July 28, 2024

Many Peaks Minerals Limited (ASX:MPK) (Many Peaks or the Company) is pleased to provide the Quarterly Activities Report for the period ending 30 June 2024.

HIGHLIGHTS

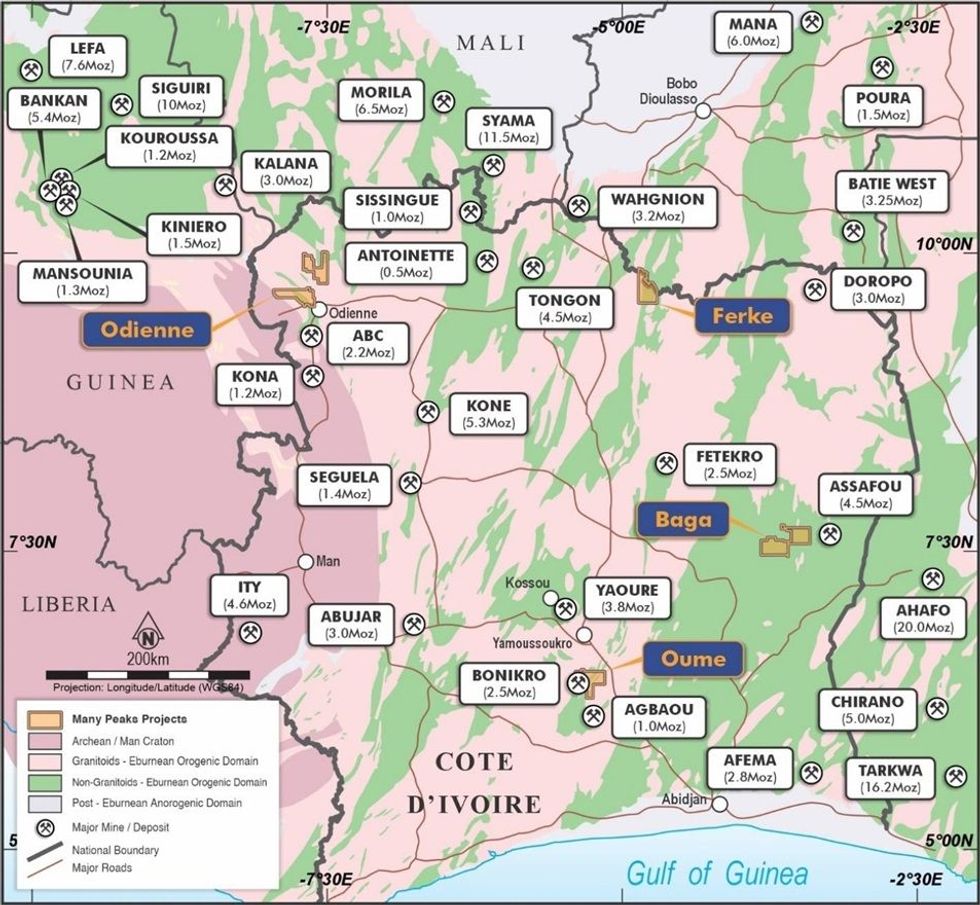

- Two successive transactions completed to acquire four highly prospective gold projects comprising 1,919km2 of land holdings in Côte d’Ivoire

- Ivorian acquisitions establish a pipeline of development opportunities for the Company, in a jurisdiction with a recent track record of gold discovery and production development

- Exploration activity initiated on both the Odienne and Baga projects within weeks following completion of each transaction

- Reporting of results from core drilling, auger sampling and surface geochemistry programmes anticipated in the coming weeks

Odienne Project, 758km2

- Results pending analyses for 1,069m of diamond core drilling and 7,741m of auger drilling sampling

- Recent drilling targets vast surface gold anomalism and follow-up drilling on 2023 success in air core drill results that returned;

- 12m @ 1.18g/t gold from 4m

- 12m @ 1.06g/t gold from 16m

- 8m @ 1.30g/t gold from 28m

- 4m @ 2.07g/t gold from 4m

- 16m @ 0.84g/t gold from 44m

- Drill targets located along trend from recent discovery drilling by Awalé Resources/Newmont joint venture Project on contiguous land holdings

- Ongoing exploration targeting the same high-strain corridor as Predictive’s 5.4Moz Au Bankan and Centamin’s 2.16Moz ABC Projects

Ferke Gold Project, 300km2

- Drilling with open mineralisation ready for follow-up, previously reported intercepts include;

- 47m @ 3.72g/t gold from surface

- 77.6m @ 2.33 g/t gold from 45.9m

- 91.1m @ 2.02 g/t gold from surface

- 45.3m @ 3.16g/t gold from 45.9m

- 12.5km gold-in-soil anomaly remaining undrilled outside a 1km segment hosting intercepts listed above

Baga Gold Project, 644km2

- Binding agreement completed securing the right to acquire 100% ownership

- Subsequent to reporting period, first surface geochemistry campaign completed, results pending analysis

- Recently granted exploration permits cover an underexplored area of structural complexity in the highly prospective Birimian gold terrane

Corporate

- $5.6 Million cash at hand as at 30 June 2024

- Firm commitments received for an additional $2,186,000 to be raised subject to shareholder approval

During the quarter, the Company completed two separate transactions for the acquisition of four highly prospective gold projects including advanced stage projects in Côte d’Ivoire. This establishes a vast land holding comprising 1,919km2 across six (6) exploration permits within the Birimian Gold Terrain of West Africa, among the fasting growing regions of gold production and discovery over the past decade.

- During the reporting period, Many Peaks announced completion of a share sale agreement with Turaco Gold Ltd (Turaco) to consolidate a 100% ownership in CDI Holdings (Guernsey) Ltd (CDI Holdings). CDI Holdings is the holding company for a wholly-owned Ivorian subsidiary (PD-CI SARL) party to a joint venture with Gold Ivoire Minerals SARL (GIV Joint Venture) in Cote d’Ivoire in which PD-CI SARL has earned a 65% interest and the Company now retains an exclusive right to earn-in to an 85% interest by sole funding any project within four exploration permits in Cote d’Ivoire to feasibility study (Refer to ASX Announcement dated 8 May 2024).

- The Company also secured an exclusive right to acquire a 100% interest in Atlantic Resources CI SARL holding two (2) granted permits referred to as the Baga Gold Project totaling 644Km2 in eastern Cote d’Ivoire. (Refer to ASX Announcement dated 27 June 2024.)

Click here for the full ASX Release

This article includes content from Many Peaks Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MPK:AU

The Conversation (0)

10 September 2024

Many Peaks Minerals

Advancing gold discoveries in Côte d’Ivoire, West Africa

Advancing gold discoveries in Côte d’Ivoire, West Africa Keep Reading...

14 April 2025

Diamond Drilling Commences at Ferke Gold Project

Many Peaks Minerals (MPK:AU) has announced Diamond Drilling Commences at Ferke Gold ProjectDownload the PDF here. Keep Reading...

19 March 2025

Raises A$6.22m to Intensify Drilling at Ferke

Many Peaks Minerals (MPK:AU) has announced Raises A$6.22m to Intensify Drilling at FerkeDownload the PDF here. Keep Reading...

16 March 2025

New High Grade Gold Shoot at Ferke Project

Many Peaks Minerals (MPK:AU) has announced New High Grade Gold Shoot at Ferke ProjectDownload the PDF here. Keep Reading...

11 March 2025

AC Drilling Commences on Priority Targets at Ferke Project

Many Peaks Minerals (MPK:AU) has announced AC Drilling Commences on Priority Targets at Ferke ProjectDownload the PDF here. Keep Reading...

23 February 2025

Reconnaissance AC Drilling Yield Structural Targets

Many Peaks Minerals (MPK:AU) has announced Reconnaissance AC Drilling Yield Structural TargetsDownload the PDF here. Keep Reading...

7h

Matthew Piepenburg: Gold, Silver Going Higher, but Expect Volatility

Matthew Piepenburg, partner at Von Greyerz, breaks down what's really driving the gold price, going beyond headlines to the ongoing debasement of the US dollar. He also discusses silver market dynamics. Don't forget to follow us @INN_Resource for real-time updates!Securities Disclosure: I,... Keep Reading...

31 January

Jeff Clark: Gold, Silver Price Drop — Cash is Key in Corrections

Jeff Clark, founder of Paydirt Prospector, remains bullish on the outlook for gold and silver, emphasizing that cash is key when prices correct. "Even though I'm very long, and even though I haven't taken profits on a lot of things, the number one antidote to a crash or a correction is your cash... Keep Reading...

31 January

Chris Vermeulen: Gold, Silver to Go "Dramatically Higher," This is When

Speaking ahead of this week's gold and silver price correction, Chris Vermeulen, chief market strategist at TheTechnicalTraders.com, said the metals were due for a "significant pullback." After that, they'll be positioned for a new leg up."There will be a time definitely to get back into metals,... Keep Reading...

30 January

Editor's Picks: Gold and Silver Prices Hit New Highs, Then Drop — What's Next?

Gold and silver are wrapping up a record-setting week once again. Starting with gold, the yellow metal left market participants hanging last week after finishing just shy of US$5,000 per ounce. However, it made up for it in spades this week, breaking through that level and continuing on up to... Keep Reading...

30 January

Lobo Tiggre: Gold, Silver Hit Record Highs, Next "Buy Low" Sector

Did gold and silver just experience a blow-off top, or do they have more room to run? Lobo Tiggre, CEO of IndependentSpeculator.com, shares his thoughts on what's going on with the precious metals, and how investors may want to position.Don't forget to follow us @INN_Resource for real-time... Keep Reading...

30 January

Ross Beaty: Gold, Silver in "Bubble Territory," What Happens Next?

Ross Beaty of Equinox Gold (TSX:EQX,NYSEAMERICAN:EQX) and Pan American Silver (TSX:PAAS,NASDAQ:PAAS) shares his thoughts on gold and silver's record-setting runs. While high prices are exciting, he noted that even US$50 per ounce silver is good for miners. "At the end of the day, there's still... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00