- NORTH AMERICA EDITIONAustraliaNorth AmericaWorld

May 10, 2024

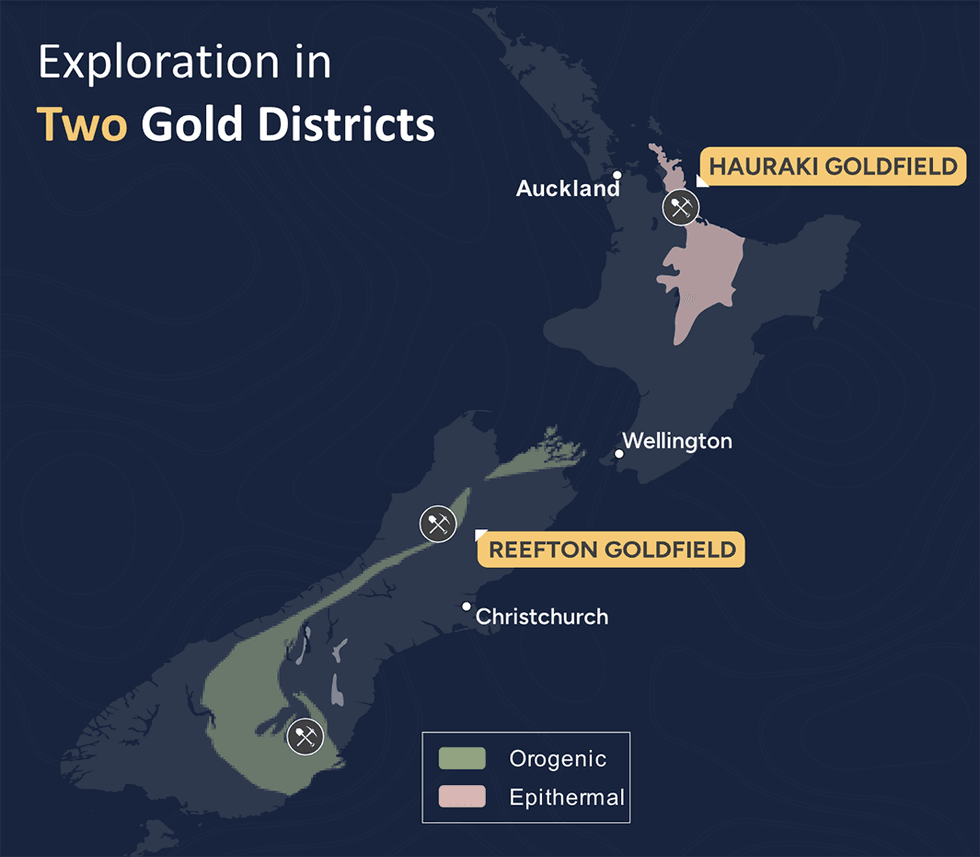

Rua Gold (CSE:RUA,OTC:NZAUF,WKN:A4010V) focuses on the Hauraki Goldfield and Reefton Goldfield - two prolific, historic gold-producing regions in New Zealand boasting previous high-grade gold production. New Zealand is a tier 1 mining jurisdiction with highly prospective geology, and a skilled workforce. The new government of New Zealand has committed to promoting economic growth through mining- and business-friendly policies, such as the Fast Track Approval Bill, which proposes quicker approval timelines for a range of projects, including mining.

New Zealand has a rich history of gold production from orogenic deposits (+9 Moz), epithermal sources (+15 Moz), and alluvial deposits (+22 Moz). The country has low sovereign risk with no corruption, making it an attractive destination for mining investment.

Rua Gold has launched a fully funded exploration program at its properties which includes a 2,500-meter diamond drill program focused on the Pactolus prospect at Reefton Goldfield. Pactolus has returned assays for three of six holes drilled on the system, with hole DD_PAC_035 intersecting 2 meters @ 5.13 grams per ton (g/t) gold. Additional work is required to accurately model this zone's geometry before proceeding with further drilling at this prospect. Consequently, the company anticipates redirecting its focus towards the previously productive areas in Reefton in the near future, which includes the Murray Creek, Crushington, Capleston and Caledonian historic districts. These historic mines collectively produced ~700 koz at 25.2 g/t within a radius of ~20 kms.

Company Highlights

- Rua Gold is a gold exploration company with two highly prospective land packages in New Zealand’s historic gold districts – Hauraki Goldfield and Reefton Goldfield.

- New Zealand is a tier 1 mining jurisdiction boasting highly promising geological formations and a significant history of gold production, with orogenic deposits (+9 Moz), epithermal sources (+15 Moz), and alluvial deposits (+22 Moz).

- The company’s two key assets include the Reefton Goldfield on New Zealand’s South Island and Glamorgan on New Zealand’s North Island.

- The new government is focused on stimulating economic growth, as evidenced by the recent Fast Track Approval Bill, which proposes fast-track approvals for a range of projects, including mining.

- Rua Gold has high-quality orogenic and epithermal gold prospects, boasting historical production grades ranging from 16 to 50 g/t gold.

- Rua Gold is fully permitted and fully financed with significant near-term catalysts. The company has launched an exploration program at its two properties. Drilling is already ongoing at the company’s properties in the Reefton district.

- A seasoned board and management team is at the helm of Rua Gold, with extensive regional knowledge and a proven track record of successful discoveries. With full financing and permits in place, the company is well-positioned to capitalize on growth prospects.

This Rua Gold profile is part of a paid investor education campaign.*

Click here to connect with Rua Gold (CSE:RUA) to receive an Investor Presentation

RUA:CNX

The Conversation (0)

2h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

19h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00