- WORLD EDITIONAustraliaNorth AmericaWorld

Top 4 ASX Uranium Stocks

Investor Insight

Group Eleven Resources’ new high-grade zinc discovery, its strong shareholders, and infrastructure-rich jurisdiction present a compelling investment case. With Glencore and Michael Gentile as the two largest shareholders, the company is well-positioned to leverage its discoveries into high-return opportunities.

Overview

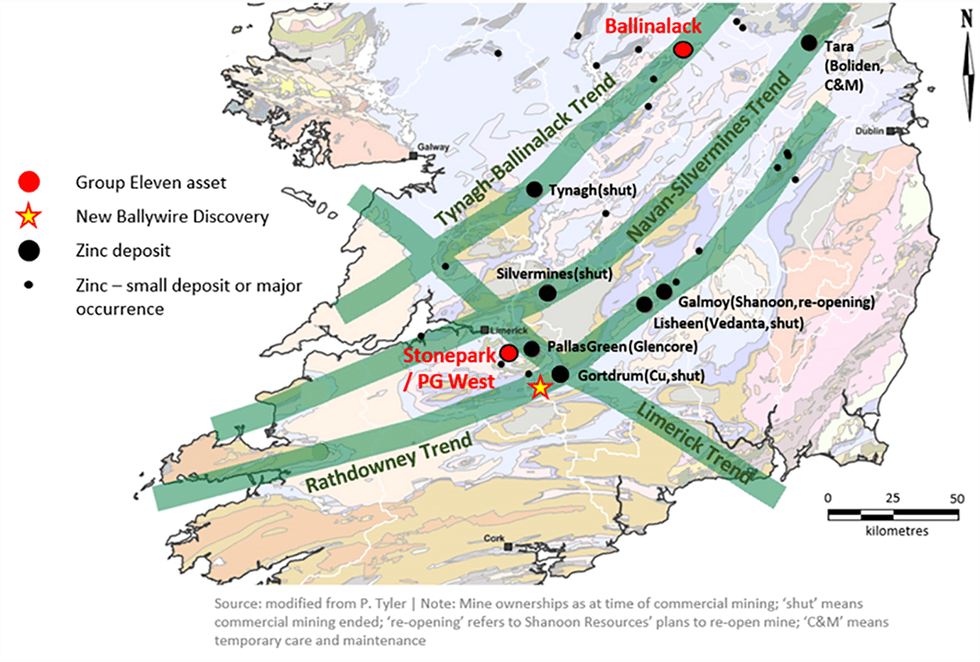

Group Eleven Resources (TSXV:ZNG,OTC:GRLVF,FRA:3GE) is a Canadian mineral exploration company focused on unlocking value in Ireland’s world-class zinc districts. The company’s two flagship assets—PG West and Stonepark—are contiguous projects that together form the largest exploration land package in the Limerick region, a prolific and mining-friendly jurisdiction historically known for high-grade zinc deposits.

A game-changing development for Group Eleven is its 2022 Ballywire discovery, a high-grade, zinc-lead-silver system with recent assays also confirming elevated levels of germanium, a critical mineral used in semiconductors and green technologies. Ongoing drilling continues to expand the mineralized footprint and strengthen Ballywire’s profile as a potentially company-making asset.

Zinc is a critical metal for global infrastructure and plays an increasingly important role in grid-scale energy storage, particularly through zinc-air and zinc-ion battery technologies, emerging alternatives to lithium-based systems. With global refined zinc inventories at multi-decade lows and demand forecast to rise sharply alongside renewable energy adoption and infrastructure investment, Group Eleven is well-positioned to benefit from strong market tailwinds.

Ireland ranks among the top mining jurisdictions globally, offering a stable political environment, modern infrastructure, and a long history of successful zinc production, including the Tara mine—one of the world’s largest and longest-operating zinc mines. Ireland consistently receives high scores in the Fraser Institute’s Mining Investment Attractiveness Index.

Adding to Group Eleven’s investment appeal is a strong strategic partnership with Glencore, which holds a 16.1% ownership stake and a seat on the company’s board. This relationship provides not only technical expertise but also potential downstream and development synergies. Other major industry players, including South32 and Boliden, also maintain a strong presence in the region.

With a high-impact discovery, supportive commodity fundamentals, a Tier-1 jurisdiction, and backing from a major global miner, Group Eleven Resources offers investors significant exposure to zinc and critical minerals at a compelling valuation.

Get access to more exclusive Gold Investing Stock profiles here