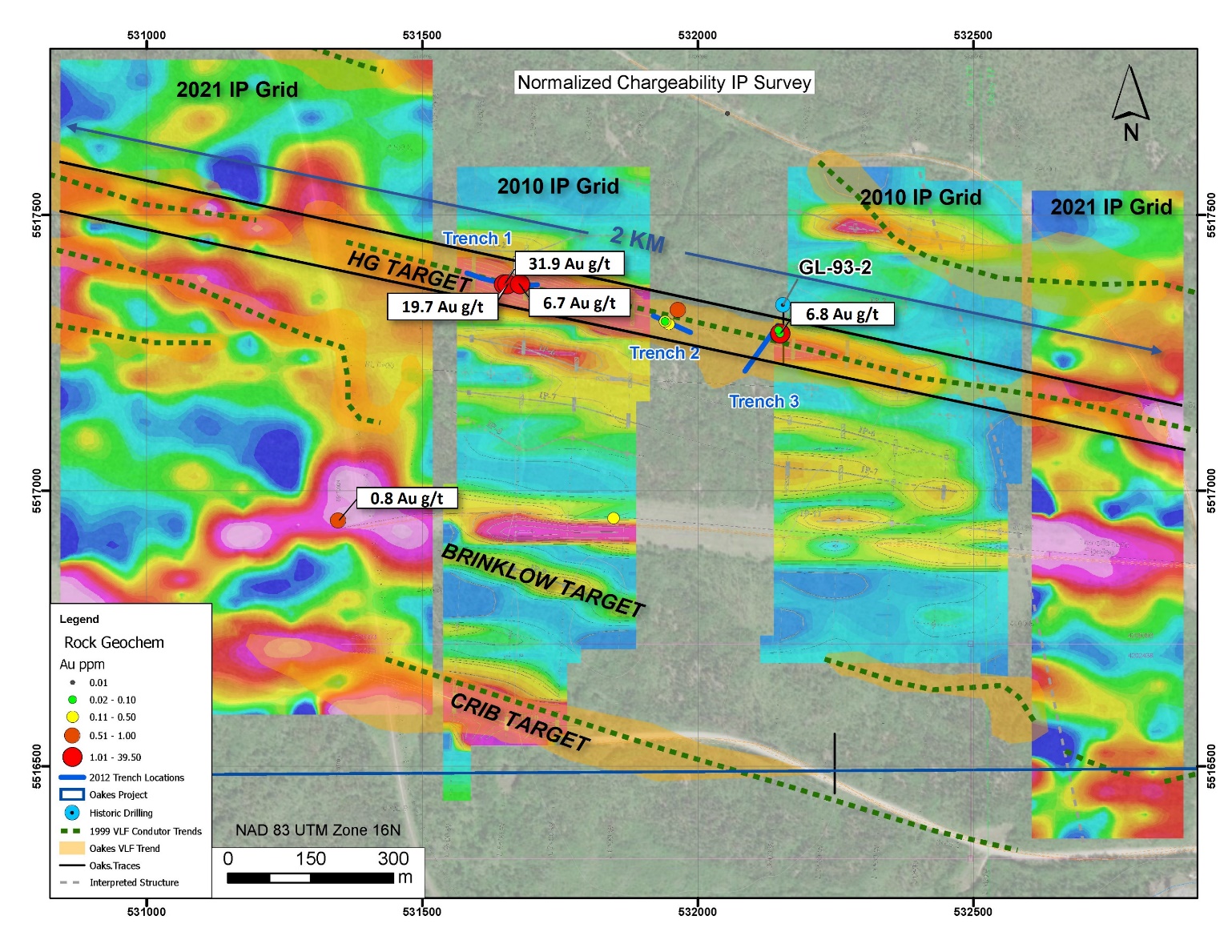

iMetal Resources, Inc. (TSX.V:IMR) (OTC PINK:ADTFF) ("iMetal" or the "Company") is pleased to announce the results of the previously announced IP Survey at the Oakes Gold Project located in the Beardmore-Geraldton Greenstone Belt (BGGB) of Northern Ontario, northeast of Thunder Bay. The IP survey has successfully confirmed the Company's premise that the gold-bearing HG Shear Zone is a significant structure shown to extend over 2km in strike length as evident from the chargeability anomaly shown in Figure 1 below

The IP survey was conducted to the east and west of the historic (2010) grid and has confirmed the extension of the HG shear from about 800 metres to 2300 metres, remaining open in both directions. A second previously unknown parallel structure located at the bottom of the grid represents a second potential gold bearing shear zone (Crib Target). The chargeability map also indicates a potential E-W structure lying between the HG and Crib targets. This new parallel anomaly is interpreted to be an additional shear zone and is important because it appears to project into the parallel structure on the western end of the grid and into the HG Shear Zone just to the east of the grid. The increased chargeability noted at these two locations enhances these junction areas as shear junctions represent excellent exploration targets for gold mineralization.

Figure 1. 2021 IP Survey (East and West Block) with the 2 Central 2010 IP Blocks

The Company plans to ground truth these new target areas, concurrent with a proposed drill program along the main HG Shear Zone.

The Oakes Project is an orogenic, shear hosted gold project and is an integral part of the BGGB property package which the Company proposes to acquire from Riverside Resources Inc. (See news release of February 10, 2021). The Oakes Project is 5,544 hectares and hosts several gold bearing shear zones, including the HG shear zone. Riverside channel sampling in 2019 at the HG shear zone returned values of 31.9 g/t gold, 19.7 g/t gold and 6.9 g/t gold over 0.5 to 1.0 m intervals.

"The IP Survey exceeded our expectations in confirming and delineating the HG Shear Zone, as well as defining two parallel structures, the Crib Target and the Bricklow Target," commented iMetal President & CEO Saf Dhillon. "We view the pending acquisition of Oakes as an important project in the growth of iMetal as it provides shareholders with a new significant gold asset in the rapidly developing Beardmore-Geraldton Greenstone Belt," he continued.

The Oakes Gold Project is currently controlled by Riverside Resources Inc., and exploration work conducted on the Project is overseen by Riverside. As previously disclosed, the Company proposes to acquire the Oakes Project as part of a larger package of properties located in Northern Ontario. Completion of the acquisition remains subject to the approval of the TSX Venture Exchange, available financing and the satisfaction of customary closing conditions. Readers are cautioned that there is no guarantee that the outstanding conditions will be satisfied and that the Company will acquire an interest in the Oakes Project.

About Oakes

The Oakes Project is located in Long Lac, Ontario east of Equinox Gold Corp.'s (TSX: EQX) Hardrock Deposit. At Oakes, early exploration by Hardrock Mining and Noranda Exploration focused on base metals. Exploration for gold began in the 1990s with a successful 2-hole drill program. Recent soil geochemistry, VLF and IP geophysics programs defined three, east-west oriented mineralized shear zones. Trench sampling by Riverside (2019) along the HG Shear Zone returned high-grade gold values of 19.7 g/t, 31.9 g/t and 6.9 g/t gold over 0.5-1.0 m channel samples perpendicular to strike, while sampling along the strike extension returned grab gold values of 7 g/t, demonstrating a strike length of at least 600 metres.

About iMetal Resources Inc.

A Canadian based junior exploration company focused on the exploration and development of its portfolio of resource properties in Ontario and Quebec. iMetal is focused on advancing its Gowganda West Project that borders the Juby Project, an advanced exploration-stage gold project located within the Shining Tree area in the southern part of the Abitibi greenstone belt about 100 km south-southeast of the Timmins gold camp.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by R. Tim Henneberry, P.Geo. (British Columbia), a director of iMetal, and a "qualified person" as defined in National Instrument 43-101.

ON BEHALF OF THE BOARD OF DIRECTORS,

Saf Dhillon

President & Chief Executive Officer

iMetal Resources Inc.

saf@imetalresources.ca

Tel. (604-484-3031)

Suite 550, 800 West Pender Street, Vancouver, British Columbia, V6C 2V6.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may include forward-looking statements that are subject to risks and uncertainties. All statements within, other than statements of historical fact, are to be considered forward looking. Forward-looking statements in this news release include, but are not limited to: statements with respect to future exploration and drilling of the Company; statements with respect to the release of assays and exploration results; and statements with respect to the Company's geological understanding of its mineral properties. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those in forward-looking statements. Factors that could cause actual results to differ materially from those in forward-looking statements include results of exploration, variations in results of mineralization, relationships with local communities, market prices, continued availability of capital and financing, and general economic, market or business conditions. There can be no assurances that such statements will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. We do not assume any obligation to update any forward-looking statements except as required under the applicable laws.

SOURCE: iMetal Resources, Inc.

View source version on accesswire.com:

https://www.accesswire.com/665107/iMetal-Resources-Defines-New-Drill-Targets-as-IP-Survey-Extends-HG-Shear-Zone-to-Open-2300-Metres-at-The-Oakes-Gold-Project