September 15, 2025

Description:

Locksley Resources (ASX:LKY,OTQB:LKYRF,FSE: X5L) has strengthened its position in the US critical minerals sector through a dual strategy that could reduce funding risk and enhance shareholder value, according to a market update from Peak Asset Management.

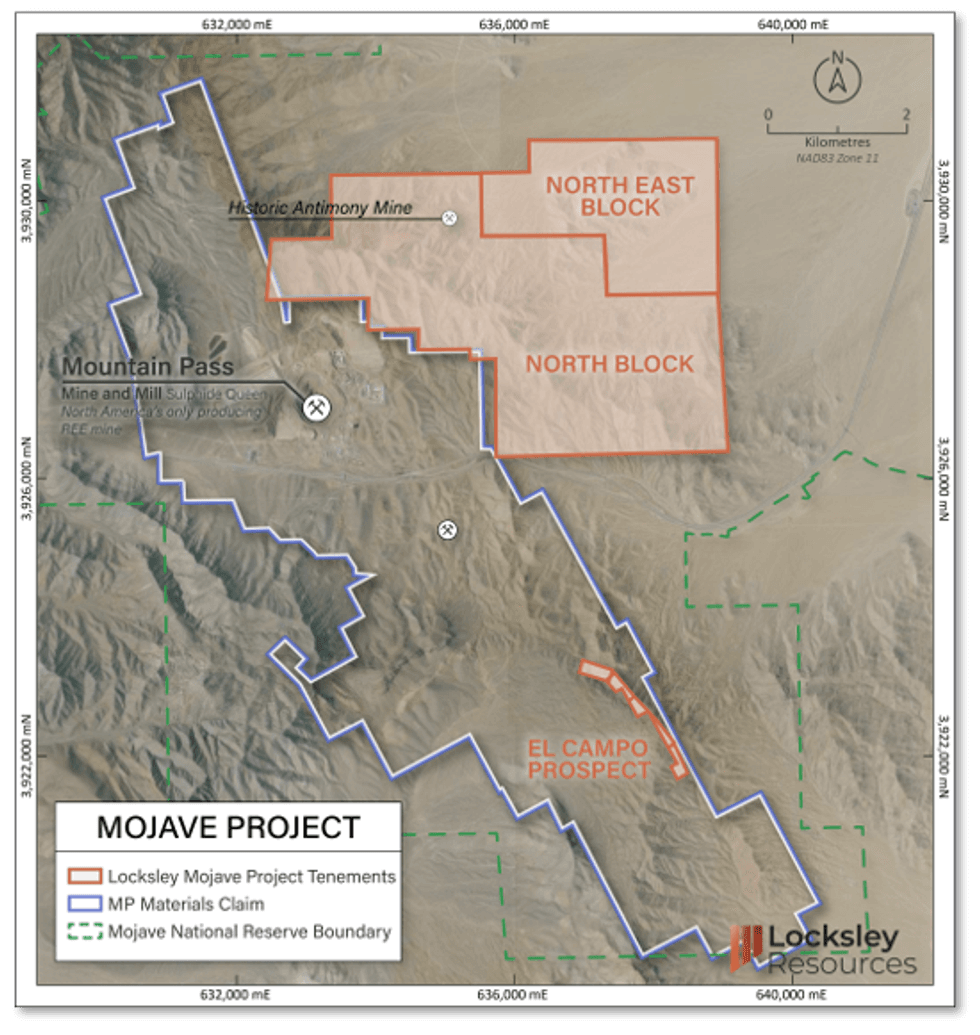

The company signed a binding research agreement with Rice University to develop green antimony processing and energy storage technologies, and engaged Washington-based advisory firm GreenMet to advance its Mojave critical minerals project into US federal programs.

Key Report Highlights

- Rice University partnership: For investors, the Rice partnership addresses a structural gap: the absence of US antimony processing capacity. With Locksley committing US$550,000 over 12 months, the collaboration is designed to generate jointly owned intellectual property in both environmentally friendly processing and advanced battery applications. This gives the company a potential first-mover advantage in establishing a sovereign supply of antimony, a metal critical to defense and energy technologies.

- GreenMet engagement: GreenMet’s mandate is equally significant for shareholders. By positioning Mojave within the Defence Production Act and Department of Energy initiatives, Locksley could gain access to grants, loans and offtake agreements.

- Near-term catalysts: Peak Asset Management notes the near-term catalysts include maiden drilling results in September and over US$1 billion in US federal critical minerals funding rounds expected later this year. Combined with favorable market dynamics – antimony prices around US$60,000/t and forecast deficits in rare earths like neodymium-praseodymium – Locksley’s dual strategy offers investors exposure to a tightly supplied market with strong policy tailwinds.

- Investor implications: For shareholders, these moves substantially de-risk Locksley’s downstream strategy. Access to non-dilutive US funding reduces the likelihood of equity dilution, preserving shareholder value. The absence of domestic antimony production in the US creates a first-mover advantage for Mojave, while alignment with US defense and energy policy priorities enhances the project’s strategic profile. At the same time, exposure to high antimony prices and looming rare earth supply deficits offers leverage to favorable commodity markets.

For the full analyst report, click here.

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned on this website.

LKY:AU

Sign up to get your FREE

Locksley Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

29 September 2025

Locksley Resources

High-grade antimony and rare earths prospects for a strategic, US critical minerals play

High-grade antimony and rare earths prospects for a strategic, US critical minerals play Keep Reading...

14h

Underground Mapping Reveals Major New Target at Mojave

Locksley Resources (LKY:AU) has announced Underground Mapping Reveals Major New Target at MojaveDownload the PDF here. Keep Reading...

02 February

High Grade Antimony Results from Batch Sampling Program

Locksley Resources (LKY:AU) has announced High Grade Antimony Results from Batch Sampling ProgramDownload the PDF here. Keep Reading...

29 January

Quarterly Activities Report and Appendix 5B

Locksley Resources (LKY:AU) has announced Quarterly Activities Report and Appendix 5BDownload the PDF here. Keep Reading...

05 January

High Grade Mineralised Corridor at the Mojave Project

Locksley Resources (LKY:AU) has announced High Grade Mineralised Corridor at the Mojave ProjectDownload the PDF here. Keep Reading...

07 December 2025

U.S. Investors Lead Oversubscribed $17m Placement

Locksley Resources (LKY:AU) has announced U.S. Investors Lead Oversubscribed $17m PlacementDownload the PDF here. Keep Reading...

06 February

After Major Gold Payout, Bian Ximing Turns Bearish Sights on Silver

A Chinese billionaire trader known for profiting from gold’s multi-year rally has turned sharply bearish on silver, building a short position now worth nearly US$300 million as the metal's price slides. Bian Ximing, who earned billions riding gold’s multi-year rally and later turned aggressively... Keep Reading...

03 February

Silver Supply Tight, Demand Rising — What's Next? First Majestic's Mani Alkhafaji

Mani Alkhafaji, president of First Majestic Silver (TSX:AG,NYSE:AG), discusses silver supply, demand and price dynamics, as well as how the company is positioning for 2026.He also shares his thoughts on when silver stocks may catch up to the silver price: "You've got to give it a couple of... Keep Reading...

03 February

Rio Silver’s Path to Near-Term Cashflow

Rio Silver (TSXV:RYO,OTCPL:RYOOF) President and CEO Chris Verrico outlines the company’s transition into a pure-play silver developer. With the silver price reaching historic highs, Rio Silver is capitalizing on its strategic position in Peru — the world’s second largest silver producer — to... Keep Reading...

02 February

When Will Silver Stocks Catch Up to the Silver Price?

The silver price remains historically high despite a recent pullback, and many silver stocks haven't kept pace. Silver's strong performance over the past year is the result of a perfect storm of factors, including an entrenched supply deficit, growing industrial demand, a weakening US dollar and... Keep Reading...

Latest News

Sign up to get your FREE

Locksley Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00