Getchell Gold Corp. (CSE: GTCH) (OTCQB: GGLDF) ("Getchell" or the "Company") is pleased to announce the 2022 drill program at the Fondaway Canyon gold project in Nevada is scheduled to commence by the end of April.

Key Highlights

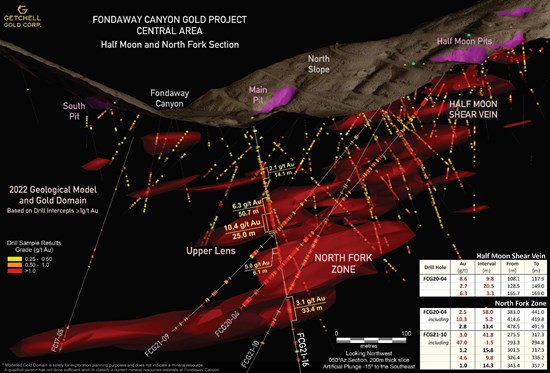

- 2022 drill program at Fondaway Canyon will initially follow up on last year's high-grade gold discovery reporting 10.4 g/t Au over 25.0m within a broader zone grading 6.3 g/t Au over 50.7m;

- The broader drill plan is to continue expanding on the substantive zones of mineralization discovered during the previous two years of drilling; and

- The Central Area zone of gold mineralization has been traced 600m along strike and 800m down dip from surface and remains open in most directions.

"The last two years of drilling at the Fondaway Canyon gold project have been extremely successful, especially punctuated by our most recent high-grade discovery. We continue to see no apparent limits to the mineralizing system and the Project's upside potential," states Mike Sieb, President, Getchell Gold Corp. "The forthcoming 2022 drill program will continue the accelerated path of advancement, and I look forward to the commencement of drilling with a high level of anticipation."

2022 Drill Program

The Company has secured two drill rigs for 2022. The first rig is scheduled to commence drilling at the Fondaway Canyon gold project before the end of this month with the second rig scheduled to commence a maiden drill program at the Star high-grade Cu-Au-Ag project situated 60 km to the north a few weeks later.

The rig slotted for Fondaway Canyon will initially be tasked with delineating the high-grade gold discovery intersected by FCG21-16, the last hole of the 2021 drill program.

FCG21-16 was stationed on the canyon floor at the junction of Fondaway Canyon and the North Fork branch to target the North Fork mineralized zone as a 30m step out to the northwest from holes FCG20-04, FCG21-09, and FCG21-10 (Figure 1).

FCG21-16 encountered a high-grade gold interval grading 6.3 g/t Au over 50.7m (117.5-168.2m) that includes 10.4 g/t Au over 25.0m (139.9-164.9m). This latter interval contained 12 samples reporting >10 g/t Au revealing strong internal high-grade gold consistency (Figure 2). Marking how truly exceptional this is, the FCG21-16 interval returned the greatest 'gold grade x thickness' value in the 40+ year history of gold exploration and mining at the Project and likely represents a major conduit for the gold mineralizing system at Fondaway Canyon.

The high-grade FCG21-16 interval was intersected shallower than the North Fork zone's targeted depth and may correspond to an upper lens recently indicated by hole FCG21-09 (see news release dated Oct. 20, 2021).

The North Fork zone drilling has consistently produced impressive grades and thicknesses of gold mineralization. The near surface mineralization of the Half Moon shear vein has been the historical focus of interest while the North Fork zone has only recently been discovered, remains underexplored, is open along strike and down dip, and represents significant value-add potential.

Drilling to expand and infill the North Fork zone is only one of a number of equally valid and promising priority gold zones at Fondaway Canyon that will be drilled this year.

Figure 1: Fondaway Canyon North Fork 3D section, 150m wide, looking northwest with an artificial -15 plunge applied, highlighting the 2020 and 2021 drilling.

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/3941/119287_d6c8195294d3e9c8_001full.jpg

To watch a recent video that provides a detailed look at the latest discovery, plus an overall summary of the recent exploration highlights at Fondaway Canyon, click here: https://youtu.be/q6Nebxwf1q0

Figure 2: FCG21-16 drill hole trace on section showing gold samples and significant intervals.

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/3941/119287_d6c8195294d3e9c8_002full.jpg

Live Presentation

Getchell Gold Corp. is also excited to be presenting on Thursday, April 7 at 1:35 ET, at the Money Show's "Money, Metals and Mining" Virtual Expo. All interested investors are invited to register for free at: https://online.moneyshow.com/2022/april/money-metals-and-mining-virtual-expo/speakers/ee2b86f2cdc6467a877f747a81dab53d/mike-sieb/?scode=056235

Scott Frostad, P.Geo., is the Qualified Person (as defined in NI 43-101) who reviewed and approved the content and scientific and technical information in the news release.

The Fondaway Canyon 2021 drill core was processed using the same methods as the 2020 drill program. The core is cut at Bureau Veritas Laboratories' ("BVL") facilities in Sparks, Nevada, with the samples analyzed for gold and multi-element analysis in BVL's Sparks, Nevada and Vancouver, BC laboratories respectively. Gold values are produced by fire assay with an Atomic Absorption finish on a 30-gram sample (BV code FA430) with over limits re-analyzed using method FA530 (30g Fire Assay with gravimetric finish). The multi-element analyses are performed by ICP-MS following aqua regia digestion on a 30g sample (BV code AQ250). Quality control measures in the field include the systematic insertion of standards and blanks.

Highlighted drill intervals are based on a 0.25 g/t Au cut-off, minimum interval lengths of 3.3 metres (10 feet), and a maximum of 3.3 metres of internal dilution, with no top cut applied. All intervals are reported as downhole drill lengths and additional work is required to determine the true width.

About Getchell Gold Corp.

The Company is a Nevada focused gold and copper exploration company trading on the CSE: GTCH and OTCQB: GGLDF. Getchell Gold is primarily directing its efforts on its most advanced stage asset, Fondaway Canyon, a past gold producer with a significant in-the-ground historic resource estimate. Complementing Getchell's asset portfolio is Dixie Comstock, a past gold producer with a historic resource and two earlier stage exploration projects, Star and Hot Springs Peak. Getchell has the option to acquire 100% of the Fondaway Canyon and Dixie Comstock properties, Churchill County, Nevada.

The Company reiterates that its near-term strategy to advance its assets is not impacted by the COVID-19 Corona virus. The Company continues to monitor the situation and is in compliance with all government guidelines.

For further information please visit the Company's website at www.getchellgold.com or contact the Company at info@getchellgold.com or at +1 647 249-4798.

Mr. William Wagener, Chairman & CEO

Getchell Gold Corp.

The Canadian Securities Exchange has not reviewed this press release and does not accept responsibility for the adequacy or accuracy of this news release. Not for distribution to U.S. news wire services or dissemination in the United States.

Certain information contained herein constitutes "forward-looking information" under Canadian securities legislation. Forward-looking information includes, but is not limited to, statements with respect to the private placement and the completion thereof and the use of proceeds. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "will" or variations of such words and phrases or statements that certain actions, events or results "will" occur. Forward-looking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results to be materially different from those expressed or implied by such forward-looking statements or forward-looking information, including: the receipt of all necessary regulatory approvals, use of proceeds from the financing, capital expenditures and other costs, and financing and additional capital requirements. Although management of Getchell have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. The Company will not update any forward-looking statements or forward-looking information that are incorporated by reference herein, except as required by applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/119287