rally is fueling a surge in scams that are quietly draining retirement accounts and life savings.Gold has long been marketed... Keep Reading...

5h

Peruvian Metals Announces the 10-Year Renewal of the Use of Surface Rights at the Aguila Norte Processing Plant

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce that the Company has renewed the lease on the use of the surface rights at its 80-per-cent-owned Aguila Norte processing plant ("Aguila Norte" or the "Plant") located in... Keep Reading...

27 February

American Eagle Announces $23 Million Strategic Investment Backed by Eric Sprott

Highlights:The investment adds a third strategic investor, when combined with investments by mining companies South32 Group Operations PTY Ltd. and Teck Resources LimitedThe Offering funds significantly expanded drill programs for 2026 and 2027 at the Company's NAK copper-gold porphyry project... Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

Latest News

Sign up to get your FREE

Aurum Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00