Strategic partnerships in the mining industry are on the rise, helping companies navigate the critical minerals race and secure stable supply chains.

With strategic partnerships such as joint ventures (JVs) and mergers and acquisitions (M&A) on the rise in the mining industry, companies involved in the critical minerals space are getting busy both in the field and the boardroom.

Taking underground deposits from discovery to production takes many years and serious investment. Amid the critical minerals race, partnerships enable a faster path to market, as they allow companies to share resources and expertise in their quest to help firm up supply chains to meet rising global demand.

Understanding these partnerships and how they de-risk early stage project development can help investors interested in this space make the best choices.

Critical minerals shortage

Across the globe, nations are pivoting away from fossil fuels and towards green energy, mainly through electrification, with huge investments underway to transition the transportation, heating and cooling, and manufacturing sectors. Most modes of generating and storing green electricity require a long list of minerals the economy did not previously need in meaningful quantities.

Most nations lack stable supply chains for these minerals and other elements, posing potential risks to their economic future, and the future of their defense sector. For example, an article published by the Carnegie Endowment for International Peace suggests the US and the North Atlantic Treaty Organization could be at risk in a crisis because of limited access to the minerals they need for a conflict. As well, attempts to control the supply chain can turn to a geopolitical wrangling between nations.

Trade in energy-related critical minerals has risen from US$53 billion to US$378 billion over the last 20 years, according to data from the World Trade Organization. Minerals and rare earth elements could see demand quadruple by 2050.

Problem solved

Demand and prices for many critical minerals have seen a dramatic turnaround in recent years due to the soaring green economy. However, mining development and production don’t pivot that quickly. We’re living in that challenging lag right now.

To help speed up the process of getting early stage deposit discoveries into production, or expand or revitalize existing mining properties, more junior mining companies and others in the space are working together.

Joint ventures allow two organizations to combine capital, expertise, access, historical data and other resources, such as extraction or processing facilities, and that results in a percentage profit sharing later on.

Such partnerships allow companies to diversify. While critical minerals are in hot demand, prices still fluctuate and shortages can shift, as can access to perks such as government funding.

Ventures are common between junior miners and more established mining businesses. The former may have access to a deposit, experience with early stage development and flexibility. Larger mining companies tend to have access to capital and possess different types of managerial and technical expertise. Many of these established firms also seek access to critical mineral opportunities, and are willing to invest to gain them.

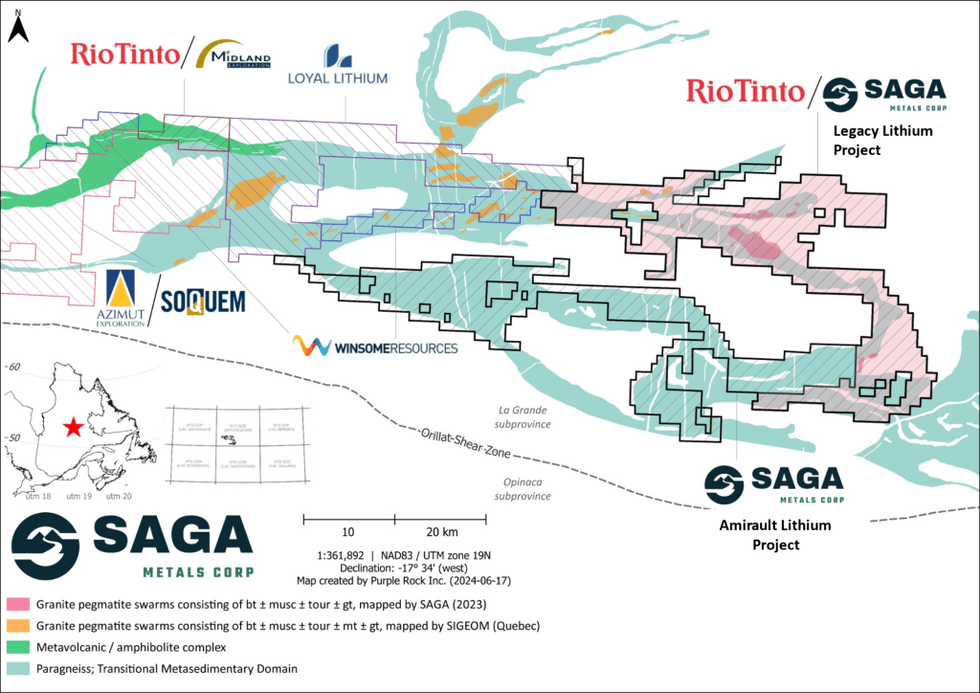

Saga Metals (TSV:SAGA), for example, struck a joint venture deal with Rio Tinto Exploration Canada, a subsidiary of mining giant Rio Tinto (ASX:RIO,NYSE:RIO,LSE:RIO), for its Legacy lithium project in James Bay, Quebec.

The total Legacy property spans over 65,849 hectares with 34,243 hectares optioned to Rio Tinto, hosting the same geological setting along strike from Rio Tinto’s other lithium project, Winsome Resources (ASX:WR1,OTCQB:WRSLF), Azimut Exploration (TSXV:AZM,OTCQX:AZMTF) and Loyal Lithium (ASX:LLI) in the La Grande sub-province.

Saga Metals' Amirault lithium project.

“It lends credibility to management’s ability to execute these types of agreements with a company as big as Rio, but it also validated the ground we staked/acquired, and management’s ability to find quality projects,” said Mike Stier, CEO and director of Saga Metals.

Such relationships are being struck in a range of mineral sectors.

“It drives shareholder value. Companies may realize what their limits are and a bigger company can come in after you’ve taken it from A to B and they can go from B to G,” said Stier.

M&A activity, meanwhile, offers similar benefits. Mining outfits in acquisition mode may purchase smaller, junior miners, or their interest in certain properties, to help expand their portfolios. Growing mining companies often seek projects at all stages of development to ensure diversification inside the organization.

Overall, the amount of mining M&A has been growing over the past few years, sitting flat between 2022 and 2023. However, the value of the deals has been on a more dramatic rise.

Collaborations of note

Saga Metals and Rio Tinto Exploration’s C$44 million two stage earn-in option agreement has led to the commencement of initial exploration in August 2024 at the Legacy lithium project.

This project is undergoing fieldwork with a focus on pegmatite mapping and geophysical surveys. Saga has 1,274 claims covering 65,849 hectares in the region, in what has become the newest lithium district in and around James Bay.

“We’ll also be keeping our eyes and ears open to the macro landscape with respect to the critical minerals in our portfolio,” said Stier of next steps for Saga Metals. “We’ll push our projects forward and continue them through their stages of development, de-risking them as we go.”

In uranium mining, Paladin Energy (ASX:PDN,OTCQX:PALAF) has agreed to acquire Fission Uranium (TSX:FCU,OTCQX:FCUUF). The deal will enable Paladin to list on the TSX, leading to increased trading liquidity and an enhanced capital markets presence. Paladin will become a multi-asset uranium company with benefits to the Patterson Lake South project. Paladin’s CEO has made it clear that the company has future acquisitions in mind as well.

Recently, Lundin Mining (TSX:LUN,OTC Pink:LUNMF) and BHP (ASX:BHP,NYSE:BHP,LSE:BHP) agreed to jointly acquire Filo (TSX:FIL,OTCQX:FLMMF), in a deal worth an estimated C$4.1 billion. The 50/50 joint venture has the aim of developing an emerging copper district in Argentina, focusing on the Filo del Sol project and the Josemaria project.

Investor takeaway

Partnerships and collaborations between mining companies have become an emerging standard of practice as the critical minerals race pushes on and both business and government try to secure supply lines. With myriad benefits, expect more future alliances in the critical minerals mining industry.

This INNSpired article is sponsored by Saga Metals (TSXV:SAGA). This INNSpired article provides information which was sourced by the Investing News Network (INN) and approved by Saga Metals in order to help investors learn more about the company. Saga Metals is a client of INN. The company’s campaign fees pay for INN to create and update this INNSpired article.

This INNSpired article was written according to INN editorial standards to educate investors.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Saga Metals and seek advice from a qualified investment advisor.