July 28, 2024

Many Peaks Minerals Limited (ASX:MPK) (Many Peaks or the Company) is pleased to provide the Quarterly Activities Report for the period ending 30 June 2024.

HIGHLIGHTS

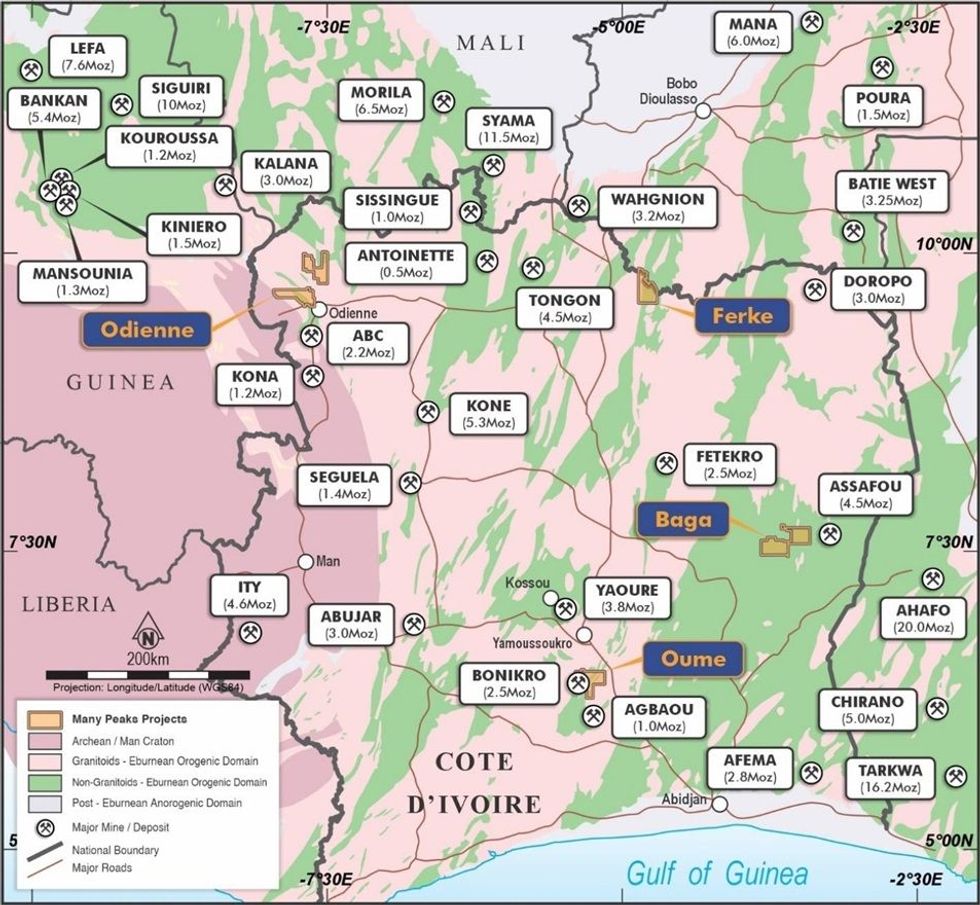

- Two successive transactions completed to acquire four highly prospective gold projects comprising 1,919km2 of land holdings in Côte d’Ivoire

- Ivorian acquisitions establish a pipeline of development opportunities for the Company, in a jurisdiction with a recent track record of gold discovery and production development

- Exploration activity initiated on both the Odienne and Baga projects within weeks following completion of each transaction

- Reporting of results from core drilling, auger sampling and surface geochemistry programmes anticipated in the coming weeks

Odienne Project, 758km2

- Results pending analyses for 1,069m of diamond core drilling and 7,741m of auger drilling sampling

- Recent drilling targets vast surface gold anomalism and follow-up drilling on 2023 success in air core drill results that returned;

- 12m @ 1.18g/t gold from 4m

- 12m @ 1.06g/t gold from 16m

- 8m @ 1.30g/t gold from 28m

- 4m @ 2.07g/t gold from 4m

- 16m @ 0.84g/t gold from 44m

- Drill targets located along trend from recent discovery drilling by Awalé Resources/Newmont joint venture Project on contiguous land holdings

- Ongoing exploration targeting the same high-strain corridor as Predictive’s 5.4Moz Au Bankan and Centamin’s 2.16Moz ABC Projects

Ferke Gold Project, 300km2

- Drilling with open mineralisation ready for follow-up, previously reported intercepts include;

- 47m @ 3.72g/t gold from surface

- 77.6m @ 2.33 g/t gold from 45.9m

- 91.1m @ 2.02 g/t gold from surface

- 45.3m @ 3.16g/t gold from 45.9m

- 12.5km gold-in-soil anomaly remaining undrilled outside a 1km segment hosting intercepts listed above

Baga Gold Project, 644km2

- Binding agreement completed securing the right to acquire 100% ownership

- Subsequent to reporting period, first surface geochemistry campaign completed, results pending analysis

- Recently granted exploration permits cover an underexplored area of structural complexity in the highly prospective Birimian gold terrane

Corporate

- $5.6 Million cash at hand as at 30 June 2024

- Firm commitments received for an additional $2,186,000 to be raised subject to shareholder approval

During the quarter, the Company completed two separate transactions for the acquisition of four highly prospective gold projects including advanced stage projects in Côte d’Ivoire. This establishes a vast land holding comprising 1,919km2 across six (6) exploration permits within the Birimian Gold Terrain of West Africa, among the fasting growing regions of gold production and discovery over the past decade.

- During the reporting period, Many Peaks announced completion of a share sale agreement with Turaco Gold Ltd (Turaco) to consolidate a 100% ownership in CDI Holdings (Guernsey) Ltd (CDI Holdings). CDI Holdings is the holding company for a wholly-owned Ivorian subsidiary (PD-CI SARL) party to a joint venture with Gold Ivoire Minerals SARL (GIV Joint Venture) in Cote d’Ivoire in which PD-CI SARL has earned a 65% interest and the Company now retains an exclusive right to earn-in to an 85% interest by sole funding any project within four exploration permits in Cote d’Ivoire to feasibility study (Refer to ASX Announcement dated 8 May 2024).

- The Company also secured an exclusive right to acquire a 100% interest in Atlantic Resources CI SARL holding two (2) granted permits referred to as the Baga Gold Project totaling 644Km2 in eastern Cote d’Ivoire. (Refer to ASX Announcement dated 27 June 2024.)

Click here for the full ASX Release

This article includes content from Many Peaks Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MPK:AU

The Conversation (0)

10 September 2024

Many Peaks Minerals

Advancing gold discoveries in Côte d’Ivoire, West Africa

Advancing gold discoveries in Côte d’Ivoire, West Africa Keep Reading...

14 April 2025

Diamond Drilling Commences at Ferke Gold Project

Many Peaks Minerals (MPK:AU) has announced Diamond Drilling Commences at Ferke Gold ProjectDownload the PDF here. Keep Reading...

19 March 2025

Raises A$6.22m to Intensify Drilling at Ferke

Many Peaks Minerals (MPK:AU) has announced Raises A$6.22m to Intensify Drilling at FerkeDownload the PDF here. Keep Reading...

16 March 2025

New High Grade Gold Shoot at Ferke Project

Many Peaks Minerals (MPK:AU) has announced New High Grade Gold Shoot at Ferke ProjectDownload the PDF here. Keep Reading...

11 March 2025

AC Drilling Commences on Priority Targets at Ferke Project

Many Peaks Minerals (MPK:AU) has announced AC Drilling Commences on Priority Targets at Ferke ProjectDownload the PDF here. Keep Reading...

23 February 2025

Reconnaissance AC Drilling Yield Structural Targets

Many Peaks Minerals (MPK:AU) has announced Reconnaissance AC Drilling Yield Structural TargetsDownload the PDF here. Keep Reading...

21h

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

21h

Jaime Carrasco: Gold Going "Much Higher," Silver Force Majeure Inevitable

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, shares his outlook for gold and silver, saying prices must rise much higher. He also talks about how to build a strong precious metals portfolio. "We're moving from a credit-based economy, a... Keep Reading...

21h

Garrett Goggin: Gold, Silver in New Era, My Stock Strategy Now

Garrett Goggin, founder of Golden Portfolio, says although gold and silver haven't gone mainstream yet, the metals — and the mining sector overall — have entered a new era. "It's a real mind shift — it's a new era in mining right here," he said.Don't forget to follow us @INN_Resource for... Keep Reading...

09 March

Nicola Mining Provides Update on NASDAQ Listing

Nicola Mining Inc. (TSXV: NIM,OTC:HUSIF) (OTCQB: HUSIF) (FSE: HLIA) (the "Company" or "Nicola") is pleased to provide an update on its proposed NASDAQ listing, which it originally disclosed in its news release of October 27, 2025. There are approximately 220 Canadian companies trading via cross... Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00