July 31, 2024

Axel REE Limited (ASX: AXL, “Axel” or “the Company”) is pleased to advise the commencement of a robust drilling program at its 100% owned and highly prospective, but yet underexplored Caladão Project (Caladão). Caladão is located in a region known as the Lithium Valley in Minas Gerais, Brazil, where many major lithium discoveries have been made, including Sigma Lithium Corp’s Grota do Cirilo LCE mine. Axel is the first company to realise the area's potential for high-grade REE mineralisation in the well-known mining region and with excellent access to infrastructure.

HIGHLIGHTS:

- Phase 1 exploration program to commence at the Caladão REE Project as part of the 20,000m drill campaign planned over the next 2 years

- Aggressive diamond drilling aims to extend the open REE mineralisation at two prospects (Area A and Area B) that previously uncovered 25km of mineralised strike, including a large radiometric circular structure at Area B

- Phase 1 program will also test the depth of the clay profile with diamond drilling the most effective method to drill to bedrock. Previous auger drilling (to average 15m depth) indicated REE mineralisation is open at depth

- This first program will include 52 holes and is anticipated to total ~2,600 metres of diamond drilling

- Phase 1 program at Caladão opens Axel’s aggressive IPO exploration strategy, with Caldas (Poços de Caldas REE) and Itiquira (Mato Grosso REE/Nb) Phase 1 campaigns to follow in the coming weeks

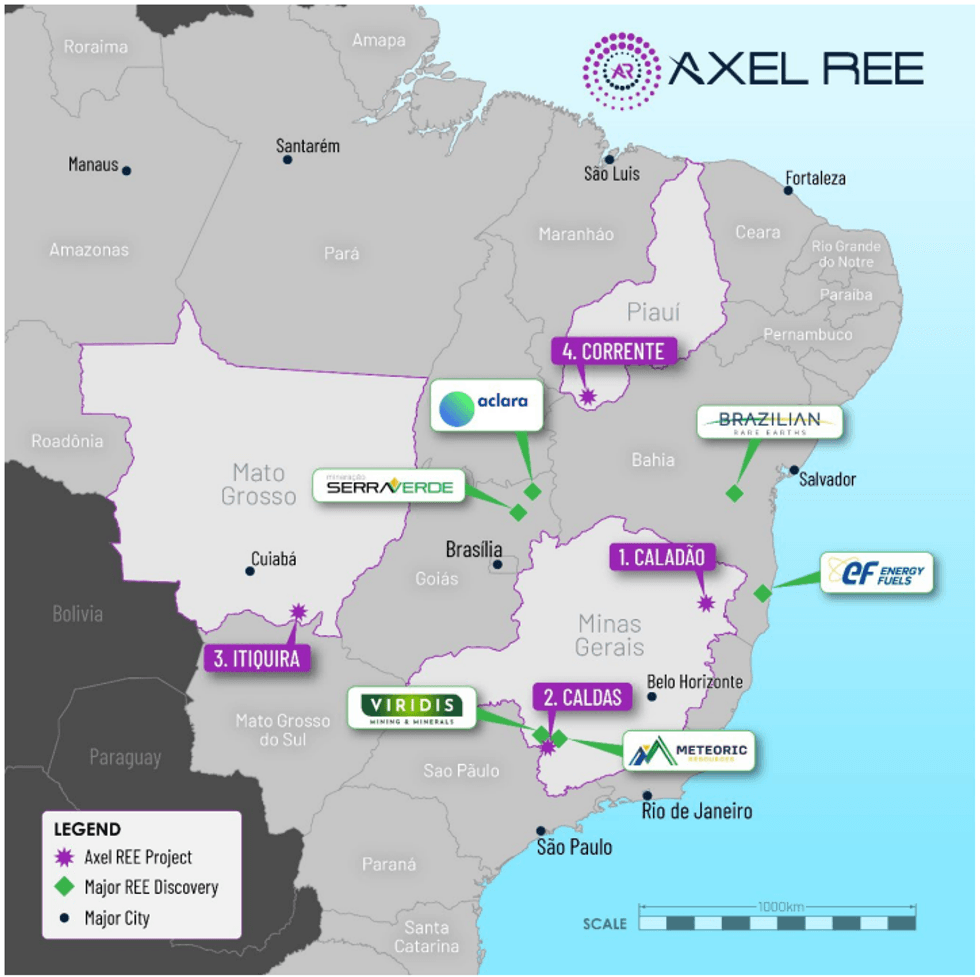

Axel holds ~400km² in exploration permits and applications at Caladão, which is one of four prospective rare earth elements (REE) and niobium (Nb) projects 100% owned by the Company that covers over 1,100km².

Managing Director, Dr Fernando Tallarico, said:

“Having successfully completed Axel’s IPO, we are now in the position to immediately embark on our strategy to unlock value in our highly prospective Caladão Project, in the Lithium Valley, by launching our Phase 1 2,600m diamond drilling program. This program holds immense potential as the historical auger results defined two target areas that spanned a combined strike length of 25km with mineralisation open at depth, laterally, and along the strike.

Diamond drilling will cross the entire regolith profile, and only cease once the bedrock is reached. This approach will enable us to comprehensively examine the entire clay profile, map the zoning of the clay horizons, and determine the true thickness of the potentially REE-bearing clay zone. We are also targeting a large circular radiometric structure at Area B and have planned our program to be fluid where we will follow the richest areas as results progressively return.

This Phase 1 program forms part of our 20,000m program planned at Caladão and aligns with our IPO strategy to aggressively work our projects. Our Caldas Project in the world-class Poços de Caldas Alkaline Complex and Itiquira REE/niobium project will progressively follow and we are excited for the continuous newsflow to come.”

Figure 1 – Map of the Axel REE’s 100% owned projects in Brazil.

Previous geochemical and shallow auger drilling programs completed by the Company in 2023 that covered only ~20% of the Project, determined two highly prospective targets (Area A and Area B), with elevated soil samples up to 3,547 ppm TREO and auger drill intercepts up to 2 metres @ 7,612 ppm TREO, with the thickest intercept including 18 metres @ 2,678 ppm TREO. All mineralised auger holes ended in mineralisation denoting that the true thickness of the REE mineralisation is yet to be determined. The prospective area is large-scale, covering more than 400km2 with Area A and Area B both open in all directions (along-strike and laterally).

Click here for the full ASX Release

This article includes content from Axel REE, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

AXL:AU

The Conversation (0)

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00