February 05, 2024

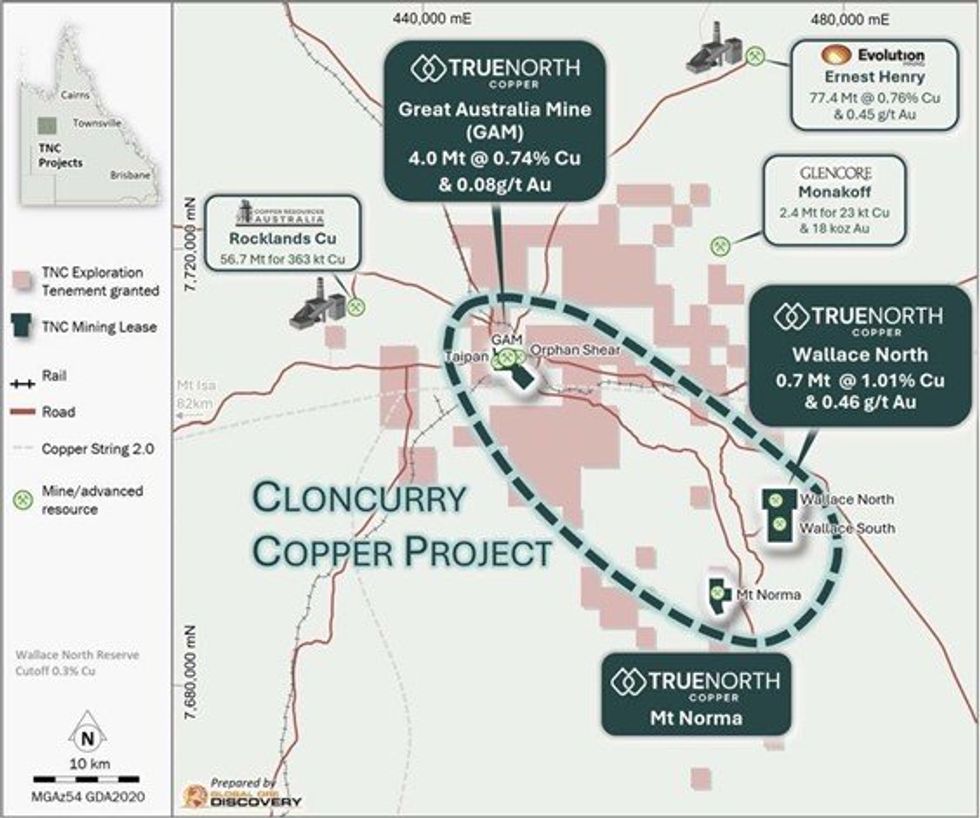

True North Copper Limited (ASX:TNC) (True North, TNC or the Company) is pleased to announce a maiden open pit ore reserve at Wallace North, part of its Cloncurry Copper Project (Queensland) (CCP).

HIGHLIGHTS

- Maiden Wallace North Ore Reserve totals 0.7Mt (Probable) grading 1.01% Cu and 0.46g/t Au for 6.8kt Cu and 10.0koz Au.

- Wallace North is scheduled as the first open pit (one of four – Wallace North, Great Australia Mine [GAM], Taipan and Orphan Shear) to be mined as part of the mining restart1 at the CCP.

- Sulphide ore will be hauled to a nearby concentrator for toll treatment as part of TNC’s toll-milling agreement with Glencore International AG2 (Glencore).

- Oxide ore from Wallace North will be hauled by road train to TNC’s Heap Leach Operations located at GAM.

- Mineralisation at Wallace North remains open along strike and at depth3. The Wallace North Ore Reserve represents 44% of the recently updated Wallace North Resource4.

- The CCP now contains combined Wallace North and GAM Ore Reserves (GAM includes GAM, Orphan Shear and Taipan deposits) totalling 4.7Mt grading 0.80% Cu and 0.13g/t Au containing 37.5kt of copper and 20.0koz of gold4,5.

- Wallace North and GAM Ore Reserves combine to form the CCP. Full details of the proposed Mining Restart Plan with project economics, assumptions and other key criteria will be released to the ASX and shareholders, in the next two weeks.

COMMENT

True North Copper’s Managing Director, Marty Costello said:

The fully permitted Wallace North Project is currently one of four open pits that will be mined as part of our Cloncurry Copper Project. We plan to schedule the Wallace North open pit as the first to be mined.

Our resource infill drilling and reconciliation confirms high-grade copper and gold. Our confidence in the Wallace North open pit extends beyond its initial ore reserve. The iterative nature of our mine design process allows us to continuously refine our understanding of the ore body. As we advance our operations and gather more data, we anticipate that future iterations of the mine design could reveal additional ore reserves, enhancing the project's overall value and extending its life.

We believe scheduling the Wallace North open-pit first, allows for early-life free cash flows, and minimises working capital and payback periods.

We are excited to shortly present to our shareholders and the market our Cloncurry Copper Project mining restart start plan.

Cloncurry Copper Project

- Addition of the Wallace North Ore Reserve raises TNC’s Cloncurry Copper Project (CCP) total Reserves to 4.7Mt Probable Ore Reserves grading 0.80% Cu and 0.13g/t Au, containing 37.5kt of copper and 20.0koz of gold4,5.

- The CCP currently incorporates four open pit deposits including: Great Australia Mine (GAM), Orphan Shear, Taipan and Wallace North.

- Initial mining development of the CCP will commence at Wallace North.

- Minimal establishment is required to commence Wallace North mining activities.

- TNC’s CCP Operations Hub, located at GAM, provides infrastructure and technical support across all CCP mining operations.

- TNC’s active oxide heap leach and solvent extraction processing plant is located at the CCP Operations Hub.

- The GAM, Orphan Shear and Taipan deposits are all located within 1km of the CCP Operations Hub. Wallace North is located less than 30km from the CCP Operations Hub.

- Oxide ore from Wallace North will be hauled by road train to TNC’s GAM Heap Leach Operations.

- Sulphide ore will be hauled to a nearby concentrator for toll treatment as part of TNC’s toll-milling agreement with Glencore2.

- Wallace North will be mined from surface with minimal topsoil and waste stripping required. Ore will be stacked at the pit, stockpiled and then reloaded to road trains for transport. Crushing will be completed at the CCP Operations Hub and at the toll treatment facility.

Wallace North Ore Reserve

Wallace North is located 37km from the CCP Operations Hub on two granted mining leases ML 2695 and ML 90236. Toll treating facilities are located less than 80km north by road.

TNC recently announced a combined Indicated and Inferred Mineral Resource Estimate at Wallace North of 1.59Mt @ 1.31% Cu and 0.78g/t Au for 23.5kt of copper and 44.8koz of gold4. The January 2024 MRE by Encompass Mining Solutions Pty Ltd (Encompass) following the inclusion of advanced grade control and re-assay data from diamond core drilling, which resulted in a 300% improvement to Indicated Resources4.

Previous mining at Wallace South has provided information on the geology and geotechnical conditions for mining. Global Ore Discovery Pty Ltd and Resolve Mining Solutions Consultants in collaboration with TNC geologists, have reviewed historic and recent drilling, including advanced grade control. Environmental Authorities, land holder and traditional owner agreements have been active for a number of years.

TNC engaged MEC to complete the ore reserve estimation for the Wallace North deposit, based on the 2024 Mineral Resource Estimate4. As part of the reserve estimation, MEC conducted an open pit optimisation, mining schedule and haulage model as part of a life of mine plan consistent with a pre-feasibility level of study. A financial model was developed by MEC based on the outputs of the mining schedule and haulage model to determine the economic viability of the deposit. Operational costs were developed for drill and blast, mining and processing based on TNC's contracts and quotes. The Indicated Resources contained within the mine design have been classified as Probable Reserves.

The optimisation study and accompanying assumptions including scheduling, haulage and financial modelling have been conducted to the accuracy level of a pre-feasibility study (+/-30%).

Financial modelling by MEC based on the outputs of the mining schedule and utilising slightly different parameters which were generally more conservative to the optimisation, delivered a positive NPV over an 18-month period, confirming the viability of the project.

The JORC 2012 Maiden Probable Ore Reserve estimate for the Wallace North project of 0.7Mt @ 1.01% Cu and 0.46g/t Au containing 6.8kt Cu and 10.0koz Au (Table 1), is a substantive addition to the total reserves for the Cloncurry Copper Project.

The ore reserve uses metal prices of sulphide at US$8,500/t, copper sulphate offtake pricing and applied premiums are used at US$9,350/t; Gold from the sulphide plant US$1,850 and exchange rate is set at AUD:USD 0.7.

Click here for the full ASX Release

This article includes content from True North Copper, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TNC:AU

The Conversation (0)

11 October 2024

True North Copper

On the path to becoming Australia’s next responsible copper producer

On the path to becoming Australia’s next responsible copper producer Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data showed that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00