September 29, 2024

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia.

HIGHLIGHTS:

- All residual assay results received from the recent 2,701m (27 holes) diamond drilling program at Ricciardo.

- Drilling underneath the Silverstone pit confirms the identified high-grade shoot continues at depth and at better than previously modelled grades:

- 13.7m @ 3.27 g/t Au and 0.36% Sb (4.04 g/t AuEq) from 253.3m, inc.

1.2m @ 9.00 g/t Au and 0.00% Sb (9.00 g/t AuEq) from 264.85m (RDRC046) - 22.6m @ 2.11 g/t Au and 0.29% Sb (2.71 g/t AuEq) from 294m, inc.

3m @ 7.22 g/t Au and 0.02 % Sb (7.26 g/t AuEq) from 312m (RDRC044)

- 13.7m @ 3.27 g/t Au and 0.36% Sb (4.04 g/t AuEq) from 253.3m, inc.

- Drilling from the Eastern Creek area, located at the southern end of Ricciardo, confirms down dip continuity with increasing grade and width at depth:

- 7.0m @ 2.54 g/t Au and 0.24% Sb (3.05 g/t AuEq) from 170m (RDRC060)

- 25.0m @ 1.23 g/t Au and 0.17% Sb (1.60 g/t AuEq) from 232m, inc.

6.8m @ 2.37 g/t Au and 0.37% Sb (3.16 g/t AuEq) from 250.2m (RDRC059)

- Update of Ricciardo Mineral Resource Estimate (MRE) on track for Q4 2024.

- Aircore drilling program now in progress at the Golden Range Project targeting an underexplored section at the southern end of the 70-km long shear.

- Further growth-focussed Reverse Circulation (RC) drilling of the ‘Golden Corridor’ scheduled to commence in November.

The assays reported in this release are full results for the final 11 diamond holes (1,021m) from the recent 27-hole diamond tail program at Ricciardo. Results for the first 16 holes of this program have previously been reported (refer WA8 ASX releases dated 3 July 2024, 19 July 2024, 2 August 2024 and 26 August 2024).

Warriedar Managing Director and CEO, Amanda Buckingham, commented:

“This final set of diamond results from the recent Ricciardo drilling have really put a bow on the whole program for us. The broad-based extensional success delivered by this drilling is both real and exciting. The fact that these results are being delivered at what are still relatively shallow down-dip depths, and in such proximity to excellent surrounding infrastructure, also delivers excellent potential for the economic character of the anticipated resource additions at Ricciardo. It is my firm belief that we are just getting started in terms of the opportunity at Ricciardo, let alone within the larger ‘Golden Corridor’ and along the broader mineralised shear.”

Key Ricciardo context

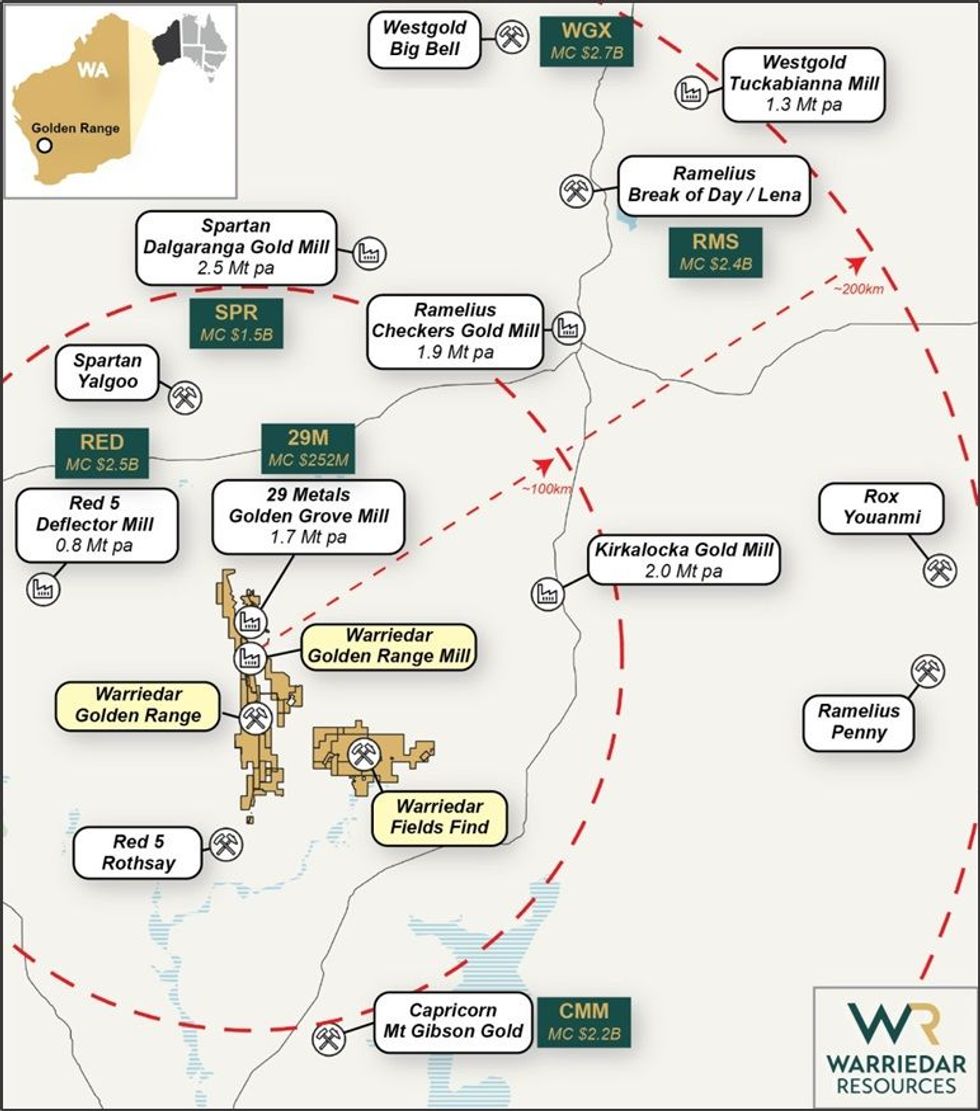

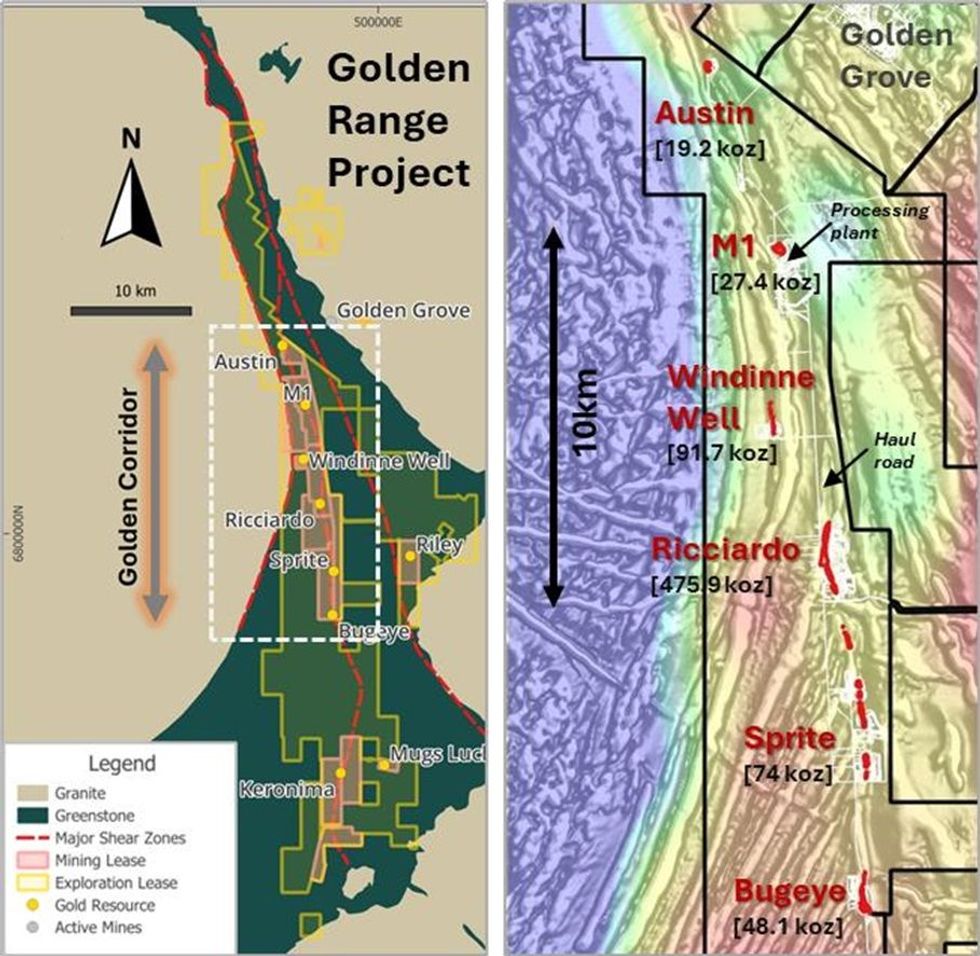

The Ricciardo gold system is located within Warriedar’s flagship Golden Range Project in the Murchison region of Western Australia (refer Figures 1 and 2).

Ricciardo spans a strike length of approximately 2.3km, with very limited drilling having been undertaken below 100m depth. It possesses a current MRE of 8.7 Mt @ 1.7 g/t Au for 476 koz gold. 1 Importantly, historical mining operations at Ricciardo were primarily focused on oxide material, with the transition and primary sulphides mineralisation not systematically explored.

The most recent phase of RC and diamond drilling of Ricciardo has concluded. This release reports on the assays from the final 11 holes of the diamond program. These holes were predominantly located in the southern part of the Ricciardo deposit, focusing on down-dip extension where no previous drilling had been undertaken (refer Table 1 and Figure 3 for drill collar and relevant section locations).

All 11 holes returned significant intersections, delivering a further round of meaningful extensional success from the recent program (refer Table 2). All results are set to be incorporated into an update of the Ricciardo MRE, which remains on track for completion during Q4 2024.

Click here for the full ASX Release

This article includes content from Warriedar Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

WA8:AU

The Conversation (0)

09 April 2024

Warriedar Resources

Advanced gold and copper exploration in Western Australia and Nevada

Advanced gold and copper exploration in Western Australia and Nevada Keep Reading...

18 November 2024

Targeted Exploration Focus Delivers an Additional 471koz or 99% Increase in Ounces, and a Higher Grade for Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) is pleased to report on an updated MRE for its flagship Ricciardo Gold Deposit, part of the broader Golden Range Project located in the Murchison region of Western Australia. HIGHLIGHTS:Updated Mineral Resource Estimate (MRE) for... Keep Reading...

30 September 2024

Continued Delivery of High Grade Antimony Mineralisation at Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides an update on its initial review of the antimony (Sb) potential at the Ricciardo deposit, located within its Golden Range Project in the Murchison region of Western Australia. HIGHLIGHTS:Review of the antimony (Sb)... Keep Reading...

26 August 2024

Further Step-Out Gold Success and High-Grade Antimony Discovery

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia. The results reported in this release are for a further 6 of the 27 diamond holes drilled in the current program at... Keep Reading...

01 August 2024

Infill Drilling of Ricciardo Deposit Delivers Significant Gold Mineralisation

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) is pleased to provide an update on drilling progress and assay results from its Golden Range Project, located in the Murchison region of Western Australia (Figure 1). HIGHLIGHTS: Assay results for a further two (2) diamond tails... Keep Reading...

48m

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

11h

Canadian Investment Regulatory Organization Trade Resumption - IMR

Trading resumes in: Company: iMetal Resources Inc. TSX-Venture Symbol: IMR All Issues: Yes Resumption (ET): 10:30 AM CIRO can make a decision to impose a temporary suspension (halt) of trading in a security of a publicly-listed company. Trading halts are implemented to ensure a fair and orderly... Keep Reading...

11h

iMetal Resources Intersects 16.65 Metres at 1.24 g/t Gold Within 62.25 Metres at 0.61 g/t Gold at Gowganda West

iMetal Resources Inc. (TSXV: IMR,OTC:IMRFF) (OTCQB: IMRFF) (FSE: A7VA) ("iMetal" or the "Company") has intersected 16.65 metres at 1.25 gt gold within 62.25 metres at 0.61 gt gold at its Gowganda West Gold Project, southwest of Timmins, Ontario. Drilling in the West Zone intersected broad levels... Keep Reading...

25 February

Precious Metals Price Update: Gold, Silver, PGMs Boosted by Geopolitical and Trade Tensions

Precious metals are recovering their safe-haven demand appeal this week.Gold, silver and platinum are up this week, all still down from the all-time highs recorded in January. Escalating geopolitical tensions and US trade policy shifts are once again at center stage in this sector of the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00