March 24, 2025

Comet Ridge Limited (ASX:COI) is pleased to advise that the Mahalo JV participants (Comet Ridge 57.14% and Santos 42.86%) have executed an agreement with Jemena Queensland Gas Pipeline (1) Pty Ltd and Jemena Queensland Gas Pipeline (2) Pty Ltd (collectively, Jemena) to undertake Front End Engineering Design (FEED) on a new Mahalo Gas Hub Pipeline (MGHP).

Key points:

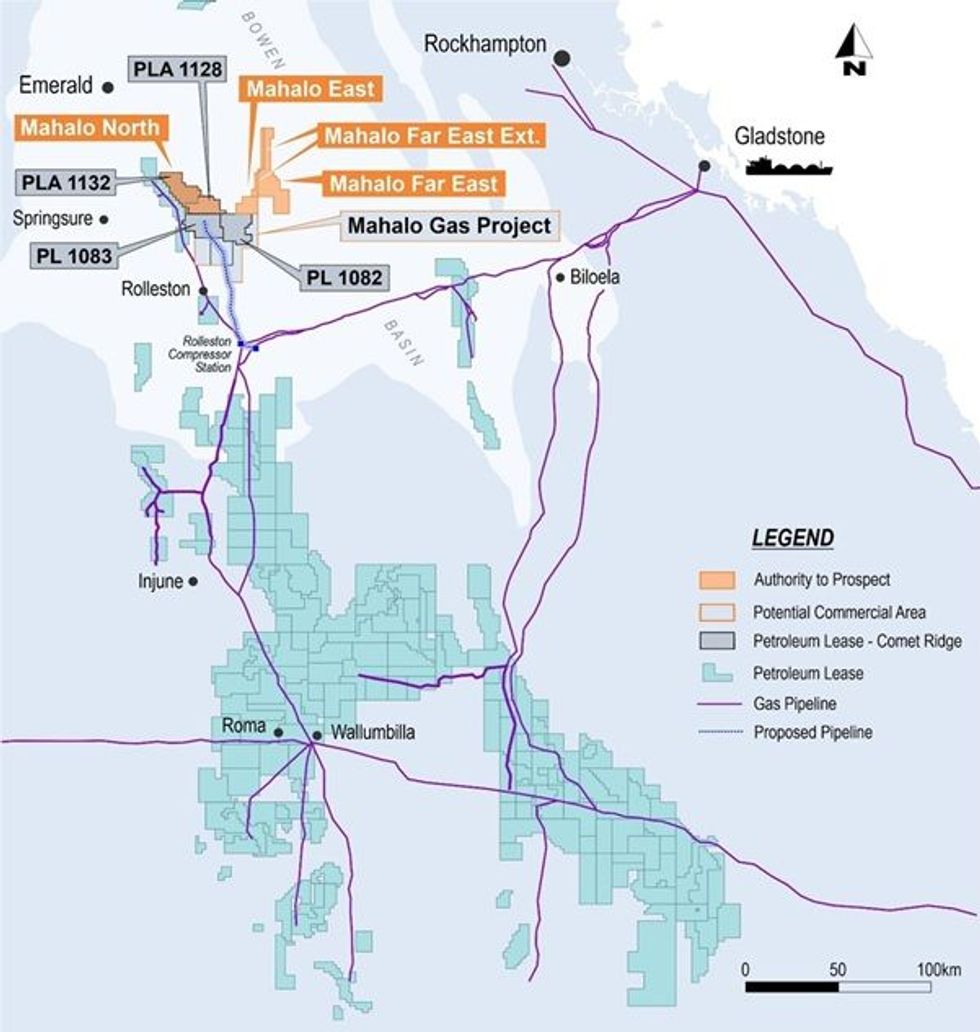

- The Mahalo Joint Venture has engaged Jemena to undertake Front End Engineering Design (FEED) on the planned Mahalo Gas Hub Pipeline (MGHP) to connect the Mahalo JV Project to the Queensland Gas Pipeline (QGP) and GLNG Pipeline.

- Jemena is currently funding the Pipeline FEED cost.

- The Pipeline FEED will run in parallel to the Mahalo JV Project Upstream FEED (announced 6 Dec 2024).

- Jemena operates a diverse portfolio of energy assets in northern Australia and Australia’s east coast, including the QGP which runs between Wallumbilla and Gladstone in Queensland.

- Jemena may construct the MGHP on a build own and operate basis following completion of FEED and subject to achieving a final investment decision (FID).

- This is a significant step in Comet Ridge’s plans to develop meaningful gas supply to fill the looming supply gap for gas in Australia’s east coast energy market.

The proposed MGHP will be a DN250 (10 inch) Class 900 pipeline, connecting the planned Mahalo JV compression facilities to the Queensland Gas Pipeline (owned and operated by Jemena) and the GLNG Pipeline. It is proposed, subject to FID, the MGHP will connect the Mahalo JV’s gas fields and processing facilities to the gas market hubs of Gladstone and Wallumbilla in Queensland (see Figure 1).

Jemena may construct the MGHP on a build, own and operate basis once Pipeline FEED is completed and subject to the Mahalo JV Project FID. Jemena is currently funding the cost of the Pipeline FEED which is intended to be rolled into the total pipeline construction cost assuming Jemena proceeds with construction of the MGHP.

Comet Ridge Managing Director, Tor McCaul, said: “Commencing Pipeline FEED is an important milestone for the Mahalo JV Project. All workstreams are now being progressed to enable a final investment decision to be reached at Mahalo, which is well positioned to contribute as a near-term solution to the growing strain on east coast gas markets.

“We are especially pleased to commence this relationship with Jemena, a high-quality pipeline operator in Australia that provides regional synergy to Comet Ridge for the transport of gas to key gas market hubs on the east coast.”

About Jemena and the Pipeline FEED

Jemena owns and operates a diverse portfolio of energy assets across northern Australia and Australia's east coast. With more than $12.4 billion worth of major utility infrastructure, Jemena supplies millions of households and businesses with essential services every day. Jemena has more than a century’s experience and expertise in the utilities sector and a strong portfolio of high-quality distribution and transmission assets, with a focus on opportunities for growth and innovation in its operations.

Click here for the full ASX Release

This article includes content from Comet Ridge Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00