June 17, 2024

Previous drilling at Blackhawk returned up to 1,270 g/t Ag (BHD006) beneath the historic Endowment Mine, previous rock chip sampling returned +1% silver from the Morning Star Mine1

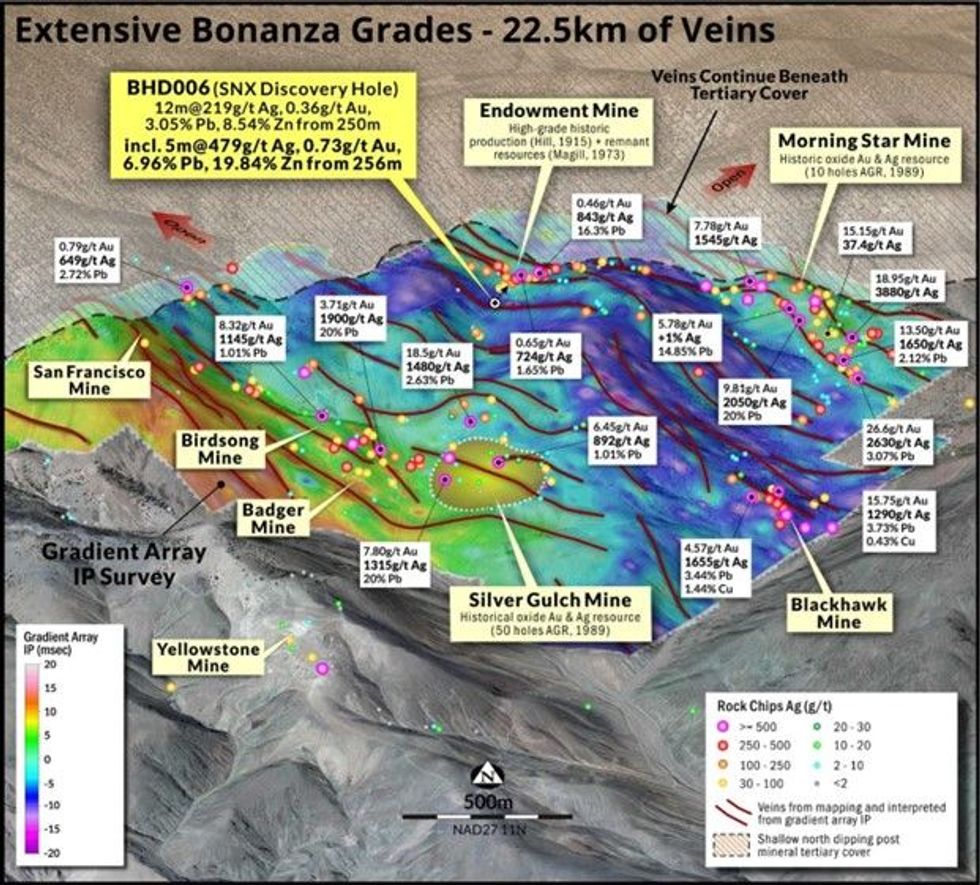

Sierra Nevada Gold (ASX: SNX) is pleased to announce it is preparing a drilling program to follow up drill hole BHD006 which returned results including 0.5m at 1,270 g/t Ag and 1m at 823g/t Ag at Endowment Mine, part of its Blackhawk Epithermal project in Nevada, USA.1

Highlights

- SNX plans seven-hole 1,500m reverse circulation (RC) drill program to follow up on drillhole BHD006, which was drilled beneath the historic Endowment Mine.

- High-grade silver intercepts are associated with very high-grade lead-zinc (see table 1), demonstrating potential for extremely high value ore at Blackhawk Epithermal Project.

- SNX’s geological team will initiate a field program to complete geological mapping, soil geochemistry surveys and rock chip sampling on vein target areas, to further refine drill targets in preparation for drilling in the third quarter of 2024.

- Underground 3D scanning survey of accessible historic workings at the Endowment Mine will map extent and location of historic workings to accurately target planned drill holes following up on drill hole BHD006.

- SNX will initiate a focused, 100m dipole-spaced Induced Polarization (IP) geophysics survey over preferred portions of the vein field to assist with drill hole targeting.

- Blackhawk epithermal project has potential for a significant silver discovery, with 22.5- line kilometres of high-grade silver-gold-lead-zinc veins identified1.

- SNX completed a $2.6 million capital raising in May 2024 to advance exploration at Blackhawk epithermal project.2

- It has commenced a strategic review to progress full or partial asset sales or joint venture partnerships over remaining copper, gold and silver assets in Nevada, USA.

SNX Executive Chairman Peter Moore said “We were encouraged by the strong support for our recent $2.6 million share placement and proceeds from this will allow the company to accelerate our exploration program at Blackhawk as we look to uncover its potential to be a significant silver discovery. We have several activities planned to ensure our drill targets are well defined ahead of mobilising a rig to site in Q3 2024 to follow up these exciting earlier silver results.”

SNX has identified a large and high-grade intermediate sulphidation polymetallic epithermal Ag-Au-Pb-Zn vein system at Blackhawk, which is related to a large porphyry system. Partially coincident with, and located north of the Blackhawk Porphyry system, the vein field covers about 5km2 and is open under cover to the north and northeast, with 22.5-line km of veins identified to date (see figures 1 & 2).

SNX’s geological team will initiate a field program to complete geological mapping, soil geochemistry surveys and rock chip sampling on mapped vein target areas, to further refine drill targets in preparation for drilling. A program of seven reverse circulation (RC) holes is planned for 1500m in the third quarter of 2024 to follow up the result of 1,270 g/t Ag hit in BHD006 drilled in 2017.

Click here for the full ASX Release

This article includes content from Sierra Nevada Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

15h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

16h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

21h

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00