April 21, 2023

Bitcoin Well (TSXV:BTCW, OTCQB:BCNWF), OTCQB:BCNWF) provides an ecosystem of products and services making it easier for people to use bitcoin. Established in Canada in 2013 and has reached significant revenue growth year-over-year, Bitcoin Well will soon be expanding to the US market.

The company's three core business lines include Crypto ATM network composed of 250+ Crypto ATMs across Canada with US$21 million revenue in 2022; Bitcoin Well Infinite which caters to high net worth individuals and businesses and with US$29 million revenue in 2022; and Online Ecosystem, the fastest and safest way for Canadians to buy, sell and use bitcoin with current monthly revenues exceeding $350,000.

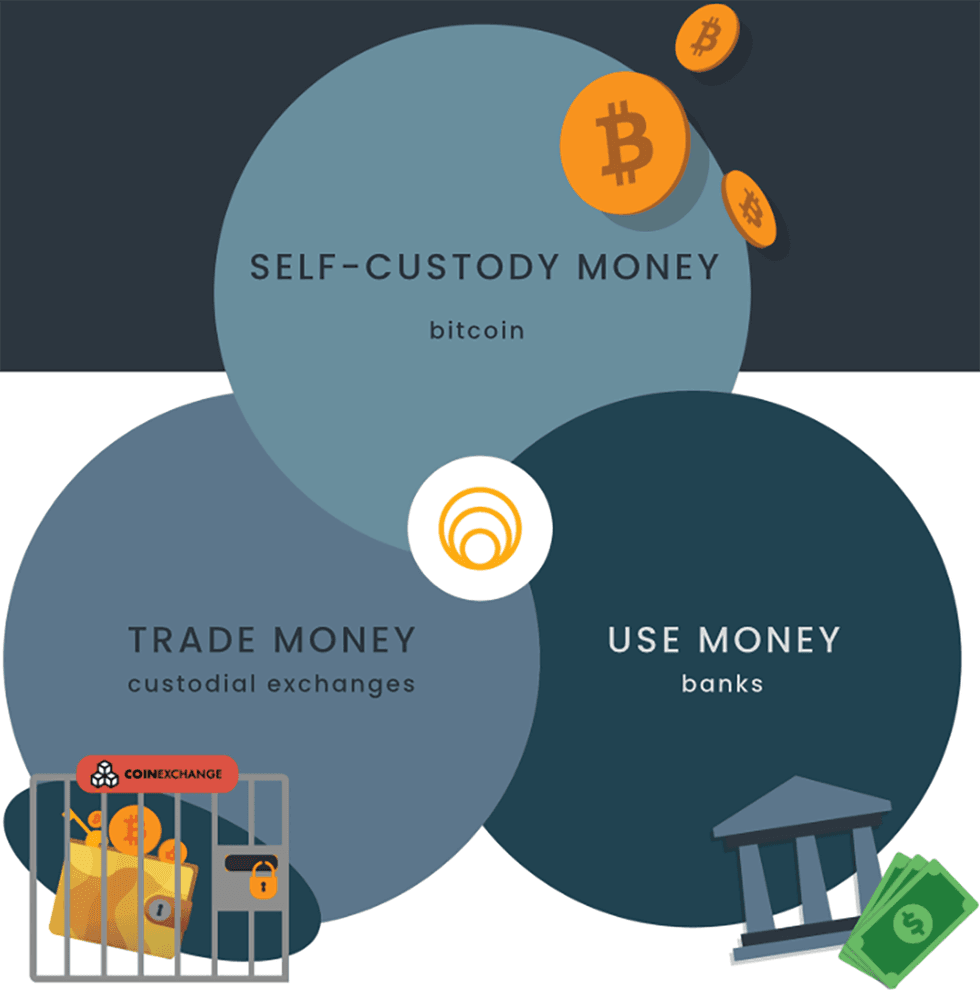

Every product or service offered by the company is wrapped in the security of its non-custodial ecosystem. This is a hot topic right now as multiple custodial exchanges have collapsed in the last few years. The non-custodial ecosystem is widely seen by knowledgeable investors as the safest way to buy bitcoin.

Company Highlights

- Bitcoin Well is a non-custodial ecosystem that merges the benefits of modern banking and the benefits of bitcoin.

- This ecosystem is split into three business units offering investors a combination of stable cash flow and high-growth potential.

- The company was established in 2013 and has experienced continuous growth regardless of the ebb and flow of the price of bitcoin.

- The price of bitcoin reached its peak in 2021 and has since scaled back, but interest in cryptocurrencies continues to grow while macroeconomic trends impact its current spot price.

- Bitcoin Well has passed significant financial milestones since launching its ATM business line in 2013. Each new service the company offers has seen rapid adoption and builds confidence in the organization's future.

- The company recently announced its expansion into the United States.

- 40+ years of bitcoin experience across management and board members.

This Bitcoin Well profile is part of a paid investor education campaign.*

Click here to connect with Bitcoin Well (TSXV:BTCW, OTCQB:BCNWF) to receive an Investor Presentation

BTCW:CC

The Conversation (0)

16 May 2024

Bitcoin Well

On a mission to enable independence by combining the convenience of modern banking with the benefits of Bitcoin

On a mission to enable independence by combining the convenience of modern banking with the benefits of Bitcoin Keep Reading...

09 February

Is Now a Good Time to Buy Bitcoin?

Bitcoin is prone to price volatility, with wide swings to the upside and downside, making it difficult for investors to know when is the right time to buy the top crypto.An emerging industry-friendly US regulatory environment, US Federal Reserve interest rate decisions, and rising institutional... Keep Reading...

09 February

Crypto Market Update: Clarity Act Stalls as Banks Push to Ban Stablecoin Yield

Here's a quick recap of the crypto landscape for Wednesday (February 11) as of 9:00 a.m. UTC. Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrency market news.Don't forget to follow us @INN_Technology for real-time news updates!Securities... Keep Reading...

06 February

Crypto Market Update: Bitcoin Price Ends Week Higher Following Earlier Losses

Here's a quick recap of the crypto landscape for Friday (February 6) as of 9:00 p.m. UTC. Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrency market news.Don't forget to follow us @INN_Technology for real-time news updates!Securities Disclosure: I,... Keep Reading...

05 February

Beyond the Pilot: Wiring Wall Street's New Internet

For years, blockchain had promise in the finance industry, but lacked the liquidity and connectivity to scale. Yuval Rooz, CEO and co-founder of Canton Network, believes that era is now ending. In correspondence with the Investing News Network, he explained how Canton Network, Digital Asset’s... Keep Reading...

04 February

From Swiss Vaults to Digital Wallets: How MKS PAMP is Modernizing the Gold Standard

Gold has seen wild swings over the last week, hitting record highs near US$5,600 per ounce before plunging nearly 10 percent to around US$4,700 in the sharpest drop in over a decade. The real story, though, isn’t just the price action, but how tokenized gold is modernizing one of the world’s... Keep Reading...

04 February

Crypto Market Update: Bitcoin Price Slide Drives Half-Trillion Crypto Wipeout

Here's a quick recap of the crypto landscape for Wednesday (February 4) as of 9:00 p.m. UTC. Get the latest insights on Bitcoin, Ether and altcoins, along with a round-up of key cryptocurrency market news.Don't forget to follow us @INN_Technology for real-time news updates!Securities Disclosure:... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00