- WORLD EDITIONAustraliaNorth AmericaWorld

October 31, 2024

Piche Resources Limited (ASX: PR2) (“Piche” or the “Company”) is pleased to announce drilling results from a further eight holes at its Ashburton uranium project in Western Australia. Results to date highlight the potential for both high grade and broad zones of uranium mineralisation.

HIGHLIGHTS

- ADD003 has delivered the widest intersection recorded to date with a 39m intersection immediately above the Proterozoic unconformity.

- Equivalent U3O8 concentration from recent drillholes include:

ADD003 39.28m @ 553 ppm eU3O8 from 124.12m

incl 1.28m @ 1,460 ppm eU3O8 from 125.46m

and 0.84m @ 1,184 ppm eU3O8 from 151.54m

and 2.42m @ 2,681 ppm eU3O8 from 155.10m

and 1.90m @ 2,215 ppm eU3O8 from 161.40m

ARC008 3.86m @ 720 ppm eU3O8 from 137.36m

ARCD005 6.50m @ 639 ppm eU3O8 from 115.23m

incl 3.02m @ 930 ppm eU3O8 from 115.23m

ADD005 10.48m @ 1412 ppm eU3O8 from 114.30m

incl 2.04m @ 3508 ppm eU3O8 from 115.72m and 0.50m @ 2911 ppm eU3O8 from 119.28m

4.08m @ 2075 ppm eU3O8 from 141.94m

incl 2.04m @ 2875 ppm eU3O8 from 142.10m

1.04m @ 1918 ppm eU3O8 from 145.80m

1.04m @ 1103 ppm eU3O8 from 148.44m

- Analyses of the drill core has

- demonstrated a northwest structural control on mineralisation

- mineralisation along the unconformity and

- within the overlying sandstone and the basement.

The combined reverse circulation and diamond drilling programme has exceeded the Company’s expectations, having met its original aims of confirming historical results, testing the potential northwest structural control of mineralisation, and expanding the known uranium mineralised envelope.

Results from the drilling are included in Table 1 with the drill hole details in Table 2. In total, 1,776m of reverse circulation drilling and 1,147m of diamond drilling have been completed for a total of 18 holes.

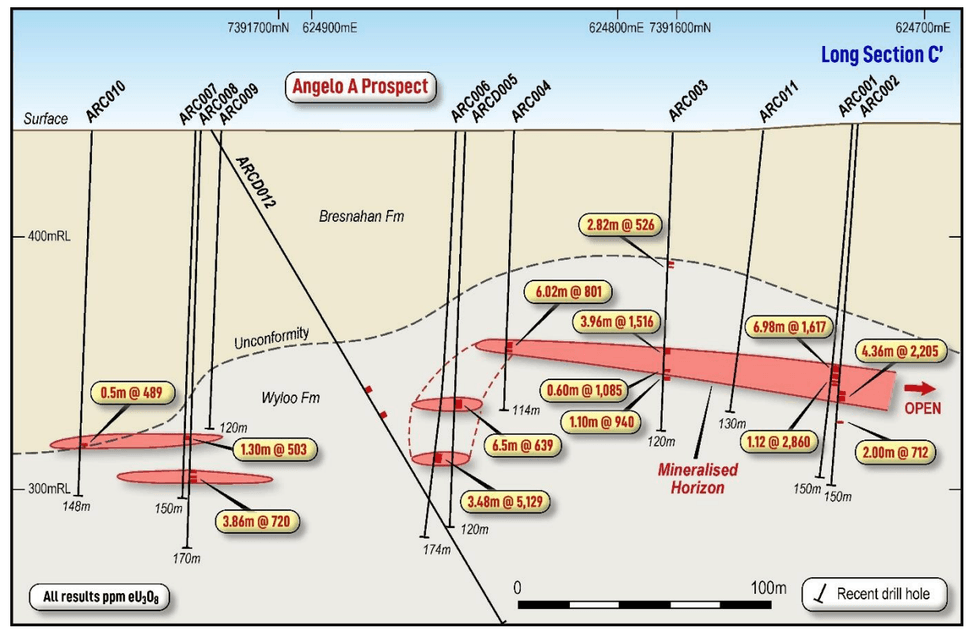

Drilling at Angelo A has confirmed the continuity of mineralisation, identified a steeply dipping mineralised structure and highlighted the undulating nature of the Proterozoic unconformity (Figure 1). A potential northwest trending structure containing uranium mineralisation was intersected between ARC004 and ARC006.

Evidence of a mineralised northwest oriented structure was encountered in ADD001, located over 1km to the northwest of Angelo A. Structural logging of this hole highlighted a shallow dipping (35 degrees) mineralised structural trending to the northwest.

The drilling programme has also confirmed historical drill results from over 40 years ago.

Diamond drill hole ADD003 identified 39.28 metres of uranium mineralisation (Figure 2), highlighting the potential to expand the area of mineralisation at both the Angelo A & B prospects, and along strike to the northwest and southeast.

Click here for the full ASX Release

This article includes content from Piche Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

PR2:AU

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

30 July 2025

Piche Resources

Targeting globally significant uranium and gold discoveries in Australia and Argentina

Targeting globally significant uranium and gold discoveries in Australia and Argentina Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Piche Resources (PR2:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

04 December 2025

Commences Maiden RC Drilling at Cerro Chacon Gold Project

Piche Resources (PR2:AU) has announced Commences Maiden RC Drilling at Cerro Chacon Gold ProjectDownload the PDF here. Keep Reading...

06 November 2025

Reinstatement to Quotation

Piche Resources (PR2:AU) has announced Reinstatement to QuotationDownload the PDF here. Keep Reading...

06 November 2025

$2million placement to advance Argentine exploration

Piche Resources (PR2:AU) has announced $2million placement to advance Argentine explorationDownload the PDF here. Keep Reading...

30 October 2025

Quarterly Appendix 5B Cash Flow Report

Piche Resources (PR2:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

2h

How Would a New BRICS Currency Affect the US Dollar?

The BRICS nations, originally composed of Brazil, Russia, India, China and South Africa, have had many discussions about establishing a new reserve currency backed by a basket of their respective currencies. The creation of a potentially gold-backed currency, known as the "Unit," as a US dollar... Keep Reading...

6h

Toronto to Host Global Mineral Sector for PDAC 2026, March 1 – 4

The Prospectors & Developers Association of Canada (PDAC) will bring together the mineral exploration and mining community in Toronto for its 94th annual Convention, taking place March 1 – 4, 2026, at the Metro Toronto Convention Centre (MTCC).As the World’s Premier Mineral Exploration & Mining... Keep Reading...

9h

THE SIGNAL ARCHITECTURE: 5 Stocks Calibrating the 2026 Infrastructure Cycle

USANewsGroup.com Market Intelligence Brief — WHAT'S HAPPENING: The infrastructure holding the global economy together is being stress-tested in real time: Gold at $5,552 per ounce as central banks loaded another 755 tonnes into reserves [1]The G7 issued formal guidance treating the quantum... Keep Reading...

23 February

Mining’s New Reality: Strategic Nationalism, Gold Records and a Fractured Cost Curve

The era of “smooth globalization” is over, and mining is entering a more fragmented, politically charged phase defined by strategic nationalism, according to speakers at S&P Global’s latest webinar.Jason Holden, who opened the “State of the Market: Mining Q4 2025” session with a macro overview,... Keep Reading...

23 February

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

23 February

Silver Hammer Closes CDN$3,913,617 Non-Brokered Private Placement Pursuant to Listed Issuer Exemption

Silver Hammer Mining Corp. (CSE: HAMR,OTC:HAMRF) (the "Company" or "Silver Hammer") is pleased to announce that further to its news release dated February 2, 2026, it has closed its previously announced non-brokered private placement pursuant to the Listed Issuer Exemption ("LIFE") (the... Keep Reading...

Latest News

Sign up to get your FREE

Piche Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00