July 28, 2024

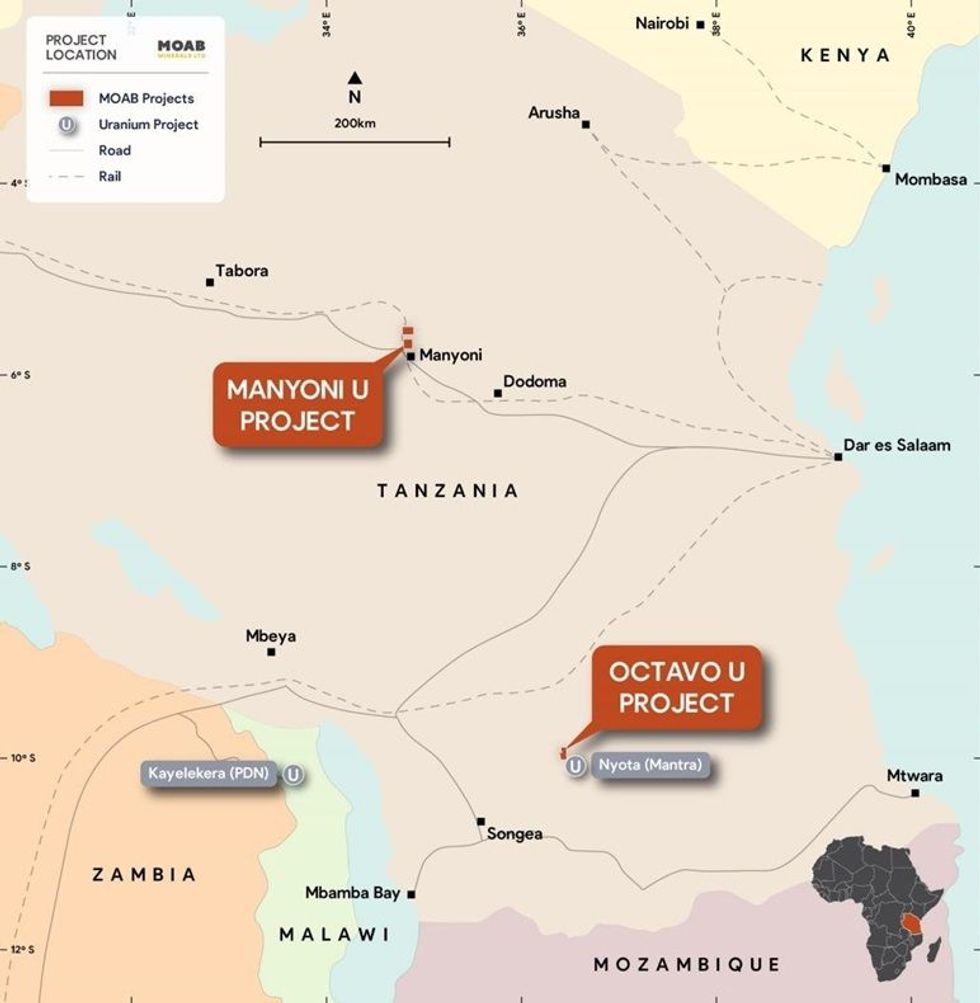

Moab Minerals Limited (ASX: MOM) (Moab or the Company) is pleased to announce that it has entered into a binding share sale agreement for the acquisition of 81.85% of the shares in Australian proprietary company Linx Resources Pty Ltd (Linx), 80% owner of certain mineral licenses comprising the Manyoni Uranium Project and the Octavo Uranium Project, both located in Tanzania.

HIGHLIGHTS:

- Moab is set to acquire 81.85% ownership of Linx Resources Pty Ltd, which boasts a diverse portfolio of advanced, large-scale uranium projects in Tanzania.

- The Asset portfolio includes the Manyoni and Octavo Uranium Projects, covering a total of 216 km2.

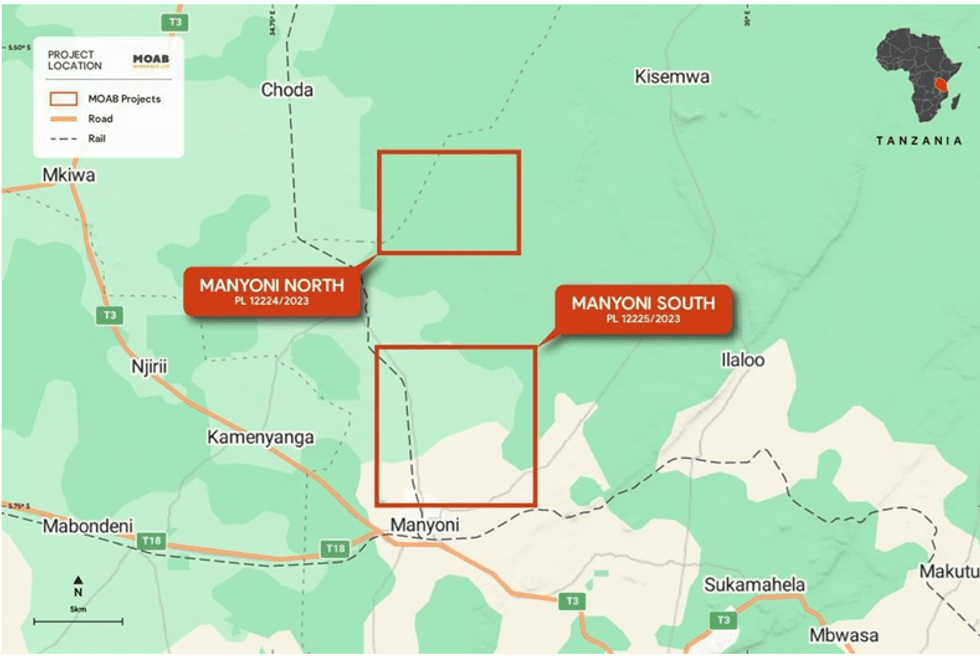

- Strategically located just 5km north of Manyoni town, the Manyoni Uranium Project enjoys convenient access to modern railway and sealed highway infrastructure as well as readily available power and water resources.

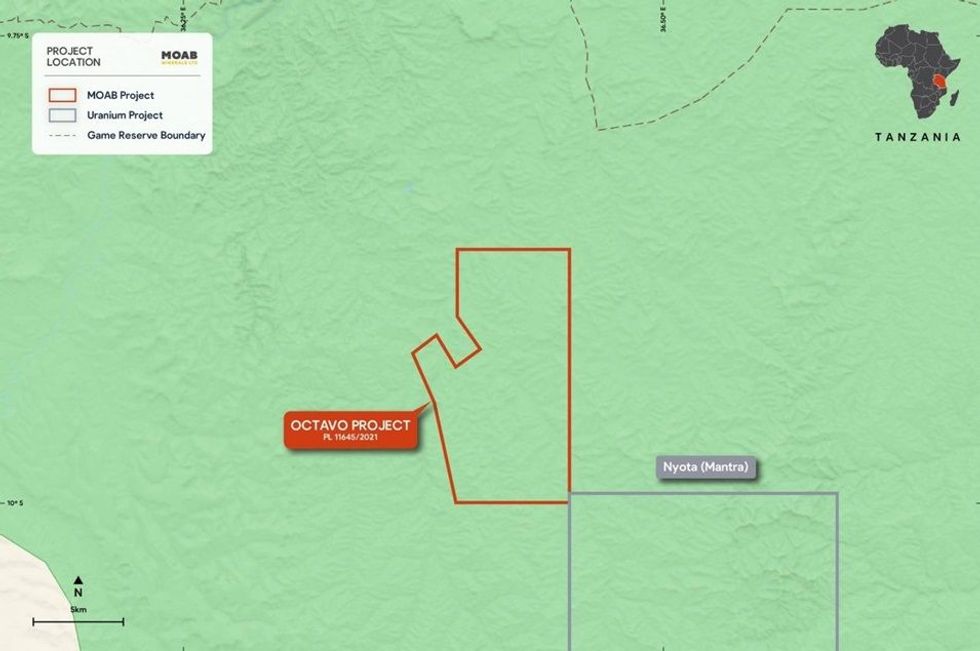

- The Octavo uranium project is adjacent to Rosatom’s world class Nyota Uranium Deposit (formerly ASX listed Mantra Resources Ltd; A$1.02bn takeover in 2011).

- Moab is committed to expediting exploration and development efforts across the Manyoni and Octavo projects.

- With approximately $3.2 million in cash and equivalents, Moab is well equipped to fund exploration and development initiatives.

Moab Managing Director, Malcolm Day commented “we are very pleased to announce the acquisition of such high potential uranium projects. The fact that Uranex Ltd previously explored the Manyoni Uranium Project and announced a JORC 2004 Mineral Resource Estimate of 20.5 m/lbs at 147pmm in 20101 is a great start for the Company. Post completion of the transaction our priority will be to convert the historic resource to a JORC 2012 compliant Mineral Resource Estimate. With the current spot price of uranium at a 17 year high of circa US$92/lb, it’s an exciting commodity to be exploring for”.

The Manyoni and Octavo Uranium Projects

The Manyoni Uranium Project tenements are located in the Republic of Tanzania (pop. 65 million), approximately 100km northwest of the capital city of Dodoma (pop. 765,000). The location of the uranium project at Manyoni is shown in Figure 2 and the location of the Octavo uranium project is shown in Figure 3.

Tenement Information

The Manyoni and Octavo tenements are Prospecting Licences that are granted for an initial period of 4 years, renewable for further periods of 3 years and then 2 years.

Click here for the full ASX Release

This article includes content from MOAB Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00