(TheNewswire)

Highlights:

-

Estimated total capital expenditure to bring ICO into production in 2022 revised to US$99.1 million (previously US$92.6 million) construction cost, principally due to market and inflationary pressures in the western United States

-

Schedule substantially unchanged: first ore anticipated August 2022 (previously July 2022), and sustainable commercial production anticipated from December 2022

-

Detailed engineering progress at 64% complete with procurement 55% completed. Commitments are substantially advanced with now over 76% planned dollars committed on purchase orders

-

Mine development has advanced in line with plan for both west and east portals. Daily advance of approximately 20 feet per day with no critical ground conditions

-

With the construction and commissioning cost and schedule update, RPM Global is now scheduled to visit site in January 2021 with a view to completing the Cost to Complete review for bondholders associated with its role as Independent Engineer for the US$100 million Senior Secured Bonds. First US$50 million drawdown is anticipated in Q1 2022

-

Once complete, ICO will be the only mine supply of cobalt in the United States, a critical mineral necessary for industry, defense, electric vehicles and energy generation and distribution in a carbon constrained economy

Australia - TheNewswire - 1 5 December 2021 - Jervois Global Limited (" Jervois ") (ASX: JRV) (TSXV:JRV) (OTC:JRVMF) is pleased to update construction progress and results of a reforecast to project cost and schedule at its 100%-owned Idaho Cobalt Operations ( "ICO" ) in Idaho, United States.

Jervois project team and EPCM M3 Engineering have completed a reforecast to schedule and budget based on current site efficiency and price submissions on all equipment and site construction contract work. In July 2021, the Jervois Board of Directors approved US$92.6 million capital for construction of the mine and process facility with a first ore commissioning date of July 2022. Based on current pricing from the market for labour and materials, inflationary pressure has resulted in an updated capital cost of US$99.1 million. First ore through the mill is now planned for August 2022. The date for sustainable ore production remains unchanged, during December 2022.

Increases in costs relating to high density polyethylene (" HDPE ") for the waste storage facility, steel and cement supply, camp materials, construction and site labour cost have contributed to inflationary pressure on the project budget, and are incorporated into the revised forecast.

Final commissioning date is now adjusted for the anticipated impact of winter weather conditions and the delays in camp construction. Update project costs and schedule will underpin a Cost to Complete test by Independent Engineer RPM Global, engaged under the terms of the previously announced US$100 million Senior Secured Bonds. Subject to the satisfaction of applicable Conditions Precedent, including the Cost to Complete test, the first US$50 million drawdown is now expected to occur in the first quarter of 2022.

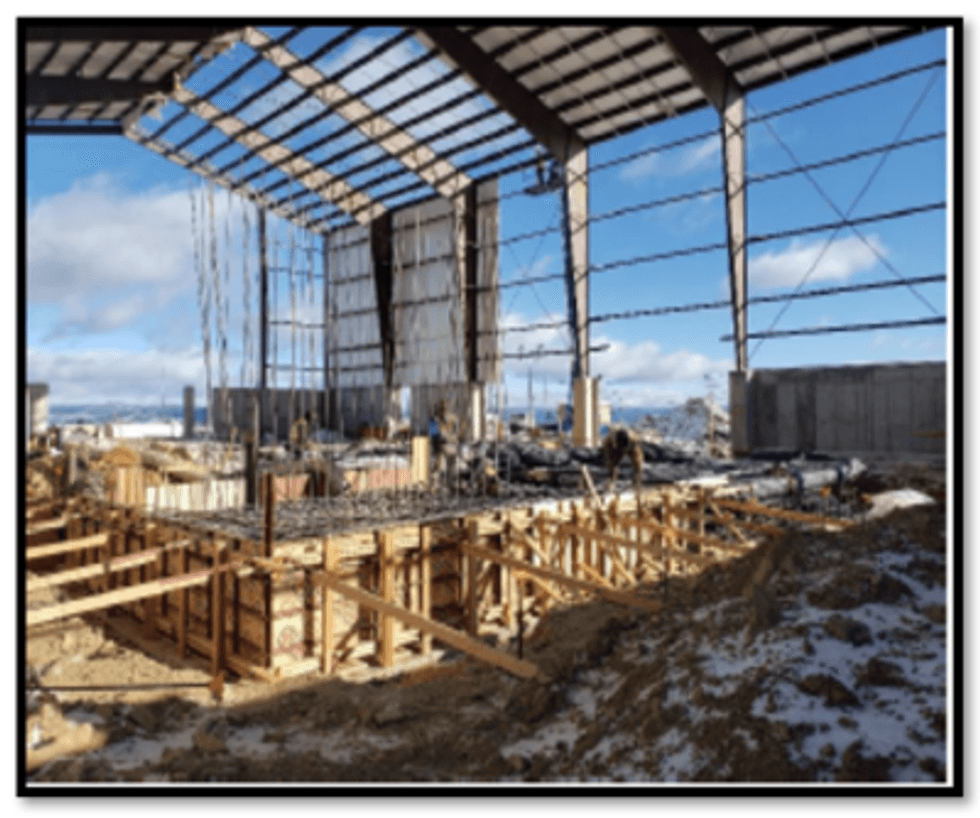

Mill and concentrator building erection and civil work continue to progress with SAG and ball mill slabs laid; and foundations to be poured in the coming weeks.

Click Image To View Full Size

SAG and ball mill form work

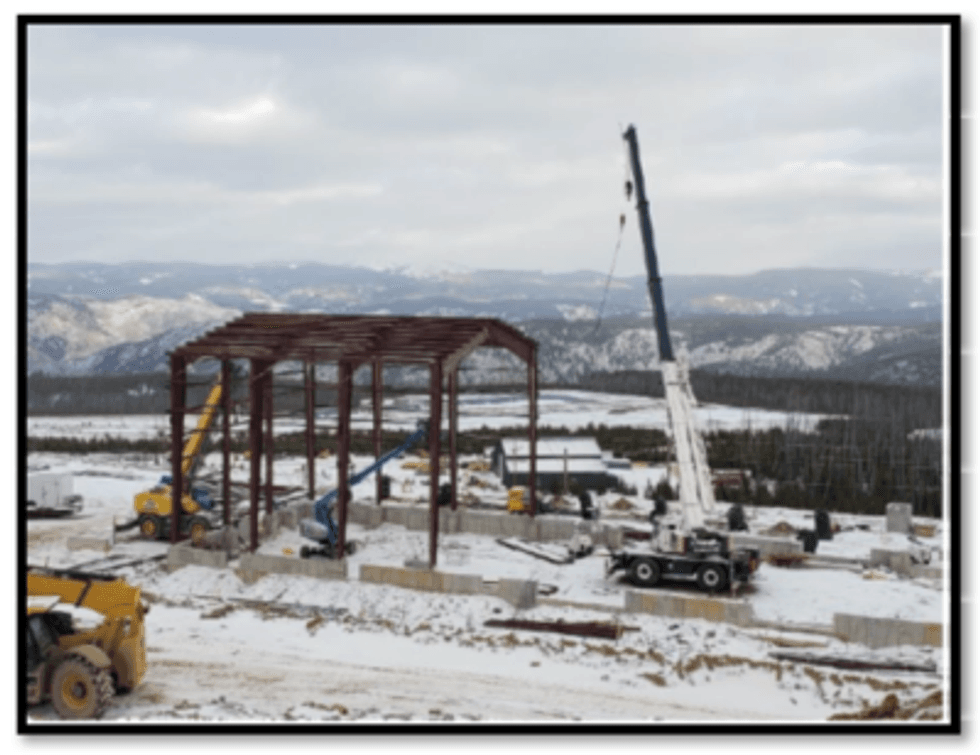

Flotation building civil work is well underway, and an additional steel erection crew, and two additional cranes have mobilized to site to complete erection.

Click Image To View Full Size

Flotation building progress

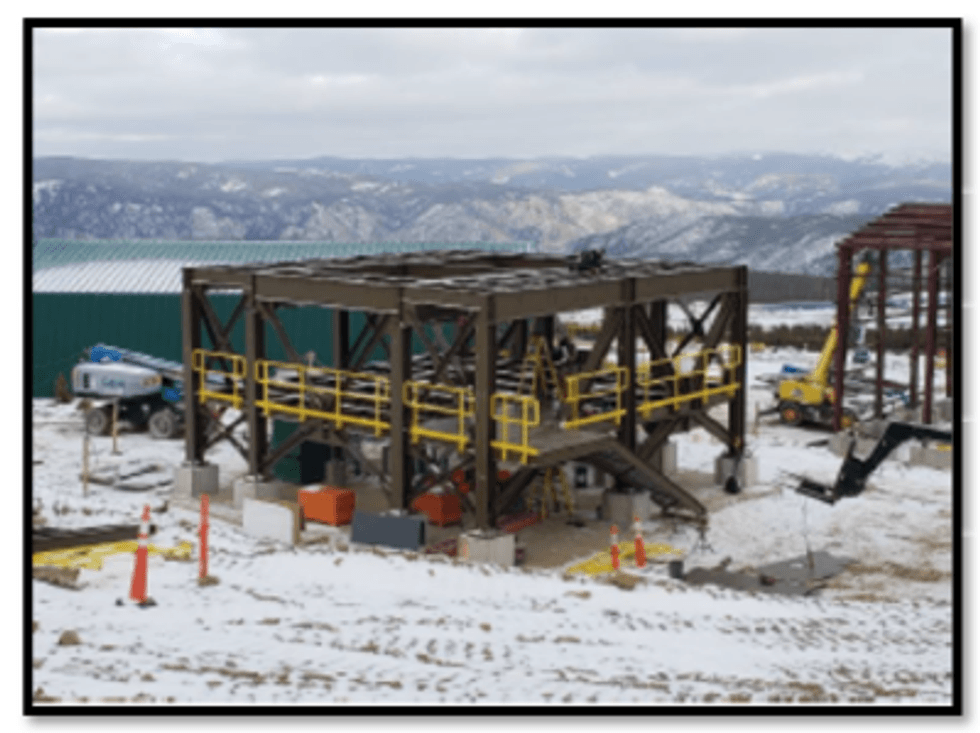

The base support for the fine ore bin and mill feed conveyor structure has been erected.

Click Image To View Full Size

Fine ore bin and mill feed conveyor base structure

The water treatment plant (" WTP ") has been water commissioned with final punch list items complete in December 2021. The pump back system will move water from the portal pump station to the WTP and will be complete and commissioned in December.

The mining advancement for both portals continues in line with plan. During the month of December both portals will be connected and underground infrastructure will be developed.

Click Image To View Full Size

West Portal development with installed ventilation

Click Image To View Full Size

Portal bench infrastructure

ICO has completed recruiting for substantially all key management positions including finance manager, mill manager and mine manager in advance of full operations.

ICO is a key asset in delivering Jervois' strategy to become a leading independent cobalt and nickel company providing metals and minerals for the world's energy transition through a western supply chain. When commissioned, ICO will be the United States' only domestic mine supply of cobalt, a critical mineral used in applications across industry, defense, energy and electric vehicles.

On behalf of Jervois

Bryce Crocker, CEO

For further information, please contact:

| Investors and analysts: James May Chief Financial Officer Jervois Global jmay@jervoisglobal.com | Media: Nathan Ryan NWR Communications nathan.ryan@nwrcommunications.com.au Mob: +61 420 582 887 |

Forward-Looking Statements

This news release may contain certain "Forward-Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target, "plan", "forecast", "may", "schedule", "expected" and other similar words or expressions identify forward-looking statements or information. These forward-looking statements or information may relate to the timing construction activities at ICO, the timing of productions at ICO and certain other factors or information. Such statements represent Jervois' current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by Jervois, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. Jervois does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affections such statements and information other than as required by applicable laws, rules and regulations.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Copyright (c) 2021 TheNewswire - All rights reserved.