November 04, 2024

Augustus Minerals Limited (ASX: AUG) has executed a binding share purchase agreement (“SPA”) with MCA Nominees Pty Ltd (“MCA”) to acquire 100% of the issued capital in Music Well Gold Mines Pty Ltd (“MWGM”), an entity which holds the exploration licences comprising the Music Well Gold Project (“Project”). The Project is in the Eastern Goldfields region of Western Australia located 35km north of Leonora.

- Augustus Minerals Limited (ASX: AUG) (“Augustus” or the “Company”) is pleased to announce that is has executed a binding share purchase agreement to acquire 100% of the issued capital in Music Well Gold Mines Pty Ltd, which holds the exploration licenses and applications comprising the Music Well Gold Project located 35km north of Leonora in the Leonora / Laverton Greenstone Belt of Western Australia.

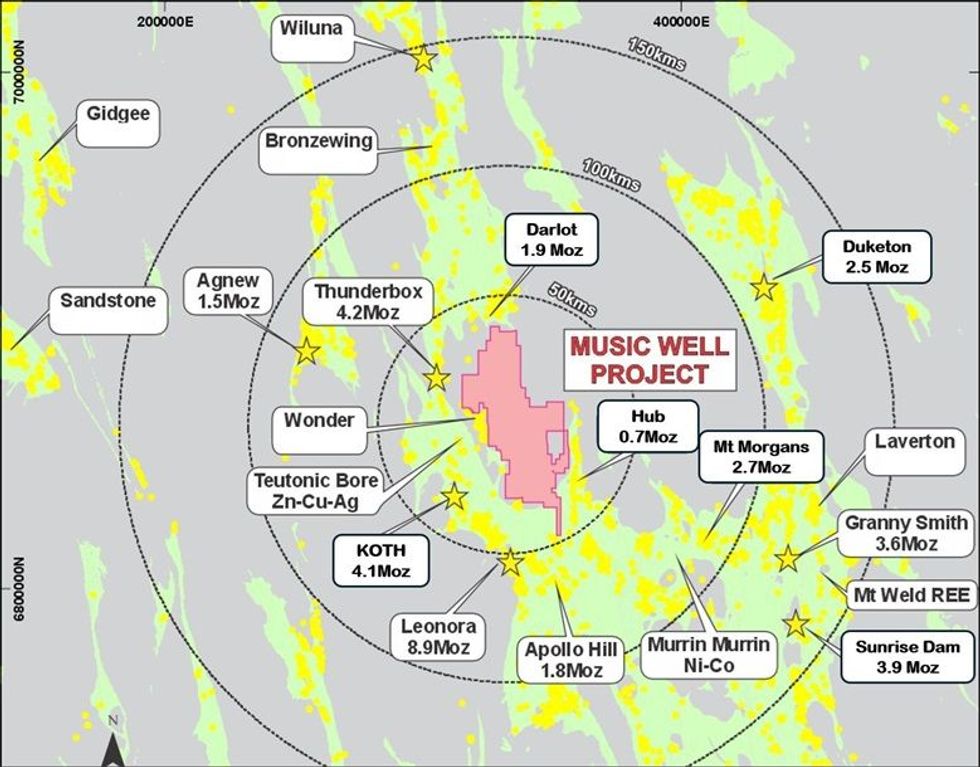

- The large contiguous tenement package covers an area of 1,345 sq km in a region that hosts gold endowment of >12Moz1 gold and >450kozpa gold production2 within 50km of the project.

Neighbouring operating mines include:

Northern Star3 (ASX:NST)

- Thunderbox Mine3 (4.2M oz Au Resources) 20km to the west

- Wonder Underground (0.9Moz Au Resources3) <1km west

Genesis Minerals4 (ASX:GMD)

- Hub Project (0.7 Moz Au Resources) adjoining Music Well Project

Vault Minerals5 (ASX:VAU)

- Darlot Gold Mine (1.9 Moz Au Resources) is located 12km north

- King of the Hills mine (4.1 Moz Au Resources) 20km to the south west

- Extensive geophysics, gravity, soil sampling and rock chipping have already been completed with data validation and target prioritization underway

- Potential for gold discoveries from the dedicated and focused Augustus exploration team over the next 2 years.

Andrew Ford, GM Exploration commented

“The acquisition of such a large prospective gold exploration package in close proximity to operating mines owned by Northern Star, Genesis and Vault Minerals with +12M oz of resources and over 450kozpa gold production2 is a significant coup for Augustus (Figure 1).

“With the gold price now exceeding A$4,000/oz it provides Augustus Shareholders with significant exposure to future discovery in one of the greatest gold provinces in the world”.

Background

Comprising ten granted exploration licences covering an area of approximately 1,052km2 and two exploration licences in application covering an area of 293km2. The total tenement package is 1,345 sq km making the Project one of the largest exploration packages in the region.

Augustus believes that adding a gold focussed exploration project of this size provides optionality and complements its copper/base-metals/uranium focus at the Ti Tree Shear project in the Gascoyne.

Music Well Project

The Project is located within the Murrin Murrin domain, Kurnalpi Terrane of the Yilgarn Craton in the Leonora / Laverton Greenstone Belt of Western Australia.

The Yilgarn is a globally significant mineralised province for gold, nickel and aluminium, and also hosts major deposits of other minerals such as copper, zinc and iron along with other resources such as tantalum, lithium, vanadium, uranium and rare earth elements (“REEs”).

MWGM initiated the consolidation of tenements and commenced field work, on ground exploration and targeting studies from November 2019. In the resulting 5-year period from November 2019 to November 2024 the Company has consolidated a tenement package of 1,345 sq kms and has identified priority targets for follow up exploration work for Air Core, RC and Diamond Drilling.

These high priority targets have been identified by using MWGMs “Three – Schema Gold Prospectivity Model” which incorporates and utilises classical structural mapping techniques, geochemistry such as Ultra Fine + (UFF) soil sampling, rock chip sampling and advanced geophysics. This multi-disciplinary approach to exploration utilising high-resolution airborne magnetics, gravity and radiometric data, including (UFF) soil sampling over + 1,052sq kms also includes the reinterpretation of the solid geology, structure and deformation history of the region to inform local interpretation of the geological framework and identification of the targets completed over a 5-year period within the Project area.

The geological studies, completed with the assistance of a group of technical specialists, including Southern Geoscience, Fathom Geophysics, Tower Geoscience, Geobase Australia, Daishat Geodictic Gravity Surveyors, Walter Witt Experience and GeoSpy Australia utilising high-resolution airborne magnetics, gravity and radiometric data.

The principal target types include gold in shear zones within granitoids and greenstones (analogous to the nearby Wonder Deeps Gold Mine (Northern Star) and intrusion-related gold systems potentially analogous to King of the Hills and Darlot Centenary mines located southwest and north of the Music Well Gold Project respectively. The Music Well Gold Project is considered to be prospective for gold, base metals and also for lithium, tantalum and REE, which will also be investigated.

The tenement area is characterised by a strongly deformed stratigraphy and intrusions and contains numerous predominantly west-northwest anastomosing subparallel shear zones providing links potentially to Wonder Deeps and Thunderbox gold mines (Northern Star) located to the west of the project area; and the Hub (Redcliffe) gold deposit located to the east (Genesis).

In addition, a series of north-northwest and north-northeast structures trend through the project area and structures of a similar orientation host many of the gold deposits in the Leonora / Laverton area.

There are numerous operating gold mines in the district including the Darlot Gold Mine (~12 km to the north), the King of the Hills Mine (~20 km to the west), the Leonora Gold Camp (~30km to the southwest), and the Thunderbox Gold Mine (~20 km to the west) (Figure 2).

Click here for the full ASX Release

This article includes content from Augustus Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AUG:AU

Sign up to get your FREE

Augustus Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 July 2023

Augustus Minerals

Vast Land Package for Critical and Precious Metals Exploration in Australia

Vast Land Package for Critical and Precious Metals Exploration in Australia Keep Reading...

28 January

Quarterly Activities/Appendix 5B Cash Flow Report

Augustus Minerals (AUG:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

11 January

Heritage Approval for Drilling at Music Well

Augustus Minerals (AUG:AU) has announced Heritage Approval for Drilling at Music WellDownload the PDF here. Keep Reading...

15 December 2025

CEO Resignation

Augustus Minerals (AUG:AU) has announced CEO ResignationDownload the PDF here. Keep Reading...

18 November 2025

Exploration Update - Soil Sampling Results

Augustus Minerals (AUG:AU) has announced Exploration Update - Soil Sampling ResultsDownload the PDF here. Keep Reading...

16 November 2025

Augustus Secures Vanapa River Tenement Application in PNG

Augustus Minerals (AUG:AU) has announced Augustus Secures Vanapa River Tenement Application in PNGDownload the PDF here. Keep Reading...

6h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

Latest News

Sign up to get your FREE

Augustus Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00