December 11, 2024

New Murchison Gold Limited (ASX: NMG) (“NMG” or the “Company”) is pleased to announce that it has entered into a binding agreement with Big Bell Gold Operations Pty Ltd (BBGO), a wholly-owned operating subsidiary of Westgold Resources Limited (ASX: WGX, TSX: WGX, OTCQX: WGXRF) (Westgold) in relation to the purchase of gold ore from the Crown Prince deposit.

HIGHLIGHTS

- New Murchison Gold (NMG) and Westgold Resources (Westgold) have entered into an Ore Purchase Agreement (OPA) which will underpin production from NMG’s Crown Prince deposit near Meekatharra, Western Australia in 2025.

- Subject to final regulatory permitting, under the OPA, NMG will commence mining from a new open pit operation at Crown Prince with a targeted commencement date of mid-2025.

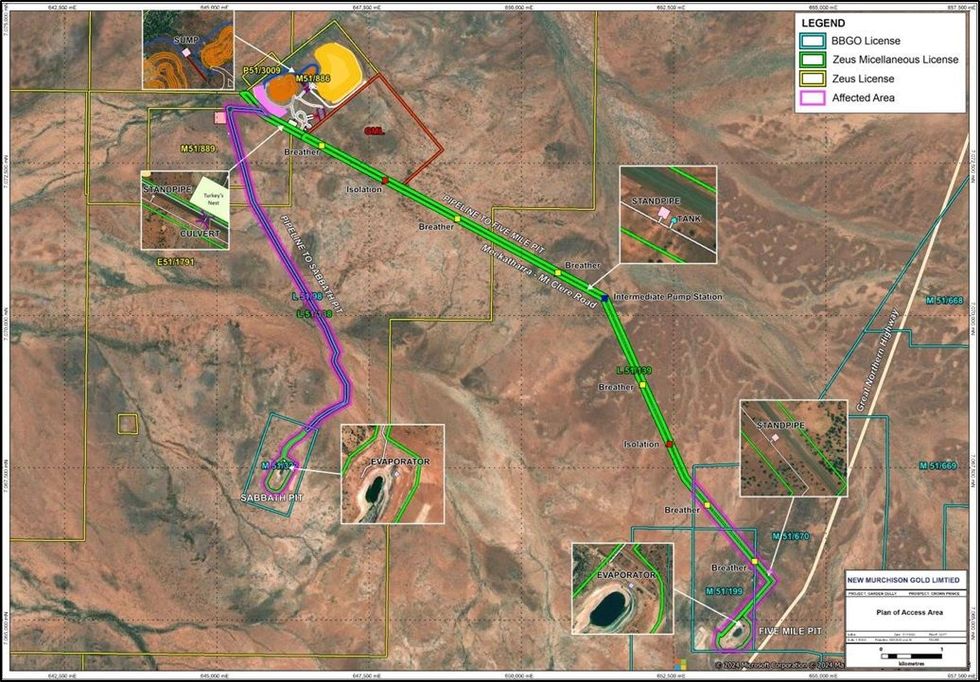

- Ore will be hauled 33km by road to the Bluebird Gold Processing Plant, part of Westgold’s Murchison Gold Operations at Meekatharra.

- Ore will be sold to Westgold in several parcels (Ore Parcels) totalling 30-50kt per month with each Ore Parcel certified for grade, moisture and recovery from sampling at the Crown Prince site and a recovery factor agreed for each mining bench from test work replicating the Bluebird Mill circuit.

- The OPA has no fixed term although NMG envisages that most of Crown Prince ore is likely to be processed in an “Initial Period” which runs over the first 24 months of the agreement. Thereafter ore tonnages are to be agreed on a rolling three-month basis once production forecasts have been completed by NMG and Westgold has confirmed mill availability.

- Westgold will purchase ore from NMG based on contained gold in each Ore Parcel at the prevailing AUD gold price in the month the Ore Parcel is collected (minus processing costs and a capital recovery charge). Westgold must promptly collect Ore Parcels that are available for collection.

- The OPA is subject to shareholder approval (Listing Rule 10.1 requirement) at a general meeting of NMG shareholders to be held in late January or early February 2025.

- NMG and Westgold have also entered into an ancillary agreement (Licence and Access Water Discharge Deed) which facilitates NMG’s potential dewatering requirements at Crown Prince.

Alex Passmore, NMG’s CEO commented: "We are very pleased to announce the Ore Purchase Agreement with Westgold as it sees both companies working together to support the development of NMG’s Crown Prince deposit in a capitally efficient manner.

We see this Agreement as beneficial to all shareholders with Westgold acquiring additional high grade oxide ore feed to supplement its Meekatharra operations and NMG transitioning to a producer for modest capital.

The Bluebird Processing Plant owned by Westgold is ideal for NMG due to its close proximity and well-matched metallurgical process. We believe the robust frameworks and protocols we have put in place in this Agreement aligns both operational teams to a common goal of maximizing operational efficiency.

We thank the Westgold team for the technical and commercial work that has led to this Agreement and look forward to working collaboratively in making the development of Crown Prince a success”

Crown Prince is located to the north of Meekatharra, around 33km via road to the Bluebird Gold Processing Plant (Bluebird) owned and operated by BBGO. Westgold and NMG have been working collaboratively on the OPA to manage technical risks and to share economic synergies which are available via the partnering of production from the Crown Prince deposit and milling at Bluebird.

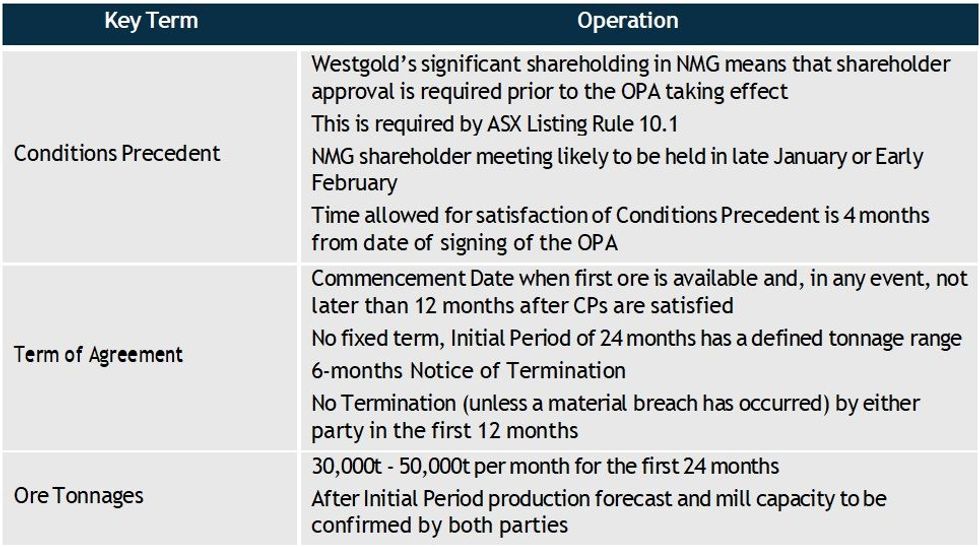

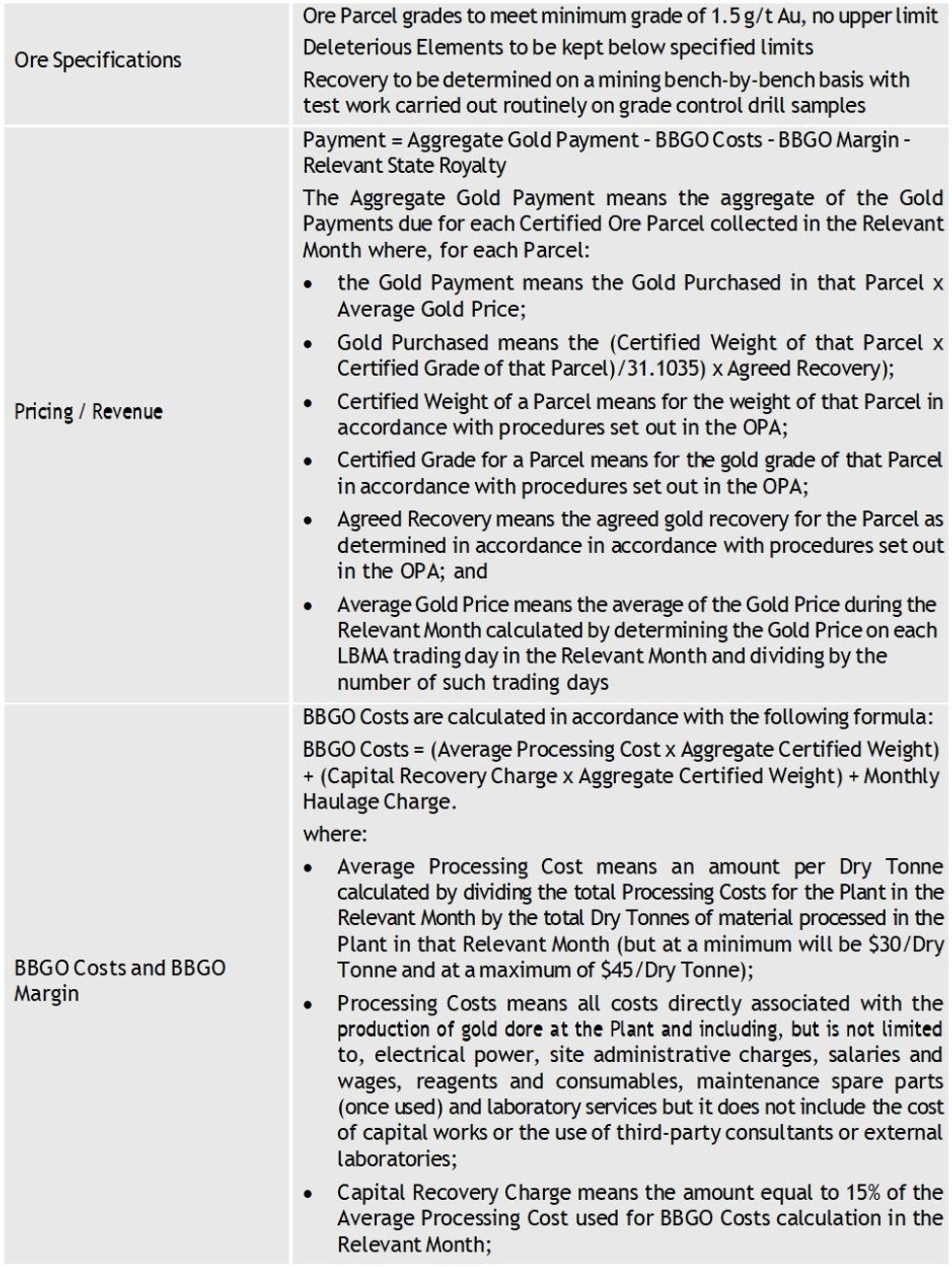

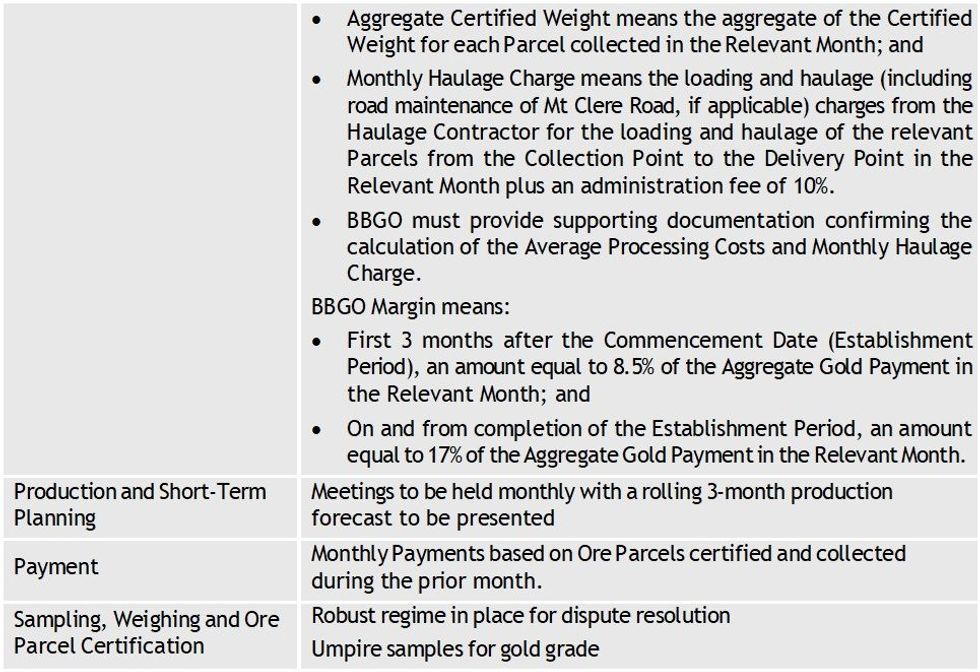

Key Terms of the OPA are outlined in the Table below and will be explained fully in a Notice of Meeting to be sent to NMG shareholders in December. The NMG shareholder meeting is likely to be held in late January or early February 2025. As a result of Westgold’s 18.7% ownership of NMG, it is deemed a related party under the ASX Listing Rules and so the OPA includes a condition precedent of NMG obtaining shareholder approval under Listing Rule 10.1.

BDO Corporate Finance Australia Pty Ltd (BDO) has been engaged to provide an opinion and Independent Expert’s Report to accompany the Notice of Meeting to assist shareholders in their considerations of whether or not to approve the OPA moving into operation.

Should the conditions precedent be met (shareholder approval) the OPA will come into effect with NMG expecting mining approvals to be received in early April 2025. Once mining operations commence, and ore stockpiles are built up, it is anticipated that first Ore Parcel sales will occur in September 2025.

The company is working towards an ore reserve estimate to provide further detail on the economics of the project which is to be released shortly.

Authorised for release to ASX by the Board of New Murchison Gold Limited.

Click here for the full ASX Release

This article includes content from New Murchison Gold Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

NMG:AU

The Conversation (0)

02 April 2025

New Murchison Gold Limited

Advanced gold exploration company with a path to production

Advanced gold exploration company with a path to production Keep Reading...

20 June 2025

Trading Halt

New Murchison Gold Limited (NMG:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

12 June 2025

Further High-Grade Gold Intersections at Crown Prince

New Murchison Gold Limited (NMG:AU) has announced Further High-Grade Gold Intersections at Crown PrinceDownload the PDF here. Keep Reading...

27 May 2025

Grade Control Drilling Results

New Murchison Gold Limited (NMG:AU) has announced Grade Control Drilling ResultsDownload the PDF here. Keep Reading...

12 May 2025

High-Grade Gold Intercepts within Caprock Drilling

New Murchison Gold Limited (NMG:AU) has announced High-Grade Gold Intercepts within Caprock DrillingDownload the PDF here. Keep Reading...

30 April 2025

Second Quarter Activities and Cashflow Report

New Murchison Gold Limited (NMG:AU) has announced Second Quarter Activities and Cashflow ReportDownload the PDF here. Keep Reading...

14h

David Erfle: Gold, Silver Under Pressure, Key Price Levels to Watch

David Erfle, editor and founder of Junior Miner Junky, explains why gold and silver prices took a hit not long after war in the Middle East was announced. While the near term could be volatile, he said the long-term outlook for precious metals is strong. Don't forget to follow us @INN_Resource... Keep Reading...

15h

Tavi Costa: Gold, Silver Stocks to Rerate, "Explosive" Energy, Copper Opportunities

Tavi Costa, CEO of Azuria Capital, explains where he's looking to deploy capital right now, mentioning mining, energy and emerging markets. "When I apply macro analysis into markets, there's a few things that look exceptionally cheap today that could be extremely asymmetric," he commented.... Keep Reading...

15h

One Bullion Advances Toward Drill-Ready Targets at Botswana Gold Assets

One Bullion (TSXV:OBUL,OTCPL:OBULF) CEO and President Adam Berk shared the advantages of working in the mining-friendly jurisdiction of Botswana and big milestones ahead in 2026.Surveys are expected to commence within the next few weeks at the company's Maitengwe and Vumba projects, which will... Keep Reading...

09 March

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

09 March

Jaime Carrasco: Gold Going "Much Higher," Silver Force Majeure Inevitable

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, shares his outlook for gold and silver, saying prices must rise much higher. He also talks about how to build a strong precious metals portfolio. "We're moving from a credit-based economy, a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00