March 13, 2024

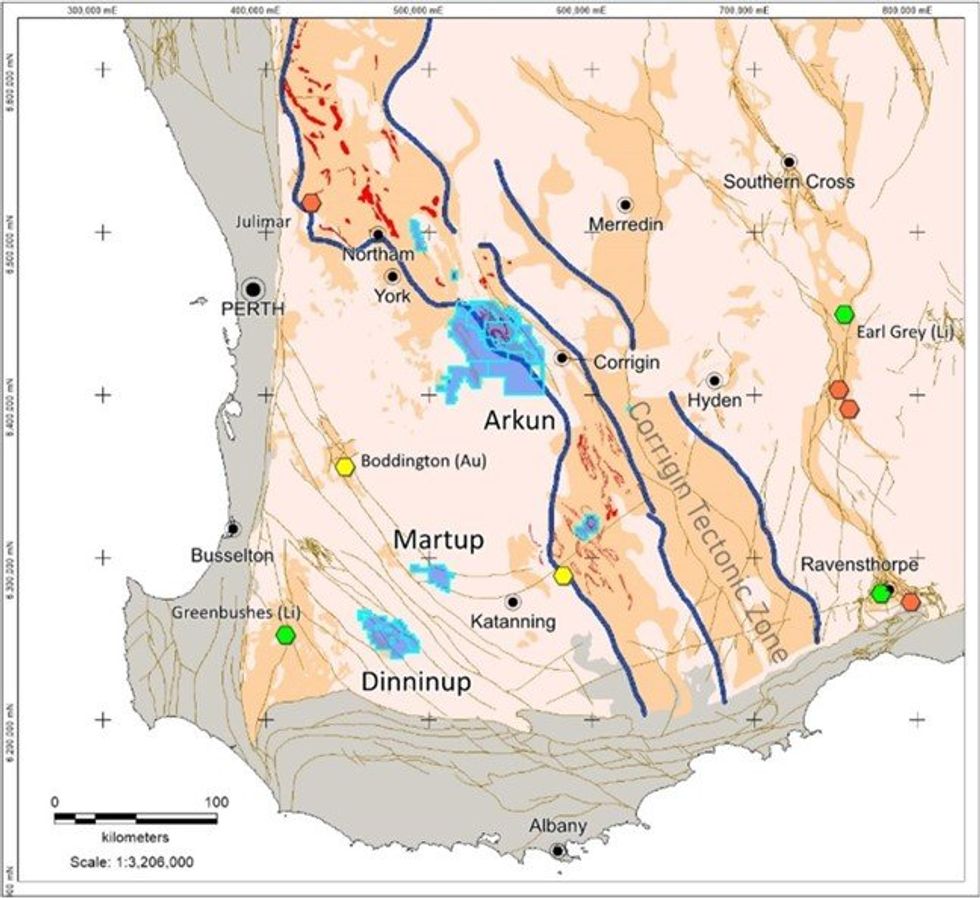

Impact Minerals Limited (ASX:IPT) is pleased to announce that it has applied for three new exploration licences covering 720 km2 north of and contiguous with the company’s 100%-owned Arkun project, located 150 km east of Perth in the emerging mineral province of south-west Western Australia (Figures 1 and 2).

- Three new Exploration Licence applications submitted immediately north of the Arkun project along trend from the recently discovered REE soil geochemistry anomalies at Hyperion, Swordfish and Horseshoe as well as the Caligula copper anomaly.

- The new licences cover a further 720 km2 and increase the size of the Arkun project to 2,900 km2 in the emerging mineral province of southwest WA.

- The new licences are considered highly prospective for a range of strategic and battery metals, including REE and copper-nickel sulphides.

- Two significant EM conductors identified in government airborne EM lines that have never been drill-tested are priority areas for follow-up work.

- Statutory approvals and land access agreements are in progress for a maiden drill programme at Hyperion and other targets, alongside negotiations with drilling contractors.

- Soil geochemistry surveys are ongoing in the north and west parts of Arkun.

Impact Minerals’ Managing Director, Dr Mike Jones, said, “After the recent significant breakthroughs in the soil geochemistry programs that discovered our Hyperion and Caligula prospects, we have been able to expand our strategic ground holding in the emerging mineral province of the southwest Yilgarn province in Western Australia. The new applications contain strike extensions and similar geology to our newly discovered prospects and are easily accessible, allowing us to start groundwork quickly following the usual land access negotiations. We are also looking forward to our maiden drill program at Arkun early in the next Quarter and are well advanced in the approvals process and securing the appropriate drill rig.”

The three applications (ELA70/6598; ELA70/6604 and E70ELA/6595) share similar geology to and are along strike from the large and significant soil geochemistry anomalies recently identified for Rare Earth Elements (REE) at Hyperion, Swordfish and Horseshoe and copper-bismuth-cobalt at Caligula (ASX Releases January 4th 2024 and January 24th 2024). There has been no significant previous exploration of the new licences.

Impact now holds a strategic ground position that covers 120 km of trend of the Corrigin Tectonic Zone (CTZ) which marks a major crustal boundary between the South West and Youanmi Terranes of the Yilgarn Craton (Figure 1). The CTZ is host to major gold deposits at Katanning (>3 million ounces gold) and copper at Calingiri (>3 million tonnes of copper) as well as mafic-ultramafic rocks similar to those at the Julimar deposit (>10 million ounces of palladium).

Impact considers the central and western part of the (CTZ) region to be highly prospective for a range of strategic and battery metals including REE, copper and nickel as well as gold and a significant number of targets have been identified within the current Arkun project area (Figure 2). Impact is looking to drill several of these anomalies in the next Quarter.

Two strong conductors have already been identified as priority areas for follow-up work in regional airborne electromagnetic data within the new licences (2.5D inversion of SkyTEM data: Figures 2 and 3).

Line 200401 has a 400 m by 300 m conductor at about 120 m depth (Figure 2), and Line 200501 has a 500 m by 200 m conductor dipping steeply west at 100m depth (Figure 3). The EM anomalies line up along a fault splay linked to Impact’s Caligula copper anomaly and this adds a further 40 km of prospective strike length to the Arkun project.

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

IPT:AU

The Conversation (0)

22 October 2024

Impact Minerals Limited

Developing the lowest-cost HPA project in Australia

Developing the lowest-cost HPA project in Australia Keep Reading...

27 March 2025

Successful Completion of the Renounceable Rights Issue

Impact Minerals Limited (IPT:AU) has announced Successful Completion of the Renounceable Rights IssueDownload the PDF here. Keep Reading...

19 March 2025

Renounceable Rights Issue Closing Date

Impact Minerals Limited (IPT:AU) has announced Renounceable Rights Issue Closing DateDownload the PDF here. Keep Reading...

13 March 2025

Major drill targets identified at the Caligula Prospect

Impact Minerals Limited (IPT:AU) has announced Major drill targets identified at the Caligula ProspectDownload the PDF here. Keep Reading...

09 March 2025

NFM: Sale of Broken Hill East Project to Impact Minerals

Impact Minerals Limited (IPT:AU) has announced NFM: Sale of Broken Hill East Project to Impact MineralsDownload the PDF here. Keep Reading...

04 March 2025

Update on the Renounceable Rights Issue to raise $5.2M

Impact Minerals Limited (IPT:AU) has announced Update on the Renounceable Rights Issue to raise $5.2MDownload the PDF here. Keep Reading...

8h

How to Invest in Gold Royalty and Streaming Stocks

Gold royalty companies offer investors exposure to gold and silver with the benefits of diversification, lower risk and a steady income stream. Royalty companies operating in the resource sector will typically agree to provide funding for the exploration or development of a resource in exchange... Keep Reading...

8h

How Would a New BRICS Currency Affect the US Dollar?

The BRICS nations, originally composed of Brazil, Russia, India, China and South Africa, have had many discussions about establishing a new reserve currency backed by a basket of their respective currencies. The creation of a potentially gold-backed currency, known as the "Unit," as a US dollar... Keep Reading...

12h

Toronto to Host Global Mineral Sector for PDAC 2026, March 1 – 4

The Prospectors & Developers Association of Canada (PDAC) will bring together the mineral exploration and mining community in Toronto for its 94th annual Convention, taking place March 1 – 4, 2026, at the Metro Toronto Convention Centre (MTCC).As the World’s Premier Mineral Exploration & Mining... Keep Reading...

15h

THE SIGNAL ARCHITECTURE: 5 Stocks Calibrating the 2026 Infrastructure Cycle

USANewsGroup.com Market Intelligence Brief — WHAT'S HAPPENING: The infrastructure holding the global economy together is being stress-tested in real time: Gold at $5,552 per ounce as central banks loaded another 755 tonnes into reserves [1]The G7 issued formal guidance treating the quantum... Keep Reading...

23 February

Mining’s New Reality: Strategic Nationalism, Gold Records and a Fractured Cost Curve

The era of “smooth globalization” is over, and mining is entering a more fragmented, politically charged phase defined by strategic nationalism, according to speakers at S&P Global’s latest webinar.Jason Holden, who opened the “State of the Market: Mining Q4 2025” session with a macro overview,... Keep Reading...

23 February

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00