Lahontan Gold Corp. (formerly, 1246765 B.C. Ltd.) (the "Company" or "Lahontan") is pleased to announce the results from five core holes, totaling 1,368 metres, completed in 2021 at the Company's 19 km2 Santa Fe Project in Nevada's Walker Lane. These core drill holes explored down-rake and on-strike extensions to the high-grade BH Zone and shallow, potentially open pit minable, Au and Ag mineralization southeast of the past producing Santa Fe open pit. High-grade intercepts from the BH zone include

- 100.3m grading 2.96 gpt Au and 62.2 gpt Ag (3.79 gpt Au Eq), including 37.3m grading 3.78 gpt Au and 96.1 gpt Ag (5.06 gpt Au Eq), also including 4.9m grading 10.76 gpt Au and 126.7 gpt Ag (12.45 gpt Au Eq) in drill hole SF21-001C.

Highlights from shallow oxide drilling include:

- 23.9m grading 0.84 gpt Au and 4.6 gpt Ag (0.90 Au Eq), and 20.7m grading 0.45 gpt Au and 3.4 gpt Ag (0.50 gpt Au Eq) in drill hole SF21-004C.

A complete table of drill results from these five core holes is shown below, along with detailed descriptions of results, drill hole location maps, core photos, and a representative cross section.

Drill Hole | Total Depth (m) | From (m) | To (m) | Interval (m) | Au (gpt) | Ag (gpt) | Au Eq (gpt) | Host Rock | Metallurgical Domain |

SF21-001C | 326.4 | 90.1 | 190.4 | 100.3 | 2.96 | 62.2 | 3.79 | Jasperoid breccia | Fresh and Transition |

including | 108.5 | 145.8 | 37.3 | 3.78 | 96.1 | 5.06 | Jasperoid breccia | Fresh | |

also includes | 176.8 | 181.7 | 4.9 | 10.76 | 126.7 | 12.45 | Jasperoid breccia | Fresh | |

SF21-002C | 270.1 | 146.6 | 169.2 | 22.5 | 1.04 | 21.6 | 1.33 | Jasperoid breccia | Fresh |

including | 151.2 | 157.9 | 6.7 | 2.37 | 58.3 | 3.14 | Jasperoid breccia | Fresh | |

SF21-003C | 251.8 | 121.5 | 149.4 | 27.9 | 0.98 | 8.5 | 1.09 | Jasperoid breccia | Fresh |

including | 124.2 | 138.4 | 14.2 | 1.34 | 17.4 | 1.57 | Jasperoid breccia | Fresh | |

SF21-004C | 195.4 | 56.4 | 80.3 | 23.9 | 0.84 | 4.6 | 0.90 | Jasperoid breccia | Oxide |

and | 106.1 | 126.8 | 20.7 | 0.45 | 3.4 | 0.50 | Jasperoid breccia | Transition | |

SF21-005C | 354.5 | 260.3 | 293.1 | 32.8 | 1.09 | 21.6 | 1.37 | Jasperoid breccia | Fresh |

including | 261.7 | 270.2 | 8.5 | 3.13 | 37.7 | 3.63 | Jasperoid breccia | Fresh |

*Notes: Au Eq equals Au (gpt) + (Ag gpt/75). Metallurgical recovery has not been factored as insufficient test-work is available to determine potential Ag recoveries. True thickness in the BH Zone (drill holes SF21-001C, -002C, -003C, and -005C) is estimated to be 50-75% of the drilled interval; true thickness for the SE extension of shallow mineralization in SF21-004C is estimated to be 75-80% of the drilled interval.

BH Zone: Core drill holes SF21-001C, -002C, and -003C all targeted portions of the BH Zone with different objectives. SF21-001C was oriented to the southeast and angled to test a down-rake portion of the BH Zone and verify continuity of high-grade Au and Ag mineralization similar in tenor and thickness to that seen in historic core drill holes BH-3 and BH-6 drilled by Victoria Gold in 2009 and 2010 respectively. SF21-001C expands the volume and thickness of high-grade mineralization, in particular the 4.9 metre interval of 12.45 gpt Au Eq (please see cross section below). It is important to note the very high Ag grades which characterize the BH Zone, e.g. 0.8m grading 6.98 gpt Au and 201 gpt Ag (95.5 - 96.3m), 1.25m grading 5.17 gpt Au and 309 gpt Ag (131.64 - 132.89m), and 1.61m grading 15.04 gpt Au and 107.2 gpt Ag (176.78 - 179.22m), please see core photos below. The Company believes that a significant Ag byproduct in potential future mining operations could have an important impact on project economics. The hydrothermal alteration and mineralogy seen in SF21-001C is identical to that seen in previous drill campaigns (Lahontan has all the core, assays, and drill logs from the Victoria core drilling program for comparitive purposes) adding further confidence to the interpreted continuity of high-grade Au and Ag mineralization in the BH Zone.

SF21-001C, 96m depth, 6.98 gpt Au, 201 gpt Ag (9.66 gpt Au Eq). Jasperoid-sulfide hydrothermal breccia: Clasts are composed of black jasperoid in silica-sulfide matrix, the matrix has abundant colloform melnikovite (likely recrystallized to alternating pyrite and marcasite) with minor pods of interstitial calcite and occasional leached voids are present.

SF21-001C, 2.1m grading 11.81 gpt Au, 161.6 gpt Ag (13.96 gpt Au Eq) (178.6 - 180.7m). From the footwall of an intensely argillically-altered and brecciated (dacite?) dike: Jasperoid-sulfide hydrothermal and structural breccia, clasts are predominantly black to dark grey jasperoid that locally includes clasts of brecciated dike (white to light-grey).

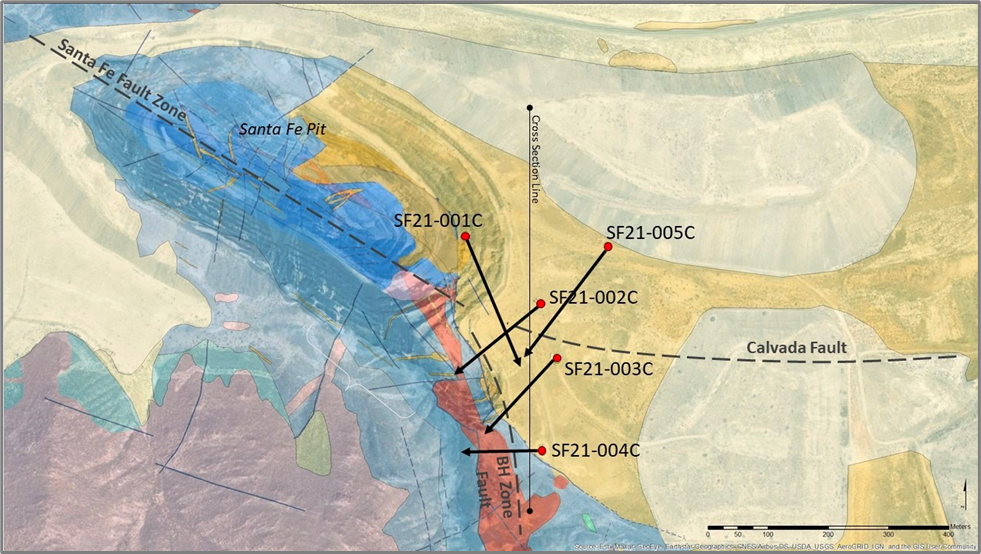

Drill hole location map, Santa Fe Project, Mineral County, Nevada.

Core drill holes SF21-002C and -003C were collared approximately 150 metres and 245 metres southeast of SF21-001C respectively (please see map above). These drill holes were targeting high-grade, Au and Ag mineralization up-rake and along strike from the main BH Zone. The core drill holes hit significant zones of precious metal mineralization: 6.7m grading 2.37 gpt Au and 58.3 gpt Ag (3.14 gpt Au Eq) in SF21-002C (151.2 - 157.9m) and fill in gaps between historic drill holes (please see cross section below). This mineralization carries the distinctive geochemical signature of the high-grade BH Zone, elevated Ag grades: 1.62 m grading 2.64 gpt Au and 93.9 gpt Ag in SF21-002C (153.62 - 155.24m) and 2.5m grading 2.25 gpt Au and 28.5 gpt Ag in SF21-003C (135.9 - 138.4m).

North-south (left to right, please see map above) cross section through the BH Zone, Santa Fe Project, Mineral County, Nevada. The grade shell outlining the BH Zone is based upon modeling historic drilling, now confirmed and expanded by Lahontan drilling. Drill hole SF21-005C is projected into the section for illustrative purposes.

Based on these drill results and modeling historic drilling, it appears that the BH zone may consist of multiple, repeating or cyclic, down to the southeast raking zones, within the Santa Fe Fault and sympathetic structures. This interpretation greatly expands that target size of the BH Zone, especially given that older drill holes, located hundreds of metres to the south and southeast of SF21-003C have high-grade intercepts that have not been drill tested since the nineties, i.e., reverse-circulation drill hole CSF-89-19 cut 16.8m grading 6.10 gpt Au including 3.3m 11.65 gpt Au (please the Company's website and Corporate Presentation for more information on this drill hole; www.lahontangoldcorp.com ). These southeast extensions to the BH Zone have significant, high-grade, resource potential.

Shallow Drilling: Core drill hole SF21-004C targeted shallow Au mineralization to the southeast of the Santa Fe open pit (please see map and cross section above). Historic drilling in this area suggested that shallow, potentially open pit minable, Au and Ag mineralization extended into the target area. SF21-004C cut two intervals of shallow, low-grade Au mineralization with grades within the range that was historically mined at Santa Fe. Importantly, this mineralization occurs in rocks assigned to the oxide and "transitional" metallurgical domains (please see core photo below). The transitional metallurgical domain is characterized as a mixed zone of oxidized and partially oxidized Au mineralization that maybe cyanide extractable. Several additional reverse-circulation drill holes were completed late in 2021 in the vicinity of SF21-004C, results from these drill holes are expected shortly.

SF21-004C, 1.1m grading 1.03 gpt Au, 5.5 gpt Ag (1.10 gpt Au Eq) (64.8 - 65.9m). Jasperoid breccia: silicified and decalcified breccia clasts; clasts are subround to subangular silicified limestone with leached voids. The matrix is composed of geothite+hematite+jarosite clays.

New High-Grade Zone: Lahontan geologists, utilizing surface geological mapping, modeling of historic drill holes, and structural re-interpretation, developed a new drill target along an inferred east-west trending structure extending from the northeast highwall of the Santa Fe open pit toward the Slab and Calvada open pits located several kilometres to the east. Core drill hole SF21-005C, collared approximately 170 metres east of the edge of the Santa Fe pit, intercepted a deep, thick interval of Au and Ag mineralization (see drill hole location map and cross section above). Significantly, within this interval, there an important intercept of BH-style mineralization: 8.5m grading 3.13 gpt Au and 37.7 gpt Ag (261.7 - 270.2m), including 1.5m grading 5.11 gpt Au and 57.2 gpt Au (5.87 gpt Au Eq) from 262.8 - 264.3m. These intercepts have the same mineralogy, hydrothermal alteration, and elevated Ag content that characterizes the BH Zone. Given the potential strike length of this east-west fault (the Calvada Fault), the high precious metal grades, and the analogy to the BH Zone, this drill hole may represent a new discovery and target area at the Santa Fe Project. Two additional drill holes were completed east of SF21-005C late in 2021, results are pending.

Kimberly Ann, President & CEO commented: "The excellent drill results seen in our BH Zone drilling confirms what Lahontan has long expected: The BH Zone has the potential to host a large, high-grade gold and silver resource that could be potentially exploited with bulk underground mining methods. While these first drill results are focused on the deeper, higher grade BH Zone style mineralization, the Company looks forward to receiving additional drill results from shallower targets focused on potentially heap-leachable oxide and transitional style mineralization. SF21-004C targeted this style of mineralization and shows that shallow oxidized and transitional mineralization extends to the southeast of the Santa Fe pit, yet another new target for resource expansion at the Santa Fe Project. We expect to release drill results for an additional 23 drill holes over the coming weeks as assays arrive from the lab, QA/QC is completed, and data is verified. Truly an exciting time for Lahontan Gold Corp".

QA/QC Protocols:

Lahontan conducts an industry standard QAQC program for its core and RC drilling programs. The QAQC program consisted of the insertion of coarse blanks and Certified Reference Materials (CRM) into the sample stream at random intervals. The targeted rate of insertion was one QAQC sample for every 16 to 20 samples. Coarse blanks were inserted at a rate of one coarse blank for every 65 samples or approximately 1.5% of the total samples. CRM's were inserted at a rate of one CRM for every 20 samples or approximately 5% of the total samples.

The standards utilized include three gold CRM's and one blank CRM that were purchased from Shea Clark Smith Laboratories (MEG) of Reno, Nevada. Expected gold values are 0.188 gpt, 1.107 gpt, 10.188 gpt, and -0.005 gpt, respectively. The coarse blank material comprised of commercially available landscape gravel with an expected gold value of -0.005 gpt.

As part of the RC drilling QAQC process, duplicate samples were collected of every 20th sample interval at the drill rig to evaluate sampling methodology. Samples were collected from the reject splitter on the drill rig cyclone splitter. Samples were collected at each 95- to 100-foot (28.96 - 30.48m) mark and labeled with a "D" suffix on the sample bag. No duplicates were submitted for core.

All drill samples were sent to American Assay Laboratories (AAL) in Sparks, Nevada, USA for analyses. Delivery to the lab was either by a Lahontan Gold employee or by an AAL driver. Analyses for all RC and core samples consisted of Au analysis using 30-gram fire assay with ICP finish, along with a 36-element geochemistry analysis performed on each sample utilizing two acid digestion ICP-AES method. Tellurium analyses were performed on select drill holes utilizing ICP-MS method. Cyanide leach analyses, using a tumble time of 2 hours and analyzed with ICP-AES method, were performed on select drill holes for Au and Ag recovery. AAL inserts their own blanks, standards and conducts duplicate analyses to ensure proper sample preparation and equipment calibration. We have all results reported in grams per tonne (gpt)

About Lahontan Gold Corp:

Lahontan Gold Corp. is a Canadian mineral exploration company that holds, through its US subsidiaries, three top-tier gold and silver exploration properties in the Walker Lane of mining friendly Nevada. Lahontan's flagship property, the 19 km2 Santa Fe Project, is a past producing gold and silver mine with excellent potential to host significant gold and silver resources (past production of 375,000 ounces of gold and 710,000 ounces of silver between 1988 and 1992; Nevada Bureau of Mines and Geology, 1996). Modeling of over 110,000 metres of historic drilling, geologic mapping, and geochemical sampling outline both shallow, oxidized gold and silver mineralization as well as deeper high grade potential resources. The Company plans an aggressive 25,000 metre drilling program with the goal of publishing a National Instrument 43-101 ("NI 43-101") compliant mineral resource estimate in 2022. For more information, please visit our website: www.lahontangoldcorp.com

All scientific and technical information in this press release has been reviewed and approved by Quentin J. Browne, P.Geo., Consulting Geologist to Lahontan Gold Corp., who is a qualified person under the definitions established by National Instrument 43-101.

On behalf of the Board of Directors Kimberly Ann

Founder, Chief Executive Officer, President, and Director

FOR FURTHER INFORMATION, PLEASE CONTACT:

Lahontan Gold Corp.

Kimberly Ann

Founder, Chief Executive Officer, President, Director

Phone: 1-530-414-4400

Email: Kimberly.ann@lahontangoldcorp.com

Website: www.lahontangoldcorp.com

Cautionary Note Regarding Forward-Looking Statements:

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

Except for statements of historic fact, this news release contains certain "forward-looking information" within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate" and other similar words, or statements that certain events or conditions "may" or "will" occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company's control. There are no assurances that the commercialization plans for the technology described in this news release will come into effect on the terms or time frame described herein. The Company undertakes no obligation to update forward-looking information if circumstances or management's estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company's filings with Canadian securities regulators, which filings are available at www.sedar.com.

SOURCE: Lahontan Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/699581/Lahontan-Drills-Thick-Intervals-of-High-Grade-Gold-at-Santa-Fe-1003M-Grading-379-GPT-Au-Eq-Incl-49M-Grading-1245-GPT-Au-Eq