June 14, 2022

New Break Resources Ltd. has a gold-focused portfolio that illustrates the Company’s commitment to precious metals. New Break is currently in the process of going public, having submitted a preliminary prospectus to the Ontario Securities Commission in early May 2022 and expects to list on the Canadian Securities Exchange in the coming weeks. New Break currently has 39,030,750 shares outstanding.

New Break’s flagship Moray Project, is situated in the Abitibi greenstone belt on a splay off of the Cadillac-Larder Lake fault zone, with access to excellent infrastructure, located 49 km south of Timmins, Ontario and 32 km northwest of the Young-Davidson gold mine, operated by Alamos Gold Inc. (TSX:AGI; NYSE:AGI). In total, the Abitibi gold belt has produced over 190 million ounces of gold since 1901 and currently features over 20 gold deposits containing over 3 million ounces of gold in each deposit.

New Break’s flagship Moray Project, is situated in the Abitibi greenstone belt on a splay off of the Cadillac-Larder Lake fault zone, with access to excellent infrastructure, located 49 km south of Timmins, Ontario and 32 km northwest of the Young-Davidson gold mine, operated by Alamos Gold Inc. (TSX:AGI; NYSE:AGI). In total, the Abitibi gold belt has produced over 190 million ounces of gold since 1901 and currently features over 20 gold deposits containing over 3 million ounces of gold in each deposit.

Company Highlights

- New Break expects to soon be publicly traded on the Canadian Securities Exchange after filing a preliminary prospectus with the Ontario Securities Commission on May 6, 2022.

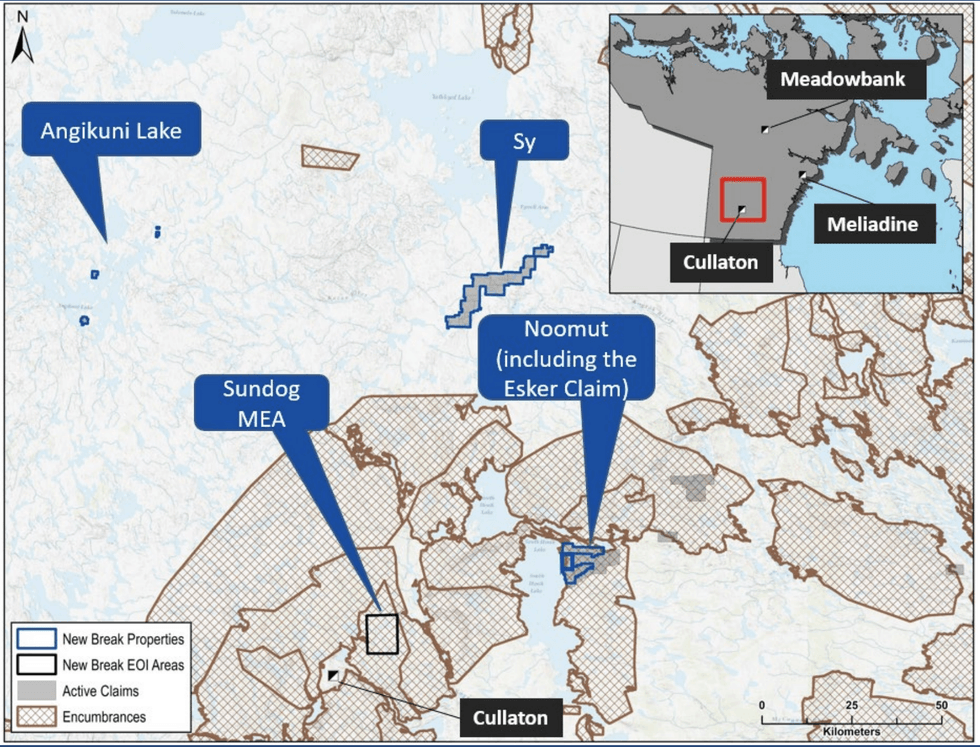

- The Company holds a 100% interest in multiple projects in two of the most prospective regions in Canada for gold exploration, the Abitibi in Ontario and Kivalliq Region in Nunavut.

- New Break has been awarded a CDN$200,000 grant from the Ontario Junior Exploration Program to help advance its fully permitted Moray Project, south of Timmins.

- Strong management and a highly skilled majority independent Board with backgrounds in finance, geology, capital markets, mergers and acquisitions and law, champion value creation, placing a premium on Environmental, Social and Corporate Governance.

- World class technical advisory group including Ashley Kirwan and Orix Geoscience Inc., Ken Reading, Gordon Morrison and Peter Hubacheck with Nunavut community and government relations represented by John Todd, politician, advisor to Agnico Eagle and friend to the Inuit.

This New Break Resources company profile is part of a paid investor education campaign.*

Sign up to get your FREE

AuKing Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

09 February

AuKing Mining

Advancing a diversified portfolio of uranium, copper and critical minerals projects across Australia, Tanzania and North America, with current priorities including the proposed tin acquisition in north-west Tasmania, the Koongie Park copper-zinc project in Western Australia, and the Mkuju uranium project in southern Tanzania.

Advancing a diversified portfolio of uranium, copper and critical minerals projects across Australia, Tanzania and North America, with current priorities including the proposed tin acquisition in north-west Tasmania, the Koongie Park copper-zinc project in Western Australia, and the Mkuju uranium project in southern Tanzania. Keep Reading...

14h

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

09 February

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

09 February

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

09 February

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

09 February

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

09 February

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Sign up to get your FREE

AuKing Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00