July 05, 2024

Alvopetro Energy (TSXV:ALV;OTCQX:ALVOF) is a pioneering independent natural gas producer in Brazil, and was the first company to deliver sales-specified natural gas onshore into the local distribution network, which the state oil company previously dominated. This marked the beginning of a new era in Brazil's gas market.

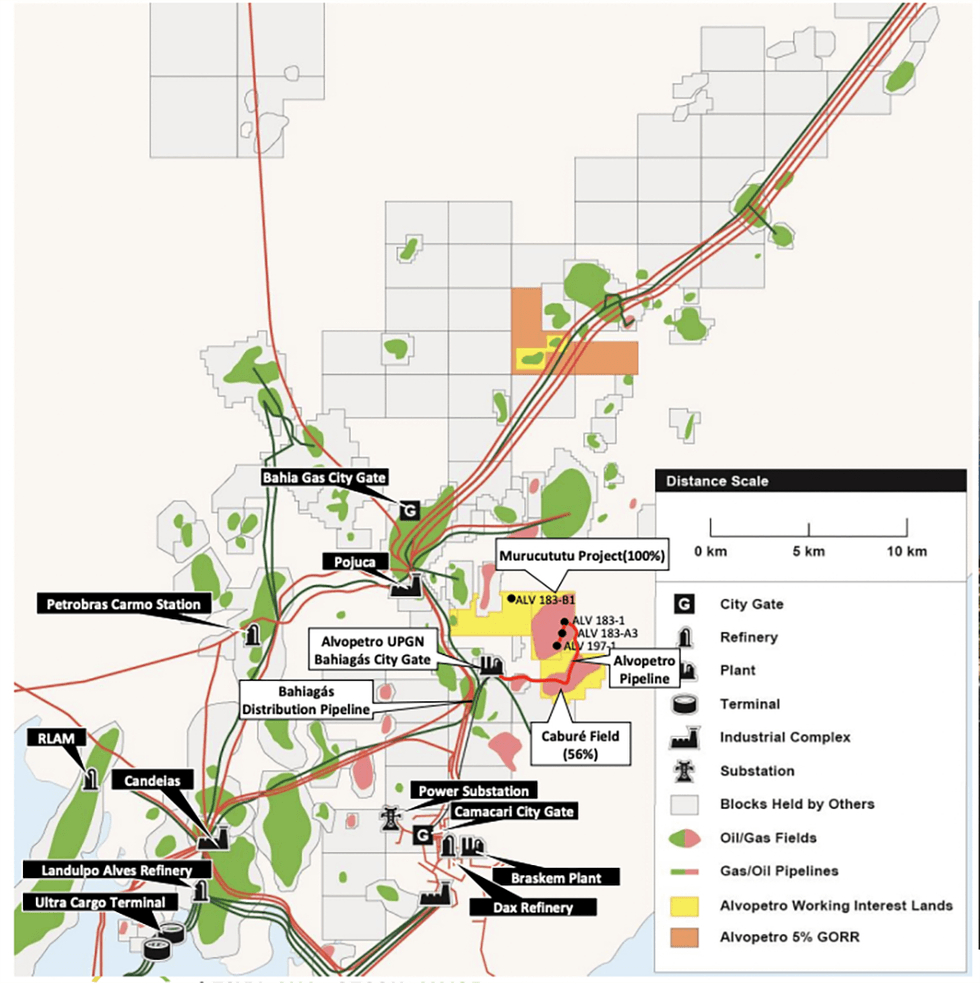

Alvopetro is an independent upstream and midstream operator that engages in the acquisition, exploration, development and production of natural gas and oil. The company's interests in the Caburé and Murucututu includes Block 182 and 183 exploration assets, and Bom Lugar and Mãe-da-lua oil fields, which cover an area of over 22,000 acres in the Recôncavo basin onshore Brazil.

The company’s flagship Caburé asset (56 percent Alvopetro) delivers the majority of Alvopetro’s current production. The project is a joint development (the unit) of a conventional natural gas discovery across four blocks, two of which are held by Alvopetro and two of which are held by its partner, with Alvopetro’s working interest being 56.2 percent following the first redetermination. The unit currently includes eight existing wells, with all production facilities already in place. The resource is well defined with 3D seismic surveys, particularly on the eastern side of a main bounding fault that runs roughly north-south through the Caruaçu formation. The company plans to drill an additional five wells in late 2024 and early 2025 to further improve the productive capacity of the field.

Company Highlights

- Alvopetro is a leading independent upstream and midstream gas operator in the state of Bahia, Brazil.

- The company’s strategy is focused on unlocking Brazil’s on-shore natural gas potential, building off the development of its Caburé and Murucututu natural gas fields strategic midstream infrastructure.

- Over 95 percent of Alvopetro’s production is from natural gas and the company has a 2P reserve base of 9.6 MMboe.

- The company boasts high operating netbacks and profitability per unit of production, setting it apart from its Latin American and North American peers. The state of Bahia boasts a favorable fiscal regime with low royalties and a 15 percent income tax rate.

This Alvopetro Energy profile is part of a paid investor education campaign.*

Click here to connect with Alvopetro Energy (TSXV:ALV) to receive an Investor Presentation

ALV:CC

Sign up to get your FREE

Alvopetro Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

04 September 2025

Alvopetro Energy

Leading independent upstream and midstream gas developer in Brazil

Leading independent upstream and midstream gas developer in Brazil Keep Reading...

7h

Angkor Resources Announces Stock Option Grant

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - March 2, 2026 - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") wishes to announce that it has granted, effective today, an aggregate of 4,275,000 stock options (each an "Option) to certain Directors, management and... Keep Reading...

27 February

US-Iran Tensions Put Europe’s Gas Storage Plans at Risk

Escalating tensions between the United States and Iran are reviving a risk energy markets have long feared: a potential closure of the Strait of Hormuz, the narrow Gulf passage that carries roughly 20 percent of global LNG trade and 25 percent of seaborne oil.New modelling from energy analytics... Keep Reading...

25 February

QIMC Intersects Major Subsurface Fault Corridor with Elevated H2 Readings at 142m Depth

Pressurized Formation Water and Visible Gas Bubbling Confirm Active Structural System in First of Five-Hole Systematic Drill Program

Quebec Innovative Materials Corp. (CSE: QIMC) (OTCQB: QIMCF) (FSE: 7FJ) ("QIMC" or the "Company") is pleased to report significant initial results from the first 300 metres of its planned 650-metre diamond drill hole DDH-26-01 at its West Advocate Eatonville Project, Nova Scotia. Drilling... Keep Reading...

24 February

Angkor Resources Commences Trenching Program At CZ Gold Prospect, Ratanakiri Province, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 24, 2026) TheNewswire - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of a trenching and sampling program at the CZ Gold Prospect in Ratanakiri Province, Cambodia. As previously announced (see... Keep Reading...

23 February

PEP 11 Update - Federal Court Proceedings

MEC Resources (MMR:AU) has announced PEP 11 Update - Federal Court ProceedingsDownload the PDF here. Keep Reading...

23 February

Kinetiko Energy Poised to Address South Africa’s Gas Supply Gap: MST Access Report

Description:A research report by MST Access highlights Kinetiko Energy (ASX:KKO) as an emerging participant in South Africa’s domestic gas sector, supported by a base-case valuation of AU$0.49 per share. The company’s project covers 5,366 sq km, located 200 km southeast of Johannesburg within an... Keep Reading...

Latest News

Sign up to get your FREE

Alvopetro Energy Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00