March 24, 2025

RareX Limited (ASX: REE – RareX, or the Company) is pleased to announce the discovery of high-grade gallium at the Cummins Range carbonatite pipe. The rare earth deposit hosts multiple wide, high-grade intercepts above the Rare and Phos carbonatite dykes. Gallium assays have been identified in the upper 80m of the carbonatite pipe, occurring alongside high-grade rare earths, phosphate, and scandium mineralisation. Deeper gallium has not yet been assayed for.

Highlights

- Historical drill holes contain values up to 6,826 g/t (0.68%) Ga2O3

- Significant Gallium Intercepts include:

- 99m at 106 g/t Ga2O3, 0.77% TREO and 160 g/t Sc2O3 from 1m

- 60m at 124 g/t Ga2O3, 3% TREO and 372 g/t Sc2O3 from 36m, Incl. 12m at 242 g/t Ga2O3, 6.7% TREO and 638 g/t Sc2O3

- 74m at 123 g/t Ga2O3, 2.4% TREO and 186 g/t Sc2O3 from surface, Incl. 30m at 206 g/t Ga2O3, 4.6% TREO and 310 g/t Sc2O3

- Research suggests these are the highest grade gallium assays reported in Australia

- Only 25% of the historical drilling has been assayed for gallium with none of the RareX drilling assayed for gallium – this discovery immediately elevates Cummins Range to the most advanced gallium deposit in Australia

- Gallium is on the critical mineral list for Europe, America and Australia and, with the growth of electronics, semi-conductors and solar panels, it is anticipated the gallium market will grow significantly from US$2.45B in 2024 to US$21.53B by 20341

- Re-assaying of samples is underway

CEO and Managing Director, James Durrant, commented: “The gallium results are an unexpected boost for the Cummins Range deposit, coming from a deep dive reassessment of the deposit in readiness for the 2025 drilling season on the near-mine anomalies. Gallium is on the critical minerals list of every major economy, including the United States and Australia, yet there are no significant Western producers. China controls 98% of the market and has imposed a comprehensive ban on all gallium exports.

“The Cummins Range deposit has been significantly de-risked through advanced heritage agreements, environmental and infrastructure studies, and mine planning. This ne aspect to Cummins Range immediately escalates this project to the most advanced gallium deposit in Australia. We look forard to conducting further studies to determine ho gallium can be integrated into our rare earth and phosphate development plans.”

Most of the world’s gallium is produced as a byproduct of aluminium and zinc refining. Gallium grades are generally classified as follows: low-grade (30–50 g/t), moderate-grade (50–100 g/t), and high-grade (>100 g/t). Initial assessments have identified a moderately mineralized area of 500m x 500m, with higher grade zones occurring within and near high grade rare earth and scandium mineralization. Notable high-grade intercepts include:

- NRC016 - 99m at 106 g/t Ga2O3, 0.77% TREO and 160 g/t Sc2O3 from 1m to EOH

- NRC058 - 74m at 123 g/t Ga2O3, 2.4% TREO and 186 g/t Sc2O3 from surface, including 30m at 206 g/t Ga2O3, 4.6% TREO and 310 g/t Sc2O3

- NRC037 - 56m at 114 g/t Ga2O3, 1.5% TREO and 263 g/t Sc2O3 from 44m, including 11m at 220 g/t Ga2O3, 3% TREO and 639 g/t Sc2O3

- NRC038 - 60m at 124 g/t Ga2O3, 3% TREO and 372 g/t Sc2O3 from 36m, including 12m at 242 g/t Ga2O3, 6.7% TREO and 638 g/t Sc2O3

- NRC068 - 86m at 105 g/t Ga2O3, 2.8% TREO and 200 g/t Sc2O3 from 14m, including 11m at 210 g/t Ga2O3, 6.6% TREO and 376 g/t Sc2O3

- NRC078 - 37m at 145 g/t Ga2O3, 3.2% TREO and 321 g/t Sc2O3 from 30m, including 10m at 292 g/t Ga2O3, 5% TREO and 500 g/t Sc2O3

Gallium at Cummins Range

Historical regolith RC drilling, conducted between 2007 and 2012 by Navigator Resources and Kimberly Rare Earths were mostly assayed for gallium. A total of 11,487 assays for gallium were completed with 36% of the assays containing >40 g/t Ga2O3.

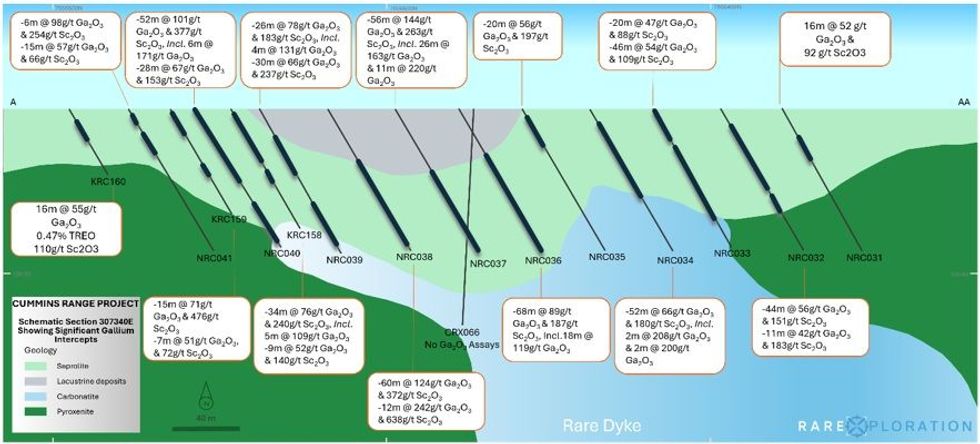

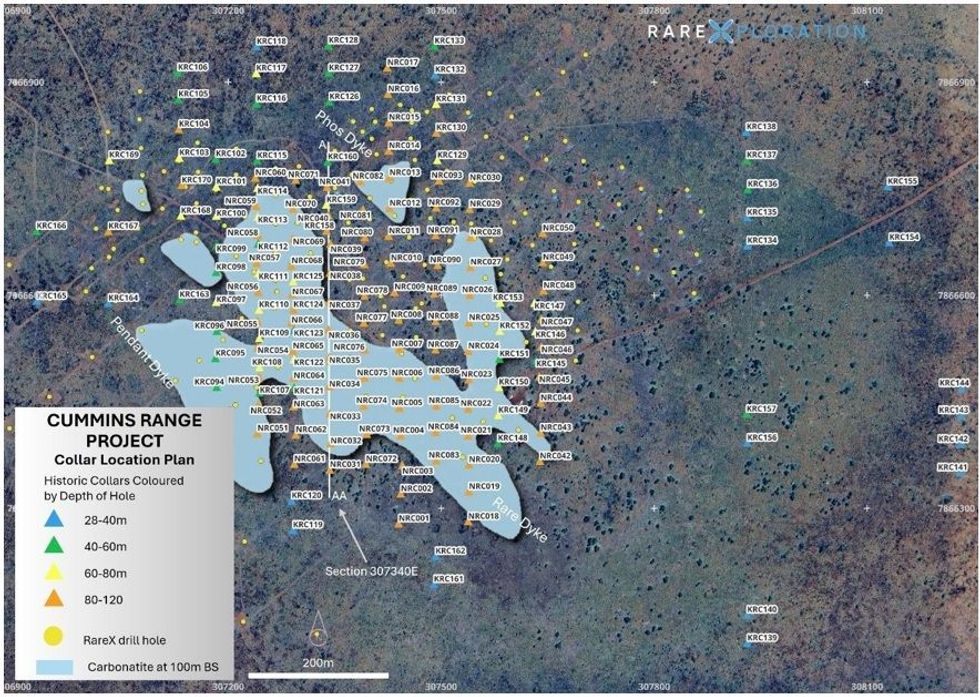

Significant intersections have been calculated using a cut-off grade of 40 g/t Ga2O3 over 5 metres and are shown in Appendix 1. Figure 1 is a cross section showing significant gallium intercepts that have formed in saprolite on top of the Rare Dyke and below an ancient lake.

Figure 1. Section 307340E. Showing gallium intercepts at Cummins Range deposit. Section location is shown in Figure 2 and intersection specifics can be found in Appendix 1

Figure 1. Section 307340E. Showing gallium intercepts at Cummins Range deposit. Section location is shown in Figure 2 and intersection specifics can be found in Appendix 1

Click here for the full ASX Release

This article includes content from RareX, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

REE:AU

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00