Rover Metals: Developing Gold Prospects in the Yellowknife Area, Northwest Territories

Rover Metals has launched its campaign on the Investing News Network

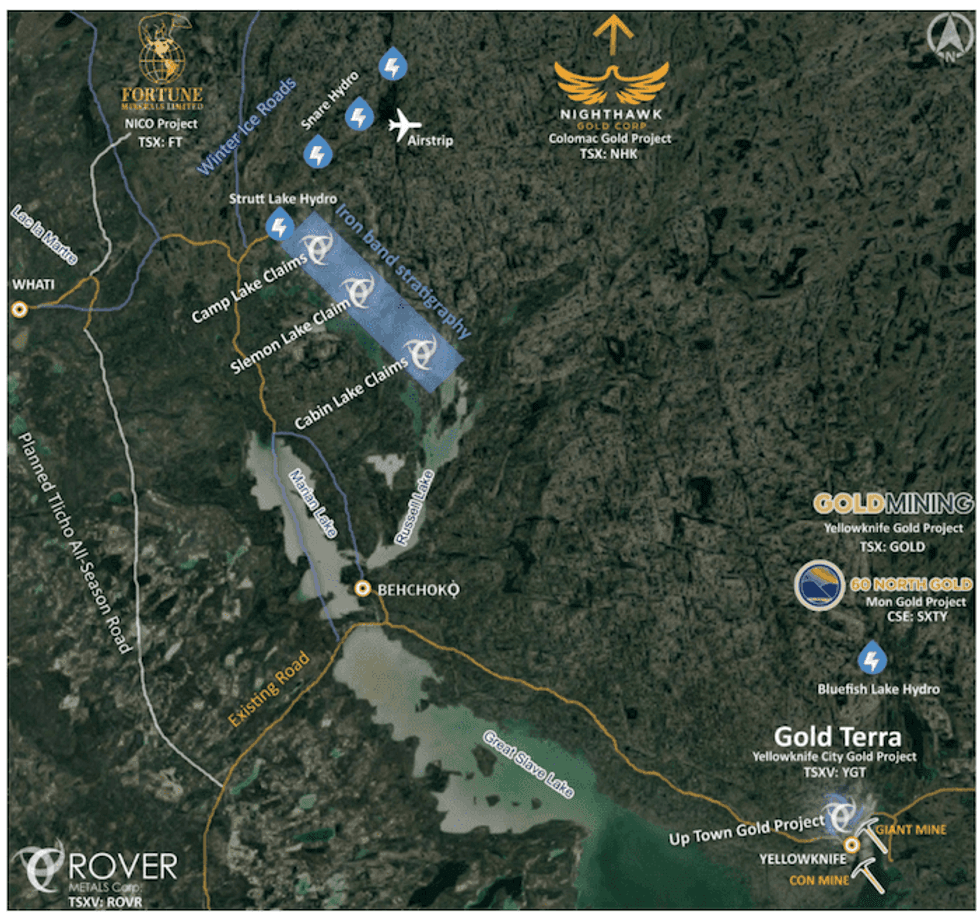

Rover Metals Corp. (TSXV:ROVR,OTCQB:ROVMF,FWB:4XO) revitalizes gold exploration by developing the potential of its flagship Cabin Lake gold project near Yellowknife. The Cabin Lake gold project and Up Town Gold property are the company’s highly prospective assets. The Yellowknife jurisdiction hosts world-class gold deposits, existing infrastructure and supportive mining relations with local government bodies. The projects also leverage accessible roadways and strategic positioning near the Tłı̨chǫ All-Season Road Project.

Since Cabin Lake’s acquisition in 2018, Rover has been quick to advance the project’s exploration and development, including obtaining exploration permits and completing extensive geophysics and drill programs.

Rover Metals’ Company Highlights

- Rover Metals is a precious mineral exploration company focused on highly prospective gold prospects in North America. The company’s gold projects are located in the mining-friendly and resource-rich landscape of Yellowknife, NWT.

- The Cabin Lake group of gold projects consist of three properties: Cabin Lake, Camp Lake, and Slemon Lake. The company has 100 percent interest in this asset.

- Rover Metals has conducted significant groundwork and exploration on Cabin Lake. Developments include drilling, geophysics, ice road permitting and assay reporting, which have reported 14 g/t gold grades at one of the property’s 32 meter drill holes located 17 meters from surface. The Company plans to drill this ore shoot discovery at depth in Q1

- There remains three at surface proven historic brownfields gold zones at Cabin Lake that are still to be drill tested by Rover, as well as at least 9 other high-quality greenfields targets.