February 21, 2024

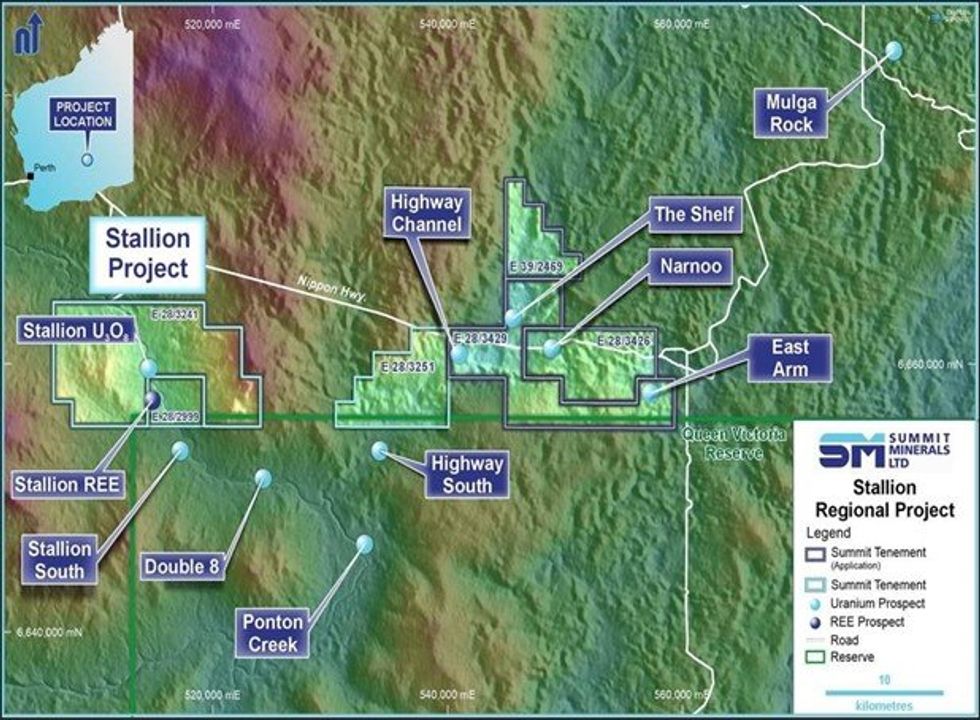

Summit Minerals Limited (ASX: SUM, “Summit” or the “Company”) is pleased to announce that it has acquired exploration license application E28/3249 through the acquisition of Radiant Exploration Pty Ltd for $40,000. This acquisition is in addition to two other exploration license applications that the Company has applied for in the Ponton Creek region (E39/2469 and E28/3426), which when granted would significantly increase the land package of its 100% owned Stallion Project, 175 km east- northeast of Kalgoorlie. The Company’s applications lie over palaeochannels prospective for aquifer sand and lignite-hosted uranium mineralisation in the Ponton Mulga Rock uranium province of WA (Figure 1) and capture the historical Highway and Shelf uranium deposits and several advanced prospects, including East Arm and Narnoo.

HIGHLIGHTS

- Stallion Uranium endowment grows to 7 Mlb U3O8 from 3.3Mlb adding 3.7 Mlb U3O8 with the addition of the Highway and Shelf uranium deposits

- Summit adds three exploration applications to the project: E28/3429, E28/3426 and E39/2469, located between Manhattan’s Double 8 and Deep Yellow’s Mulga Rock uranium deposits in the prospective Ponton Creek region

- The applications also capture drill-indicated mineralisation at Narnoo and East Arm

- Summit’s land holdings in the highly prospective region increase to 361 km2 from 196 km2

- The Stallion Uranium Project resource restatement and project expansion targeted for the first half of 2024

On conferring titles, the uranium endowment secured at the now larger Stallion Project grows to 7 million pounds (Mlb) U3O8 from 3.3 Mlb U3O8, an uplift of 3.7 Mlb U3O8. The applications host an Inferred Resource (JORC 2012) for the Highway uranium deposit of 5.7 million tonnes (Mt), for 1.9 Mlb U3O8 and an Inferred Resource (JORC 2012) for the Shelf uranium deposit of 5.9 Mt, for 1.8 million pounds (Mlb) U3O8; both utilising a 100 ppm U3O8 cutoff. The resources were established by Manhattan Corporation Limited (Refer to MHC ASX Announcement dated 23 January 20171).

Including the applications, Summit expands its holdings in the highly prospective uranium region from 196 km2 to 361 km2 and increases the length of palaeochannel-hosted uranium mineralisation under assessment from 8km to 28 km.

MHC previously stated that “the uranium mineralisation is in shallow reduced sand hosted tabular uranium deposits in a confined palaeochannel with uranium mineralisation that is potentially amenable to in-situ metal recovery (“ISR”), the lowest cost method of producing yellowcake with the least environmental impact”.

The Company intends to restate the resource, advance resource expansion work, and accelerate the exploration of high-priority regional targets, including those within the applications.

Cautionary Statement

The resource estimates contained herein were prepared in accordance with the JORC (2012) Code by Manhattan Corporation Limited in 2017. The information has not materially changed since it was last reported. Nothing causes Summit to question the accuracy or reliability of the MHC estimates. Summit accepts the quoted estimates and the Competent Person’s (Hellman and Schofield) view that the resource classification appropriately reflects the deposit’s knowledge level. Summit has not independently validated the former owner’s estimates and is not to be regarded as reporting, adopting, or endorsing those estimates.

Full disclosures are required to comply with ASX's “Mining Report Rules for Mining Entities: See Frequently Asked Questions” FAQ 37 (Appendix 1) and the attached JORC Table (Appendix 2).

Summit’s Managing Director, Gower He, said:

“Considering recent global trends towards utilising nuclear energy as a clean source of baseload power, we are excited to increase our uranium exposure in anticipation of potential uranium-friendly legislative changes in WA. These acquisitions more than double our historical uranium resources as we work towards a resource restatement over the coming months.”

New tenure and applications

The recently granted tenement (E28/3251) and the new applications cover 20 kilometers of palaeochannels known for their uranium mineralisation potential, including hosting several uranium deposits and drilled uranium prospects.

Highway South Prospect

The Highway South tenement (E28/3251), granted in October 2023, separates the Highway and Highway South deposits. It contains 374 accessible drill holes, including seven sonic holes and 367 air core holes for over 24,000m of drilling. The Manhattan developed holes were on 400 m spaced lines at 100-metre centres along each grid line across the palaeochannel.

The tenement captures the southern and western extensions of the Highway Deposit.

Nippon Application (E28/3429)

The Nippon Exploration Licence Application, E28/3429, contains the historical resources of the Highway and The Shelf deposits. The Highway Inferred Resource contains an estimated 860 tonnes (1.9Mlb) of uranium oxide at a 100 ppm U3O8 cutoff. The Shelf Deposit contains an Inferred Resource estimated at 810 tonnes (1.8Mlb) of uranium oxide at a 100 ppm U3O8. Expanded summaries of the work related to each estimate are available in the modified JORC table (Appendix 1)3.

Manhattan’s resource estimate for the Highway deposit is based on 304 drill holes totaling 18,236m of drilling. Drilling has been completed on 200m and 400m spaced lines with holes drilled at 100m centres along each grid line across the palaeochannel within mineralised zones. All drill holes were gamma- logged.

Apart from some shallow lignite-hosted uranium mineralisation encountered along the northern part of the palaeochannel at Highway, the geological controls and style of the channel sand-hosted uranium mineralisation is like the mineralisation encountered at Stallion.

Manhattan’s resource estimate for the Shelf deposit is based on 352 drill holes totaling 21,550m of drilling. At the Shelf, drilling on 200m x 100m centres identified shallower lignite-hosted uranium mineralisation within the upper sandstone and claystone.

The application includes the East Arm prospect, where wide-spaced reconnaissance drilling in the 1980s intersected anomalous uranium mineralisation with similar grades to those reported for Stallion and other known deposits in the region.

Click here for the full ASX Release

This article includes content from Summit Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00