June 21, 2023

Siren Gold Limited (ASX: SNG) (Siren or the Company) is pleased to provide an exploration updated on the Sams Creek Project.

Highlights

- Sams Creek is an intrusion-related gold deposit (IRGD) with mineralisation contained within a porphyry dyke.

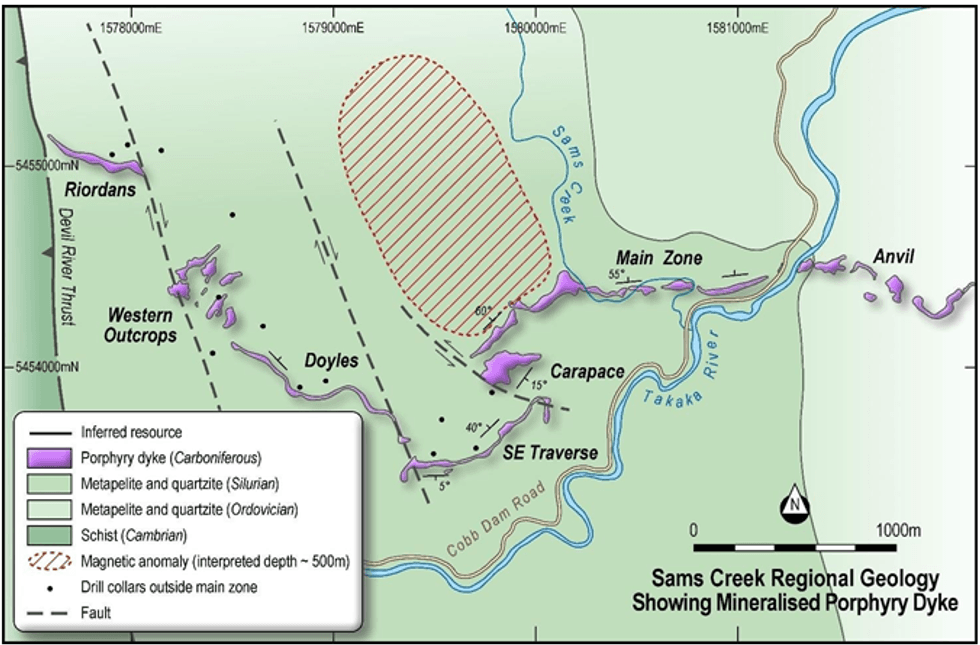

- The Sams Creek porphyry dyke (SCD) is over 7kms long, up to 60m thick, and extends down dip for at least 1km.

- The Sams Creek MRE comprises 9.1Mt @ 2.82 g/t Au for 824koz (1.5g/t cut-off), with only around 15% of the SCD drilled to date.

- An interpreted magnetic anomaly below the Main Zone could represent a large felsic intrusion that may be the source of the SCD and gold mineralisation.

- Historic diamond drillholes at the Main Zone includes:

- DDHSC84019, which intersected 183m @ 2.46g/t Au from 31m (including eight mineralised sections >2g/t Au with a weighted average of 101m @ 3.39g/t Au).

- DDH84SC016, which intersected 87m @ 4.2g/t Au across 7 high grade intervals.

- A trial Ionic Leach soil survey detected the SCD mineralisation over 500m below the surface. This survey will now be extended along the length of the SCD and over the magnetic anomaly to identify additional mineralisation that can be targeted by drilling.

Managing Director Brian Rodan commented:

Siren believes there is significant potential at Sams Creek for a large underground mining operation. The Sams Creek Dyke (SCD) is up to 60m thick, can be traced for over 7kms along strike, has a vertical extent of at least 1km and is open at depth. Drilling to date has focused on a 1km section of the dyke from the Carapace to the Main Zone (Figure 2). The trial Ionic Leach soil sampling program has successfully identified Sams Creek mineralisation 500m below the surface and identified new target areas. This program will now be extended across the whole deposit. We look forward to seeing these results in the coming months.

Background

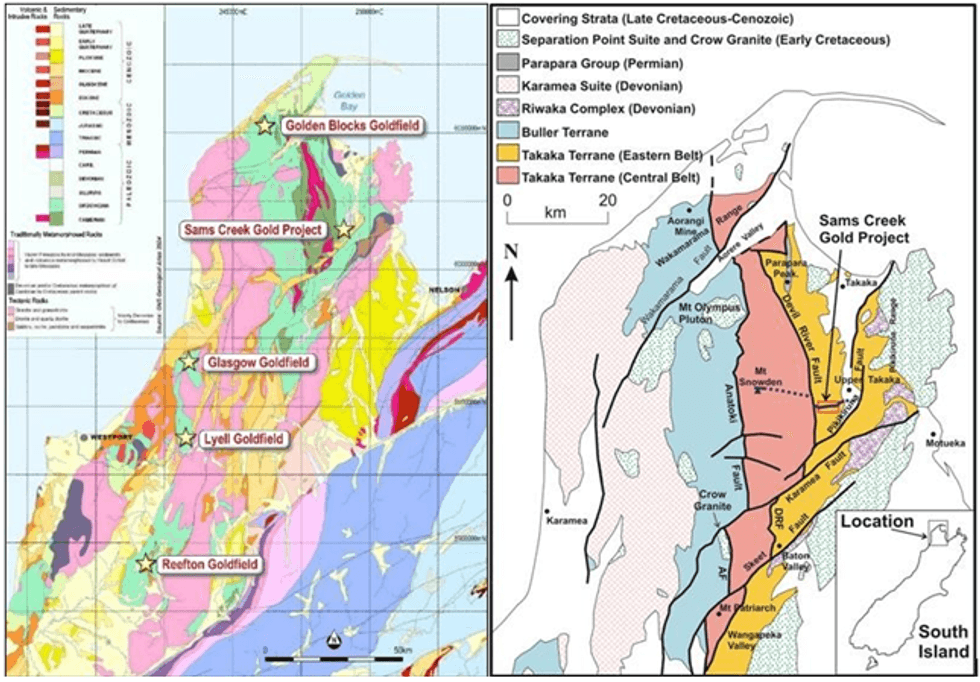

The Sams Creek Gold Project is located 140kms NE of Reefton and 100kms NE of Lyell (Figure 1). The Project comprises two exploration tenements: EP 54454, which is 100% held by Sams Creek Gold Limited (SCGL), a wholly owned subsidiary of Siren, and EP40338, which is 81.9% held by SCGL under a joint- venture agreement with New Zealand’s largest gold miner, OceanaGold Limited (OGL), who own the remaining 18.1% interest.

Western New Zealand was originally part of Gondwana and lay adjacent to eastern Australia until around 80 Ma ago. The NW of the South Island of New Zealand comprises an area of predominantly early Paleozoic rocks in broad northerly trending belts which terminate at the Alpine Fault (Figure 1). The Paleozoic sequence is divided into the Buller Terrane, Takaka Central and Takaka Eastern Belts. These belts are interpreted to correspond with the Western, Central and Eastern belts of the Lachlan Fold Belt. The Buller and Western Lachlan belts contain the orogenic gold deposits like Bendigo, Ballarat and Fosterville in Australia and the Reefton and Lyell Goldfields in New Zealand.

The Sams Creek porphyry dyke (SCD) is located in the Eastern Takaka Terrane, which is equivalent to the Eastern Lachlan belt that hosts porphyry copper-gold deposits like Cadia and Ridgeway.

The SCD mineralisation is contained within a hydrothermally altered peralkaline granite porphyry dyke that intrudes the Early Paleozoic metasediments. The dyke is up to 60m thick and can be traced E-W for over 7kms along strike (Figure 2). The SCD generally dips steeply to the north (~600), with gold mineralisation extending down dip for at least 1km and is open at depth (Figure 3).

The SCD has been divided into a number of exploration prospects including Riordans, Western Outcrops, Doyles, SE Traverse, Carapace, Main Zone, Anvil and Barrons Flat. The dyke generally dips steeply to the north but dips more shallowly to the NW and SE between the Carapace and Western Outcrops where it intrudes argillite (Figure 2).

Mineralisation

The geological and geochemical characteristics of the SCD indicate it is a member of the intrusion- related gold deposits (IRGDs). Globally, there are many examples of where IRGDs contain multi-million- ounce resources, including Pogo (5Moz), Donlin Creek (10Moz) Fort Knox (7Moz) in Alaska, Kidston (4Moz), Cadia (15Moz) in Australia and Vasilkovskoe (10Moz) in Kazakhstan (Lang & Baker 2001)2.

The Sams Creek porphyry dyke can best be described as a distal deposit (Figure 3) located in the host sediments outside the contact aureole of the source intrusion. These deposits typically have an Au-As- Sb-Hg Zn-Pb-Ag mineral association and may lie over 1km from the source (Figure 3). At structurally higher levels (500mRL to 800mRL) the SCD contains considerably more silver (up 90g/t) with Ag:Au ratios in the order of 30:1 whilst at lower levels (-200mRL to 500mRL) gold dominates silver, with ratios around 0.3:1. Base metals (Zn and Pb) also increase at these lower levels. This most probably reflects increasing proximity to the source intrusion with the top of the dyke showing signs of epithermal style mineralisation.

The porphyry dyke is variably mineralised and has been modified by at least four alteration / mineralisation stages (Angus 20133). The main gold mineralising event is Stage III where mineralisation consists of irregular to planar gold-bearing arsenopyrite-pyrite±quartz veins (Figure 4c), which form sheeted and local stockwork vein complexes that generally dip to the SE and form moderate-high grade gold zones (Figure 5). Veins vary in thickness from <1mm to 15mm. These veins are cut by later base metal veins up to 15mm thick containing galena, sphalerite, chalcopyrite and pyrite (Figure 4d). These veins do not appear to contain any gold but appear to be associated with the high-grade gold zones. Significant drillhole intersections are shown in Tables 1 and 2.

Click here for the full ASX Release

This article includes content from Siren Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

SNG:AU

The Conversation (0)

18 March 2024

Siren Gold

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District

Exploring Highly Prospective Gold Assets in A Historic New Zealand Mining District Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00