October 25, 2024

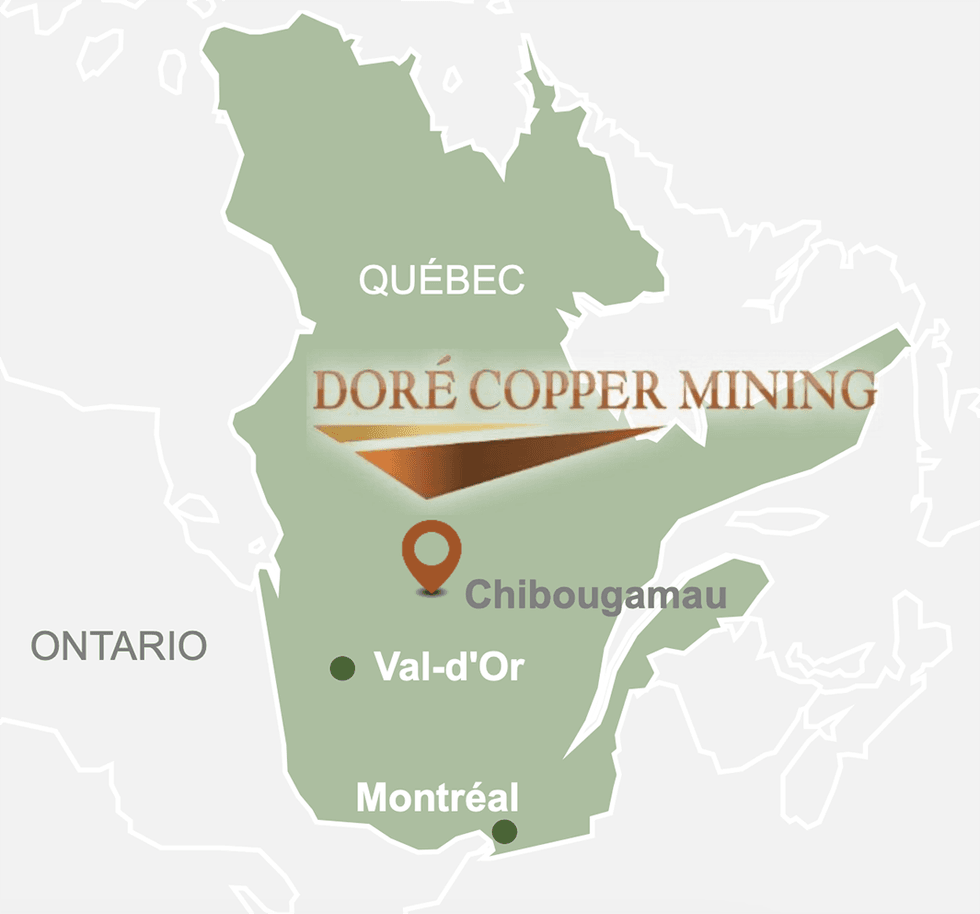

Doré Copper Mining (TSXV:DCMC,OTCQB:DRCMF,FRA:DCM) is positioning itself as a near-term producer in the prolific Chibougamau region of Québec, Canada. The company is actively advancing its assets toward production, taking advantage of its brownfields high-grade copper and gold projects, existing infrastructure, and supportive jurisdiction. The company aims to establish itself as Quebec’s next copper producer, with a hub-and-spoke mining strategy centered around its Copper Rand mill.

Doré Copper Mining operates in the Chibougamau mining camp, an area known for its historical copper and gold production, within the world-renowned Abitibi Greenstone Belt. The company’s flagship asset, Corner Bay, is complemented by several other projects, including Devlin, Joe Mann, Cedar Bay, and Copper Rand. These properties form the foundation of Doré Copper Mining’s near-term and future production plans.

Doré Copper Mining’s assets are located within a well-known copper and gold mining region, with a long history of production. The company’s current strategy revolves around a hub-and-spoke model, with the Copper Rand mill serving as the processing hub, fed by multiple satellite deposits. The key projects in the PEA include Corner Bay, Devlin, and Joe Mann. Other past producing mines, like Cedar Bay and Copper Rand, have further exploration potential.

Company Highlights

- Doré Copper Mining’s hub-and-spoke mining model—using the Copper Rand mill as the central processing facility for its satellite deposits—would support an initial production target of more than 50 million pounds of copper equivalent annually, with a mine life exceeding 10 years.

- A Preliminary Economic Assessment (PEA) was released in 2022 outlining a relatively modest initial capital expenditure of C$180.6 million, highlighting the economic potential of the project with an after-tax net present value (NPV) of C$193 million and an internal rate of return (IRR) of 22.1 percent.

- A feasibility study is underway, which is expected to provide more detailed engineering data and further de-risk the operations

- Corner Bay, the flagship asset, is among the highest-grade copper deposits in North America, with an indicated resource of 2.6 million tonnes at a grade of 2.66 percent copper and an inferred resource of 5.8 million tonnes at a grade of 3.44 percent copper.

- The 100 percent owned Copper Rand mill will be refurbished for future production and will be the only operating mill in the Chibougamau region. The mill will have extra capacity and provides the ability to process its own ore while potentially offering toll milling services to other nearby mining projects.

- Doré Copper Mining is led by an experienced and highly skilled management team.

This Doré Copper Mining profile is part of a paid investor education campaign.*

Click here to connect with Dore Copper Mining (TSXV:DCMC) to receive an Investor Presentation

DCMC:AU

The Conversation (0)

19 February

Northern Dynasty Shares Plunge as DOJ Backs EPA Veto of Alaska’s Pebble Mine

Northern Dynasty Minerals (TSX:NDM,NYSEAMERICAN:NAK) shares plunged on Wednesday (February 18) after the US Department of Justice (DOJ) filed a court brief backing the Environmental Protection Agency’s (EPA) January 2023 veto of the company’s long-contested Pebble project in Alaska.The brief... Keep Reading...

18 February

BHP Reports Strong Half-Year Copper Results, Boosts Guidance for 2026

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has published its financial results for the half-year ended December 31, 2025.The mining giant said its copper operations, which span multiple continents, accounted for the largest share of its overall earnings for the first time, coming in at 51 percent of... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00