February 29, 2024

Antilles Gold Limited (“Antilles Gold” or the “Company”) (ASX: AAU, OTCQB: ANTMF) advises that the Company has entered into an Agreement with Patras Capital Pte Ltd to provide up to three A$1.0 million Convertible Loan Notes to Antilles Gold Limited over the next three months.

The provision of the second and third Loan Note will be at the Company’s option, and may require shareholder approval with respect to placement capacity.

The aim is to raise funds to maintain the momentum of the near-term development of the Nueva Sabana gold-copper mine in Cuba while waiting on the outcome of the Groups’ arbitration of approximately A$45 million of claims against the Dominican Republic Government resulting from a project that was completed in 2019.

The Tribunal undertaking the arbitration has advised that the Award will be issued by the end of March 2024. It is anticipated that if the Award is favourable for the Company, and does not need to be enforced, the second and third Notes would not be issued.

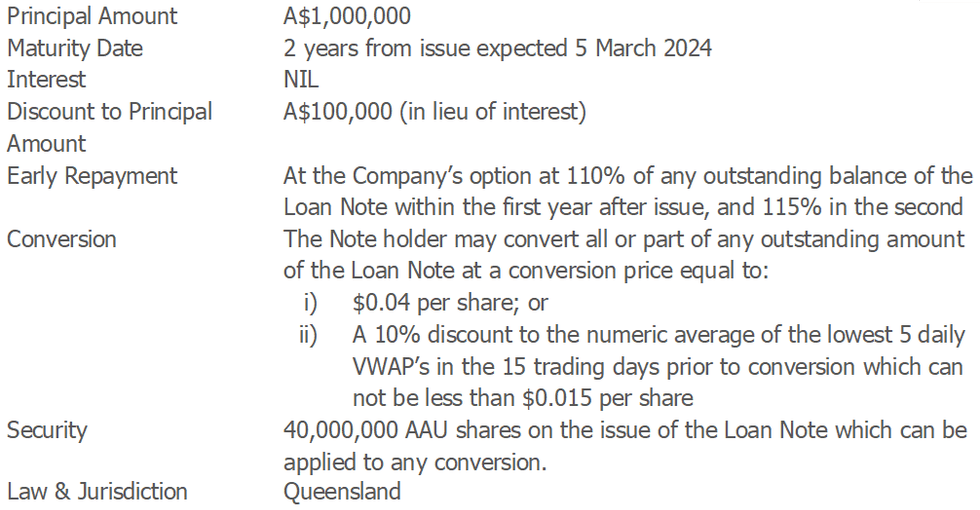

The basic terms of each Loan Note are as follows;

Antilles Gold has sufficient placement capacity under Listing Rule 7.1 for the first Loan Note.

The 50:50 joint venture in Cuba expects to commence construction of the site works and a short access road from the central highway in April 2024, and the mine and associated infrastructure in July 2024.

The Chairman of Antilles Gold, Mr Brian Johnson, said that “the dilution of shareholders with recurring capital raises was extremely disappointing but unavoidable when the Company had no existing operations producing a cashflow.

In his opinion, irrespective of the dilution, and the current low market capitalisation, the value of the Company’s projects in Cuba is increasing significantly with continuing expenditure.

Antilles Gold is assisting the Cuban joint venture company, Minera La Victoria, in negotiations that have commenced with three potential Investors showing interest in buying into the company, and supporting its progressive growth. Successful negotiations with any Investor, would minimise additional raises by Antilles Gold in the foreseeable future.

Recent meetings with the Company’s Cuban partner, GeoMinera, have indicated it will be possible for the existing Joint Venture Agreement to be amended to permit majority foreign ownership in order to accommodate additional shareholders.

Drafting of amendments to the Agreement, and the joint venture company’s Articles is proceeding.”

Click here for the full ASX Release

This article includes content from Antilles Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AAU:AU

The Conversation (0)

23 June 2024

Antilles Gold Limited

Developing Gold and Copper Projects in mineral‐rich Cuba

Developing Gold and Copper Projects in mineral‐rich Cuba Keep Reading...

17 February 2025

Antilles Gold to Raise $1.0M for Working Capital

Antilles Gold Limited (AAU:AU) has announced Antilles Gold to Raise $1.0M for Working CapitalDownload the PDF here. Keep Reading...

31 January 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Antilles Gold Limited (AAU:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

12 January 2025

Summary of Pre-Feasibility Study for Nueva Sabana Mine

Antilles Gold Limited (AAU:AU) has announced Summary of Pre-Feasibility Study for Nueva Sabana MineDownload the PDF here. Keep Reading...

11 December 2024

Revision to Updated Scoping Study Nueva Sabana Mine, Cuba

Antilles Gold Limited (AAU:AU) has announced Revision to Updated Scoping Study Nueva Sabana Mine, CubaDownload the PDF here. Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

19h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00