October 03, 2023

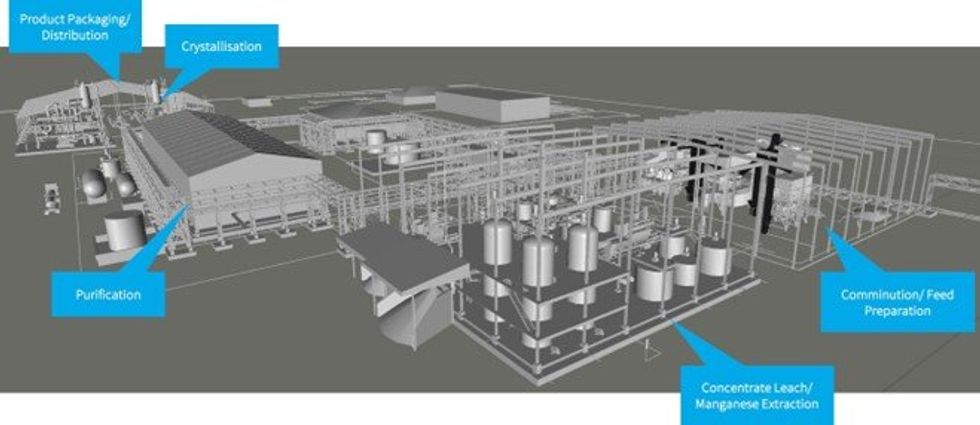

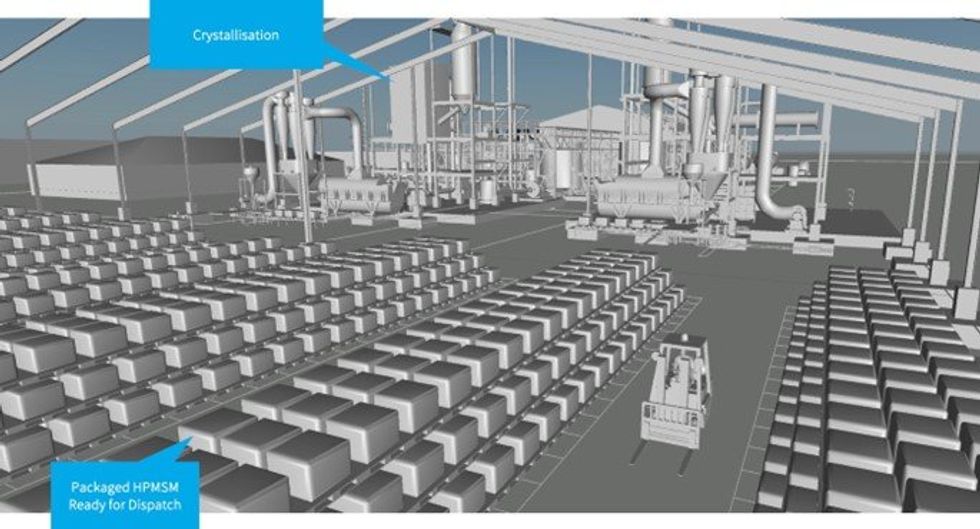

Element 25 Limited (E25 or Company) (ASX:E25) is pleased to provide an update in relation to the planned construction of the first North American commercial scale battery grade high purity manganese sulphate (HPMSM) processing facility to produce key raw materials for electric vehicle (EV) battery manufacture in the USA. The facility is targeting commissioning in 2025 to produce the first low carbon, ethically sourced HPMSM in the USA (Project or Facility), processing manganese oxide ore from the Company’s 100%-owned Butcherbird Manganese Project in Western Australia (Butcherbird).

Highlights:

- Front-end Engineering and Design (FEED) completed to optimise HPMSM plant design for preferred Louisiana site.

- Cost reduction opportunities identified for further assessment during detailed design phase.

- Detailed project execution schedule finalised with mechanical completion on track for 2025 target.

- Local engineering and construction firms CDI Engineering Solutions and Universal Plant Services to continue engineering activities.

- CSRS Inc and subsidiary Fides Consulting to continue to support E25 as the owners engineer/strategic consultant.

- Local legal firm Roedel Parsons has been engaged to represent E25 as Louisiana legal advisor.

- Key utility and reagent supply agreements in negotiation.

- Preferred site offers significant strategic advantage including over the fence supply of sulphuric acid, steam and other key inputs.

- Site assessments including cultural, environmental and geotechnical surveys completed with no issues or concerns.

- Project execution plan advancing in line with project development timelines outlined in the FS.

- All contractual milestones under the General Motors LLC (GM) and Stellantis N.V. (Stellantis) offtake and funding packages on track.

- Final approvals for Louisiana state government subsidy package received.

- Industrial Tax Exemption Plan (ITEP) has been submitted.

Element 25 Managing Director Justin Brown said: “E25 aims to be a leading source of high quality, vertically integrated, traceable and ESG and IRA-compliant battery material to the global electric vehicle industry . The construction of our first HPMSM facility in the USA – the first of its kind there – is a key pillar to the strategic plan which aims to position E25 as the industry leading provider of high quality ethically sourced battery grade manganese to support global electrification efforts. The team has made extraordinary progress to date and we will continue to push hard to achieve the project execution plans which are rapidly taking shape for a 2025 commissioning date.”

Project Execution Update

In April 2023, E25 published the detailed Feasibility Study (FS) for the construction of an integrated battery grade high purity manganese sulphate facility in Louisiana USA to produce HPMSM1. HPMSM is a critical raw material used in the construction of various lithium-ion battery cathode precursor materials to power the electrification of the global vehicle fleet. The HPMSM produced in Louisiana will be used in the manufacture of electric vehicle Pre-Cathode Active Materials (pCAM).

The Project is supported by key offtake and funding agreements in place with General Motors LLC (GM) and Stellantis N.V. (Stellantis) which are contributing a combined US$115M in project funding through a combination of equity, pre-payment and senior debt alongside offtake for approximately 65% of the planned HPMSM production from the first production train.

Subsequent to the release of the FS, E25 has continued to engage local engineering firms CSRS Inc (CSRS) and FIDES (a CSRS subsidiary) as owners engineers and CDI Engineering Solutions (CDI) and Universal Plant Services (UPS) as design and construction engineers to continue to refine the engineering and design of the facility prior to commencement of construction targeted for first half 2024. Key focus areas include:

- Front end Engineering and Design (FEED).

- Site Assessments and permitting.

- Inbound and outbound logistics and reagent supply.

- Project financing.

Engineering/Procurement Services

CSRS, FIDES, CDI and UPS are experienced local engineering contractors in Louisiana a track record of chemical plant design and construction in the Louisiana region. Subsequent to the publication of the FS, E25 engaged CDI (with the support of UPS) to execute front end engineering and design (FEED) for the Project. The FEED programme began in early May 2023 and is now complete.

FEED work programme covers engineering which is conducted to a greater level of rigor and detail compared to a Feasibility Study. It is an important engineering phase which provides additional engineering and cost estimation detail as a project transitions from conceptual design to an Engineering, Procurement and Construction (EPC) contract.

The FEED study typically precedes a final investment decision phase of a large project such as E25’s planned HPMSM facility in Louisiana. The scope of the study covers a range of engineering disciplines including:

- Site layout optimisation.

- Civil and Structural design and layout.

- Process flow diagrams.

- Process and instrumentation diagrams.

- Electrical design.

- Piping and mechanical design.

- Material take-offs to inform cost estimation activities.

E25 have commissioned FIDES, CDI and UPS to undertake the next phase of detailed engineering and design which will advance the project through to FID and commencement of construction targeted for Quarter 1, calendar 2024.

This article includes content from Element 25 Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

E25:AU

The Conversation (0)

14 August 2023

Element 25

Australia’s Largest Manganese Resource Driving Multiple Growth Pathways Towards a Zero-Carbon EV Battery-grade Manganese Future

Australia’s Largest Manganese Resource Driving Multiple Growth Pathways Towards a Zero-Carbon EV Battery-grade Manganese Future Keep Reading...

21 April 2024

Goldfields Exploration Update

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to provide an update on gold exploration activities within the Company’s strategic Eastern Goldfields project portfolio. RC drill hole completed under high-grade Blackfriars gold prospect (Gidji JV)New Exploration Licence... Keep Reading...

22 January

Manganese Market Forecast: Top Trends for Manganese in 2026

After taking a bearish turn in late 2024, manganese prices started 2025 on a flat note despite a robust demand outlook supported by growth in the electric vehicle (EV) battery segment. In the first half of 2025, the manganese market experienced mixed signals as supply dynamics shifted and demand... Keep Reading...

04 December 2025

Rubidium Could be Next Frontier for Critical Minerals Exploration, Investment

In the evolving landscape of critical minerals investing, the alkali metal rubidium is increasingly gaining attention as a potential growth opportunity. Historically under the radar compared to lithium, cobalt or rare earth elements, rubidium’s unique properties, constrained supply and emerging... Keep Reading...

12 November 2025

Spartan Metals Touts Eagle Project as Critical Minerals Supply Source to DoD

On the heels of the recent identification of a silver-rich deposit at its Eagle project in Nevada, Spartan Metals (TSXV:W) is ramping up exploration and drilling efforts toward a potential resource estimate.In a recent interview, Spartan President and CEO Brett Marsh highlighted the polymetallic... Keep Reading...

16 October 2025

Spartan Metals Commences Exploration Program at the Eagle Tungsten-Silver-Rubidium Project, Nevada

(TheNewswire) Vancouver, Canada, October 16, 2025 TheNewswire - Spartan Metals Corp. (" Spartan " or the " Company ") (TSX-V: W) is pleased to announce, it has initiated an exploration program (" Program ") at its Eagle Tungsten-Silver-Rubidium Project in Nevada (Figure 1). The focus of the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00