October 25, 2024

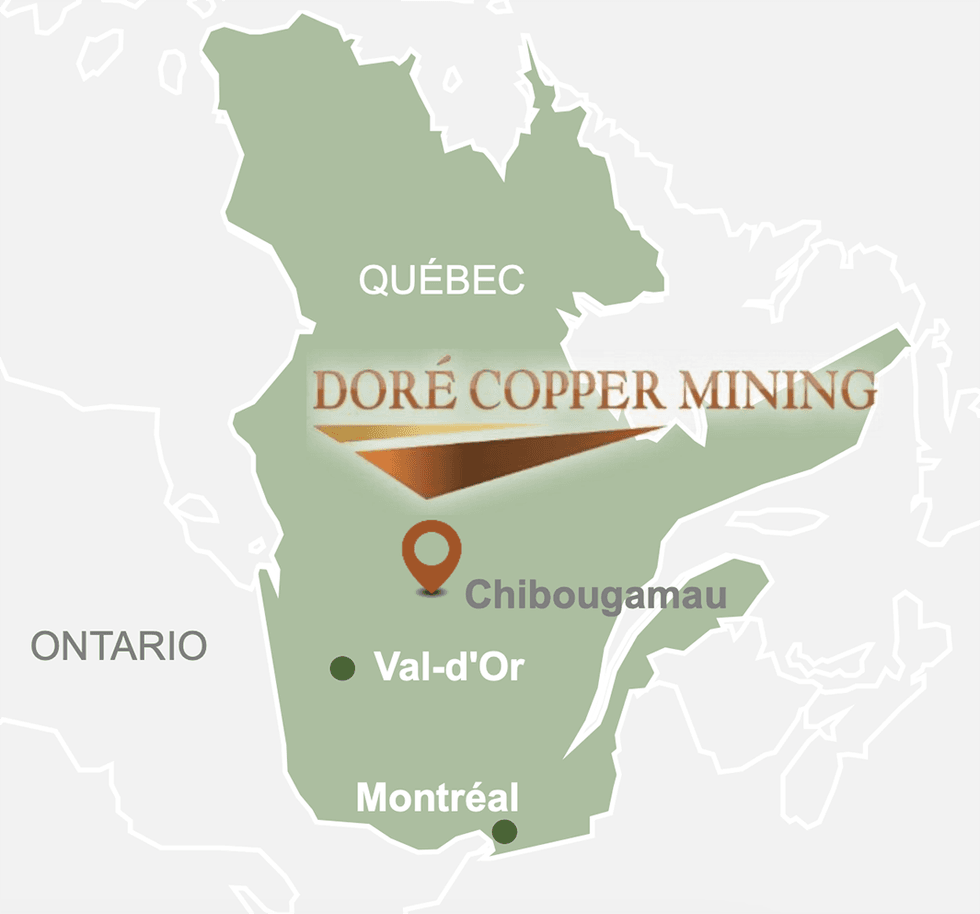

Doré Copper Mining (TSXV:DCMC,OTCQB:DRCMF,FRA:DCM) is positioning itself as a near-term producer in the prolific Chibougamau region of Québec, Canada. The company is actively advancing its assets toward production, taking advantage of its brownfields high-grade copper and gold projects, existing infrastructure, and supportive jurisdiction. The company aims to establish itself as Quebec’s next copper producer, with a hub-and-spoke mining strategy centered around its Copper Rand mill.

Doré Copper Mining operates in the Chibougamau mining camp, an area known for its historical copper and gold production, within the world-renowned Abitibi Greenstone Belt. The company’s flagship asset, Corner Bay, is complemented by several other projects, including Devlin, Joe Mann, Cedar Bay, and Copper Rand. These properties form the foundation of Doré Copper Mining’s near-term and future production plans.

Doré Copper Mining’s assets are located within a well-known copper and gold mining region, with a long history of production. The company’s current strategy revolves around a hub-and-spoke model, with the Copper Rand mill serving as the processing hub, fed by multiple satellite deposits. The key projects in the PEA include Corner Bay, Devlin, and Joe Mann. Other past producing mines, like Cedar Bay and Copper Rand, have further exploration potential.

Company Highlights

- Doré Copper Mining’s hub-and-spoke mining model—using the Copper Rand mill as the central processing facility for its satellite deposits—would support an initial production target of more than 50 million pounds of copper equivalent annually, with a mine life exceeding 10 years.

- A Preliminary Economic Assessment (PEA) was released in 2022 outlining a relatively modest initial capital expenditure of C$180.6 million, highlighting the economic potential of the project with an after-tax net present value (NPV) of C$193 million and an internal rate of return (IRR) of 22.1 percent.

- A feasibility study is underway, which is expected to provide more detailed engineering data and further de-risk the operations

- Corner Bay, the flagship asset, is among the highest-grade copper deposits in North America, with an indicated resource of 2.6 million tonnes at a grade of 2.66 percent copper and an inferred resource of 5.8 million tonnes at a grade of 3.44 percent copper.

- The 100 percent owned Copper Rand mill will be refurbished for future production and will be the only operating mill in the Chibougamau region. The mill will have extra capacity and provides the ability to process its own ore while potentially offering toll milling services to other nearby mining projects.

- Doré Copper Mining is led by an experienced and highly skilled management team.

This Doré Copper Mining profile is part of a paid investor education campaign.*

Click here to connect with Dore Copper Mining (TSXV:DCMC) to receive an Investor Presentation

DCMC:AU

The Conversation (0)

04 March

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

04 March

BHP: Targeted AI Platforms Boost Efficiency, Safety and More

Modern society has a metals problem. The demands of modern consumer culture, the energy transition and the emergence of artificial intelligence (AI) and robotics have created a dilemma.As demand rises, the supply of many metals is at a bottleneck brought about by a number of factors, from... Keep Reading...

04 March

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

03 March

Top 10 Copper Producers by Country

In 2025, supply disruptions highlighted a growing concern as copper mines in the top copper-producing countries were aging without new mines to replace them.Additionally, copper demand from electrification is expected to rise significantly in the coming years.The competing forces of the global... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00