February 27, 2023

Breaker Resources NL (ASX:BRB, Breaker, or the Company) is pleased to advise that it has now received the results from the last five holes (or wedges) drilled at as part of its resource development program which completed in late December 2022 at Bombora, targeting various lodes beneath the prospective Bombora open pit at its Lake Roe Gold Project.

Again, the results validate the predictability, interpretation and grade continuity of the lode structures applied during resource estimation. The drilling successfully intersected various lodes beneath the future open pit which are the subject of underground mining studies. The results will enable a future upgrade from inferred to indicated categorisation but more importantly validate the integrity of the inferred estimates completed so far on 80m spaced drill lines.

Best results include:

0.8m @ 28.8 g/t gold from 388.62m in BBDD0162 (est. true width = 0.55m)

8.95m @ 2.44 g/t gold from 415.05m in BBDD0162 (est. true width = 6.26m)

6m @ 5.51 g/t gold from 596m in BBDD0162 (est. true width = 4.20m)

2.65m @ 4.27 g/t gold from 484m in BBDD0162 (est. true width = 1.86m)

0.45m @ 30.6 g/t gold from 292.45m in BBDD0164 (est. true width = 0.32m)

3.00m @ 6.50 g/t gold from 472m in BBDD0164 (est. true width = 2.70m)

1.2m @ 8.93 g/t gold from 478m in BBDD0164W1 (est. true width = 1.08m)

5.68m @ 5.81 g/t gold from 115.32m in BBDD0166 (est. true width = 5.10m)

Breaker’s CEO, Sam Smith said

“It’s great we can drill holes into our resource model and hit the ore where it was interpreted to be with ore intercepts sometimes better than the global resource estimate. Our underground mining plans are continuously being supported by high grade drill results at Tura and the Northern Flats. Our scoping study for underground mining of the Tura lodes beneath the planned Bombora pit showed strongly positive outcomes from what is just the immediate extensions of the primary structures. Same for the Northern Flats where our scoping studies are nearing completion. The latest round of assays boost our expectations for economic studies and demonstrate that Lake Roe could have a longer mine life from underground mining on completion of the open pits”.

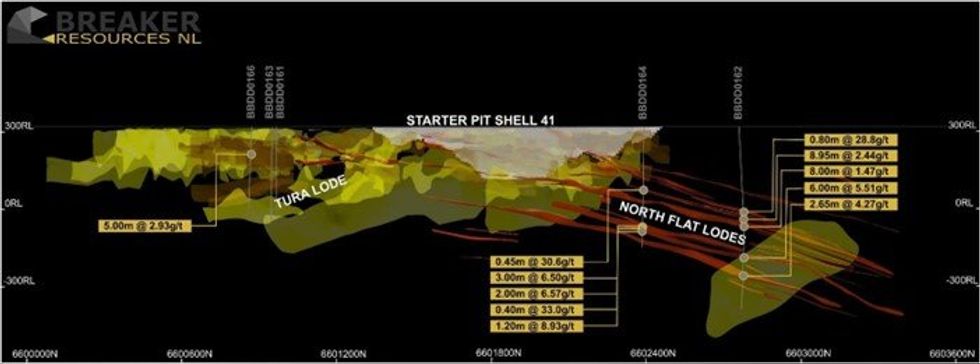

Drill holes BBDD0162, BBDD0164 and BBDD0164W1 targeted the Northern Flats Lodes, which are a series of stacked, shallow north plunging flat lodes with numerous high grade gold shoots located below and north of the future open pit. Each hole was expected to intersect the flat lodes and assays confirmed continuity of mineralisation at economical grades along the structures.

The Northern Flats Lodes, plunging north from the proposed Bombora open pit manifest as stacked flatly dipping narrow, but high-grade lode structures typically 1-3m in thickness. The intersection of these with the NW trending and steeply east-dipping lodes, and the NW trending and west dipping lodes creates elongated corridors where much thicker and higher-grade shoots tend to form.

Drill holes BBDD0161, BBDD0163 and BBDD0166 were targeting the Tura structure, aimed at defining the extent of the internal high grade shoot. Each hole intersected the Tura structure outside of the internal high grade shoot, refining the mineralisation model for mining studies.

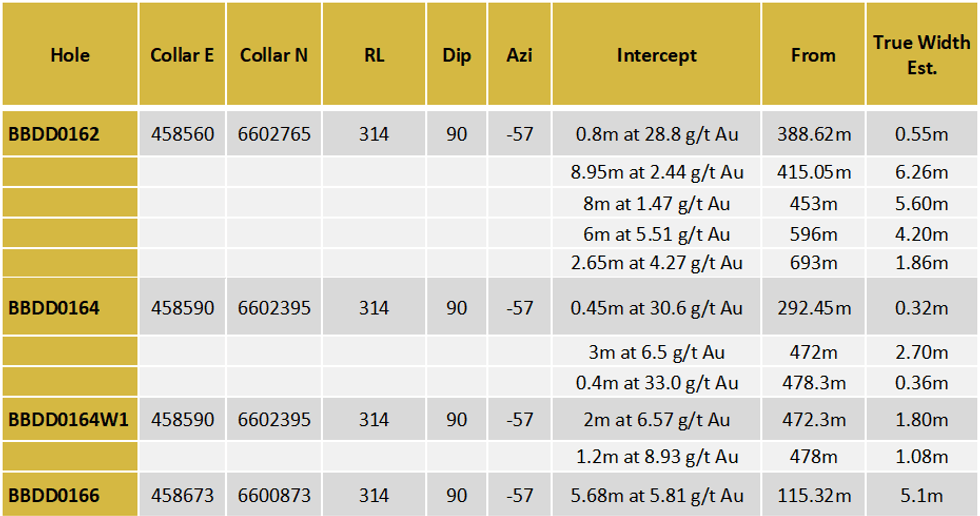

Table 1: Bombora drill results report (1.0 g/t cut-off and a minimum of 10 gram x meters):

The information in this report that relates to Exploration Results is based on information compiled by Stephane Roudaut BSc (Geology); MSc (Economic Geology); MAusIMM. Mr. Roudaut is the Chief Geologist of Breaker Resources NL. Mr. Roudaut has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr. Roudaut consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

Click here for the full ASX Release

This article includes content from Breaker Resources NL, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BRB:AU

The Conversation (0)

29 June 2022

Breaker Resources

Transitioning From Explorer to Developer in Western Australia

Transitioning From Explorer to Developer in Western Australia Keep Reading...

18h

Aurum Hits High-Grade Gold at Napie, Cote d'Ivoire

Aurum Resources (AUE:AU) has announced Aurum Hits High-Grade Gold at Napie, Cote d'IvoireDownload the PDF here. Keep Reading...

20h

Precious Metals Price Update: Gold, Silver, PGMs Fall on Escalating US-Iran War

Precious metals prices are down on potential for economic fallout from escalating US-Iran War.Volatility has returned to the precious metals market this past week. All eyes are on the breakout of a full-scale war across the Middle East prompted by a coordinated assault on Iran by the United... Keep Reading...

04 March

SSR Mining to Sell Çöpler Gold Mine Stake in US$1.5 Billion Deal

SSR Mining (NASDAQ:SSRM,TSX:SSRM,OTCPL:SSRGF) has agreed to sell its majority stake in the Çöpler gold mine in Turkey for US$1.5 billion in cash, shifting the company’s portfolio towards the Americas as the yellow metal continues to surge amid rising geopolitical tensions.The Denver-based miner... Keep Reading...

04 March

Blackrock Silver Announces the Appointment of Bernard Poznanski and Susan Mathieu to the Board of Directors

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce the appointment of Bernard Poznanski and Susan Mathieu as independent directors to the Board of Directors of the Company (the "Board of Directors").In conjunction with... Keep Reading...

03 March

Fortune Bay: Exploration Underway, Fully Funded Program at the Goldfields Project in Saskatchewan

While Saskatchewan has long been recognized for uranium, its geology and historical exploration also make it a promising place for gold. Canadian company Fortune Bay (TSXV:FOR,OTCQB:FTBYF) seeks to maximize this potential with its flagship Goldfields project. Fortune Bay’s 100 percent owned... Keep Reading...

03 March

RUA GOLD Files 43-101 Technical Reports for the Reefton and Glamorgan Projects in New Zealand

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZX: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce the filing on SEDAR+ of independent Technical Reports for its Reefton Project ("Reefton Technical Report") on the South Island and Glamorgan Project ("Glamorgan Technical Report") on... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00