February 21, 2024

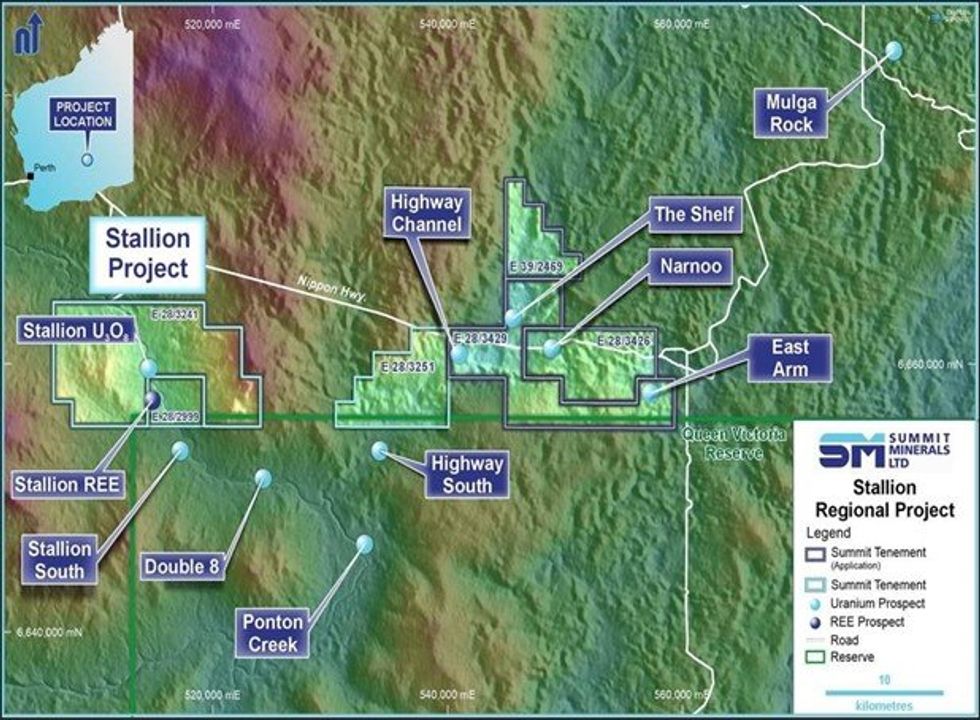

Summit Minerals Limited (ASX: SUM, “Summit” or the “Company”) is pleased to announce that it has acquired exploration license application E28/3249 through the acquisition of Radiant Exploration Pty Ltd for $40,000. This acquisition is in addition to two other exploration license applications that the Company has applied for in the Ponton Creek region (E39/2469 and E28/3426), which when granted would significantly increase the land package of its 100% owned Stallion Project, 175 km east- northeast of Kalgoorlie. The Company’s applications lie over palaeochannels prospective for aquifer sand and lignite-hosted uranium mineralisation in the Ponton Mulga Rock uranium province of WA (Figure 1) and capture the historical Highway and Shelf uranium deposits and several advanced prospects, including East Arm and Narnoo.

HIGHLIGHTS

- Stallion Uranium endowment grows to 7 Mlb U3O8 from 3.3Mlb adding 3.7 Mlb U3O8 with the addition of the Highway and Shelf uranium deposits

- Summit adds three exploration applications to the project: E28/3429, E28/3426 and E39/2469, located between Manhattan’s Double 8 and Deep Yellow’s Mulga Rock uranium deposits in the prospective Ponton Creek region

- The applications also capture drill-indicated mineralisation at Narnoo and East Arm

- Summit’s land holdings in the highly prospective region increase to 361 km2 from 196 km2

- The Stallion Uranium Project resource restatement and project expansion targeted for the first half of 2024

On conferring titles, the uranium endowment secured at the now larger Stallion Project grows to 7 million pounds (Mlb) U3O8 from 3.3 Mlb U3O8, an uplift of 3.7 Mlb U3O8. The applications host an Inferred Resource (JORC 2012) for the Highway uranium deposit of 5.7 million tonnes (Mt), for 1.9 Mlb U3O8 and an Inferred Resource (JORC 2012) for the Shelf uranium deposit of 5.9 Mt, for 1.8 million pounds (Mlb) U3O8; both utilising a 100 ppm U3O8 cutoff. The resources were established by Manhattan Corporation Limited (Refer to MHC ASX Announcement dated 23 January 20171).

Including the applications, Summit expands its holdings in the highly prospective uranium region from 196 km2 to 361 km2 and increases the length of palaeochannel-hosted uranium mineralisation under assessment from 8km to 28 km.

MHC previously stated that “the uranium mineralisation is in shallow reduced sand hosted tabular uranium deposits in a confined palaeochannel with uranium mineralisation that is potentially amenable to in-situ metal recovery (“ISR”), the lowest cost method of producing yellowcake with the least environmental impact”.

The Company intends to restate the resource, advance resource expansion work, and accelerate the exploration of high-priority regional targets, including those within the applications.

Cautionary Statement

The resource estimates contained herein were prepared in accordance with the JORC (2012) Code by Manhattan Corporation Limited in 2017. The information has not materially changed since it was last reported. Nothing causes Summit to question the accuracy or reliability of the MHC estimates. Summit accepts the quoted estimates and the Competent Person’s (Hellman and Schofield) view that the resource classification appropriately reflects the deposit’s knowledge level. Summit has not independently validated the former owner’s estimates and is not to be regarded as reporting, adopting, or endorsing those estimates.

Full disclosures are required to comply with ASX's “Mining Report Rules for Mining Entities: See Frequently Asked Questions” FAQ 37 (Appendix 1) and the attached JORC Table (Appendix 2).

Summit’s Managing Director, Gower He, said:

“Considering recent global trends towards utilising nuclear energy as a clean source of baseload power, we are excited to increase our uranium exposure in anticipation of potential uranium-friendly legislative changes in WA. These acquisitions more than double our historical uranium resources as we work towards a resource restatement over the coming months.”

New tenure and applications

The recently granted tenement (E28/3251) and the new applications cover 20 kilometers of palaeochannels known for their uranium mineralisation potential, including hosting several uranium deposits and drilled uranium prospects.

Highway South Prospect

The Highway South tenement (E28/3251), granted in October 2023, separates the Highway and Highway South deposits. It contains 374 accessible drill holes, including seven sonic holes and 367 air core holes for over 24,000m of drilling. The Manhattan developed holes were on 400 m spaced lines at 100-metre centres along each grid line across the palaeochannel.

The tenement captures the southern and western extensions of the Highway Deposit.

Nippon Application (E28/3429)

The Nippon Exploration Licence Application, E28/3429, contains the historical resources of the Highway and The Shelf deposits. The Highway Inferred Resource contains an estimated 860 tonnes (1.9Mlb) of uranium oxide at a 100 ppm U3O8 cutoff. The Shelf Deposit contains an Inferred Resource estimated at 810 tonnes (1.8Mlb) of uranium oxide at a 100 ppm U3O8. Expanded summaries of the work related to each estimate are available in the modified JORC table (Appendix 1)3.

Manhattan’s resource estimate for the Highway deposit is based on 304 drill holes totaling 18,236m of drilling. Drilling has been completed on 200m and 400m spaced lines with holes drilled at 100m centres along each grid line across the palaeochannel within mineralised zones. All drill holes were gamma- logged.

Apart from some shallow lignite-hosted uranium mineralisation encountered along the northern part of the palaeochannel at Highway, the geological controls and style of the channel sand-hosted uranium mineralisation is like the mineralisation encountered at Stallion.

Manhattan’s resource estimate for the Shelf deposit is based on 352 drill holes totaling 21,550m of drilling. At the Shelf, drilling on 200m x 100m centres identified shallower lignite-hosted uranium mineralisation within the upper sandstone and claystone.

The application includes the East Arm prospect, where wide-spaced reconnaissance drilling in the 1980s intersected anomalous uranium mineralisation with similar grades to those reported for Stallion and other known deposits in the region.

Click here for the full ASX Release

This article includes content from Summit Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

04 March

Cameco Signs US$2.6 Billion Uranium Deal With India to Fuel Nuclear Expansion

Cameco (TSX:CCO,NYSE:CCJ) has secured a nine-year uranium supply agreement with India worth an estimated US$2.6 billion, accelerating its nuclear power expansion as it deepens critical mineral ties with the country.The Saskatoon-based uranium producer will supply nearly 22 million pounds of... Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00