October 09, 2024

Artemis Resources Limited (‘Artemis’ or the ‘Company’) (ASX/AIM: ARV) is pleased to announce ground reconnaissance at the Titan prospect in the West Pilbara region of Western Australia continues to deliver high grade gold and silver from assays, highlighting the emergence of a broad mineralised area over the prospect.

Highlights:

- Recent rock chip sampling at Titan delivers further high-grade gold from assays, and newly discovered silver including:

- 553,754 g/t Au & 1,305 g/t Ag (24AR19-075)

- 223,056 g/t Au & 1,195 g/t Ag (24AR19-068)

- 33,389 g/t Au & 233 g/t Ag (24AR19-061)

- 7.5 g/t Au (24AR19-032)

- 5.7 g/t Au (24AR19-047)

- 1.2 g/t Au (24AR19-040)

- 2.0 g/t Au (24AR19-030)

- Emerging broad prospective area covering >63ha and considered to remain open pending further exploration

- Previous reported over-limit and high-grade assays have now been quantified by the laboratory and returned assay results as follows;

- 692,579 g/t Au & 3,000 g/t Ag (24AR11-005)

- 471,937 g/t Au & 1,775 g/t Ag (24AR11-008)

- 45,103 g/t Au & 344 g/t Ag (24AR11-004)

- 7,440 g/t Au & 212 g/t Ag (24AR11-002)

Executive Director George Ventouras commented: “It is pleasing to see further high- grade rock chip assays being recorded at the Titan prospect, together with confirmation of the extent of gold in previous sampling. These results, together with the previously reported gold, silver and copper results, point to the Carlow tenement being a highly prospective region with the potential for a larger scale gold system.

These high-grade gold assays continue the trend found in our original rock chip discoveries at Titan1 by emerging from quartz-iron veining and are therefore not analogous to conglomerate mineralisation. This veining structure will vary throughout Titan but the structure continues to demonstrate its potential. We are looking forward to further gold exploration at Titan and over the greater Carlow tenement.”

Titan Prospect

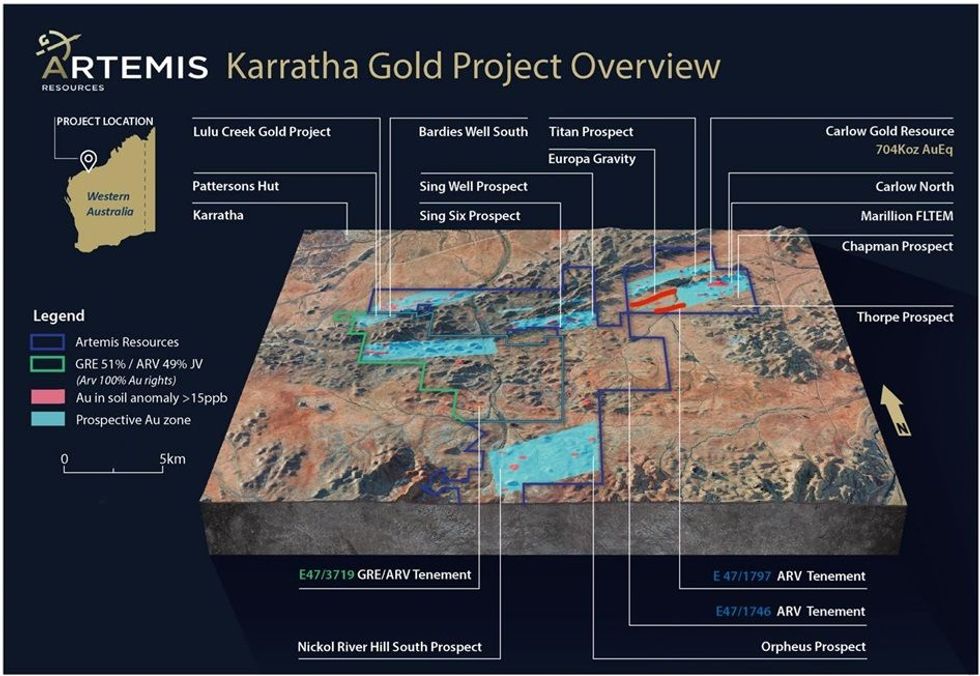

The Titan prospect is located towards the northern part of the Carlow tenement E47/1797, in the West Pilbara region of Western Australia. Titan has had minimal exploration work conducted previously other than broad spaced soil sampling and a constrained moving loop transient electromagnetic survey (MLTEM).

The Company has followed up the preliminary ground reconnaissance undertaken in August 2024 with a second phase of sampling. This second phase has confirmed the previously reported over-limit assay results and also identified further potential mineralised areas through the discovery of additional high grade, previously untested quartz/iron-oxide veins. In total, 97 samples were collected and sent to the laboratory for processing. The majority of samples were collected from in-situ veining with some sub-crop and three float samples.

Click here for the full ASX Release

This article includes content from Artemis Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

13h

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

13h

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

14h

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

14h

Oreterra Metals Fully Financed for Maiden Discovery Drilling at Trek South

Oreterra Metals (TSXV:OTMC) is set to launch its first-ever discovery drill program at the Trek South porphyry copper-gold prospect in BC, Canada, a pivotal moment following a corporate restructuring that culminated in the company emerging under its new name on February 2.Speaking at the... Keep Reading...

04 March

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00