November 10, 2024

Aurum Resources Limited (ASX: AUE) (Aurum) is pleased to report further high-grade gold intercepts from exploration diamond drilling at multiple prospects on the BM Tenement, part of its 1037km2 Boundiali Gold Project in Côte d'Ivoire, West Africa.

Highlights

- Exploration diamond drilling (26 holes for 5,049.5m) from the expanded diamond program targeting multiple prospects on the Boundiali BM tenement returns shallow, wide and high- grade gold hits1 including:

- 1m @ 35.86 g/t Au from 82m & 4.25m @ 3.75 g/t Au from 120m (MBDD070)

- 17m @ 1.60 g/t Au from 230m inc. 10.05m @ 2.02 g/t Au (MBDD057)

- 13m @ 2.07 g/t Au from 139m inc. 4m @ 3.29 g/t Au (MBDD054)

- 6m @ 3.57 g/t Au from 118m inc. 2m @ 10.14 g/t Au (MBDD065)

- Gold mineralisation remains open along strike and down dip at BM Targets 1 (up to 2.5km strike), 2 & 3

- Diamond drilling continues at both Boundiali tenements with assays pending for ~60 holes (13,000m), next batch expected end of November

- Aurum has six self-owned diamond rigs at Boundiali Gold Project with up to ~10,000m drilling capacity per month and will complete more than 45,000m in CY2024

- Results from metallurgical test work overseen by MACA Interquip Mintrex (MIM) and ALS (Perth) expected by year end

- Inaugural Mineral Resource Estimate for Boundiali Gold Project targeted for late CY2024

- Aurum’s takeover of Mako Gold (ASX: MXG)2 progressing well – the merged company will achieve greater scale and market presence, creating a stronger platform for future growth and success in the industry

- Aurum is well-funded (~$19M cash at bank at 30 Sept) for continued aggressive exploration.

Aurum’s Managing Director Dr. Caigen Wang said: “Our exploration drilling at BM continues to grow the known extent of gold mineralisation, which is now up to 2.5km at BM Target 1. Our expanded drilling program at BM is hitting multiple intercepts downhole including shallow high-grade hits such as 1m @ 35.86 g/t Au from 82m and 4.25m @ 3.75 g/t Au from 120m in MBDD070.

Our six rigs are systematically ramping up production and with our new camp coming online, we expect to see increased operational efficiencies to demonstrate the full potential of the Boundiali gold project. We're well-funded with $19 million cash at bank, allowing us to accelerate drilling and build on these encouraging results. We're targeting an inaugural JORC resource for Boundiali by late 2024.”

BM Target 1 - Latest Drill Results

Aurum reports results for 26 holes for 5,049.5m of diamond core drilled at BM Target 1 (19 holes for 3,445m), BM Target 2 (two holes for 314.5m) and BM Target 3 (five holes for 1,290m) on the BM Tenement, part of an expanded drill program on the BM Tenement where Aurum is working toward and 80% project interest3. Best results for these holes4 include:

BM Target 1

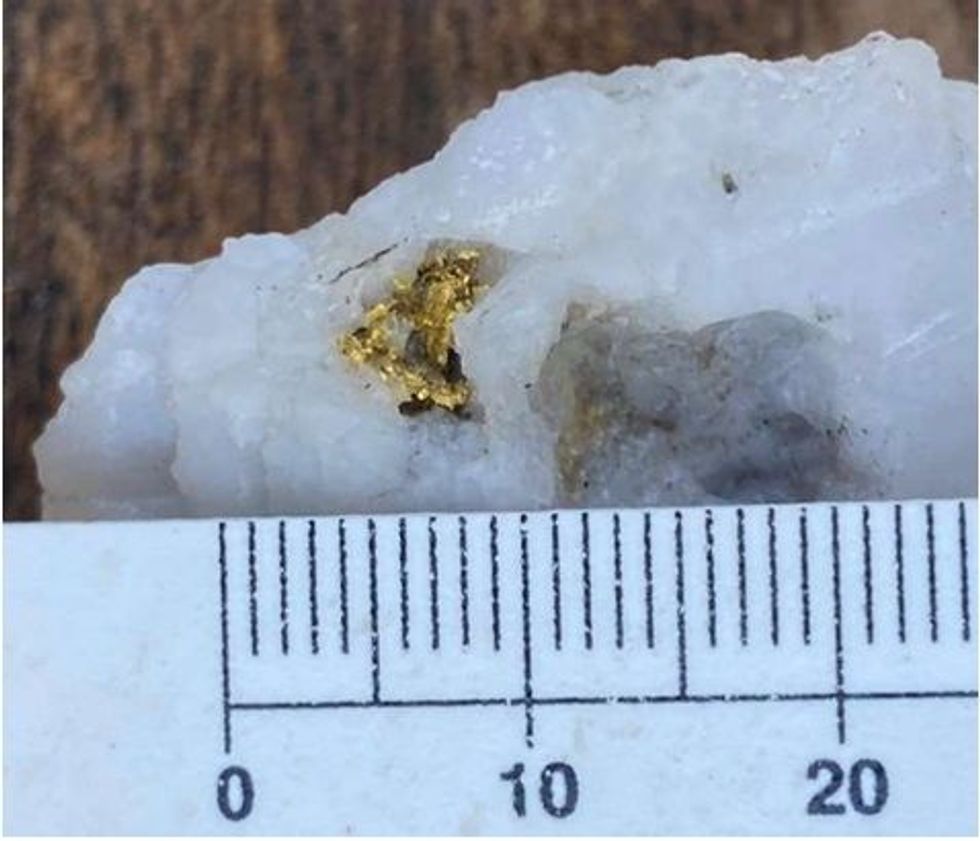

- 1m @ 35.86 g/t Au from 82m (Figure 1) & 4.25m @ 3.75 g/t Au from 120m (MBDD070)

- 17m @ 1.60 g/t Au from 230m inc. 10.05m @ 2.02 g/t Au (MBDD057)

BM Target 3

- 13m @ 2.07 g/t Au from 139m inc. 4m @ 3.29 g/t Au (MBDD054)

- 6m @ 3.57 g/t Au from 118m inc. 2m @ 10.14 g/t Au (MBDD065).

These new results are in addition to diamond holes previously drilled by Aurum at BM Target 1 and reported on 22 January 2024, 1 March 2024 and 18 September 2024, which included:

- 11.46m @ 6.67 g/t Au from 162.54m incl. 1.46m @ 45.04 g/t Au (MBDD049)

- 45m @ 0.93 g/t Au from 78m incl. 8m @ 1.18 g/t Au from 78m & 25m @ 1.15 g/t Au from 98m (MBDD0045)

- 16m @ 1.24 g/t Au from 117m incl. 6m @ 2.44 g/t Au (MBDD0010)

- 7.39m @ 1.94 g/t Au from 139.34m incl. 5.35m @ 2.53 g/t Au (MBDD017)

- 16.3m @ 1.02 g/t Au from 86.7m incl. 8m @ 1.71 g/t Au (MBDD019)

- 16.64m @ 1.45 g/t Au from 56.26m incl. 10.40m @ 2.11 g/t Au (MBDD007)

- 5m @ 4.73 g/t Au from 53.5m incl. 1.10m @ 20.35 g/t Au (MBDD004).

Click here for the full ASX Release

This article includes content from Aurum Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AUE:AU

Sign up to get your FREE

Aurum Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 September 2025

Aurum Resources

Game-changing gold exploration at prolific Côte d’Ivoire, West Africa.

Game-changing gold exploration at prolific Côte d’Ivoire, West Africa. Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

22 February

Boundiali Resource Grows to 3Moz - Indicated Up 49%

Aurum Resources (AUE:AU) has announced Boundiali Resource Grows to 3Moz - Indicated Up 49%Download the PDF here. Keep Reading...

15 February

Boundiali extends strike and depth at BDT3 and BST1

Aurum Resources (AUE:AU) has announced Boundiali extends strike and depth at BDT3 and BST1Download the PDF here. Keep Reading...

09 February

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

04 February

High-Grade Extensions at BD Deposits for Resource Growth

Aurum Resources (AUE:AU) has announced High-Grade Extensions at BD Deposits for Resource GrowthDownload the PDF here. Keep Reading...

6h

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

6h

Jaime Carrasco: Gold Going "Much Higher," Silver Force Majeure Inevitable

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, shares his outlook for gold and silver, saying prices must rise much higher. He also talks about how to build a strong precious metals portfolio. "We're moving from a credit-based economy, a... Keep Reading...

6h

Garrett Goggin: Gold, Silver in New Era, My Stock Strategy Now

Garrett Goggin, founder of Golden Portfolio, says although gold and silver haven't gone mainstream yet, the metals — and the mining sector overall — have entered a new era. "It's a real mind shift — it's a new era in mining right here," he said.Don't forget to follow us @INN_Resource for... Keep Reading...

16h

Nicola Mining Provides Update on NASDAQ Listing

Nicola Mining Inc. (TSXV: NIM,OTC:HUSIF) (OTCQB: HUSIF) (FSE: HLIA) (the "Company" or "Nicola") is pleased to provide an update on its proposed NASDAQ listing, which it originally disclosed in its news release of October 27, 2025. There are approximately 220 Canadian companies trading via cross... Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

Latest News

Sign up to get your FREE

Aurum Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00