January 24, 2022

GTI Resources Limited (GTI or the Company) is pleased to report on its activities for the December 2021 quarter.

Quarterly Highlights:

- Wyoming ISR uranium project acquisition settlement

- ~$2m of new capital raised this quarter with $4.75m now on hand at 31 Dec 2021

- Exploration drilling for ISR uranium commenced at the Thor project in Wyoming

- Early drill results to date at Thor confirm discovery of a significant uranium mineralised system which demonstrates characteristics conducive to ISR recovery

- Annual ESG reporting program has been implemented

- A carbon offset program was initiated & Climate Active certification is underway

- Options were successfully listed on ASX and now trade with the ASX code: GTRO

- Final payment made to Anfield Energy Inc. for 100% of Utah uranium properties

GREAT DIVIDE BASIN ISR URANIUM, WYOMING, USA

ACQUISITION

In August the Company entered into a binding agreement to acquire 100% of Branka Minerals Pty Ltd (Branka) (Acquisition) the holder of ~22,000 acres (~8,900 hectares) across several groups of strategically located and underexplored mineral lode claims (Claims) and 2 state leases (Leases), prospective for sandstone hosted ISR amenable uranium, located in the Great Divide Basin (GDB), Wyoming, USA & the Uravan Belt, Colorado, USA (the Properties).

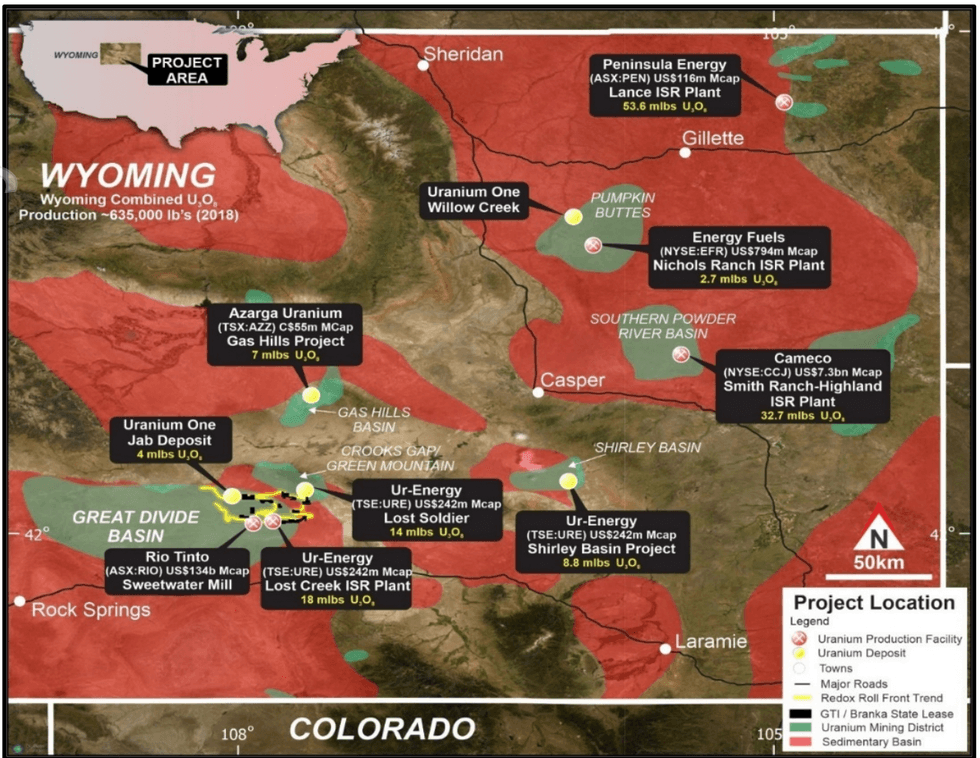

The GDB is one of the several major basins within the Wyoming Basin Physiographic Province (Figure1). Wyoming basins include the Powder River Basin, Wind River Basin (Gas Hills), Shirley Basin and the Great Divide Basin with all of these basins known to host economic, ISR amenable, sandstone‐ type roll front hosted uranium deposits.

The Wyoming Properties, which are GTI’s priority for exploration, are located close to UR Energy’s (URE) Lost Creek ISR Facility & Rio Tinto’s (RIO) Sweetwater Mill (Figure2).

Click here for the full ASX Release

This article includes content from GTI Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GTR:AU

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

15 December 2025

American Uranium

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming

Disrupting the uranium supply chain through highly prospective ISR projects in Wyoming Keep Reading...

11 August 2025

Snow Lake Completes Due Diligence and Confirms Placement

GTI Energy (GTR:AU) has announced Snow Lake Completes Due Diligence and Confirms PlacementDownload the PDF here. Keep Reading...

28 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

GTI Energy (GTR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

23 July 2025

Lo Herma Drilling Permit & Contract Confirmed

GTI Energy (GTR:AU) has announced Lo Herma Drilling Permit & Contract ConfirmedDownload the PDF here. Keep Reading...

14 July 2025

Company Update - Name Change to 'American Uranium Limited'

GTI Energy (GTR:AU) has announced Company Update - Name Change to 'American Uranium Limited'Download the PDF here. Keep Reading...

10 July 2025

Placement Shares Issued & Drilling Approval Expected August

GTI Energy (GTR:AU) has announced Placement Shares Issued & Drilling Approval Expected AugustDownload the PDF here. Keep Reading...

14h

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

19 February

Drilling Confirms Potential REE System at Sybella Barkly

Basin Energy (BSN:AU) has announced Drilling Confirms Potential REE System at Sybella BarklyDownload the PDF here. Keep Reading...

18 February

Niger’s Seized Uranium Remains in Geopolitical Limbo

A stockpile of 1,000 metric tons of uranium seized from a French-operated mine in Niger is now sitting at a military airbase in Niamey that was recently attacked by Islamic State militants, raising fresh concerns over security and the material’s uncertain future.The uranium, which is processed... Keep Reading...

12 February

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

Latest News

Sign up to get your FREE

American Uranium Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00