Piedmont Lithium Inc., (“Piedmont” or the “Company”) (NASDAQ: PLL; ASX: PLL) is pleased to report the results of the updated scoping study (“Scoping Study” or “Study”) for its proposed integrated lithium hydroxide business (“Carolina Lithium” or the “Project”) in Gaston County, North Carolina. The Study confirms that Carolina Lithium will be one of the world’s largest and lowest-cost producers of lithium hydroxide, with a sustainability footprint that is superior to incumbent producers, all in an ideal location to supply the rapidly growing electric vehicle supply chain in the United States.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210609005267/en/

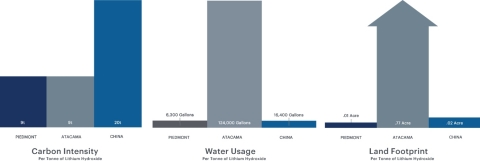

Figure 1 – Life cycle analysis of key carbon intensity, water usage, and land footprint of Piedmont Carolina Lithium (Graphic: Business Wire)

PROJECT HIGHLIGHTS

Sustainable Lithium Hydroxide Manufacturing

Piedmont Carolina Lithium is expected to have a superior sustainability profile relative to the current producers based in China and South America. Chinese lithium producers are highly reliant on coal-fired power and generally utilize a carbon-intensive sulfuric acid roasting process to convert raw materials shipped in from Australia, while South American producers tend to utilize vast tracts of land and large quantities of water, all in the driest desert in the world, the Atacama.

Metso Outotec process reduces emissions, eliminates sulfuric acid roasting, and reduces solid waste

Solar power generation, in-pit crushing, and electric conveying reduce reliance on carbon-based energy sources

Vastly diminished transportation distances for raw materials and finished product

Highly efficient land and water use compared with South American brine production

Far lower CO 2 intensity than incumbent China hydroxide production including Scope 1, 2, and 3 emissions

Independent preliminary Life-Cycle Analysis (“LCA”) completed with Minviro

Exceptional Economics and Scale

The Study confirms that Piedmont will be a large and low-cost producer of lithium hydroxide, benefitting from its ideal location in Gaston County, North Carolina, with exceptional infrastructure, a deep local talent pool, low-cost energy, and proximity to local markets for the monetization of by-product industrial minerals. The Study results represent a substantial improvement over prior studies despite the use of more conservative assumptions related to mining dilution and metallurgical recoveries.

The competitive advantage of Piedmont’s unique location is depicted in the following lithium hydroxide cost curve, which was prepared by Roskill, a leading lithium industry consultancy.

Fully Integrated Manufacturing Campus

Piedmont Carolina Lithium contemplates a single, integrated site, comprising quarrying, spodumene concentration, by-products processing, and spodumene conversion to lithium hydroxide. There are currently no such integrated sites operating anywhere in the world, and the economic and environmental advantages of this strategy are compelling:

Premier location in Gaston County, North Carolina – “the cradle of the lithium business”

Elimination of SC6 transportation costs and related noise and emissions

On-site solar complex to power concentrate operations and reduce reliance on diesel fueled equipment

Potential to co-locate other downstream battery materials / Li-ion battery manufacturing

Creation of up to 500 manufacturing, engineering, and management jobs

Site offers potential to expand hydroxide capacity by adding additional manufacturing trains in the future

“We are exceedingly pleased with the results of our updated Scoping Study. The economics of our Project continue to impress, but I am particularly proud of the Project’s sustainability profile. Customers, investors, and neighbors are increasingly focused on businesses that are “doing things the right way.” It is critical that raw material supply chains do not detract from the overall sustainability of the transition to electric vehicles. Our project will have a far lower environmental footprint than alternative suppliers, and we expect that to position Piedmont well with all stakeholders.

As we move forward to complete a Definitive Feasibility Study for Carolina Lithium later in 2021, Piedmont has engaged Evercore and JPMorgan as financial advisors to evaluate potential strategic partnering and financing options for its North Carolina Project. Given the Project’s unique position as the only American spodumene project, with world-class scale, economics, and sustainability, we expect strategic interest to be robust.

Keith D. Phillips, President and Chief Executive Officer

Click here to view the complete release.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210609005267/en/

Keith Phillips

President & CEO

T: +1 973 809 0505

E: kphillips@piedmontlithium.com

Brian Risinger

VP – Corporate Communications

T: +1 704 910 9688

E: brisinger@piedmontlithium.com