October 06, 2024

33.0 m at 2.4 g/t of gold from 31m

African Gold Ltd (African Gold or the Company) (ASX: A1G) is very pleased to announce results from the first of 6 recently completed diamond drillholes which were planned to test possible extension of the gold lodes and to infill previous drilling on gold controlling structures at the Blaffo Guetto prospect, on the Company’s Didievi Gold Project in Cote d’Ivoire.

HIGHLIGHTS

- Assay results from the first of 6 completed diamond drillholes returns a wide, high- grade intercept of:

- 33.0 m at 2.4 g/t of gold from 31m (DDD047)

- The mineralisation intersected by the first drill hole is hosted by a newly discovered quartz porphyry located in the southern zone of the deposit

- Similar untested porphyries have been identified in the southern Blaffo Guetto zone, with potential for a major new mineral discovery

- The new drill results are outside of, and in addition to, the existing Didievi Project Maiden Inferred Resource of 4.93Mt for 452koz of gold at 2.9 g/t Au (1.0 g/t Au cut off)1

- The result is consistent with previous drilling on Blaffo Guetto, indicating that the prospect is high-grade, shallow and potentially suitable for open pit mining

- Drilling has recently been completed and samples for the remaining 5 holes are being submitted to the laboratory

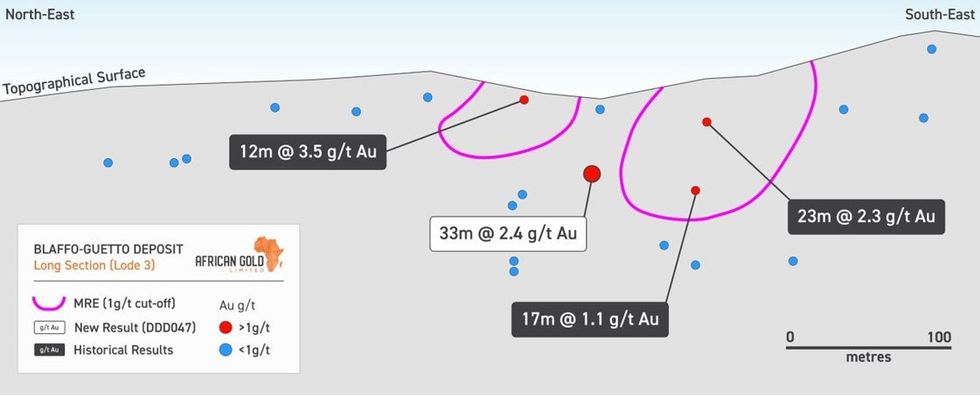

The assay results from hole first drill hole of the program have returned shallow and wide high grade gold values, the highlight intersection being 33.0 m at 2.4 g/t of gold from 31 m (DDD047).

The drilling program was designed to expand and upgrade the recently announced shallow, high grade, maiden gold inferred resource of 4.93Mt for 452koz of gold at 2.9 g/t Au (1.0 g/t Au cut off)1.

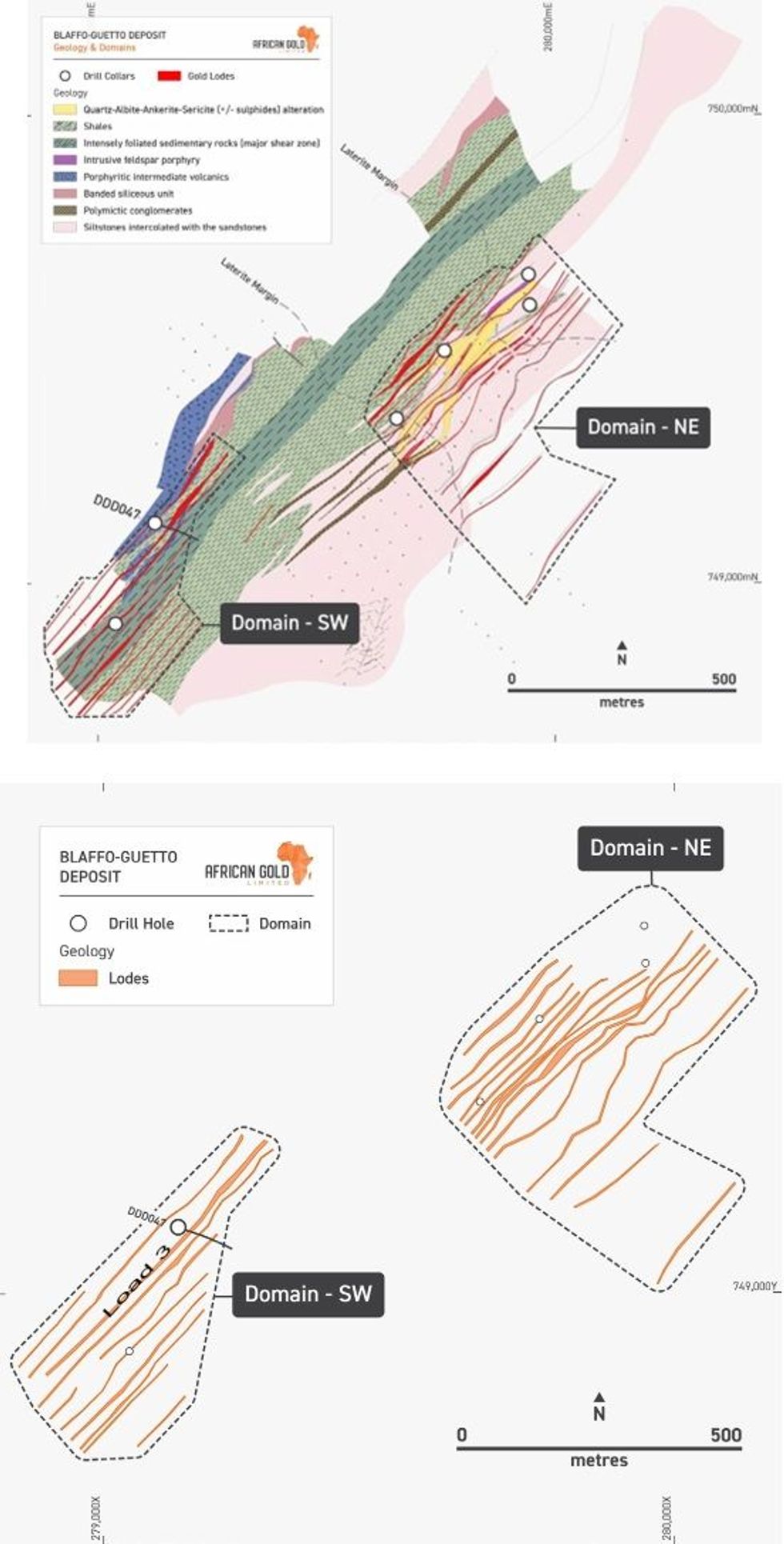

The first hole, DDD047, was drilled in the Domain – SW of the Blaffo Guetto prospect (Figure 1).

The mineralised intercept obtained by the first drillhole, DDD047, is located outside of the Blaffo Guetto Inferred Resource envelopes (Figure 2).

Mineralisation from hole DDD047 is hosted in a quartz porphyry (Figure 3a). Field traverses have identified sub- crops of the porphyries on the surface above this intersection suggesting that the mineralised porphyry extends to the surface, and it also remains open at depth (Figure 3b).

The discovery of the porphyry acting as a main host of the gold mineralisation is new for the Didievi Project and indicates the presence of a new mineralisation type, which significantly enhances the prospectivity of the project area and the potential for new gold discoveries. The gold lodes delineated by the previous drilling data were preferentially controlled by shear zones cutting the host volcano-sedimentary succession and also distributed along the contacts of the intrusive porphyry bodies. The mineralised porphyries represent new exploration targets and mapped by resistivity high anomalies, which could be due to unexposed and yet to be drill-tested porphyry bodies.

Click here for the full ASX Release

This article includes content from African Gold Ltd., licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

14h

Mining’s New Reality: Strategic Nationalism, Gold Records and a Fractured Cost Curve

The era of “smooth globalization” is over, and mining is entering a more fragmented, politically charged phase defined by strategic nationalism, according to speakers at S&P Global’s latest webinar.Jason Holden, who opened the “State of the Market: Mining Q4 2025” session with a macro overview,... Keep Reading...

19h

Brazilian State Firm Seeks Injunction to Block Equinox Gold-CMOC Asset Sale

A Brazilian state-run mining company is seeking an emergency court injunction to block the sale of one of Equinox Gold's (TSX:EQX,NYSEAMERICAN:EQX) Brazilian assets. Bloomberg reported that Companhia Baiana de Produção Mineral (CBPM) has asked the Bahia State Court of Justice to immediately... Keep Reading...

20h

Silver Hammer Closes CDN$3,913,617 Non-Brokered Private Placement Pursuant to Listed Issuer Exemption

Silver Hammer Mining Corp. (CSE: HAMR,OTC:HAMRF) (the "Company" or "Silver Hammer") is pleased to announce that further to its news release dated February 2, 2026, it has closed its previously announced non-brokered private placement pursuant to the Listed Issuer Exemption ("LIFE") (the... Keep Reading...

22 February

High-Grade Near-Surface Graphite Intersected at Millennium

Metal Bank (MBK:AU) has announced High-Grade Near-Surface Graphite Intersected at MillenniumDownload the PDF here. Keep Reading...

22 February

Boundiali Resource Grows to 3Moz - Indicated Up 49%

Aurum Resources (AUE:AU) has announced Boundiali Resource Grows to 3Moz - Indicated Up 49%Download the PDF here. Keep Reading...

22 February

High-grade Assays incl 4m @ 26.7g/t Au in Sandstone Drilling

Brightstar Resources (BTR:AU) has announced High-grade assays incl 4m @ 26.7g/t Au in Sandstone drillingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00