October 23, 2024

Metal Hawk Limited (ASX: MHK, “Metal Hawk” or the “Company”) is pleased to report on its quarterly activities for the period ending 30 September 2024.

HIGHLIGHTS

EXPLORATION ACTIVITIES

LEINSTER SOUTH PROJECT

- Maiden field campaign at Leinster South returns numerous high grade gold assays from rock chips (up to 20.2g/t Au) at the new Siberian Tiger prospect. There is no previous drilling at Siberian Tiger.

- UAV (drone) magnetic survey, detailed orthophotography and LiDAR survey completed over Siberian Tiger and the majority of tenement E36/1068.

- Geological mapping and geochemical sampling expand the gold mineralisation footprint at Siberian Tiger and continue to generate new regional gold prospects.

- Additional tenement applications increase Metal Hawk’s landholding to over 430km2.

- Heritage Agreement executed, approvals progressing towards maiden RC program.

BEREHAVEN PROJECT

- Gold assays returned from RC drilling completed in June 2024 at the Commodore North gold zone.

- Significant results include:

- 6m @ 1.58g/t Au from 40m (BVNC066)

- 2m @ 2.51g/t Au from 105m (BVNC067)

- 3m @ 1.41g/t Au from 92m (BVNC069)

CORPORATE

- End of quarter cash position of $1.7 million.

- The Company is looking at divesting a number of non-core assets and tenements.

Managing Director Will Belbin commented: “The early exploration success at Siberian Tiger puts Metal Hawk in an excellent position heading into the December quarter and beyond. At Leinster South we have a big package of ground surrounded by world class gold deposits and it is quite incredible that there has been virtually no historical gold exploration at Siberian Tiger. We are very excited to push towards a maiden drilling program as soon as possible.”

DECEMBER QUARTER 2024 – PLANNED ACTIVITY

The Company will be focusing the majority of exploration efforts towards the maiden drill program at the Leinster South project, with planned activities in the lead-up including:

- Geochemical sampling (rock chips and soils).

- Detailed structural mapping and interpretation.

- Targeting and preparations for drilling.

- Processing and interpretation of detailed geophysical data, aerial photography/imagery and LiDAR data.

- Scheduled heritage clearance surveys.

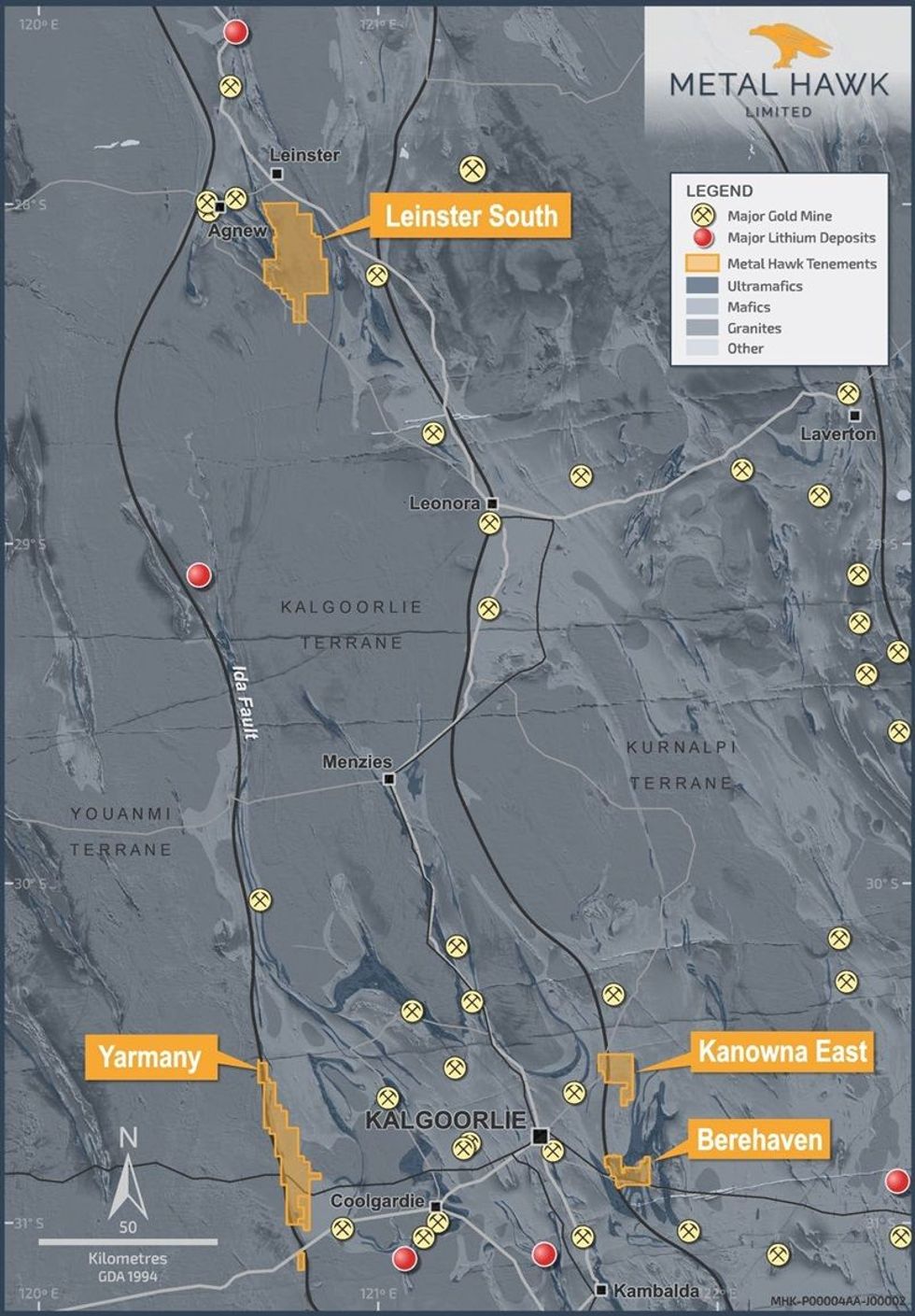

COMPANY PROJECTS – WESTERN AUSTRALIA

LEINSTER SOUTH PROJECT

The Leinster South project area covers more than 430km2 and is situated between 10km and 40km south of Leinster. Limited historical exploration has been conducted on the tenements.

Field reconnaissance mapping and rock chip sampling commenced in late June 2024. The majority of work focused on tenement E36/1068, which is located along the southeastern limb of the Agnew Greenstone Belt and only 15km from the Lawlers mining centre. The initial field trip included follow-up of a highly anomalous geochemical gold anomaly (482ppb Au) from historical wide-spaced soil sampling at the northern portion of this tenement.

Click here for the full ASX Release

This article includes content from Metal Hawk Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

MHK:AU

The Conversation (0)

02 October 2024

Metal Hawk Limited

Gold-focused exploration in Western Australia’s prolific Eastern Goldfields region

Gold-focused exploration in Western Australia’s prolific Eastern Goldfields region Keep Reading...

05 May 2025

MHK Presentation RIU Sydney - May 2025

Metal Hawk Limited (MHK:AU) has announced MHK Presentation RIU Sydney - May 2025Download the PDF here. Keep Reading...

23 April 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Metal Hawk Limited (MHK:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

31 March 2025

Heritage Survey Completed at Leinster South

Metal Hawk Limited (MHK:AU) has announced Heritage Survey Completed at Leinster SouthDownload the PDF here. Keep Reading...

23 March 2025

$2.5m Placement to Fund Extensive Gold Drilling

Metal Hawk Limited (MHK:AU) has announced $2.5m Placement to Fund Extensive Gold DrillingDownload the PDF here. Keep Reading...

20 March 2025

Trading Halt

Metal Hawk Limited (MHK:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

22h

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

22h

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00