Sandy MacDougall, CEO of Noram Lithium Corp. ("Noram" or the "Company") (TSXV:NRM)(OTCQB:NRVTF)(Frankfurt:N7R) is pleased to announce" that the Company has successfully completed the Phase VI infill drill program on the Zeus Lithium Project in Clayton Valley, Nevada. The Zeus Project contains a current NI 43-101 measured and indicated resource estimate* of 363 million tonnes grading 923 ppm lithium, and an inferred resource of 827 million tonnes grading 884 ppm lithium utilizing a 400 ppm Li cut-off. In December 2021, a robust PEA** indicated an After-Tax NPV(8) of US$1.3 Billion and IRR of 31% using US$9,500tonne Lithium Carbonate Equivalent (LCE). Using the LCE long term forecast of US$14,000tonne, the PEA indicates an NPV (8%) of approximately US$2.6 Billion and an IRR of 52% at US$14,000tonne LCE

All 12 of the Phase VI proposed holes were completed to, or beyond, their anticipated depths for a total of 5246 ft (1599 m) of drilling. Most of the holes were drilled with HQ-size core with a diameter of 2.5 inches (63.5 mm). However, 4 of the holes were drilled with PQ-size (3.35 inches, 85 mm diameter) to be used for the ongoing metallurgical test work. The samples from the core have been hand-delivered to ALS Laboratory in Reno, Nevada for processing. QA/QC samples have been inserted into the sample stream to confirm sample results.

Figure 1 - The last batch of Phase VI drilling samples as they were delivered to ALS in Reno, Nevada.

"This is a significant milestone for Noram" stated CEO and Director, Sandy MacDougall "with the completion of this drilling, the inferred resource calculation will be confidently upgraded to the indicated category. This marks one of the final steps required to complete the Prefeasibility Study ("PFS") in the near term. While we have only received results from 2 of the 12 holes, the results supersede our expectations, and we can confidently say that a PFS superior to the PEA would not be surprising. All assays are being processed on a rush basis and we expect to receive the balance of the results shortly. Noram is on track to complete the PFS in the fall of 2022 while simultaneously working on new and innovative solutions to become a leader in the green technology space."

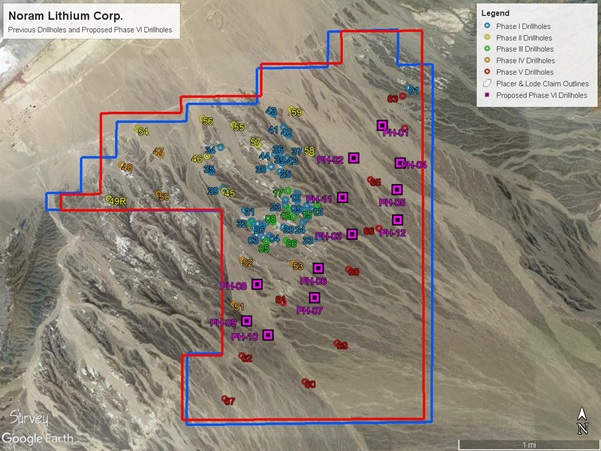

Figure 2 - Location of all past drill holes (Phase I to Phase V) previously completed in addition to the 12 holes completed under the Phase VI Program. Phase VI holes are shown as purple squares.

The Company has also begun initial preparation for the completion of a Plan of Operations (PoO) with the Tonopah, Nevada field office of the Bureau of Land Management. Results from the Phase VI drilling will be needed to determine whether additional drilling, bulk sampling, etc. will be required to carry the project through the PFS and DFS stages. These elements are essential to determine what goes into the PoO. The DFS is expected to follow closely on the heels of this fall's PFS.

The technical information contained in this news release has been reviewed and approved by Brad Peek., M.Sc., CPG, who is a Qualified Person with respect to Noram's Clayton Valley Lithium Project as defined under National Instrument 43-101.

About Noram Lithium Corp.

Noram Lithium Corp. (TSXV:NRM)(OTCQB:NRVTF)(Frankfurt:N7R) is a well-financed Canadian based advanced Lithium development stage company with less than 90 million shares issued. Noram is aggressively advancing its Zeus Lithium Project in Nevada from the development-stage level through the completion of a Pre-Feasibility Study in 2022. The Company's flagship asset is the Zeus Lithium Project ("Zeus"), located in Clayton Valley, Nevada. The Zeus Project contains a current 43-101 measured and indicated resource estimate* of 363 million tonnes grading 923 ppm lithium, and an inferred resource of 827 million tonnes grading 884 ppm lithium utilizing a 400 ppm Li cut-off. In December 2021, a robust PEA** indicated an After-Tax NPV(8) of US$1.299 Billion and IRR of 31% using US$9,500/tonne Lithium Carbonate Equivalent (LCE). Using the LCE long term forecast of US$14,000/tonne, the PEA indicates an NPV (8%) of approximately US$2.6 Billion and an IRR of 52% at US$14,000/tonne LCE.

Please visit our web site for further information: www.noramlithiumcorp.com.

ON BEHALF OF THE BOARD OF DIRECTORS

Sandy MacDougall

CEO and Director

C: 778.999.2159

For additional information please contact:

Peter A. Ball

President and Chief Operating Officer

peter@noramlithiumcorp.com

C: 778.344.4653

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain forward-looking information which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes statements regarding, among other things, the completion of the engagement of Bridgeview and the approval of the TSX Venture Exchange. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, regulatory approval processes. Although Noram believes that the assumptions used in preparing the forward-looking information in this news release are reasonable, including that all necessary regulatory approvals will be obtained in a timely manner, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Noram disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by applicable securities laws. *Updated Lithium Mineral Resource Estimate, Zeus Project, Clayton Valley, Esmeralda County, Nevada, USA (August 2021) **Preliminary Economic Assessment Zeus Project, ABH Engineering (December 2021).

SOURCE: Noram Lithium Corp.

View source version on accesswire.com:

https://www.accesswire.com/701089/Noram-Completes-Major-Milestone-Infill-Drill-Program-for-Pre-Feasiblity-Study-Completion-and-Commencement-of-Plan-of-Operations