- WORLD EDITIONAustraliaNorth AmericaWorld

November 27, 2023

Cyclone Metals Limited (ASX: CLE) (Cyclone or the Company) is pleased to report the results of the first phase of metallurgical test work performed on its flagship Block 103 / Iron Bear Magnetite Iron Ore Project (Block 103 / Iron Bear) in Canada.

- Blast furnace magnetite concentrate produced grading 68.7% Fe with very low deleterious elements and silica below 3.5%

- Very high recovery > 97% for magnetite Fe

- The current market price for this class leading blast furnace magnetite concentrate is USD 159/t CFR China1 – representing a premium of 25 USD/t above the 62% Fe benchmark

- Sediment bulk sample of 1.6t used with magnetic Fe of 17%; representative of overall deposit which has an average magnetic Fe of 18%

- Flow sheet for production of blast furnace grade concentrate being defined with high yields, recovery rates and low grinding costs

- Specifications of Block 103/ Iron Bear base blast furnace concentrate are class leading with high Fe and low silica, alumina and deleterious elements

- Metallurgical test work is ongoing to define a Block 103 / Iron Bear premium direct reduction (DR) magnetite concentrate with Fe of 70% and silica below 1.5% to enable ultra-low carbon steel production

Cyclone CEO, Paul Berend, commented: “We have achieved a major milestone in the development of our flagship Iron Bear Project by demonstrating that we can easily produce a class leading 68.7% Fe grade iron ore product with a 97% magnetite recovery. Given the massive scale of the deposit, the access to rail and port infrastructure, this is starting to look like the future. We are working hard to define a premium ultra-low silica direct reduction magnetite product which will be very attractive to European steel makers looking to reduce their carbon footprint. We are targeting to introduce this unique premium product to the steel industry as early as first quarter next year.”

Flash Operational Update

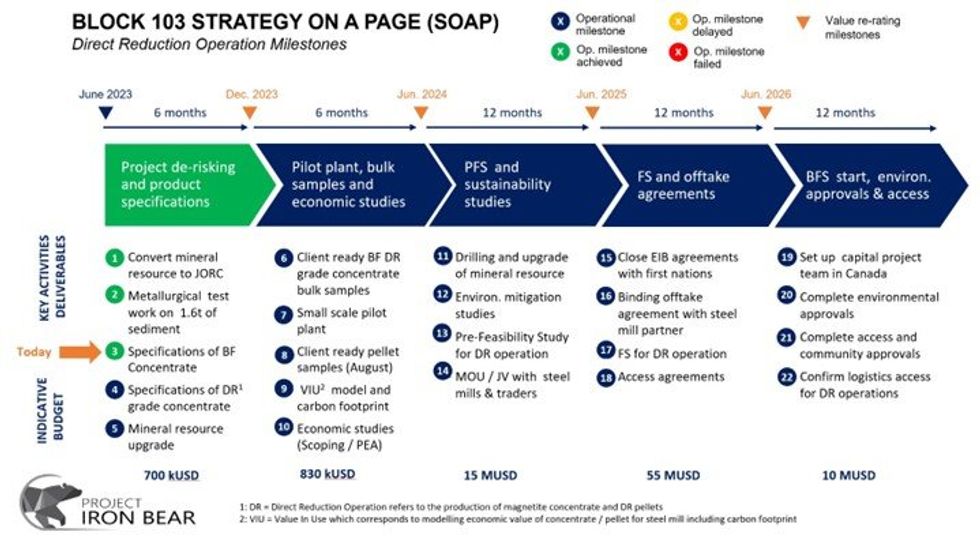

Cyclone is pleased to report that it is currently on track to achieve all its SOAP (Strategy On A Page) operational milestones planned in calendar year 2023, specifically milestones 4 and 5.

Work is currently ongoing to produce a premium DR grade magnetite concentrate (milestone 4) leveraging reverse flotation and other separation methods to reduce the levels of silica whilst maintaining high Fe recovery levels. The outcome of this metallurgical test work is anticipated by mid- December 2023, and if successful, would potentially make Block 103/ Iron Bear one of a handful of iron ore producers with the capability to produce premium DR grade concentrates.

Concurrently, we are also working to upgrade the mineral resource (milestone 5), in terms of size, and more importantly quality. Specifically, we are aiming to upgrade a portion of the mineral resource to JORC indicated status. Cyclone has been able to locate a high-quality magnetic survey of its Block 103 claims and we are working with Perth-based, Resource Potentials, to correlate this data with the existing drilling results and to leverage this to upgrade the mineral resource. This is a complex endeavour, and the outcome remains uncertain. However, if successful, this endeavour would enable Cyclone to forego a costly drilling program.

Cyclone is committed to being transparent with stakeholders and investors and will update progress on the SOAP on a regular basis.

Click here for the full ASX Release

This article includes content from Cyclone Metals Ltd., licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CLE:AU

The Conversation (0)

11 April 2024

Cyclone Metals

Focused on Developing a World-class Iron Ore Asset in Canada, project Iron Bear

Focused on Developing a World-class Iron Ore Asset in Canada, project Iron Bear Keep Reading...

11 November 2025

BHP Invests AU$944 Million in Western Australia Communities

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has released its 2025 Community Development Report for Western Australia, demonstrating a record-breaking investment of AU$944 million. According to the report, a majority of this year’s investment went to local suppliers, with AU$737 million spent. Of this, AU$529... Keep Reading...

02 April 2025

Fortescue's Forrest Hones in on Renewable Energy, Aims to Go Green by 2030

Andrew Forrest, founder and executive chair of major mining company Fortescue (ASX:FMG,OTCQX:FSUMF), has been making headlines following his bold statements on renewable energy.Toward the end of February, the mining tycoon was quoted as saying that Fortescue is quitting fossil fuels. According... Keep Reading...

10 March 2025

Rio Tinto Plans US$1.8 Billion Investment in BS1 Extension, Completes Arcadium Acquisition

Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO) made headlines after two announcements on March 6. The mining giant said it will invest US$1.8 billion to develop the Brockman Syncline 1 mine project (BS1), a move that will extend the life of the Brockman region in West Pilbara, Western Australia.BS1 now... Keep Reading...

13 August 2024

Australia's Mining Dilemma: Can ESG Goals and Competitive Production Coexist?

With investors placing increasing value on environmental, social and governance (ESG) issues, mining companies are having to choose between maintaining competitive production and promoting ESG principles. That's the topic explored in an August 8 report from Callum Perry, Solomon Cefai, Alice Li... Keep Reading...

27 February 2020

Rio Tinto to Invest US$1 Billion to Reach Zero Emissions Goal by 2050

Mining giant Rio Tinto (ASX:RIO,LSE:RIO,NYSE:RIO) is set to invest US$1 billion in the next five years to reach its new climate change targets. The company is aiming to reduce emissions intensity by 30 percent and absolute emissions by a further 15 percent from 2018 levels by 2030. “Climate... Keep Reading...

02 January 2020

Iron Outlook 2020: Prices to Stabilize Following Supply Shock

Click here to read the latest iron outlook. Iron ore prices have come off their highest level of 2019, but are still ending on a high note. The year was marked once again by a disaster in the space, with Vale’s (NYSE:VALE) news of a dam collapse in January remaining in the spotlight throughout... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00